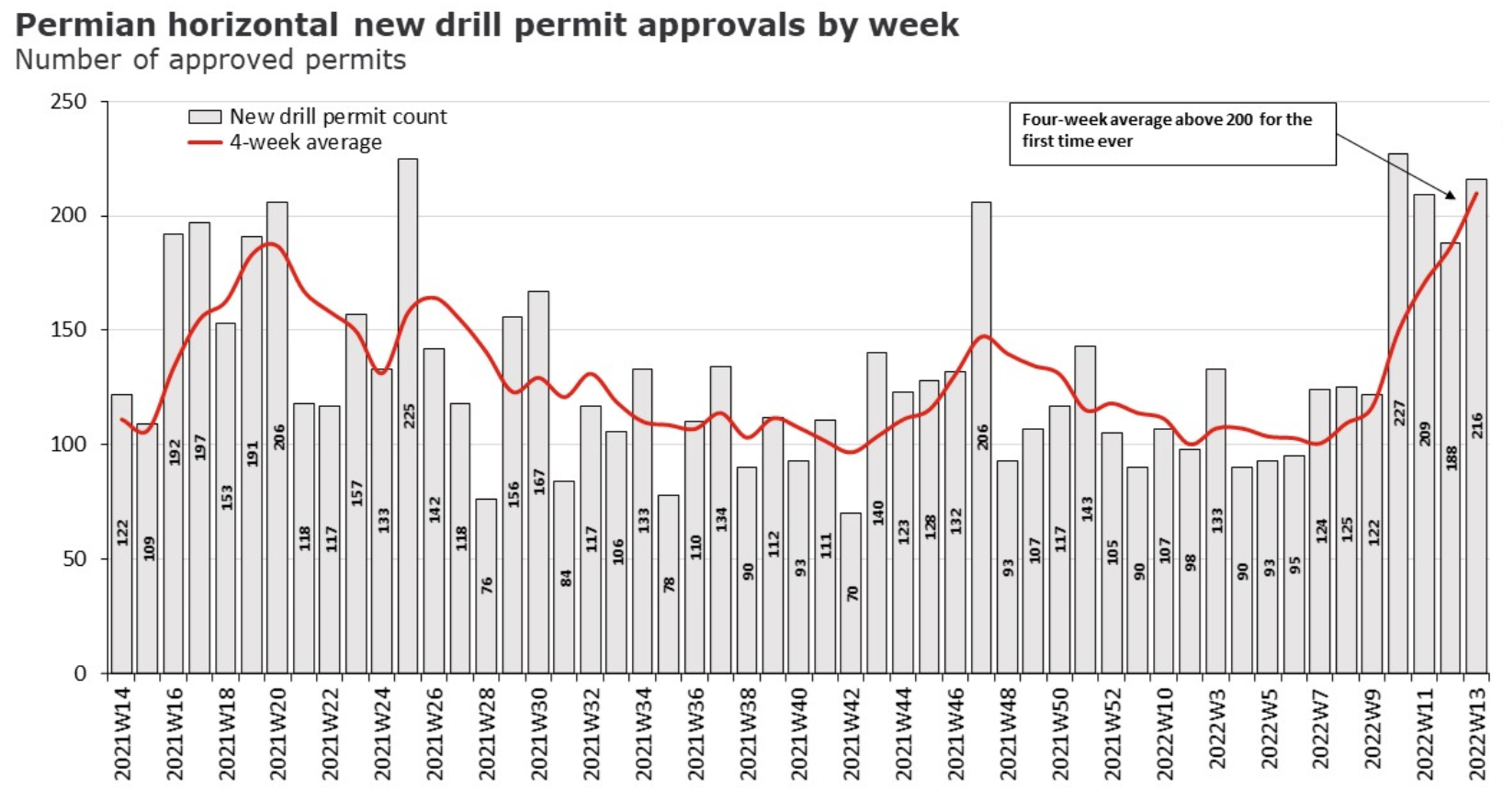

Horizontal drilling permits for new wells in the Permian Basin of Texas and New Mexico—the most productive oil basin in the United States—hit an all-time high in March, with 904 total permit awards, driven by high oil prices and rising world demand for U.S. oil. Weekly approved permits hovered between 188 and 227 since March 7, 2022, that pushed the four-week average to 210 for the week ending April 3—a record for horizontal permit approvals in the Permian Basin over four weeks. Private operators, who normally comprise a third of production, accounted for more than half of the permits, as publicly traded companies have pledged to shareholders to pay down debt and raise dividends before investing in new wells. A survey by the Federal Reserve Bank of Dallas indicated that many (29 percent of the respondents) will stick to those commitments regardless of oil prices.

The increase in permitting activity positions the industry for continuous rig count additions in the second half of 2022. Data from the Baker Hughes rig count shows momentum in the same direction, increasing by 101 oil rigs (23 percent) and 43 gas rigs (44 percent) during the past six months. Last week’s Baker Hughes rig count showed an additional 16 oil and gas rigs.

While these numbers are encouraging, caution is needed because many permits never get drilled, and operators follow diverse permitting strategies – i.e. the time from permit approval to the start of drilling varies substantially across producers in the same basin. However, while weekly horizontal permit approvals have occasionally spiked above 200 in recent years, persistently elevated levels from regulators in Texas and New Mexico are unprecedented. That implies that this trend reflects an expansion in activity plans for many Permian operators.

Federal Reserve Bank of Dallas Survey

The Dallas Fed surveyed 141 oil and gas firms in the 11th Fed District, which includes Texas and parts of New Mexico and Louisiana. When asked why they are not increasing production more, 59 percent of respondents indicated it was because investors are pressuring them to maintain capital discipline. Another 11 percent said it was because of the environmental social and governance movement, 8 percent said it was because of trouble accessing financing and 6 percent said it was because of government regulations. Fifteen percent marked “other,” which included things like “personnel shortages, limited availability of equipment, and supply-chain issues.”

