The Energy Information Administration (EIA) released its Annual Energy Outlook for 2012 (AEO) this week. The AEO updates EIA’s reference case forecasts for regulatory changes and data changes that have occurred since it released its earlier version at the beginning of this year. The full outlook also contains 29 sensitivity cases that examine changes to the reference case assumptions to highlight the uncertainty that exists in projecting the energy future for the next 25 years.[i] In the updated reference case, the nation’s future looks roughly the same as it did in the early release version that IER summarized here.

- EIA still sees a fossil fuel future for the United States with fossil fuels representing 77 percent of energy consumption in 2035, compared to 82 percent in 2011.

- New EPA regulations cause coal-fired generation to decrease its share of electric generation from 42 percent in 2011 to 38 percent in 2035, with increased shares from natural gas-fired and renewable generation.

- Natural gas production increases by over 6 trillion cubic feet in the 25-year projection period thanks to hydraulic fracturing technology with the United States becoming an exporter of liquefied natural gas and a net natural gas pipeline exporter.

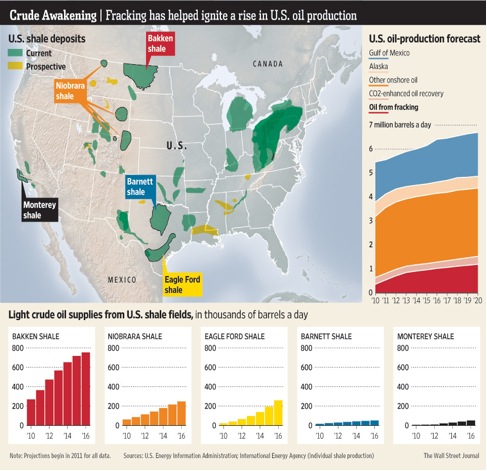

- Similarly, oil production from onshore lands, mainly privately owned, increases by over a million barrels per day by 2020, helping to reduce oil imports from a 45 percent share in 2011 to a 36 percent share by 2035. Like natural gas, this increase is due in large part to shale formations that are accessed with hydraulic fracturing.

- Energy demand is expected to increase slowly at just 0.3 percent per year due to a slow economic recovery, higher energy prices, and greater energy efficiency in end-use technologies.

- Energy-related carbon dioxide emissions remain below 2005 levels through 2035.

Crude Oil and Petroleum

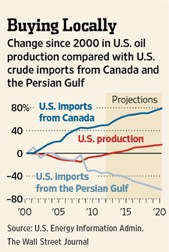

According to EIA, by 2020, nearly half of the crude oil the United States consumes will be produced at home, and 82 percent is expected to come from this side of the Atlantic. Government forecasters expect that U.S. petroleum purchases from the Middle East, Africa, and Europe will fall to about 2.5 million barrels a day by 2020, from more than 4 million barrels today. Oil imports from the Persian Gulf’s OPEC members are expected to drop to 860,000 barrels a day in 2020—about half of their current level. Even OPEC predicts that oil shipments from the Middle East to North America “could almost be nonexistent” by 2035.[ii]

EIA’s estimates are backed up by data from IHS Cambridge Energy Research Associates (IHS CERA). IHS CERA calculates that between 2003 and 2011, oil and gas investments nearly quadrupled in the Western Hemisphere. Due to greater political stability in the Americas, 48 percent of global oil investment ($320 billion) occurred here in 2011, compared to 39 percent in 2003.

North Dakota surpassed Alaska earlier this year to become the nation’s second largest state oil producer, exceeded only by Texas. North Dakota developed its Bakken Shale formation through the use of hydraulic fracturing and horizontal drilling technology. Average U.S. daily production of crude oil increased 6 percent between October 2011 and March 2012 spurred by production of shale oil from the Bakken and the Eagle Ford shale formation in Texas. In November 2011, U.S. oil production was over 6 million barrels per day for the first time since 1998.

