According to an International Energy Agency (IEA) report, President Biden’s and Europe’s energy transition is probably not feasible because demand for key minerals such as lithium, graphite, nickel and rare-earth metals would explode, rising by 4,200 percent, 2,500 percent, 1,900 percent and 700 percent, respectively, by 2040. The world does not have the capacity to meet such demand and there are no plans to fund and build the necessary mines and refineries. Further, radical increases in demand for these metals will raise commodity prices, which will reverberate throughout the global economy.

If the goals of the energy transition were pursued as stipulated, the world would face daunting environmental, economic and social challenges, along with geopolitical risks as the energy transition shifts from a fuel-intensive to a material-intensive energy system. Rather than using fossil fuels that are transported easily, cheaply and efficiently, the transition is to the energy-intensive transport of massive amounts of rocks and other solid materials that need chemical processing and refining.

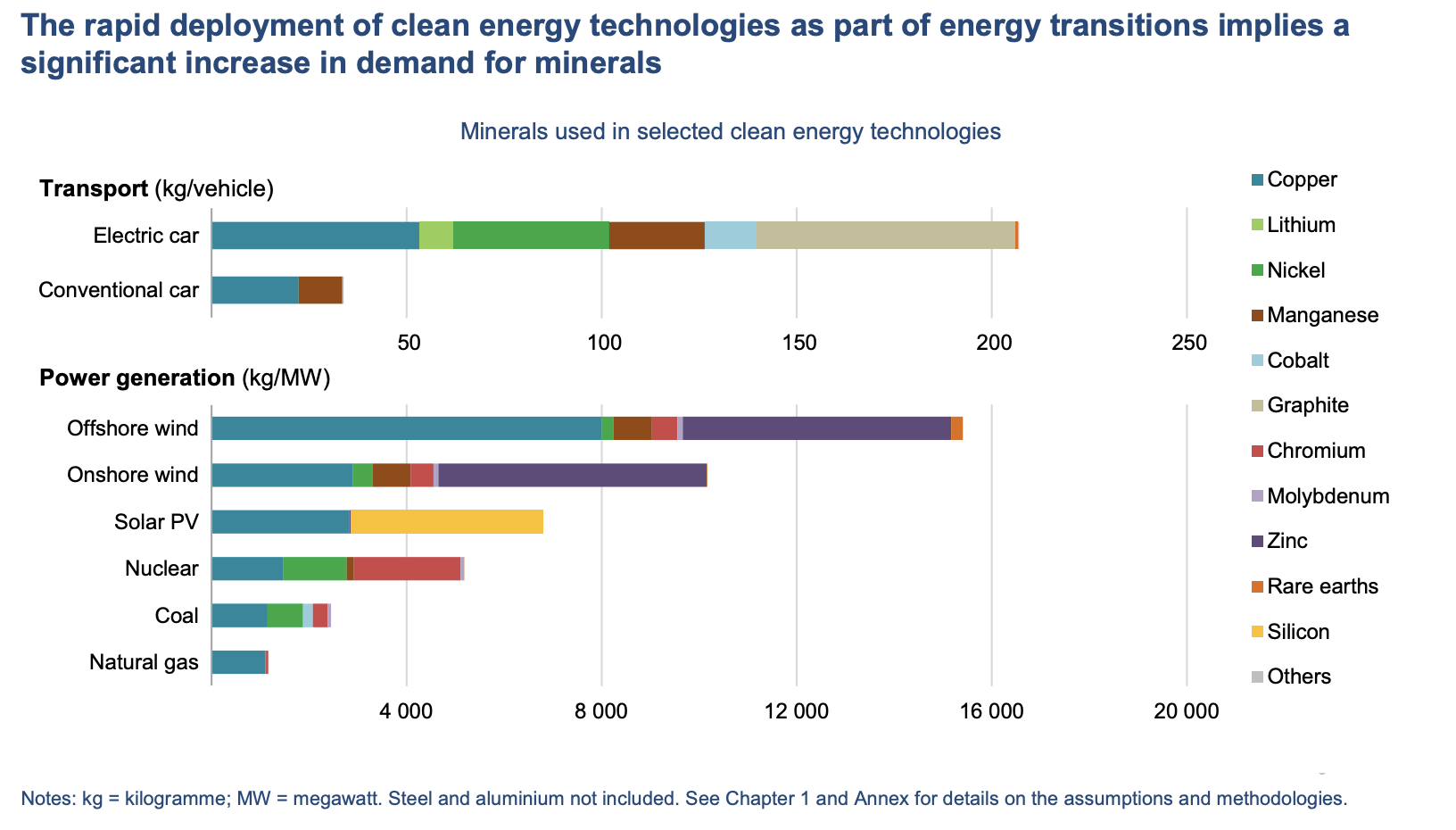

IEA’s report, “The Role of Critical Minerals in Clean Energy Transitions,” explains that “green-energy machines” use far more critical minerals than conventional-energy machines. A typical electric car requires six times the mineral inputs of a conventional car, and an onshore wind plant requires nine times more mineral resources than a gas-fired power plant. Since 2010, the average amount of minerals needed for a new unit of power generation capacity increased by 50 percent as the share of renewables has risen. That brought wind and solar to a 10 percent share of the world’s electricity. With the world 84-percent dependent on fossil fuels and countries shuttering nuclear plants, “green-energy machines” have a long way to go.

It takes on average over 16 years for mining projects to go from discovery to first production. If the United States starts tomorrow, new production for these materials will begin after 2035. This is a considerable problem for the Biden administration if it expects to achieve 100-percent carbon-free electricity by that date.

Further, mining and mineral processing require large volumes of water, and pose contamination risks through acid mine drainage, wastewater discharge and the disposal of tailings. Copper and lithium have high water requirements. Over 50 percent of today’s lithium and copper production is concentrated in areas with high water stress levels. Several major producing regions such as Australia, China, and Africa are also subject to extreme heat or flooding, which pose greater challenges in ensuring reliable and sustainable supplies.

Production of these green energy materials is also energy intensive and that trend is increasing. In recent years, ore quality has fallen across a range of commodities. For example, the average copper ore grade in Chile declined by 30 percent over the past 15 years. Extracting metal content from lower-grade ores requires more energy, higher production costs, and more greenhouse gas emissions and waste volumes. The IEA data show that, depending on the location and nature of future mines, the emissions from obtaining these materials could wipe out much or most of the emissions saved by driving electric cars.

