The budget reconciliation bill that the Democrats are writing is not only very costly to taxpayers at $3.5 trillion dollars, but it will raise energy prices for consumers while it destroys the U.S. energy system as similar policies are doing in Europe. Europe is facing energy crises due to its anti-carbon policies, which has resulted in its enormous investment in intermittent wind and solar technologies over the past decade.

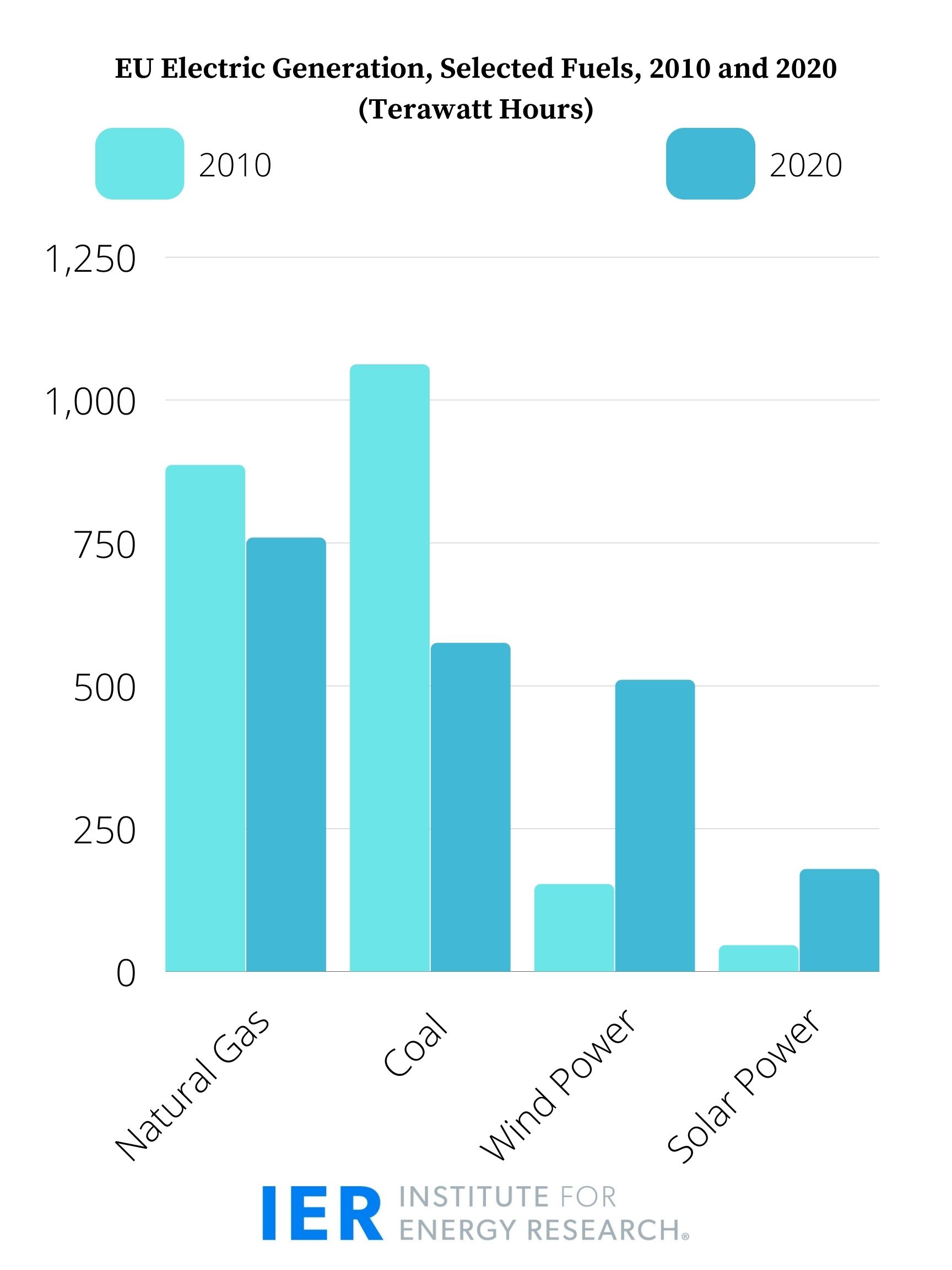

Over the past ten years, the European Union increased its wind generation by 183 percent and its solar generation by 532 percent, while decreasing its generation from coal by 49 percent and natural gas by 5 percent. It is now facing skyrocketing natural gas and electricity prices and the potential for blackouts as energy supply is insufficient to meet demand. President Biden’s anti-carbon and energy policies and those being written in the Democrats’ reconciliation bill are likely to result in similar conditions with the U.S. energy system. Rather than following the old Yankee axiom of “if it ain’t broke don’t fix it,” European politicians have been tinkering and politicizing their energy system with predictable results. And many U.S. politicians are urging that we pursue the same failed course in the budget reconciliation package.

