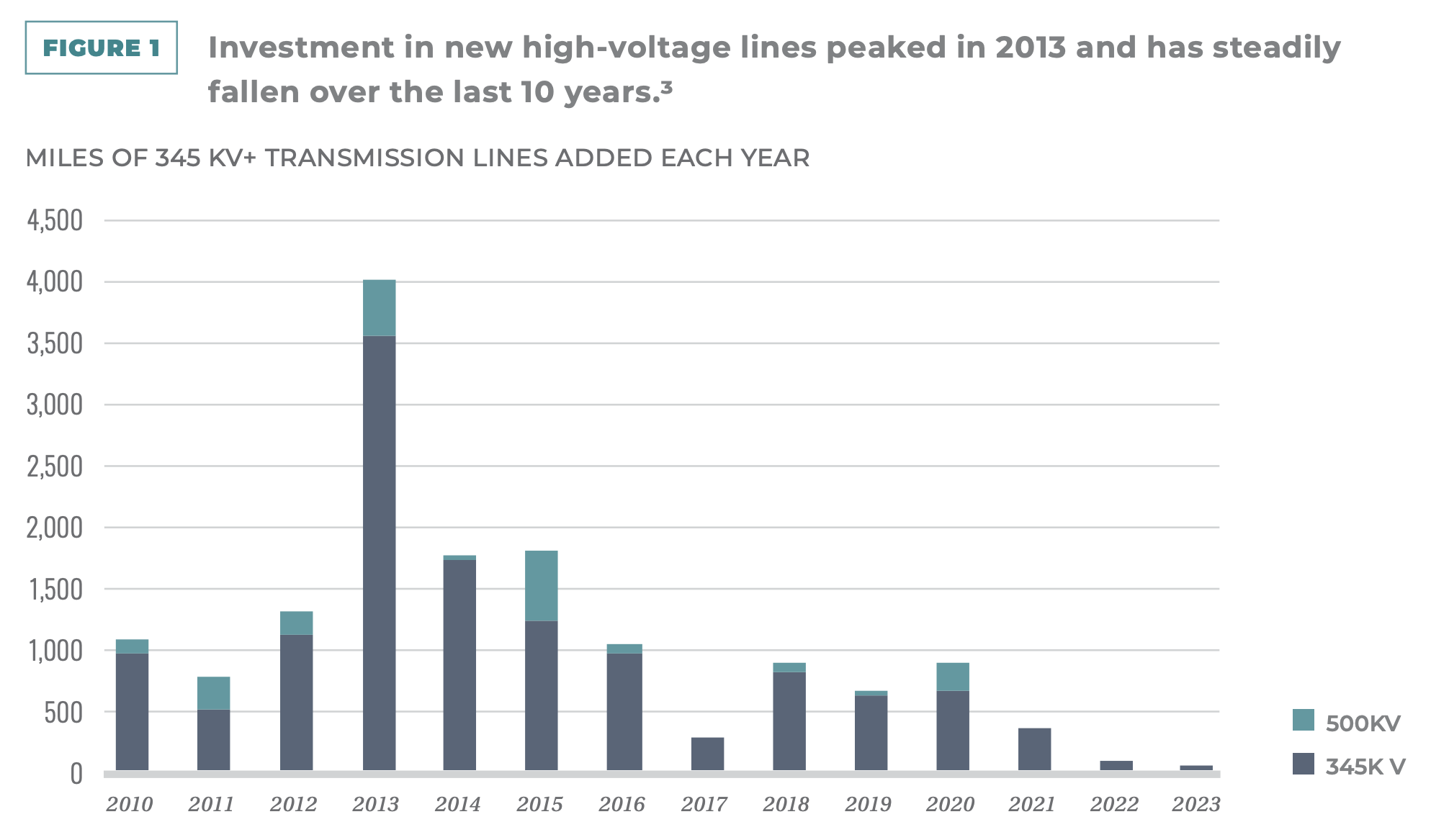

The Biden-Harris administration’s preferred technologies of wind and solar electrical power require additional high voltage transmission lines as they need enormous land areas located near their resource; that is, where there is the most sun and wind resources, which are typically located far from demand centers. This is the opposite of traditional coal and natural gas generators, which are constructed close to demand centers and therefore need much less high voltage transmission capacity. In 2023, utilities and other transmission developers brought only 55 miles of high-voltage transmission lines into service, which is a huge drop from the yearly average of 1,700 miles of new high-voltage transmission built from 2010 to 2014. Despite this decline in new construction, annual transmission spending has risen to more than $25 billion in 2023—up from $20 billion in 2013. Ninety percent of the 2023 amount was spent on reliability upgrades and the replacement of aging equipment, which does not increase delivery capacity. This is happening against a backdrop of policies by the Biden-Harris Administration increasing electrical demand (mandating electric vehicles, electric heating, etc.) to satisfy its promise to the U.N. under the Paris Climate Accord.

