Michigan, Texas, and California are just a few areas of the country that may not have enough generating capacity to make it through this summer’s heat and may have to institute controlled outages as an emergency measure. The Midcontinent Independent System Operator (MISO) is expecting a summer peak forecast of 124 gigawatts, with only 119 gigawatts of regularly available generating capacity. In California, an electricity supply crunch is expected, with projections showing that peak demand could exceed available supplies by as much as 3,500 megawatts. The Electric Reliability Council of Texas had to ask customers to conserve energy after several power plants closed unexpectedly, causing real-time prices to briefly surge to over $4,000 per megawatt hour, compared with an average of $60 per megawatt hour this year.

MISO

MISO is one of the world’s largest energy markets and operates the power grid for 15 states including Michigan and parts of the South as well as portions of Canada. MISO’s seasonal assessment indicates capacity shortfalls in both the north and central regions, leaving those areas at increased risk of temporary, controlled outages, which it has never had to undertake before. One utility, DTE, will be bringing a new 1,150 megawatt natural gas plant online in June, and has a large number of customers on voluntary interruptible rates whose service can be curtailed to maintain system reliability.

Consumers Energy claims it has a reliable supply of energy to serve its customers, but will take action if need be on the hottest summer days. The utility is prepared to ask large industrial customers to use less energy, which could rock Michigan’s manufacturing economy, and, if necessary, to ask all customers to voluntarily reduce energy use. The utility has been very aggressive in shutting down conventional power plants and moving towards renewable energy. It had purchased power from Entergy’s Palisades Nuclear plant, which closed at the end of May, 9 years before the expiration of its license. Consumers Energy will replace the power from the nuclear plant, which represented about 10 percent of its peak load capacity, with natural gas plants, solar energy, electric system upgrades, energy efficiency programs and battery storage, which is also part of its broader, long-term plan to shutter its coal plants in 2025. With an investment in 8,000 megawatts of solar by 2040, solar and wind are eventually expected to generate 60 percent of its electricity.

California

To address California’s potential electricity shortage problem, Governor Gavin Newsom wants to spend $5.2 billion to boost reliability. That includes extending the lives of plants that were scheduled to retire, and ramping up new generation and storage projects, new clean energy backup generation projects, and diesel and natural gas backup generation units with emission controls. Initial plans include keeping natural gas plants on-line that were due to retire despite California law mandating that 60 percent of its electricity come from renewable sources by 2030, which is part of the state’s plan to be carbon free by 2045.

Heat waves have increased energy demand in California while wildfires, drought and environmental opposition to water storage have cut solar and hydroelectric generation. Rolling blackouts hit the state in August 2020 during a West-wide heat wave where neighboring states did not have excess power to sell to California, which imports about a third of its electricity. Since the August 2020 rolling blackouts, the state has ordered utilities to procure 11,500 megawatts of power and accelerate generation projects. Battery storage capacity grew twentyfold in 2.5 years, but is still tiny and costly for consumers. The state also installed emergency generators and delayed planned retirement dates for existing power plants.

Energy planners, however, want a 22.5 percent buffer of available electricity supplies over projected peak demand. But, right now, the state lacks that buffer for the next five summers. This summer, the potential gap between energy demand and supply could hit 3,500 megawatts. Beginning next summer, the state is expected to have sufficient electricity supply under normal circumstances, but extreme events could create a demand surge and electricity supply shortage. In 2023, the power supply gap is expected to be 600 megawatts. In 2024, it increases to 2,700 megawatts, and a year later, in 2025, the potential shortfall is 3,300 megawatts.

California has a mandate to reduce its greenhouse gas emissions 40 percent below 1990 levels by 2030. To meet that requirement, the state needs to cut emissions about 4.3 percent annually — about 2.5 times its 2019 reduction level. It was expected that part of those goals would be met by closing the state’s natural gas plants. Power plant retirements are expected to reduce available supply by about 6,300 megawatts by 2025. Those planned retirements include the retirement of the Diablo Canyon nuclear plant’s two generators in 2024 and 2025. The Newsom administration, however, has asked the Department of Energy for help in getting federal funding that could delay the plant’s closure. Governor Newsom has recently bragged that California is running a $97.5 billion budget surplus, so it is unclear whether federal funds will be forthcoming.

