The Energy Information Administration’s (EIA) Short-Term Energy Outlook expects U.S. electricity consumption to hit a record this year and to exceed that record in 2025. U.S. electricity demand is rising due to hotter than normal weather and demand from data centers and artificial intelligence (AI). During the first half of 2024, the U.S. electric power sector generated 5 percent more electricity than during the same period in 2023 due to a hotter-than-normal start to summer and increasing power demand from the commercial sector. U.S. sales of electricity to commercial customers in 2023 totaled 14 billion kilowatt hours, or 1 percent, more than in 2019 and was concentrated in a handful of states experiencing rapid development of large-scale computing facilities. Electricity demand in 2023 grew the most in Virginia, which added 14 billion kilowatt hours and Texas, which added 13 billion kilowatt hours. The Energy Information Administration expects more U.S. generation in the second half of 2024 than in the second half of 2023, but a slowing in growth to 2 percent in commercial demand because of expectations that space cooling use in that sector will be similar to the second half of 2023.

Despite AI centers needing reliable electricity 24/7 and negotiating with nuclear plants to supply that power directly, EIA sees solar power to be the fastest growing source of electricity in the United States with 36 billion kilowatt hours more electricity to be generated in the United States from solar in the second half of 2024 than in the second half of 2023–an increase of 42 percent. The agency is also forecasting 6 percent more U.S. wind generation during the second half of 2024–12 billion kilowatt hours more than in the second half of 2023 due to more wind turbines coming on line, and 4 percent (5 billion kilowatt hours) more hydropower, as a result of slightly improved water supply conditions this year. The expectation is that hydropower output will increase in nearly every part of the country, with notable increases in the Southeast and in the Northwest and Rockies. In other regions with significant hydropower generation, the agency expects hydro output to either increase slightly, such as in New York, or remain about the same, such as in California.

Despite the grid needing back-up power from natural gas and coal, EIA expects natural gas generation—the largest source of U.S. generation to decline by 21 billion kilowatt hours (2 percent less natural gas generation) in the second half of 2024 than in the second half of 2023. The forecast decline is due to more generation from renewable sources as noted above and the agency’s expectation of 7 percent higher Henry Hub natural gas prices in the second half of 2024 as compared to the second half of 2023. The higher natural gas prices, however, are expected to increase coal generation by 3 percent (10 billion kilowatt hours) during the second half of 2024.

Hot weather in June helped increase coal consumption by electric generators by 37 percent from May. EIA expects coal-fired electric power consumption to increase an additional 19 percent in July and 3 percent in August, reaching 45 million short tons in August, as utilities ramp up generation in response to summer air-conditioning needs. EIA expects the U.S. electric power sector to consume about 395 million short tons of coal in 2024, and then decline by 2 percent in 2025. In response, EIA expects coal production to increase month over month by 10 percent in June, 6 percent in July, and 13 percent in August. EIA expects 69 percent more U.S. coal consumption in August compared with May, while coal production is expected to increase 33 percent. With growth in U.S. coal consumption outstripping production this summer, combined with exports ramping back up in the summer months after the Francis Scott Key bridge collapse in late March, EIA expects electric power coal stocks to drop to 113 million short tons in August from 137 million short tons in May and end the year at 115 million short tons—12 percent less than at the end of 2023. Baltimore is the second-largest coal exporting port in the United States, accounting for 28 percent of coal exports in 2023. EIA expects coal stocks to end 2025 at 85 million short tons because of less coal production and rising coal exports.

Wholesale power prices

Due to rising U.S. natural gas prices, EIA expects wholesale power prices during the second half of 2024 to exceed average prices during the first half of 2024 in most regions despite expectations that temperatures for the rest of the summer to be close to the 10-year average. The agency notes that temporary heat waves in the remaining summer months could cause spikes in wholesale power prices. The lowest wholesale prices in the first half of 2024 were in the Southwest and in California, where prices averaged around $20 per megawatt hour. EIA expects the wholesale prices in those two regions to rise into the low $30 per megawatt hour range in second half of 2024.

