The Interior Department announced today that the administration will hold the nation’s first offshore wind lease sale in late July. The area scheduled for lease consists of 164,750 acres off the coasts of Rhode Island and Massachusetts. In response to this announcement, IER published a fact sheet on offshore wind energy development in the United States:

Offshore Wind Is Very, Very Expensive

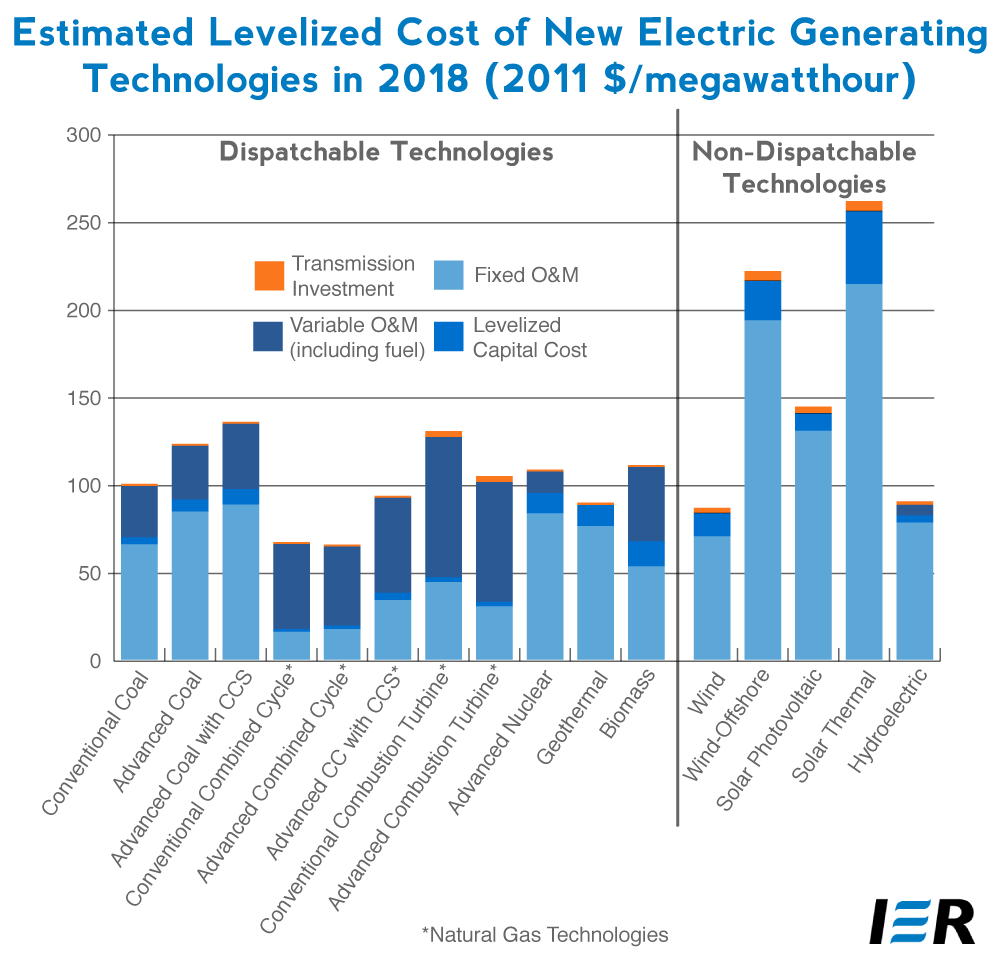

- According to the Energy Information Administration (EIA), offshore wind is 2.6 times more expensive as onshore wind power and is 3.4 times more expensive than power produced by a natural gas combined cycle plant.

- On a kilowatt hour basis, offshore wind power is estimated to cost 22.15 cents per kilowatt hour, while onshore wind is estimated to cost 8.66 cents per kilowatt hour, and natural gas combined cycle is estimated to cost 6.56 per kilowatt hour.

- Overnight capital costs (excludes financing charges) are 2.8 times higher for offshore wind than onshore wind power. According to EIA, an offshore wind farm is estimated to cost $6,230 per kilowatt, while those costs for an onshore wind farm are estimated to be $2,213 per kilowatt.

Cape Wind Shows Just How Expensive Offshore Wind Is

- The first offshore wind project to be proposed is Cape Wind, off Cape Cod, Massachusetts. It was proposed in 2001 as a 468-megawatt wind farm consisting of 130 turbines, each with a maximum capacity of 3.6 megawatts, standing 440 feet tall in the Nantucket Sound and covering 25 square miles. The project is estimated to cost $2.5 billion, or over $5,300 per kilowatt.

