To encourage rooftop solar systems on homes and businesses, federal and state governments have provided a number of generous subsidies and other encouraging policies. The outcome of those perks has been a contribution of distributed solar PV from rooftop systems of 0.3 percent of U.S. electricity generation in the first 11 months of 2015, according to the Energy Information Administration. That has brought solar energy’s contribution in those first 11 months of 2015 to just under 1 percent of total generation.

But, one of those policies has been found to treat consumers of electricity without solar panels on their roof unfairly. That policy is net metering, where owners of a rooftop solar system are paid retail electric rates for any unused power that they generate. The problem is that they do not pay for the infrastructure that the excess power uses to reach other consumers, even though they are dependent upon the infrastructure for their sales of electricity. Those electric consumers without rooftop solar systems are paying for transmission and distribution costs that should also be borne by solar rooftop owners. Net metering also results in additional administrative costs for the electric utility, which show up in other users’ bills. People who cannot afford solar installations are subsidizing the more wealthy who can afford them, and those costs to the non-solar consumers are rising as more solar is deployed.

To fix the problem, states are making changes to their net metering policies. Nevada, for example, recently made changes to its net metering rules and rates that provide a less generous rate system to current and future customers. The changes prompted SolarCity and other solar panel industry leaders like Vivint and Sunrun to leave the state.

It may be surprising that a net metering change would be so problematic to solar panel companies when solar panels are declining in cost and the federal government’s lucrative 30 percent investment tax credit for solar energy, which was to expire this year, was recently extended until 2022. To understand the issue, look at the economics of the following example.

Suppose electric utilities in Nevada were to reduce the compensation for net metering from retail to wholesale rates to put solar panel users on a level playing field with other generators. The retail rate of electricity in Nevada is 12.39 cents per kilowatt-hour, while the wholesale price for electricity in the region averaged around two cents per kilowatt-hour in December 2015. Solar panel owners are effectively receiving more than 6 times as much for their electricity sales than the going rate of electricity generation, and the utility is passing those costs on to other users.

According to a report from Lawrence Berkeley National Lab, the cost of a residential solar system is around 25 to 30 cents per kilowatt-hour.[i] Including federal and state subsidies and tax benefits, that figure would be reduced to 15 cents per kilowatt-hour or less. If the retail rate for electricity from the grid without net metering fees is less than that, solar is a poor investment; if it is more, solar is a good investment.[ii]

Nevada’s Net Metering Rule Changes

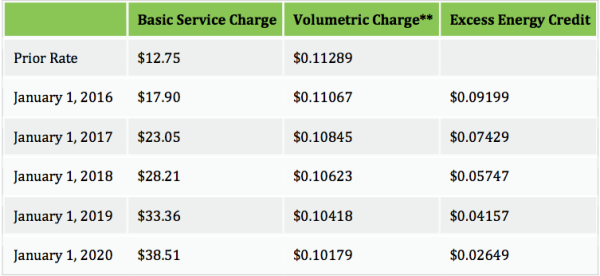

On December 23, 2015, the Public Utility Commission of Nevada established new net energy metering rules and rates that creates new classes of net metering customers and a structured process for transitioning to the new rules and rates. Over five years, the basic service charge will increase in gradual increments accompanied by a related decrease in the energy charge that net metering customers pay for each unit of energy delivered by the utility as well as decreasing the credit that the utility provides for energy delivered by net metering customers to the grid. The rates and credits will be reset periodically by the Public Utility Commission. Below is an example of the rates and credits.[iii]

*These rates are subject to change.

**Volumetric Charge is comprised of all components charged on a per kWh basis. Those components are BTER, BTGR, TRED, REPR, DEAA, EE, and UEC. Additional information about the individual components is available on the Statement of Rates and the Rate Schedule included with your bill.

Source: https://www.nvenergy.com/renewablesenvironment/renewablegenerations/NetMetering.cfm

Other State Proposals

Across the country, as many as 20 other states are rethinking their net metering policies, which could alter the economics of rooftop solar. Mississippi recently announced a net metering policy that will pay wholesale rates instead of retail for solar power produced by homes and small businesses. In October 2015, Hawaii closed its net metering program to new solar owners, replacing it with two options, neither of which are as favorable to solar PV.[iv] In Arizona, regulators are seeking a compromise between utilities and solar advocates. Because many states are at or near the limits established on total solar capacity under their net metering programs, new residential installations will not be covered.[v]

Other states such as New York, which has a major restructuring of its electricity sector underway, suspended its cap on solar photovoltaic systems covered by the state’s net metering program in October.[vi] Also in October, New Mexico regulators dismissed a proposal by El Paso Electric to impose new fees on solar owners. In California, regulators are proposing to leave current compensation policies in place.[vii]

