The Congressional Research Service (CRS) recently performed two studies evaluating fossil fuel and renewable energy subsidies—one in April and one in May. From those studies, in 2009:

- Renewable energy subsidies were 49 times greater than fossil fuel subsidies when evaluated on a Btu (British thermal unit) basis of production. In other words, when making a comparison based on the amount of energy produced, renewable subsidies were 49 times greater than fossil fuel subsidies.

- On a straight amount-of-subsidy basis, renewable fuels received over 6 times more tax revenue dollars than fossil fuels received, as estimated by the Joint Tax Committee.

- Renewables received a 77 percent share of total federal energy incentives in 2009, while fossil fuels received a 13 percent share but produced more than 7 times the energy.

The April CRS Analysis

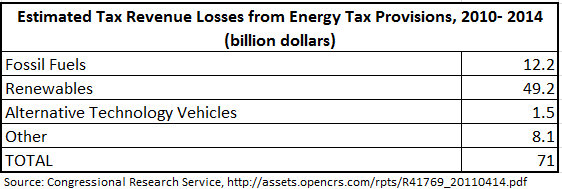

In April, the CRS produced a report that discussed the reasons why governments provide subsidies, listing the estimated tax revenue losses as a result of U.S. energy-related subsidies for 2010 to 2014. According to the CRS, governments provide subsidies to fix market failures, i.e. to correct distortions in energy markets, or to achieve an economic objective. But, as CRS notes, tax policy is determined within a political system with compromises, which complicates the process and can either mitigate or compound the distortions. Current and past policies have been used in an attempt to reduce imported oil through greater use of domestic resources and to decrease environmental emissions by promoting renewable energy and conservation.

The total tax revenue lost due to energy-related federal subsidies for the 5-year period from 2010 to 2014 is estimated at $71 billion with renewables getting the lion’s share of $49 billion or 69 percent. See table below.

The May CRS Analysis

The May CRS analysis, like the one above, is based solely on Federal tax incentives targeted to energy. It does not include federal support that is also available to other industries or forms of federal financial support such as research and development funds, nor does it include state energy incentives. The tax expenditure estimates are from the Joint Tax Committee and are projected revenue losses, not actual losses.

The study found that in 2009, estimated tax revenue losses for the energy sector totaled $19.9 billion. Of the $19.9 billion, renewable energy received $15.4 billion in tax breaks, while fossil fuels received $2.5 billion. Another $2 billion worth of tax breaks went toward conservation, efficiency, alternative vehicles, and other energy-related tax incentives. Alcohol fuels and biofuels received the largest share of tax breaks in 2009, consisting of estimated tax revenue losses of $12.5 billion. Over half of this amount was for black liquor qualifying for a tax credit as an alternate fuel mixture—a tax credit that was discontinued after 2009. Black liquor is a fuel obtained from digesters in the process of chemically pulping wood that is burned in a recovery furnace to extract certain basic chemicals.

Tax Incentives by Category, 2009

Source: Congressional Research Service, http://assets.nationaljournal.com/pdf/051411_CRSsubsidies.pdf

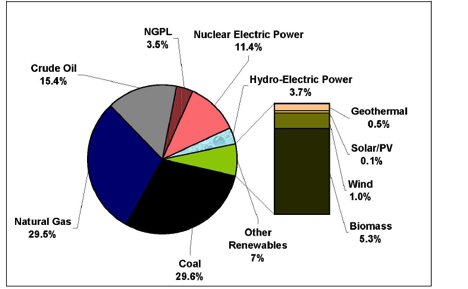

CRS used primary energy production data reported by Energy information Administration (EIA) in its Annual Energy Review to compare the amount of production from each source. The following figure provides the distribution of primary energy production in 2009 by fuel type using EIA data. Fossil fuels represented 77.9 percent of total energy production in the United States in 2009, while nuclear fuel represented 11.4 percent, and all renewable fuels combined represented 10.6 percent. Of the renewable share, biomass represented the largest portion, exactly half at 5.3 percent, with hydroelectric power second with a 3.7 percent share. Wind and solar energy represented a combined 1.1 percent of the 10.6 percent renewable production share.

Primary Energy Production by Source, 2009

Source: Congressional Research Service, http://assets.nationaljournal.com/pdf/051411_CRSsubsidies.pdf

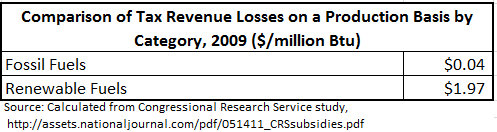

One way to compare subsidies is based on the amount of energy produced. When evaluated on a unit of production basis, fossil fuel estimated subsidies were $0.04 per million Btu (British thermal unit) and renewable fuel subsidies were $1.97 per million Btu. In other words, renewable fuel subsidies were 49 times greater than fossil fuel subsidies on a per Btu basis.

Alcohol and biofuels, excluding black liquor, received estimated subsidies of over $6 per million Btu based on production of 981 trillion Btu in 2009. Alcohol and biofuel subsidies on a Btu basis of production were over 150 times higher than fossil fuels subsidies. While biofuels and other oxygenates received the largest share of subsidies, these fuels only produced 3.9 percent of total petroleum products supplied in 2009, according to EIA.

CRS also compared the 2009 estimated tax revenue losses by tax subsidy category to the estimated tax revenue losses estimated for 2010. The alcohol and biofuels tax subsidies decreased from an estimated $12.5 billion to $6.3 billion because black liquor is no longer eligible for the subsidy, but those for other renewables increased from $2.9 billion to $6.7 billion. The latter increase was mainly due to the section 1603 grants that are provided for qualifying investments in lieu of tax credits. Those grants allow solar plants and wind farms to get an immediate rebate of 30 percent of their investment cost instead of taking the 30 percent over time as a tax credit. That change increased the lost tax revenues due to those subsidies from $1.1 billion in 2009 to $4.2 billion in 2010. The decline in tax revenue losses for alcohol fuels was due to the scheduled expiration of the excise tax credit at the end of 2010. That tax credit, however, was temporarily extended through the end of 2011 by the Tax Relief, Unemployment Reauthorization, and Job Creation Act of 2010 (P.L. 111-312). The tax revenue losses from subsidies for energy efficiency improvements to existing homes also saw a large increase, rising from $0.3 billion in 2009 to $1.7 billion in 2010. The revenue losses from tax subsidies for fossil fuels were estimated to decline from $2.5 billion in 2009 to $2.4 billion in 2010. Total revenue losses due to direct energy subsidies in 2010 were estimated to be $19.1 billion, 4 percent less than in 2009.

Conclusion

While renewable energy advocates do not want to admit it, renewables get the lion’s share of direct energy subsidies both on a total dollar basis and also when compared to the amount of energy produced. Fossil fuels garnered an estimated 13 percent of 2009 energy tax incentives, while renewable energy received 76 percent. Alcohol and biofuels subsidies received the largest share of renewable tax incentives in 2009. In 2010, total tax incentives were estimated to be 4 percent less than in 2009, but fossil fuels still only garnered an estimated 13 percent, while renewables totaled an estimated 68 percent. And, on a unit of production basis, renewable subsidies in 2009 were 49 times as great as fossil fuel subsidies.

The questions for policy makers are: “What market distortions are the subsidies trying to fix? Are the distortions mitigated or compounded by the subsidies? Are benefits being reaped?”