One major survey finding dealt with costs, which are increasing fast for producers and oil service companies as inflation affects the raw material and labor markets. The indexes that are used to track the oil and gas labor market were at the highest level in the six years that the Fed has taken the survey, and oil services firms are charging record prices. Services firms are also seeing higher costs, and running short of materials including even the sand needed for shale drilling. The survey showed that the median producer expects oil production to grow 6 percent between the fourth quarter of 2021 and the fourth quarter of 2022—a rate that is not fast enough to add the barrels needed to slow down the rise in oil prices.

In the anonymous comment sections of the survey, executives indicated that President Biden and other government officials should get out of the industry’s way. Comments from oil producers included: “In the first quarter of 2021, I divested all properties in the state of Colorado due to the unbelievably hostile and increasingly aggressive regulatory environment driven by anti-fossil-fuel ideology.” Another indicated: “The administration has no clue about the oil-and-gas industry.”

Conclusion

The increase in the drilling permit approval activity and oil rigs in the non-federal Permian Basin is good news for oil production growth and helping to contain oil price increases. However, having more permit approvals does not necessarily mean more production as permits are often not used for a number of reasons. It is clear from the Dallas Fed survey that public companies are heeding investors’ wishes to protect higher returns, which comes at the expense of higher production growth. Investors are opposed to large-scale increases because it is unclear what oil prices could be in a couple of years, especially given President Biden’s commitment to “end fossil fuels.” While oil prices are in triple digits today, they could fall significantly in the near future and oil companies would bear the economic risk, which could be very large. A shale well could cost $7 million to drill.

Further, the industry is hampered by labor constraints and supply chain bottlenecks, as are other industries. Korean battery manufacturers, for example, are warning their electric vehicle batteries may increase 40 percent in price because of mineral shortages. Supply chain problems and rising diesel fuel and labor costs will slow the pace of oil development and lead to higher costs of operation. Accelerating the modest growth in oil production that is occurring, could exacerbate the problem. The regulatory environment is also an issue as Biden has made his anti-oil and gas policies clear—something investors are well aware of.