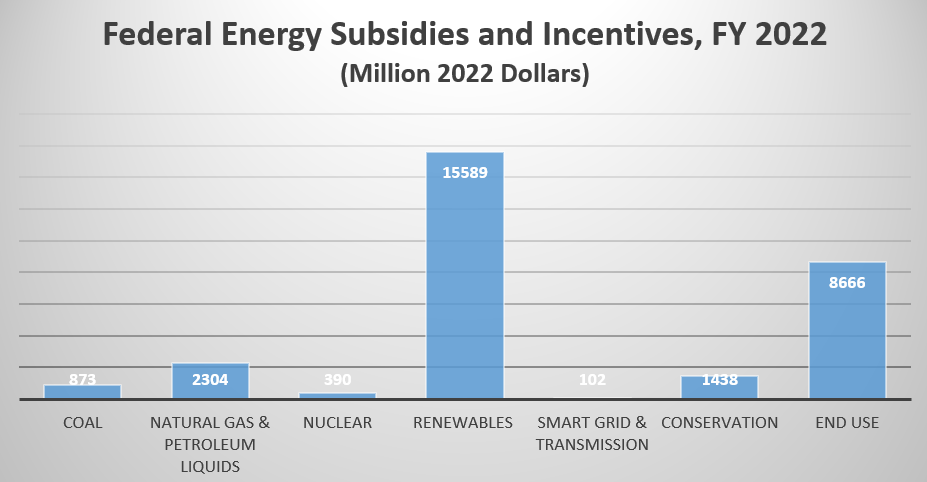

The Energy Information Administration (EIA), an independent agency of the U.S. Department of Energy, evaluated the amount of subsidies that the federal government provides energy producers for fiscal years 2016 through 2022, in its report Federal Financial Interventions and Subsidies in Energy, updating its previous subsidy reports. Federal subsidies to support renewable energy formed nearly half of all federal energy-related support between fiscal years 2016 and 2022. Traditional fuels (coal, natural gas, oil and nuclear) received just 15 percent of all subsidies between FY 2016 and FY 2022, while renewables, conservation and end use received a whopping 85 percent. Renewable subsidies more than doubled between FY 2016 and FY 2022, increasing to $15.6 billion in fiscal year 2022 from $7.4 billion in fiscal year 2016 (both in 2022 dollars). Federal subsidies and incentives to support renewable energy in fiscal year 2022 were almost 5 times higher than those for fossil energy, which totaled $3.2 billion in subsidies. The subsidies in EIA’s report do not include state and local subsidies, mandates or incentives that in many cases are quite substantial, especially for renewable energy sources. EIA also did not include the massive subsidies authorized in the Inflation Reduction Act (IRA) since it was passed in August 2022. Goldman Sachs has estimated the costs of that bill at $1.2 trillion.

______

Fast Facts

- The Energy Information Administration found that subsidies for renewable energy more than doubled between FY 2016 and FY 2022, occurring before the Inflation Reduction Act (President Biden’s climate bill) became law in 2022 that increased renewable subsidies.

- Coal, oil, natural gas and nuclear received 15 percent of all subsidies in FY 2022, despite providing vastly larger amounts of energy than renewable energy—the largest subsidy recipient.

- End use subsidies that provide support for lower income Americans to help pay utility bills were the second largest subsidy category after renewable energy.

- Wind and solar combined represented 94 percent of the federal renewable electricity-related subsidies in FY 2022, while producing a combined 5.5 percent of primary energy.

______

Energy end-use subsidies (Low-Income Heating Assistance and other such programs) were the second highest category after renewable subsidies. Energy end-use subsidies increased from $7.9 billion in FY 2016 to $8.7 billion in FY 2022. The largest program of this category—the Low Income Home Energy Assistance Program (LIHEAP), administered through the U.S. Department of Health and Human Services (HHS)—slightly decreased its funding from $4.0 billion in FY 2016 to $3.9 billion in FY 2022, with a noteworthy one-year increase to nearly $10.0 billion in FY 2021. In 2021, funding for the Low Income Home Energy Assistance Program, which assists with energy bills and other energy-related costs, saw a one-time doubling to nearly $10 billion, after Congress approved additional funding for the program under its COVID-19 relief plan that resulted in end use subsidies totaling $14.3 billion in FY 2021. The end use subsidy programs help people at the bottom of the economic ladder pay their rising utility bills, but do nothing to aid most tax payers.

