In 2018, natural gas generated 35 percent of the nation’s electricity while coal only generated 27 percent–about half of its historical high. And, not only has natural gas generation overtaken coal generation, but natural gas combined cycle capacity has overtaken coal capacity as existing coal capacity is forced to retire due to low natural gas prices, onerous regulations during the Obama years, and mandates and subsidies that promote and sustain renewable energy. When generators are forced to operate less, as coal is, their costs go up because there are fewer kilowatt-hours to spread those costs over, and they become uncompetitive. Despite the United States having the largest coal reserves in the world, federal and state policies have forced the retirement of many U.S. coal plants, while China and India are continuing to build coal plants, helping to improve their economies and electrify their population.

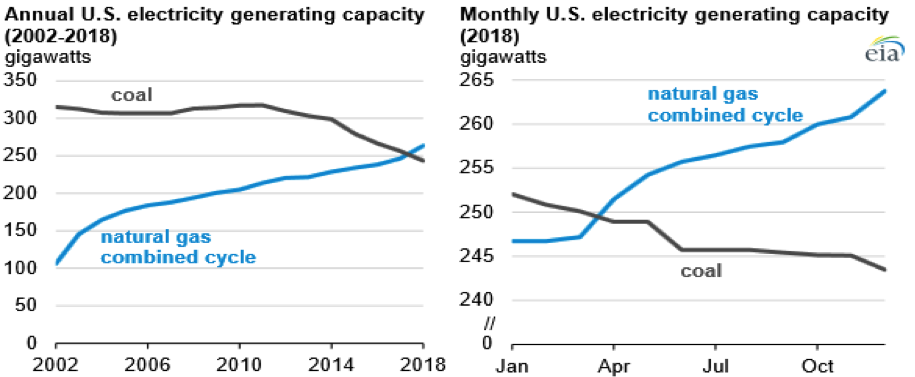

Coal and Natural Gas Capacity

As of January 2019, U.S. generating capacity of natural gas combined cycle power plants totaled 264 gigawatts, compared with 243 gigawatts at coal-fired power plants—almost 9 percent higher. Since the beginning of 2015, about 40 gigawatts of coal-fired capacity have retired, and no new coal capacity has been built in the United States. During that same time period, natural gas combined cycle capacity has increased by about 30 gigawatts. The decreased generation from coal-fired power plants was replaced by generation from the natural gas combined cycle capacity additions, and generation from new subsidized and mandated wind and solar units.

That trend continues through 2019. According to EIA’s latest inventory of electric generators, an additional 6.1 gigawatts of combined cycle natural gas plants are expected to come online, most of which will be operating by June 2019 in preparation for higher summer demand. Most of the planned natural gas capacity additions are in Pennsylvania, Florida, and Louisiana.

There are 4.5 gigawatts of coal capacity that is expected to retire in 2019, most of which are scheduled for retirement at the end of the year. Half of the planned retirement capacity for coal is the Navajo generating plant (2.3 gigawatts) in Arizona that came online in the 1970s. The 2019 expected coal capacity retirements is relatively small compared with the 13.7 gigawatts that retired in 2018–the second-highest coal capacity retired in a single year.

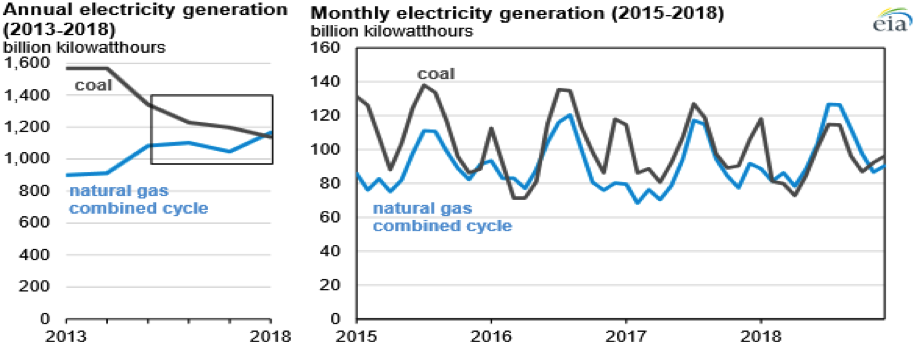

Coal and Natural Gas Generation

Electricity generation from natural gas combined cycle power plants surpassed coal-fired generation beginning in December 2015 and continued into the first half of 2016 when natural gas prices were low. That crossover was reversed during the second half of 2016 due to higher natural gas prices, which continued until February 2018, when natural gas combined cycle generation again surpassed coal generation. As more natural gas combined cycle plants continue to be built and coal plants continue to retire, natural gas generation will likely continue to outrank coal generation.

Capacity Factors

Capacity factors measure the actual output of a plant as a percentage of its total possible output based on its capacity. Both coal plant and natural gas plant capacity factors are typically in the 50 percent to 60 percent range. In 2018, the capacity factor for coal dropped to 54 percent from 61 percent in 2014, while the capacity factor for natural gas combined cycle increased from 48.3 percent to 57.6 percent over that same 5-year time period. Thus, not only has natural gas combined cycle capacity surpassed coal capacity but the natural gas combined cycle capacity is operating more (producing more electricity) than the coal capacity.

Conclusion

Natural gas generation surpassed coal generation by 8 percentage points in 2018—a 27 percent share for coal and a 35 percent share for natural gas. It now seems that natural gas will continue to surpass coal as a generating source as coal capacity continues to retire and as natural gas combined cycle capacity continues to be built. Whether that is a trend that makes sense economically and from a supply diversification standpoint will remain to be seen. Recent experience has shown that price differences matter in the generating market as explained above. Historically, natural gas prices have shown considerable variation, while coal prices have been relatively stable. If natural gas prices were to escalate in the future, the United States may no longer have sufficient coal generating capacity to meet electricity demand at affordable prices. This is especially true as more of the nation’s system is becoming dependent upon intermittent renewables such as wind and solar as a result of favorable mandates and subsidies. Regulators, businesses and policymakers need to keep a watchful eye to ensure that the overall system does not hit a breaking point due to political interventions. Consumers will be harmed if this should happen.