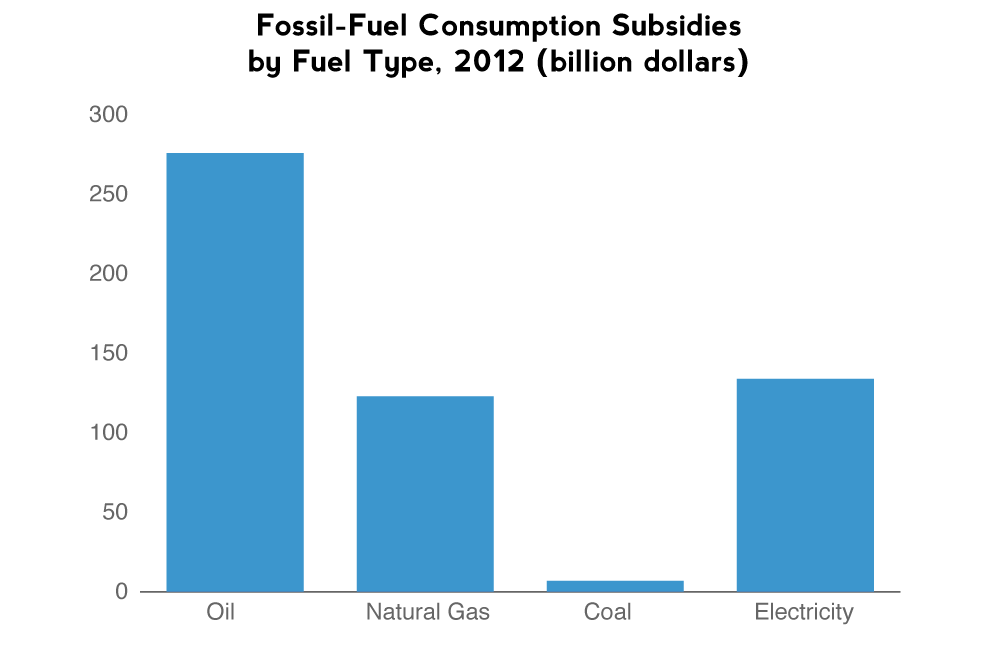

The International Energy Agency (IEA) annually estimates global fossil-fuel consumption subsidies that measure what many developing countries spend to provide below-market cost fuel to their citizens. In 2012, IEA found that fossil fuel consumption subsidies totaled $544 billion, 4 percent higher than the 2011 total of $523 billion.[i] This increase is due to moderately higher international energy prices and increased consumption. Oil subsidies make up over half of the total fossil fuel consumption subsidies, while electricity makes up 25 percent, natural gas 23 percent and coal 1 percent. According to the IEA, the United States does not have any consumption subsidies for oil, coal, or natural gas.

The IEA is a creation of the Organization for Economic Cooperation and Development (OECD), which represents the developed nations of the world. IEA’s study found that many developing countries artificially lower energy prices to their citizens, paying the difference from their government resources.[ii] An example of a similar welfare transfer in the United States is the U.S.’s Low Income Home Energy Assistance Program (LIHEAP).[iii] Wealth transfers are differentiable from subsidies in the name of commercializing uneconomic energy sources such as on-grid wind or solar. The United States and other developed countries offer support to energy production in the form of tax credits, loan guarantees or use mandates, which are not included in IEA’s fossil fuel consumption subsidy calculations since they are directed towards production rather than consumption of the fuel.

Source: International Energy Agency, World Energy Outlook 2012, Energy Subsidies, http://www.worldenergyoutlook.org/resources/energysubsidies/

According to the IEA, global fossil fuel consumption subsidies are over 5 times higher than global renewable subsidies.[iv] IEA’s estimate for global renewable subsidies (biofuels and renewable electricity) in 2012 is over $100 billion, higher than the $88 billion they reached in 2011. In contrast to fossil fuel consumption subsidies, renewable fuel subsidies often take the form of tax credits for investment or production, or premiums over market prices to cover the higher production costs compared to traditional fuels.

