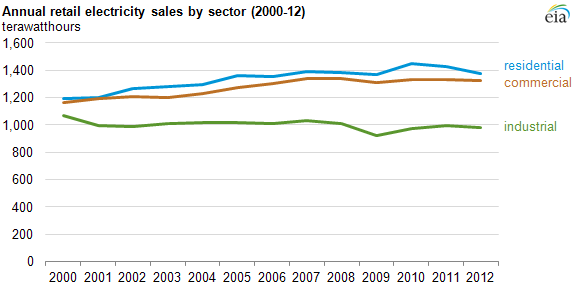

Since 2007, U.S. electricity sales have declined. With 10 months of data available for 2013, that declining trend is expected to continue. Between 2010 and 2012, total electricity sales declined by 1.6 percent. During that time period, residential electricity sales declined by 4.9 percent despite a growth in households, and commercial electricity sales declined by 0.2 percent despite growth in commercial building space. Industrial electricity sales took the hardest hit, declining by 9.1 percent between 2008 and 2009, and then slowing increasing, but without regaining their 2008 level. This stagnation in electricity markets is surprising given that the growth in electricity demand had tracked the growth in the GDP historically.

Residential electricity sales had been increasing by about 2 percent per year between 2000 and 2010 due to the construction of larger homes and the growth in new technologies using electricity, such as personal computers. However, once the recession hit, residential electricity sales declined by about 1 percent and then increased by 6 percent in 2010 before declining by almost 5 percent between 2010 and 2012. The decline is expected to be a result of relatively mild weather, resulting in less heating and cooling use, population shifts to less energy intensive areas and smaller homes, and efficiency improvements resulting from appliance efficiency standards. Increased efficiency in space heating, air conditioning, and major appliances and better insulation and thermal pane windows have resulted in decreased consumption per household, despite increases in the number of homes, the average size of homes, and the increased use of electronics.

Source: Energy Information Administration, http://www.eia.gov/todayinenergy/detail.cfm?id=6570

Not included in these numbers is the amount of generation that comes from rooftop solar and other distributed generation sources. That generation lowers electricity retail sales. While the amount of generation coming from these sources is not available, the Energy Information Administration is working on plugging that data gap.

It is interesting that the cost of many electronic items in residential households is quite low. For example, the cost of charging a mobile phone is about 25 cents per year. An iPhone battery, for example, holds a charge of about 5.45 watt hours. If it is fully drained and recharged every day, then over a year it would need about 2,000 watt hours of electricity (i.e. 2 kilowatt hours). At an average electricity price of 12 cents per kilowatt hour for the residential sector, a cell phone uses about 25 cents of electricity per year.[i]

Electricity sales to the commercial sector have increased by about 1 percent per year between 2000 and 2010, but have been fairly flat since 2010. Similar to the residential sector, weather patterns affect electricity demand for heating and cooling, and efficiency standards improved the efficiency for lighting and space heating, helping to keep commercial building energy demand flat in recent years.

Industrial electricity sales remained fairly flat between 2000 and 2008 and then decreased by 9 percent between 2008 and 2009 as a result of the recession. Electricity use in the industrial sector is dependent on economic conditions and the demand for U.S. products. Since 2009, electricity sales to the industrial sector have been increasing slowly, but have not returned to their pre-recession level. Efficiency improvements in production processes have contributed to stagnating electricity sales in the industrial sector. Since 2010, however, the U.S. industrial sector has been revitalized due to low natural gas prices.

The transportation sector is mostly oil driven. While electricity sales to the transportation sector have increased at a rate of 3 percent a year between 2000 and 2010, those sales represented just 0.2 percent of total retail sales in 2012.

Policies That Lower Electricity Sales

Both the federal government and state governments have enacted policies that lower the demand for electricity, frequently by increasing the cost of the items that use electricity. While declining or flat electricity sales may benefit certain goals of the Obama Administration, such as lowering greenhouse gas emissions, the declining trend in electricity demand is an issue for the viability of the electric generation industry that obtain their earnings from sales of electricity. The following government policies affect electricity demand:

- Building Codes – Most states have codes that new construction must meet requiring a specified level of insulation and other efficiency measures on the building. These codes increase building costs.