The Northwest experienced high power prices in first half of 2024, averaging $66 per megawatt hour, reflecting high regional natural gas prices, less hydroelectric generation that fell to a 22-year low in 2023, and increased power demand from Canada. EIA expects average wholesale prices in the Northwest to fall to less than $50 per megawatt hour in the second half of 2024. The agency expects wholesale prices at other major hubs in the second half of 2024 to be higher than prices in the first half of 2024 by less than $10 per megawatt hour.

Conclusion

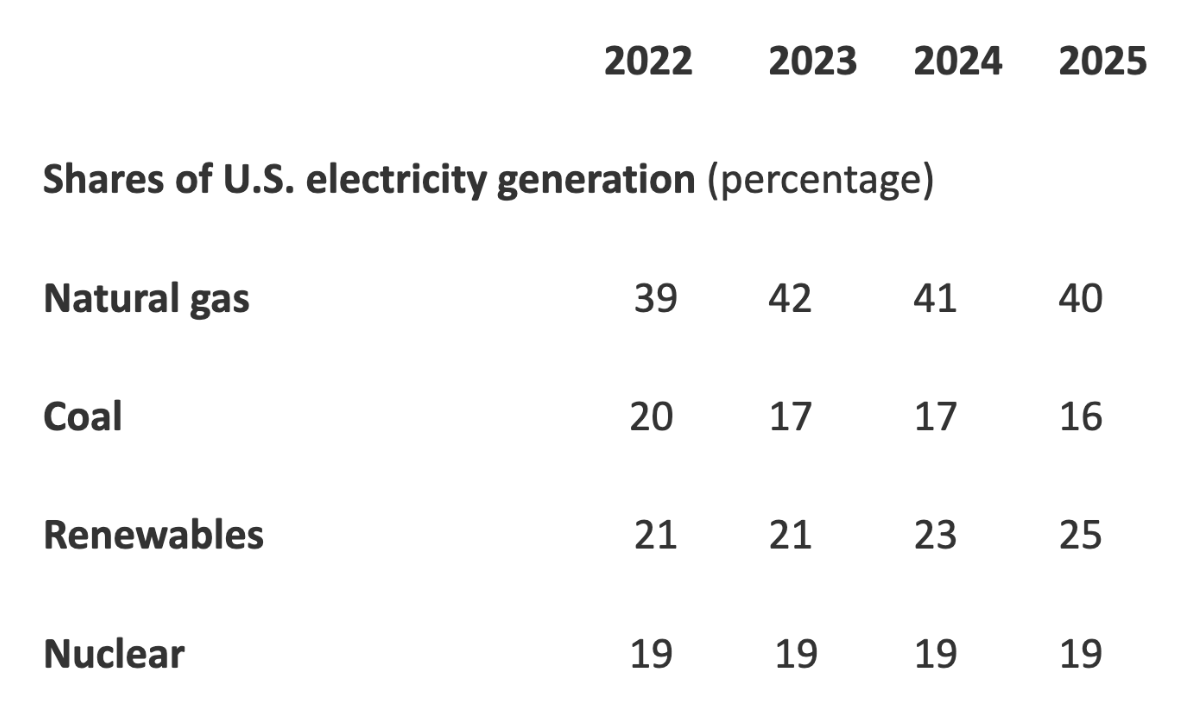

EIA is forecasting record electric demand in 2024 and 2025 with a 3.5 percent yearly increase in 2024 and a 1.1 percent increase in 2025. The agency expects solar capacity to grow by 40 percent in 2024 and 21 percent in 2025 to meet that demand, with some help from wind capacity which is expected to increase 5 percent in 2024 and 3 percent in 2025. Despite wind and solar needing a stable and reliable back-up as they are intermittent, weather-driven sources of power, EIA is not expecting much growth from natural gas and coal generation. In fact, by 2025, their shares decline. Apparently, the U.S. utility industry is not paying much attention to warnings from the North American Electric Reliability Corporation (NERC), who is concerned that extreme weather events, rapid demand growth, and systemic vulnerabilities pose risks for supply shortfalls and grid reliability.