One of the largest wind facilities in the world is benefiting from millions of dollars in state tax credits it is not qualified for and does not need, according to a recent series of investigative reports in The Oregonian.

The 845 megawatt Shepherds Flat wind facility that opened in 2012 received final approval last month from the Oregon Department of Energy (ODOE) for three separate tax credits totaling $30 million. Caithness Energy, owner of Shepherds Flat, was able to secure the credits by defining the project as three separate wind facilities. But as the new reports reveal, Shepherds Flat likely qualifies for just one out of three Business Energy Tax Credits under explicit ODOE rules that determine what constitutes a “separate and distinct” facility.

Under state rules, if a project meets three out of seven definitions for a single facility, the ODOE should award only one tax credit. The Oregonian’s analysis finds that Shepherds Flat meets at least four of the state’s criteria, which should disqualify the project from two of the three $10 million credits.

In any case, Shepherds Flat does not need the tax breaks, as the project was already generating electricity without the $30 million from the state. Lynn Frank, former director of the ODOE, told the newspaper, “These tax credits would not have made a whit of difference in the construction of this project, and yet $20 million would make an extraordinary difference to the people of Oregon.” In other words, the state tax credits do not actually assist in the construction or operation of the facility—they serve merely to line the pockets of the developers.

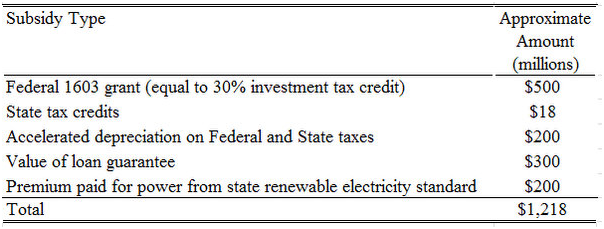

Unfortunately, the $30 million in state tax credits are merely “frosting on a multi-layered cake of federal, state and local subsidies,” as The Oregonian put it. A 2010 internal Obama administration memo showed that, at the time of the memo’s issuance, the Shepherds Flat facility was slated to receive more than $1.2 billion in subsidies for a $1.9 billion project—about 64 percent of the total cost—including a partial loan guarantee from the U.S. Department of Energy (DOE). The following table from the Obama administration memo totals these various subsidies:

As IER previously pointed out, the internal White House memo is also troubling in that senior Obama administration officials expressed deep concerns with the Shepherds Flat loan guarantee—concerns that ultimately appear to have been ignored. The issues mentioned by key officials such as former White House Energy and Climate Change top advisor Carol Browner include “double dipping” of massive subsidies from multiple sources, a “lack of skin in the game” from private investors, and “non-incremental investment,” the funding of projects that would likely proceed without a loan guarantee.

To the last point, the memo concludes that Shepherds Flat would have likely been constructed regardless of whether the developers received a DOE loan guarantee. A combination of tax credits and state renewable electricity mandates created “favorable” economics for wind investment, the authors of the memo explained. Despite warnings from these high-ranking Obama officials that the Shepherds Flat loan guarantee was completely unnecessary, the administration pushed it through anyway. This should come as no surprise, since the wind turbines for Shepherds Flat come from General Electric, a company with deep ties to the Obama administration. Google, another one of Obama’s favorite companies, is also a major investor in Shepherds Flat.

For such lavish subsidies, Shepherds Flat was only expected to create 400 construction jobs and 35 permanent jobs. Divided into the $1.2 billion in federal and state subsidies, each permanent job cost over $34 million to “create.”

Caithness Energy hails Shepherds Flat as a “world-class wind farm that is providing clean renewable energy.” Yet lifting the green veil reveals a wind facility dependent largely on government subsidies, with a handful of private investors that are tied to politicians who can keep the taxpayer dollars flowing. As economist Alex Tabarrok explains, Shepherds Flat remains nothing more than “corporate welfare masquerading under an environmental rainbow.”

IER Policy Associate Alex Fitzsimmons wrote this post.