- The original contract specifications with National Grid, the state of Massachusetts’ largest electric utility, and Cape Wind is that the cost would start at 18.7 cents per kilowatt hour and then increase annually by 3.5 percent in a 15-year deal, ending up more than 40 percent higher than EIA’s estimate. The starting price of 18.7 cents per kilowatt hour is twice what the utility pays for power from fossil fuels and it would add 1.7 percent to the electricity bill of residential customers. As of June 2013, Cape Wind has not been built.

Offshore Natural Gas Produces More Energy than Offshore Wind Projects

- IER produced an analysis comparing the potential energy production from a new offshore natural gas field versus the potential offshore wind generation from Cape Wind. The analysis compared the potential energy production from the Manteo natural gas prospect offshore North Carolina and the Cape Wind farm. Assuming the Manteo project would produce as much natural gas as Independence Hub, it would supply 320 trillion Btu of energy annually, while the Cape Wind project would supply 5.4 trillion Btu. Therefore, it would take about 59 Cape Wind developments to equal the energy output of the Manteo project.

More Examples of Potential Offshore Wind Projects in the United States

- NRG Bluewater Wind was granted a federal lease by the Department of Interior last year to build a 450 megawatt offshore wind farm about 11 nautical miles off the coast of Delaware. While the lease grants NRG Bluewater Wind Delaware LLC the exclusive right to submit wind development plans for the area, the company still does not have investors or buyers for its wind energy and is contemplating selling the lease. In 2011, NRG called the project financially untenable because of dwindling federal incentives and its lack of investors.

- New York State, which usually is an advocate of green energy, is foregoing an offshore wind project due to its high cost. The project was to develop offshore wind farms for Great Lakes Ontario and Erie, whose cost of construction would be recovered over the next 20 years by selling its generation to the New York Power Authority. But the New York Power Authority turned the project down due to its expense. According to the New York Power Authority, a 150-megawatt wind farm would cost between $1.2 billion and $2.0 billion to build and would cost the Authority between $60 million and $100 million annually in power purchases, translating into a per kilowatt cost of $8,000 to over $13,000, much higher than the estimated cost of an offshore wind farm by the Energy Information Administration noted above. Other issues cited against the offshore wind farm are lowering values of shoreline properties, ruining spectacular views, and harming birds and fish.

Interior Department Will Announce Its First Offshore Wind Lease Sale

- The Interior Department is expected to announce tomorrow that it will hold its first offshore wind lease sale in late July. The area for lease consists of 164,750 acres off the coasts of Rhode Island and Massachusetts. While nine companies are “legally, technically and financially qualified” to bid at the auction, it is unclear, however, how many will bid. Interior had previously moved forward with offshore wind proposals for 96,000 acres off the coast of Delaware, but found only one company interested. It struck a deal with Bluewater Wind Delaware last October for a 450-megawatt project (see bullet above). According to a notice to be published in the Federal register tomorrow, wind development in the lease area “would not significantly impact the environment” and thus does not yet require a more stringent environmental impact statement.

Leasing Offshore Wind in the Atlantic While Banning Oil and Natural Gas Production Is “Picking Winners and Losers”

- Senate Environment and Public Works ranking member David Vitter indicated that the Interior Department’s plan to offer offshore wind leases near the New England coast amounts to “picking winners and losers.” Last November, Vitter and Senator Lamar Alexander sent the Interior Department a letter demanding an economic comparison of offshore wind and offshore oil and gas lease sales. Vitter and Alexander wanted a comparison of royalty rates on NRG Bluewater Wind’s lease off the coast of Delaware with similarly sized offshore oil and gas leases. They also wanted to know what the environmental review concluded about bird life. One of Vitter’s points was that the federal government receives significant revenue from offshore oil and gas production in the form of rents, royalties, bonus bids and taxes, but offshore wind is not expected to produce such revenues.

- On May 6, the Interior Department responded to the letter, explaining that it has adopted acquisition, rental and operating fees for wind projects that are lower than those it charges for oil and natural gas lease rights offshore because wind energy is renewable, not depletable as oil and gas resources are, and because of the difference in maturity of each industry.

- According to Interior’s response letter, “The Cash Bonus and/or Acquisition Fee paid by NRG for the lease was $0.25 per acre amounting to $24,107.50 for the 96,430 acres. The average bid per acre for the last oil and gas lease sale held on November 28, 2012, in the western Gulf of Mexico, was $205.” In other words, the federal government gets 820 times more money in bonus bids from offshore oil and gas leasing per acre than they do from leasing offshore wind.

For a downloadable PDF, click here.