High-voltage transmission construction — 345-kV or greater — has fallen from the 1,700 miles added each year on average between 2010 and 2014 to 925 miles on average from 2015 to 2019, and 350 miles a year from 2020 to 2023. The Edison Electric Institute, a trade group representing investor-owned utilities, expects its members will spend about $30 billion a year on transmission over three years starting this year. According to the report by consulting firm Grid Strategies, the Federal Energy Regulatory Commission, the U.S. Department of Energy and many in Congress are supporting transmission development, but more private investment is needed. The report states, “a significant increase in federal funding and utility investment in new greenfield high-capacity projects is still needed to truly move the needle on transmission expansion and ensure a reliable and affordable transition to a cleaner grid,” which acknowledges that the purpose of the additional high-voltage transmission is to connect wind and solar power to the grid from their distant locations.

FERC issued Order No. 1920 in May 2024 to reform long-term planning practices, and the Energy Department has taken action to support siting, permitting, and funding for new lines through the new Transmission Facilitation Program (TFP) and proposed National Interest Electric Transmission Corridors (NIETCs), which were facilitated by the passage of the Infrastructure, Investment, and Jobs Act (IIJA) and Inflation Reduction Act (IRA) in Congress.

The Biden-Harris goal announced in April 2024 is to “upgrade 100,000 miles of transmission lines over the next five years.” Through May of this year, the 125-mile, 500-kV Delaney-to-Colorado line between Arizona and California has been constructed, but it was the only project so far this year, according to the Federal Energy Regulatory Commission’s Energy Infrastructure Updates for 2024.

Projects in the Works

Merchant developers and utilities are driving new transmission development in the West–projects that have taken over 10 years to develop. Pattern Energy broke ground in 2023 on the 550-mile SunZia line in the Southwest as a merchant project, over 15 years after the line was initially conceived. Pattern Energy developed the line with the New Mexico Renewable Energy Transmission Authority to deliver New Mexico power to Arizona. Building also commenced in 2023 for the 730-mile Transwest Express line, a merchant project developed by the Anschutz Corporation that was first proposed 16 years ago in 2007.

There are several other merchant projects that are ready-to-go in the west, including the 275-mile SWIP North line, a merchant project developed by LS Power between Utah and Nevada, and the 213-mile Cross-Tie Transmission Line from Idaho to Nevada, a merchant project developed by TransCanyon.

Utility projects include NV Energy’s Greenlink projects that will allow for better interconnection of the state as well as new generation resources, most likely wind and solar power. PacifiCorp’s Energy Gateway projects are a portfolio of lines currently under construction that will deliver energy from Wyoming to the Southwest and Northwest.

Problem Worsened by Forced Coal and Natural Gas Generator Retirements

In New York, the Independent System operator found a resource deficiency of at least 1,000 megawatts by 2034 driven by increasing demand, large loads, and assumed gas unavailability. It found that New York City transmission security margin baseline deficiency beginning in 2031 is driven by assumed NYPA small gas plant retirements.

PJM, the nation’s largest regional transmission organization, is expected to see higher electricity costs in the next year. In a recent auction, prices for power plants jumped to $269.92 per megawatt-day—more than an 800 percent increase from a record low of $28.92 per megawatt-day. The costs are driven up by shrinking supply and robust demand from data centers and the Biden-Harris administration’s push to electrify everything. In Virginia, where new data centers are expected, four gigawatts of coal and natural gas capacity will be retired despite the state adding 14 billion kilowatt hours of new demand last year, leading the nation.

Biden-Harris Power Plant Rule

The Environmental Protection Agency’s (EPA) “power plant rule” forces existing coal and new natural gas plants to use a technology that is neither economic nor commercial to reduce carbon dioxide emissions or shutter. EPA’s power plant rule targets electricity from coal and natural gas, which together make up about 60 percent of the electricity generation in the United States while providing firm power to the grid and back-up to intermittent and weather-driven solar and wind plants. The rule includes:

- Coal plants will have to start capturing 90 percent of their carbon dioxide emissions by 2032 by using carbon capture and sequestration technology, which is neither commercially available nor economic.

- Future gas-fired plants must install carbon capture systems by 2032.

- The threshold for future gas facilities that are considered high-capacity and thus covered by the rule’s strictest standards applies to plants that run 40 percent of the time.

- Facilities that broke ground after the EPA proposal came out last year and that will run frequently must capture 90 percent of their emissions, or prevent those emissions some other way, or close down.

- Fossil fuels plants that are not retrofitted with carbon capture systems must exit the grid by January 2039.

EPA has decided to define the requirements for existing natural gas power plants later in the year, most likely after the November election.

Conclusion

The growth in transmission has slowed while the Biden-Harris energy transition requires huge amounts of new wind and solar capacity to replace the natural gas and coal plants that will be forced to retire by its power plant rule and to cover the new demand that will come from its forced electrification of everything from electric vehicles to heating, cooking and other appliances. The only reason that taxpayers and consumers need to pay for new transmission is to connect politically correct wind and solar plants to the grid that are located far from demand centers. An inexpensive solution would be to allow existing coal and natural gas plants to remain operating and to allow new and affordable natural gas plants to be built that can be located near demand centers, but clearly that is not in the works for the Biden-Harris administration, whose goal is zero carbon in the electric sector by 2035.