Fossil Fuel Consumption Subsidies by Country

Fossil fuel consumption subsidies are most prevalent in the Middle East and in North Africa. (See chart below.) Iran leads the world in fossil fuel consumption subsidies providing over $82 billion from its government resources in 2012 to lower the cost of fossil fuels to end-users in its country.[v] Of the $82 billion in fossil fuel consumption subsidies Iran paid, over 40 percent covered oil, 36 percent funded natural gas, and the remainder (21 percent) went to electricity. Saudi Arabia is the second largest country subsidizing end-use fossil fuel prices, providing 77 percent of its almost $61 billion in fossil fuel consumption subsidies to oil and 23 percent to electricity in 2012. Russia comes in third with $46 billion in fossil fuel consumption subsidies, with natural gas getting 53 percent and electricity 47 percent of the total. India ranked fourth with almost $43 billion in fossil fuel consumption subsidies, 76 percent covering oil, 9 percent covering natural gas, and 15 percent going to electricity.

Venezuela and China rank fifth and sixth, respectively, both funding over $26 billion in fossil fuel consumption subsidies. Venezuela’s fossil fuel consumption subsidies totaled $28 billion in 2012 and mainly fund lower oil (and gasoline) prices. The distribution of Venezuela’s fossil fuel consumption subsidies was: 71 percent oil, 15 percent natural gas, and 14 percent electricity. China is one of the few countries that subsidize coal consumption. Of China’s almost $27 billion in fossil fuel consumption subsidies in 2012, oil received the most (48 percent), then electricity (38 percent), followed by coal at 12 percent and natural gas at 2 percent.

Many of the countries providing fossil fuel consumption subsidies own state energy companies, including countries that comprise the Organization of Petroleum Exporting Countries, such as Iran, Saudi Arabia, and Venezuela. Net exporting countries see these subsidies as an opportunity cost.

Fossil fuel consumption subsidies are often used to alleviate energy poverty, but are an inefficient means for doing so, creating market distortions that result in wasteful energy consumption.

Developed countries, such as the United States, do not have fossil fuel consumption subsidies, as seen in the following chart.

Conclusion

Many Americans are confused by the large amount of global fossil fuel consumption subsidies that the IEA calculates, not realizing that these subsidies have nothing to do with tax policy, research and development or loan guarantees, where most U.S. programs are directed. In fact, most liberalized countries not only do not offer fossil fuel consumption subsidies that artificially lower the end-use price of the fuel, but in fact, tax energy consumption. Fossil fuel consumption subsidies are common and even pervasive in the developing world, particularly in economies with state-owned energy companies. The IEA has been advocating for years that fossil fuel consumption subsidies should be eliminated since they encourage wasteful consumption.

Fossil fuel consumption subsidies in developing countries are welfare transfers that can be differentiated from subsidies in the name of commercializing or sustaining uneconomic energy sources such as on-grid wind or solar, which the United States and other industrialized countries have been heavily subsidizing. These latter forms of energy subsidies that help promote production of uneconomic energy sources can be abolished without detrimental affects to the U.S. economy or its citizens, and in fact would increase economic efficiency since by their very nature, they are more expensive than competing forms of energy.

The OECD countries find fault with developing countries for subsidizing the costs of energy purchased by their citizens, but those same OECD nations are busy subsidizing and mandating the use of uneconomic and inefficient forms of energy which will make energy more expensive and less reliable for their citizens. Neither of these policies reflects markets or makes sense, and the economies of all concerned would be better off if all such supports by governments were abolished.

[i] International Energy Agency, World Energy Outlook 2013, Energy Subsidies, http://www.worldenergyoutlook.org/resources/energysubsidies/

[ii] International Energy Agency, Fossil Fuel Subsidies—Methodology and Assumptions, http://www.worldenergyoutlook.org/resources/energysubsidies/methodology/

[iii] Department of Health and Human Services, Low Income Home Energy Assistance Program, http://www.hhs.gov/news/press/2012pres/01/20120119a.html

[iv] International Energy Agency, World Energy Outlook 2012, Executive Summary, http://www.iea.org/publications/freepublications/publication/English.pdf

[v] International Energy Agency, World Energy Outlook 2013, Energy Subsidies, http://www.worldenergyoutlook.org/resources/energysubsidies/