Most of the renewable subsidies were tax incentives, with solar applications making up the largest share of those subsidies. In FY 2022, solar subsidies totaling $7.5 billion overtook biofuel subsidies–the largest beneficiary of tax incentives in FY 2016, having total subsidies of $3.7 billion, with wind a close third at $3.6 billion in total FY 2022 subsidies. These sources typically receive additional support at the state and local level, including credits in California for biofuels at $3.70 per gallon for its production rather than petroleum refining. Other benefits in some states include “net metering” for solar energy which requires utilities to purchase solar at a retail price rather than wholesale.

Despite renewable energy receiving over half the federal subsidies in FY 2022, EIA reports that fossil energy in the form of coal, oil, natural gas and natural gas plant liquids made up 79.1 percent of primary energy production in FY 2022. Nuclear power contributed 7.9 percent, followed by biomass at 5.1 percent, wind at 3.7 percent, hydroelectric at 2.3 percent, solar at 1.8 percent, and geothermal at 0.2 percent.

Federal Subsidy and Support for Renewable Energy

Renewable energy (including biofuels) comprised 53 percent of total energy subsidies in FY 2022–up from 41 percent in FY 2016. In FY 2022, tax expenditures accounted for 98 percent of total renewable energy subsidies. Biofuels represented 42 percent of total subsidies for renewable energy in FY 2022 while renewable energy used in electricity production represented the other 58 percent.

The largest electricity-related federal energy subsidies were for renewable energy since subsidies for wind and solar each exceeded subsidies for coal, natural gas and petroleum, and nuclear. Wind and solar combined represented 94 percent of the federal renewable electricity-related subsidies in FY 2022, while producing a combined 5.5 percent of primary energy.

The Institute for Energy Research calculated the federal subsidies and support per unit of electricity production from the information provided in EIA’s report for renewable technologies and nuclear power for FY 2022. Because EIA did not break out the electricity-related subsidies for coal, natural gas and petroleum from their total subsidies, the subsidy per unit of energy produced could not be calculated for these sources of electricity. However, if one assumed that all of coal’s subsidies that EIA calculated were for electricity production in FY 2022, the subsidy cost per unit of production for coal would be $1.06 per megawatt hour.

The figure below provides the subsidy costs per unit of production for those technologies that EIA provided relevant data. On a per-dollar basis, government policies have led to solar generation being subsidized by over 76 times more than nuclear electricity production, and wind being subsidized almost 17 times more than nuclear power on a unit-of-production basis in FY 2022. Nuclear power is the largest source of carbon-free energy in the United States.

Conclusion

From FY 2016 to FY 2022, most federal subsidies were for renewable energy producers (primarily biofuels, wind, and solar), low-income households, and energy-efficiency improvements. From FY 2016 to FY 2022, nearly half (46 percent) of federal energy subsidies were associated with renewable energy, and 35 percent were associated with energy end uses. Federal support for renewable energy of all types more than doubled, from $7.4 billion in FY 2016 to $15.6 billion in FY 2022.

From FY 2016 to FY 2022, provisions in the tax code were the largest source of federal financial support. In FY 2016, the Internal Revenue Code (IRC)—with its 31 energy-specific tax provisions—provided greater financial support to energy than direct expenditures, including R&D expenditures. Total tax expenditures were 70 percent of the total federal financial support. Since FY 2016, tax expenditures have continued to grow, increasing to over 75 percent of total federal support in recent years.

On a total dollar basis and on a unit of production basis, solar energy had the highest federal electricity-related subsidies in FY 2022.