Europe’s recovery from the coronavirus pandemic resulted in strong energy demand and a shortage of supply. A cold and long winter increased the demand for natural gas and electricity and low wind speeds meant natural gas and coal were needed to back-up the lull in wind generation. Russia slowed natural gas deliveries to Europe accentuating the gas supply shortage, most likely to increase pressure on Germany to finish the Nord Stream 2 pipeline certification.

Europe had to compete with Asia for LNG deliveries. Gas demand remained strong throughout the year, particularly in China, Japan and Korea. Drought reduced hydropower generation in Asia, and energy demand increased as manufacturers supplied the West with more goods. Due to a natural gas and coal shortage, China had to ration power to its aluminum smelters, resulting in aluminum prices hitting a 13-year high. On the supply side, LNG production was lower than expected due to unplanned outages and delayed maintenance from 2020.

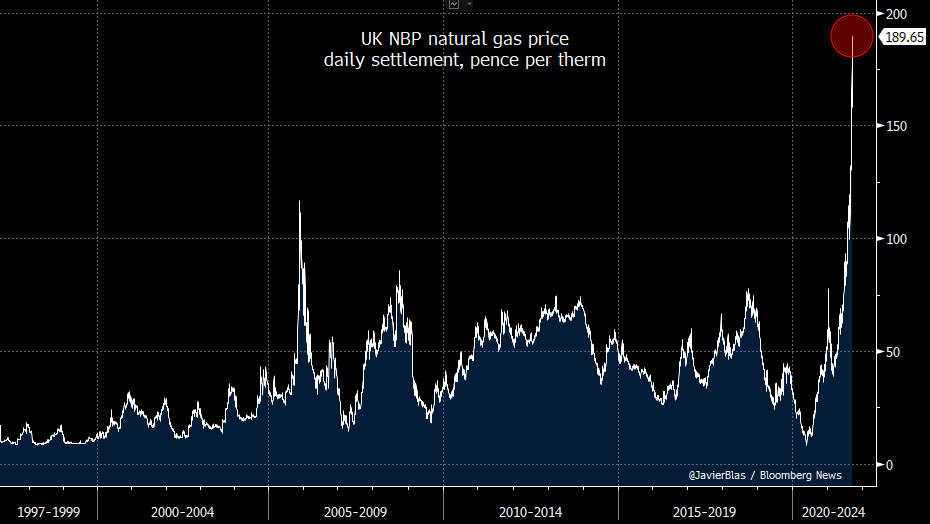

European natural-gas spot prices increased five-fold in the last year and coal prices tripled. Electricity prices hit record levels. Prices for carbon permits under the EU’s cap-and-trade scheme surged due to the higher prices on fossil fuels, pushing electricity prices higher than would have resulted from the increased cost of the fossil fuels.

United Kingdom

U.K. natural gas prices escalated to the equivalent of $150 a barrel oil. Electricity prices in the U.K. recently increased to a record £354 ($490) per megawatt hour—a 700 percent increase from the 2010 to 2020 average. The high fuel costs have affected its industrial sector. CF Industries Holdings Inc., a major fertilizer producer, shut two plants, and Norwegian ammonia manufacturer Yara International ASA curbed its European production.

