Europe generated 10.4 percent of its electricity from solar in June—a record amount–which more than doubled solar power’s share of Europe’s generation mix since 2018. The rapid growth in solar capacity is starting to eat into utility profits, as surplus power from solar depresses wholesale electricity prices and results in utilities earning decreasing revenues. This phenomenon is called the renewables cannibalization effect, which is a result of Europe prioritizing renewable electricity supplies and pricing wholesale electricity at the marginal and most expensive source of electricity needed to meet demand at a given time. While natural gas has been the primary source of electricity in Europe for decades and the main factor in determining electricity producer prices, the situation is changing with Russia’s invasion of Ukraine as Europe’s power companies have accelerated the building of renewable capacity while cutting back on electricity generated from fossil fuels and nuclear. That has tipped the balance of the continent’s electricity price-setting markets away from natural gas and toward solar and wind sources resulting in renewable power having increasing influence over wholesale electricity prices.

In the first half of 2023, wind and solar accounted for about 19 percent of total electricity generation in Europe, less than the natural gas share of 24.7 percent share. Wind and solar power, however, increased their share 5 percentage points from 2021, when they had a 14 percent share, while natural gas’s share dropped from its 2021 level of almost 26 percent. The combination of increased wind and solar power along with diminished gas-fired generation altered the load profile of Europe’s electricity system and allowed utilities to deploy maximum volumes of renewable power while conserving natural gas. Although this has allowed utilities to increase their revenues as they have been able to scrimp on volumes of high-priced natural gas while allowing cheaper-to-produce renewables to make up for electricity shortfalls, those strong earnings may become harder to obtain as additional volumes of solar capacity are brought online and compete with other forms of generation to set wholesale electricity prices.

Capture Rates and Prices

Capture rates and prices determine how much a power producer can earn from selling electricity over any given period. The capture price is a weighted average price during which the generation asset produces electricity; the capture rate is the capture price divided by the market price. In the case of a natural gas plant that produces power during peak demand periods, the typical capture rate can be 100 percent, as the plant can dispatch maximum volumes of electricity to fulfil demand needs at peak prices, and then reduce or stop output when demand declines. For renewables, the capture rate is typically less than 100 percent and may be substantially lower given that solar only produces electricity when the sun shines and often hits peak output when demand may be near its lowest level during a typical day.

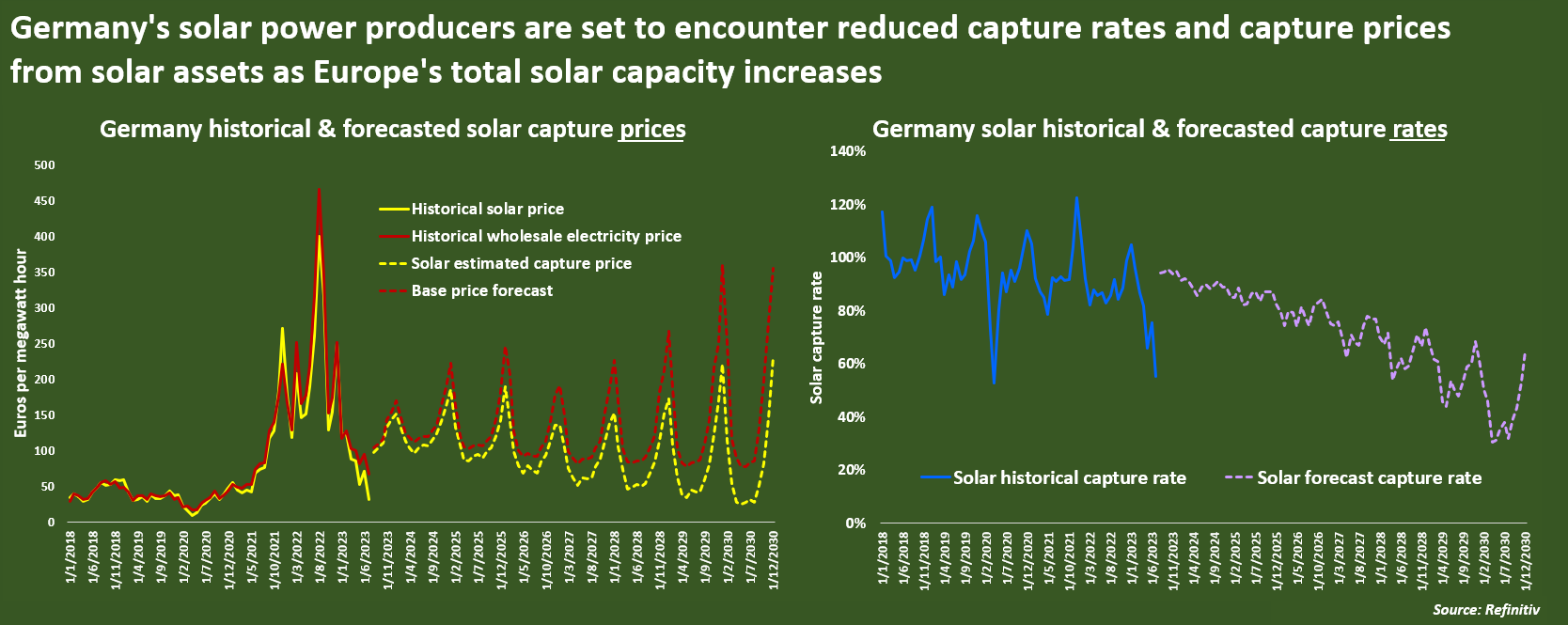

As more solar supply capacity gets added to Europe’s generation mix, solar producers can expect competition from other solar sources, which will eventually drive electricity prices lower. In turn, this will lower each producer’s capture rate. The capture rate for Germany, Europe’s top solar producer, is currently around 94 percent. But, it is expected to decline to less than 80 percent during peak production periods by 2026 and to under 50 percent during the summer by 2029.

US Cannibalization Issues with Renewables

Renewable price cannibalization has shown up in California, where solar power inundates the market during the central hours of the typical summer day and power prices dip close to or below zero. In 2021, day-ahead wholesale power prices averaged $50 per megawatt hour in California Independent System Operator (CAISO) SP15, while solar capture prices averaged $36 per megawatt hour. In other words, solar capture prices were well below market prices with a capture rate of 72 percent. In contrast, solar PV has achieved a growing price premium in Texas, a state where solar power has a relatively modest market share.

On the other hand, wind capture prices at the CAISO SP15 were above market prices, averaging $52 per megawatt hour in 2021 because not all wind generates at the same time, and there is more wind output at the beginning and end of the day when prices are higher. In contrast, wind capture prices in the Southwest Power Pool North Hub trend lower than day-ahead wholesale prices and wind capture prices in Texas vary widely by region.

U.S. renewable capture prices are expected to see a relatively steep decline through 2025, but through the mid-2030s, the rate of decline decelerates or flattens, and in most regions they remain in positive territory through 2050.

Renewable capture prices could see short-term swings due to variations in fuel prices. During the hours renewables are producing, the marginal generator is often natural gas-fired, so market prices for renewables will be higher when the price of natural gas is higher.

Conclusion

The renewables cannibalization effect occurs when renewables of the same generation profile produce simultaneously, depressing the wholesale electricity price. Renewables increasingly experience a “cannibalization” effect in jurisdictions where significant additions of wind or solar power capacity cause market prices to fall during hours when renewable sources are at peak capacity. The effect has already been observed in California, and Europe may see it in the future as it adds wind and solar capacity. Battery storage helps to alleviate the effect, but battery storage is very expensive and simply unloads more costs on the consumers.