EIA’s updated energy outlook finds that tight oil found in low-permeability reservoirs such as shale and chalk formations is the largest new source of U.S. supply since the offshore Gulf of Mexico was developed. Production of tight oil is expected to more than double over the next two decades. Production from eight tight oil prospects is expected to reach 1.23 million barrels per day by 2035, more than double their 2011 levels. In 2012, tight oil output is expected to reach 720,000 barrels per day, or 12.5 percent of domestic production.[iii]

The new energy outlook also finds that total U.S. oil production is expected to peak at 6.7 million barrels per day in 2020, the highest since 1994 with about 18 percent coming from tight oil. In 2035, EIA expects tight oil to account for 20.5 percent of the 5.99 million barrels per day of total oil it expects to be produced in the United States. Tight oil production is expected to reach its peak in 2029 at 1.33 million barrels per day.

Alaska’s oil production is expected to continue its decline unless new federal areas are opened for development. EIA expects its production to decline by 55 percent from 2010 to 2035, from 600,000 barrels per day in 2010 to 270,000 barrels per day in 2035. The problem with declining Alaskan production is the feasibility of maintaining the Trans-Alaska Pipeline System (TAPS), an 800-mile pipeline that transports crude from the North Slope to a marine terminal in Valdez, from which tankers are used to transport the crude to West Coast refineries. TAPS is currently the only means of transporting North Slope crude oil. The pipeline was reconfigured and refurbished from 2004 to 2006 to permit it to operate at lower than designed flow rates, costing $400 to $500 million, with minimum flow expected to be at 200,000 barrels per day, just below the 2035 EIA forecasted production level in its reference case. However, in its Low Oil Price Case, North Slope oil production levels decline sufficiently as to close TAPS. Engineers indicate that problems may start to occur on the pipeline with flows below 550,000 barrels per day and severe operational problems are expected to occur at 350,000 barrels a day, requiring significant investment in the pipeline.

EIA expects that U.S. refineries will continue the trend begun last year of being a net exporter of refined petroleum products due to abundant crude oil supplies, a large refining base and decreasing domestic demand.

Natural Gas Production and Consumption

EIA projects that natural gas production will increase throughout the projection period and the United States will eventually transition from being a net importer to a net exporter of natural gas. Like oil production, much of the growth in natural gas production comes from hydraulic fracturing and drilling in shale plays. Shale gas production increases from 5.0 trillion cubic feet per year in 2010 (23 percent of total U.S. dry gas production) to 13.6 trillion cubic feet per year in 2035 (49 percent of total U.S. dry gas production). EIA explores the uncertainty of shale gas production in its sensitivity cases finding that it can range from 9.7 to 20.5 trillion cubic feet by 2035, or as much as 50 percent more than the reference case projection.

Total U.S. natural gas production is expected to reach 27.93 trillion cubic feet in 2035, over 6 trillion cubic feet more than produced in 2010. As a result of the projected growth in production, U.S. natural gas production exceeds consumption and the United States becomes a liquefied natural gas (LNG) exporter early in the next decade. Of the fossil fuels, natural gas demand is projected to increase the most, reaching 26.63 trillion cubic feet in 2035, and an increase of 2.5 trillion cubic feet from 2010 levels.

Coal Consumption

Coal consumption is expected to decline by 137 million short tons between 2010 and 2015 and then increase, reaching 1,137 million short tons by 2035, 86 million short tons more than in 2010. Reduced demand for coal in the early years of the forecast is due to lower coal-fired generation caused by new EPA regulations, resulting in coal-fired capacity retirements and the addition of new EPA-required equipment that forces most coal-fired units to be offline for at least 18 months. EIA expects 49 gigawatts of coal-fired capacity to retire by 2035 in its reference case, with the majority (41 gigawatts) retiring by 2015. In the sensitivity cases, as many as 69 gigawatts of existing coal-fired capacity are projected to be retired. IER estimated retirements for just 2 of EPA’s regulations to be almost 35 gigawatts, double EPA’s estimates, which are almost certainly an underestimate. Retired coal-fired capacity is expected to be replaced by natural gas-fired and renewable capacity.