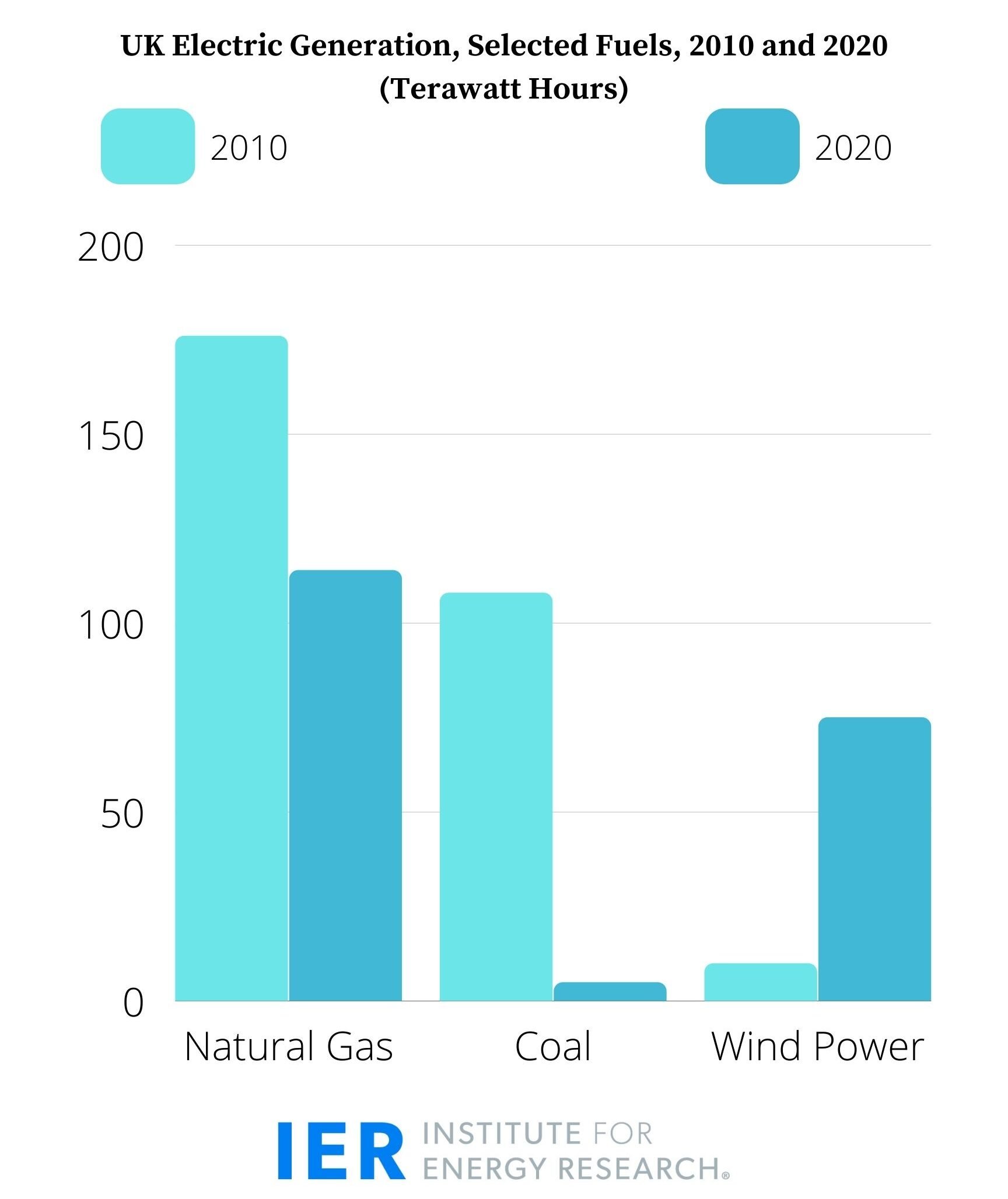

Over the past ten years, the U.K. decreased its coal generation by 95 percent and its natural gas generation by 35 percent, increasing wind generation by 635 percent and solar generation by 317 percent. Recently, it had to restart a coal plant to keep the lights on as Ireland warned of possible blackouts due to low wind generation.

Germany

Germany’s electricity benchmark doubled this year, having increased 12.3 percent last month, which was the largest increase since 1974 and contributed to the highest inflation level since 1993. Germany Chancellor Angela Merkel’s energy policies have cost German citizens hundreds of billions of euros in subsidies as the country closed nuclear and coal plants and built wind and solar farms in their place. German households already pay electricity prices that are three times higher than American households. German consumers paid $38 billion ($30.9 billion euros) in subsidies for its renewable energy growth in 2020, despite the financial needs of other sectors of its economy afflicted by the coronavirus pandemic.

U.S. Natural Gas Situation

Electricity and utility gas prices increased 5.2 percent and 21.1 percent, respectively, over the last 12 months in August and natural gas spot prices in the United States doubled over the past year. The Biden Administration’s plan and the Democrats’ reconciliation bill would curtail oil, gas and coal production and empower Russia and Iran to increase their natural gas production. While the United States is the world’s largest natural gas producer, some analysts predict that natural gas prices could double this winter if U.S. production does not increase and global demand remains high. LNG exports to Europe and Asia have increased over 40 percent during the first six months this year over the same period in 2020.

Conclusion

Europe has shown that a push to renewable energy and anti-carbon policies results in escalating energy prices due to shortages of fossil fuels needed to back-up the intermittent wind and solar power when they do not produce their expected share. The continent’s dependence on imported energy puts its energy sector in a volatile position and the energy needs of its residents in a precarious situation with many more reaching energy poverty levels as prices increase. The EU’s cap and trade scheme, which is essentially a carbon tax, raises end use prices to reduce consumer demand. But, with no other way to provide the energy needed except through fossil fuels, it just serves to escalate prices. Americans need to be aware of the potential energy crises that awaits if Biden and his Democrat politicians achieve their goals being documented in the reconciliation bill. Our system is not yet broken as the EU system is. There is no good reason for politicians in the United States to try to “fix it.”