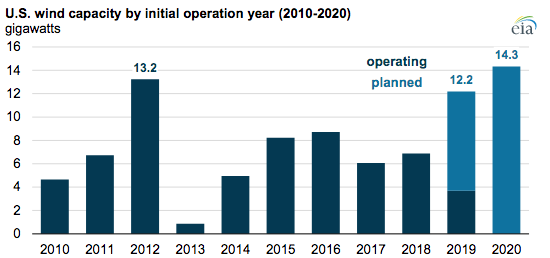

According to the Energy Information Administration (EIA), U.S. wind capacity additions in 2019 and 2020 will approach the annual record set in 2012. For the first half of 2019, wind capacity additions totaled 3.7 gigawatts, and EIA expects another 8.5 gigawatts to come online by the end of this year and an additional 14.3 gigawatts by the end of 2020. The legislated phase out of the production tax credit extension for wind is driving the increase in annual wind capacity additions in 2019, driving the business in a manner akin to a “clearance sale.” The production tax credit provides wind operators with a tax credit for the first 10 years a facility is in operation. In 2012, when the production tax credit was initially set to expire wind capacity additions totaled 13.2 gigawatts.

The Production Tax Credit

In 2013, the production tax credit for wind generation was 2.3 cents per kilowatt hour for the first 10 years of production. Under the phase out, the tax credit decreases by 20 percent per year from 2017 through 2019. Wind farms that begin construction after the end of 2020 cannot claim the credit.

Wind projects are eligible to receive the tax credit based on either the year the project begins operation or the year in which the project owner demonstrates that construction has begun and they have spent 5 percent of the total capital cost for the project. The 5 percent threshold allows wind developers to receive the tax credit based on the credit available for that year if they complete construction in no more than four calendar years after the calendar year during which facility construction began. Wind projects must come online by December 2020 to receive the full tax credit. EIA expects half of the 2020 wind capacity additions to be completed in December.

U.S. Wind Capacity and Generation

Wind capacity in the United States totaled 94.3 gigawatts at the end of 2018 and generated 275 billion kilowatt hours, 6.6 percent of total generation, and about double the 2012 wind generation level. Almost all wind farms are onshore. While several states have proposals for offshore wind projects, only one has been completed, which is a 30-megawatt, 5 turbine, wind farm off of Block Island, Rhode Island. Block Island residents had been getting their electricity from diesel generators that obtained their fuel supply from floating diesel tanks. The high cost of the diesel generators made the offshore wind farm feasible, despite its high cost, about 3 times the cost of onshore wind.

In EIA’s Annual Energy Outlook 2019, the agency predicts that only 43 gigawatts of wind capacity will be built between 2018 and 2050—only 16 gigawatts more than what is expected to be built by the end of 2020. The weak performance post 2020 is primarily due to the expiration of the production tax credit, despite wind proponents touting that wind is cost competitive with traditional technologies in the generating market.

Wind in the International Market

According to EIA in its International Energy Outlook 2019, global wind capacity totaled 556 gigawatts at the end of 2018, of which the U.S. share was 17 percent. EIA projects that the world will construct 1,852 gigawatts of wind capacity by 2050—over 3 times more than the total constructed in 2018. EIA expects China to have 839 gigawatts by 2050—almost 5 times more than the wind capacity level in China in 2018. India is projected to have 556 gigawatts of wind capacity in 2050—over 15 times more than the country’s wind capacity level in 2018. The OECD countries are expected to have 853 gigawatts of wind capacity in 2050, almost 3 times more than in 2018 with half of the 2050 total located in OECD Europe.

Conclusion

Despite wind advocates indicating that wind is now cost competitive in the United States with traditional generating technologies without the production tax credit, EIA forecasts show a dramatic slowing of additions once the tax credit expires. In the international market, however, wind power, along with solar power are expected to capture a large portion of the new generating capacity market, with most additions occurring in China and India.