- Appliance Efficiency Standards—The Federal government requires manufacturers to meet efficiency standards on the appliances (refrigerators, dishwashers, clothes dryers, etc.) they produce that limits the amount of energy they consume. These mandates increase the cost of appliances and frequently decrease their performance.

- Net Metering—Many states require their electric utilities to purchase excess electricity from homeowners that have rooftop solar systems or other forms of distributed generation. In its current form, net metering is a large subsidy for rooftop solar.

- Revenue Decoupling—Some states decouple electricity sales from the revenues that electric utilities receive in order to promote lower consumption of electricity[ii]

Certain states, such as California[iii], have allowed their utilities to “decouple” revenue from the sale of electricity to enable utilities to increase their revenue while selling less electricity. Revenue decoupling is defined as a ratemaking mechanism designed to eliminate or reduce the dependence of a utility’s revenues on sales. Under this program, utilities get to charge more for supplying less. Its intent, in theory, is to remove the disincentive a utility has to promote customer efforts to reduce energy consumption and demand or to install distributed generation to displace electricity delivered by the utility. Revenue decoupling provides an allowance so that the utility can maintain a certain level of revenues or revenues per customer. Differences from the targeted revenues are recaptured from customers through a surcharge or credit.[iv]

Traditional cost-of-service for electric utility companies provides for a fair return on investment, while revenue decoupling guarantees earnings at an authorized level that is reviewed periodically. Under revenue decoupling, a utility is indifferent to the level of sales. As a result, revenue decoupling reduces a utility company’s financial risk from reducing sales, due to conservation, weather and/or economic conditions.

Note that by its definition, revenue decoupling does not necessarily benefit customers because consumers are essentially charged a higher rate for the electricity they use. Theoretically, because consumers have lowered their demand through efficiency improvements, their bills are expected to be lower despite the higher rate. Critics of revenue decoupling say it distorts the core business functions of electric utilities and interferes with the overall regulatory process. (IER previously explained the issues with decoupling here.)

Source: NRDC, http://switchboard.nrdc.org/blogs/rcavanagh/Decoupling%20report%20Final%20Feb%202013%20-%20pdf%20%282%29.pdf

Electric utilities are also finding issues with net metering in that the excess electricity produced by the customer enters the grid that is maintained by the electric utility companies without a charge for its use. Electric utilities in Arizona are asking their Public Utility Commission to allow a charge for the use of the electricity grid by customers using distributed electricity, arguing that customers who do not produce solar power have to subsidize the use of transmission lines for those that do produce solar power and sell their excess electricity to the grid. That is, utilities are forced to buy electricity from people with solar panels and transport it on their lines without cost, forcing other customers to pay all of the utilities’ transmission costs.

Conclusion

Electricity sales are declining despite a greater number of households and increasing commercial floor space, indicators usually of increasing energy demand. While the number of households has increased, the electricity used per household has declined. A number of factors have influenced this trend including weather, appliance efficiency standards, building codes, and homeowners generating their own electricity. Since electricity consumption has historically been linked to economic growth, this reduction in electricity poses important questions for policymakers about the country’s economic growth rate, the potential to grow further, and ultimately, the direction of electricity pricing for future investment decisions.

[i] Forbes, Mobile phone: 25 cents per year, http://www.forbes.com/pictures/mef45mkmf/mobile-phone-25-cents-per-year-5/

[ii] Environmental Protection Agency, Decoupling for Electric and Gas Utilities: Frequently Asked Questions, 2007, http://epa.gov/statelocalclimate/documents/pdf/supp_mat_decoupling_elec_gas_utilities.pdf

[iii] Graceful Systems LLC, A Decade of Decoupling for US Energy Utilities: Rate Impacts, Designs, and Observations, February 2013, http://switchboard.nrdc.org/blogs/rcavanagh/Decoupling%20report%20Final%20Feb%202013%20-%20pdf%20%282%29.pdf

[iv] Revenue Decoupling, http://www.elcon.org/Documents/Publications/3-1RevenueDecoupling.PDF