And, geopolitical risks abound. The top three producers for three key green-energy materials control more than 80 percent of global supply with China in the dominant position. The United States is not even a player when it comes to these metals. That compares with the oil-and-gas market, which is characterized by supply diversity. The top three oil and gas producers, including the United States, account for less than half of world supply.

The Democratic Republic of the Congo (DRC) and People’s Republic of China (China) were responsible for 70 percent and 60 percent of global production of cobalt and rare-earth elements respectively in 2019. China is even more dominant when it comes to the processing of these energy materials. China’s share of refining is about 35 percent for nickel, 50 to 70 percent for lithium and cobalt, and almost 90 percent for rare-earth elements. Chinese companies have also made substantial investment in overseas assets in Australia, Chile, the DRC and Indonesia. The high levels of concentration and complex supply chains increase the risks of physical disruption and trade restrictions, while also increasing China’s leverage with the United States in negotiations on all matters. Dependency, we have learned as a consequence of decades of oil dependency, carries costs of all kinds. The levels of dependency on Chinese “green energy” supply lines dwarf those the United States encountered in its relations with Mideast oil suppliers.

Conclusion

It is unclear whether the expensive energy transition that President Biden wants will result in net zero carbon emissions by 2035 in the electric generating sector and by 2050 overall. The growing energy intensive nature of these energy metals as their quality goes down requires extra processing, releasing more greenhouse gas emissions. The geopolitical risks due to the lack of domestic resources or the processing capability puts the United States at a 100 percent risk of trade wars, shortages, and escalating prices. The average length of time to ready a mine for production at 16 years means even if the United States had the resources, Biden’s first date would be missed before massive construction could start.

The IEA should be applauded for pointing out these issues regarding green energy machines (e.g., electric vehicles, wind turbines, solar power) and their requirement for energy materials such as cobalt, lithium, and rare-earth metals. Americans, however, should ask these questions: Why does the Biden administration need the IEA to inform them about these issues? Why isn’t the Biden administration aware of them before it sets unrealistic goals? How much will it cost the American economy and the public? Can Biden’s goals even be attained? The United States is sailing into uncharted energy territory with its emphasis on “green energy.” Political leaders should acknowledge this and seek solutions to the problems already being revealed before plunging headlong into what could ultimately prove very dangerous to our economy and energy security.