Coal-fired capacity retirements are concentrated in two North American Reliability Council regions: the southeast (SERC Reliability Corporation) and most of the Mid-Atlantic and Ohio Valley region (the Reliability First Corporation (RFC)). These two regions (SERC and RFC) accounted for 65 percent of all U.S. coal-fired generating capacity in 2010, and 43 percent of the plants do not have flue gas desulfurization units installed. The coal plants in these regions are primarily fueled by bituminous coal, generally the most expensive of the coal types.

Electricity Generation

The natural gas share of electric power generation is expected to increase from 25 percent in 2011 to 28 percent in 2035 due to lower capital costs for natural gas fired capacity and relatively low natural gas prices due to hydraulic fracturing that enables production of abundant U.S. shale gas resources.

Coal’s share of generation continues its historical decline. Over the next 25 years, the projected coal share of electricity generation falls to 38 percent from 42 percent in 2011, because of onerous EPA regulation, slow growth in electricity demand, continued competition from natural gas, and state-mandated renewable plants. Just 4 years ago, in 2008, coal’s share of electricity generation was 48 percent.

The new EPA regulations also affect old oil and natural gas steam units. EIA expects 17 gigawatts of those units to retire by 2015 and a total of 20 gigawatts of oil and gas steam units to retire by 2035.

EIA estimates that 6 gigawatts of nuclear capacity will be retired by 2035 and are replaced by almost 9 gigawatts of new nuclear capacity and 6.5 gigawatts of increases to existing nuclear capacity. The 6 gigawatts of retirements occur primarily in the last few years of the projection period and result from nuclear plant owners not applying for and/or receiving license renewals to operate their plants beyond 60 years.

The share of renewable energy is expected to grow from 13 percent to 15 percent between 2011 and 2035 mainly because of Federal tax credits and implementation of state renewable portfolio standards that mandate utilities to purchase power from renewable energy sources. All renewable technologies increase their capacity levels, with wind power’s capacity increasing by 77 percent (30 gigawatts) between 2010 and 2035, solar power’s capacity increasing over 600 percent (20 gigawatts), biomass capacity increasing almost 140 percent (10 gigawatts), geothermal capacity increasing almost 170 percent (4 gigawatts), and hydroelectric capacity increasing 4 percent (3 gigawatts).

EIA looked at a sensitivity case where renewable tax incentives did not sunset. In this case, renewable energy represents about 20 percent of electricity generation in 2035, up from 15 percent in the reference case. In this sensitivity case, extension of the production tax credit and the 30-percent investment tax credit results in average reductions in Government tax revenues of approximately $2.5 billion per year between 2011 and 2035, compared to $520 million per year in the reference case.

Conclusion

Fossil fuels will still dominate the future energy picture at least through 2035, according to EIA. While renewable energy is expected to increase its share of electric generation, it will still remain a small portion of total generation over the next 25 years. And even if tax incentives for renewable technologies were to be extended, renewable generation would still garner less than a 20 percent share of generation in 2035.

Clearly, this AEO indicates that attention is needed regarding the Trans-Alaskan Pipeline System to circumvent its potential demise and regarding the new EPA regulations affecting the coal industry, in which a large number of coal-fired plants could be forced to retire, losing some of our ability to use affordable coal in the future.

[i] Energy Information Administration, Annual Energy Outlook 2012, June 25, 2012, http://www.eia.gov/forecasts/aeo/pdf/0383(2012).pdf

[ii] Wall Street Journal, Expanded Oil Drilling Helps the U.S. to Wean Itself From Mideast, June 27, 2012, http://professional.wsj.com/article/SB10001424052702304441404577480952719124264.html?mod=WSJ_business_LeftSecondHighlights&mg=reno64-wsj

[iii] Reuters, U.S. “tight oil” output to double by 2035: EIA, June 25, 2012, http://www.reuters.com/article/2012/06/25/us-energy-data-eia-idUSBRE85O1AS20120625