Another possibility is to have the market determine the rates. For example, beginning this year, Germany instituted an open market for distributed energy generation, where wind and solar producers trade directly with consumers and prices are set by supply and demand, along with a minimum service charge for the utility.[viii]

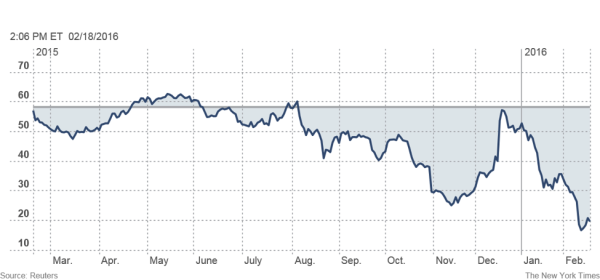

SolarCity

SolarCity is the nation’s largest provider of rooftop systems. It was built with the aid of government subsidies and utility incentives. But, because of changes to those incentives and investors having doubts about its business model, stock prices, once nearly $86 a share, were sent spiraling downward. Recently, after the company reported fourth-quarter earnings, the shares fell nearly 30 percent to close at $18.63.[ix]

Solar City on Wall Street

Source: NY Times, http://www.nytimes.com/2016/02/11/business/energy-environment/rooftop-solar-providers-face-a-cloudier-future.html?_r=1

Last year, SolarCity’s revenue grew almost 60 percent to $400 million from the prior year. But, because its costs grew at a much faster rate, the company had an operating loss of $648 million for the year. In other words, the company spent nearly two dollars for every new dollar in sales.

Last fall, SolarCity announced a shift in its strategy where it intends to cut its growth rate from 85 percent a year to about 40 percent. It is planning to sell the cash flows from its customer agreements and has raised $345 million in debt, including some backed by customer loan agreements. But, its debt levels are increasing as its cash levels decrease. Last year, the company’s interest payments on its debt totaled nearly a quarter of its revenue.

Many of the assumptions that underpin the financial models used by these companies are political, and therefore far from certain, and as market conditions, public policies and technologies evolve, the risks are becoming more evident. Further, inexpensive natural gas is making it harder for rooftop solar energy to compete in markets with low electric rates.

Conclusion

Rooftop solar systems had a huge advantage under net metering policies, but as rooftop solar systems grew, electric utilities were finding that non-solar customers were paying for rooftop solar customers’ use of the electric grid. That and administrative costs made utility companies complain to their public utility commissions about the benefits rooftop solar owners receive. Agreeing with the complaints, several state public utility commissions are making changes as described above in Nevada. As a result, solar companies are having a hard time and leaving states where major changes to their net metering policies have occurred. An example is SolarCity, whose stock price has dropped to less than a fourth of its high value.

[i] Lawrence Berkley National Laboratory, Tracking the Sun VI, July 2013, https://emp.lbl.gov/sites/all/files/lbnl-6350e.pdf

[ii] MIT Technology Review, Battles Over Net Metering Cloud the Future of Rooftop Solar, January 5, 2016, https://www.technologyreview.com/s/545146/battles-over-net-metering-cloud-the-future-of-rooftop-solar/

[iii] NV Energy, Net Metering, https://www.nvenergy.com/renewablesenvironment/renewablegenerations/NetMetering.cfm

[iv] RMI Outlet, Hawaii just ended net metering for solar. Now what?, October 16, 2015, http://blog.rmi.org/blog_2015_10_16_hawaii_just_ended_net_metering_for_solar_now_what

[v] MIT Technology Review, Battles Over Net Metering Cloud the Future of Rooftop Solar, January 5, 2016, https://www.technologyreview.com/s/545146/battles-over-net-metering-cloud-the-future-of-rooftop-solar/

[vi] New York, Reforming the Energy Vision, http://www3.dps.ny.gov/W/PSCWeb.nsf/All/CC4F2EFA3A23551585257DEA007DCFE2?OpenDocument

[vii] SolarCity Press Release, December 15, 2015, http://www.solarcity.com/newsroom/press/solarcity-statement-california-public-utilities-commission-proposed-decision-solar

[viii] MIT Technology Review, Renewable Energy Trading Launched In Germany, December 29, 2015, https://www.technologyreview.com/s/545146/battles-over-net-metering-cloud-the-future-of-rooftop-solar/

[ix] New York Times, SolarCity and Other Rooftop Providers Face A Cloudier Future, February 10, 2016, http://www.nytimes.com/2016/02/11/business/energy-environment/rooftop-solar-providers-face-a-cloudier-future.html?_r=1