Texas

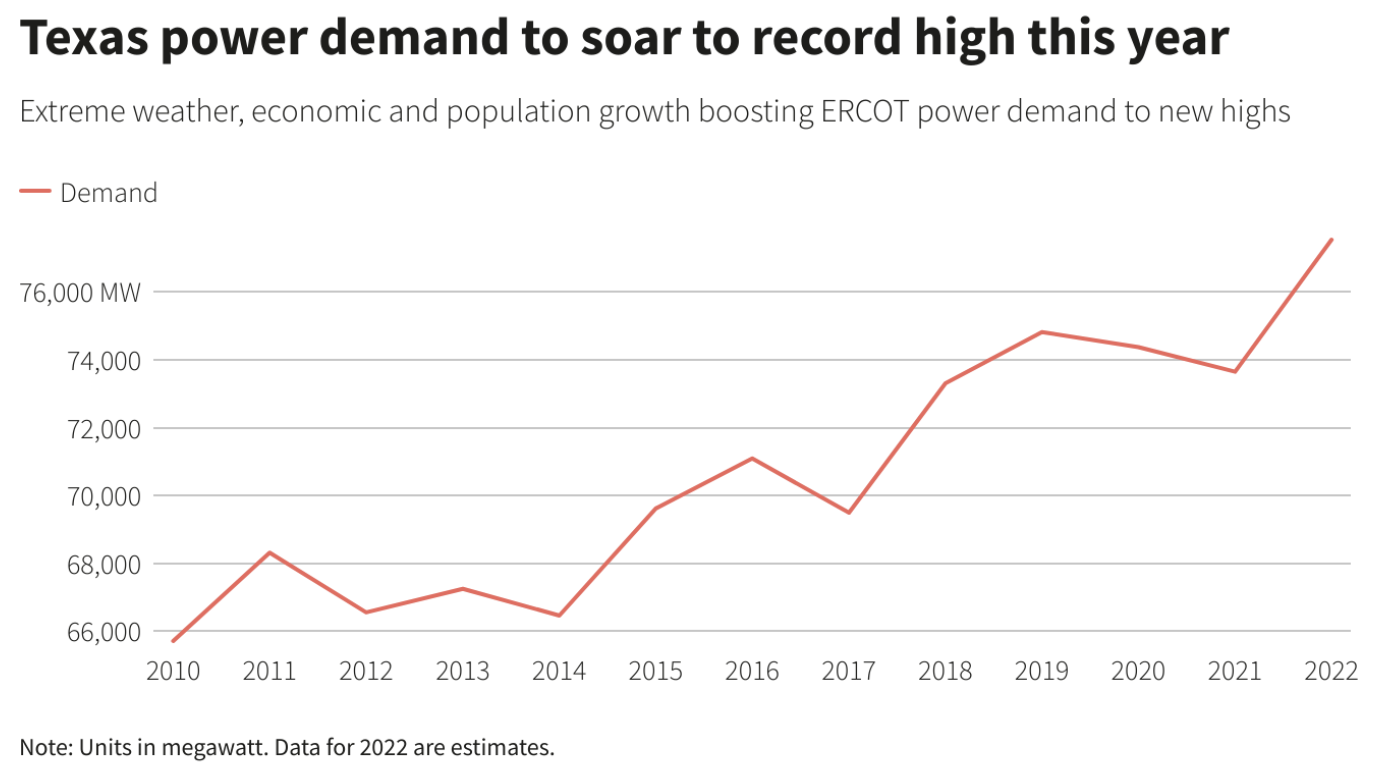

The Electric Reliability Council of Texas (ERCOT), which operates the grid for most of the state, expects power demand to surge to an all-time record in June – surpassing levels reached in August of 2019. ERCOT expects power usage to reach 77,544 megawatts on Tuesday, June 7, topping the grid’s all-time high of 74,820 megawatts set in August 2019. The state’s worst power loss, however, was during Winter Storm Uri in February 2021, where parts of the state lost power for several days as its wind generation precipitously dropped from 40+ percent to less than 10 percent of the state’s generation. The addition of wind and solar plants over the past year is expected to raise ERCOT’s power resources to 91,392 megawatts. However, as the February 2021 power loss indicated wind and solar power do not provide reliable capacity, rather they provide generation when the resources are available for them to operate.

ERCOT claims it has enough resources to meet forecast demand, but it has already had a close call. During a mini-heatwave in mid-May, ERCOT was forced to ask customers to conserve energy after six power plants, providing 2,900 megawatts of power, closed unexpectedly, causing real-time prices to briefly surge to over $4,000 per megawatt hour, from less than $6 per megawatt hour earlier.

Even if ERCOT has enough resources to keep the lights on this summer, the grid’s power lines may not be able to move all the energy from where it is generated to where it is consumed, increasing costs for consumers. Transmission congestion in the real-time market was up 46 percent in 2021, totaling $2.1 billion. When that congestion occurs, it raises prices for buyers who need to source power. More than $560 million of the congestion cost was generated during Winter Storm Uri.

Conclusion

Regulators in several regions of the United States are predicting record heat and drought this summer that could cause rotating blackouts. MISO, ERCOT, and the California Independent operator are a few that are already warning their residents that problems may occur where they would need to conserve energy. States are pushing solar and wind generation to become carbon free, but those technologies are intermittent, operating only when the wind blows and the sun shines so they cannot be relied on 24/7 to supply power.

Some states, particularly California, are adding expensive battery storage capacity to hold excess power to be released when needed. The cost of battery storage capacity is not factored in when states and manufacturers tell the public that wind and solar are cost competitive with natural gas and coal generated power. These renewable technologies have helped increase electricity costs to consumers because of their intermittency, and electricity prices continue to rise. In fact, the Energy Information Administration estimates that electricity prices will rise by a national average of 3.9 percent from last summer.