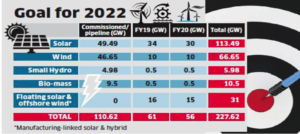

Several years ago, India set a target of 175 gigawatts of installed non-hydroelectric renewable energy capacity by March 2022 as part of its Intended Nationally Determined Contributions under the Paris Agreement. This June, India upped that goal to 227 gigawatts, of which solar power is to contribute 113 gigawatts, wind energy 66 gigawatts, and floating solar and offshore wind power 31 gigawatts. The additional 52 gigawatts of capacity will require an additional investment of $50 billion over the next couple of years.

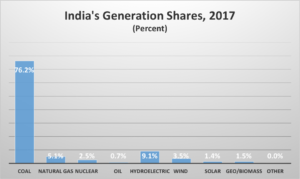

Currently, non-hydroelectric renewable energy represents just 6.4 percent of India’s power generation, according to BP’s Statistical Review of World Energy. Coal generated the lion’s share of India’s power in 2017—76 percent—followed by hydroelectric power at 9 percent. India’s 19 gigawatts of installed solar capacity in 2017 generated just 21.5 terawatt hours of generation—a 1.4 percent share—and its 33 gigawatts of wind capacity generated 52.6 terawatt hours—a 3.5 percent share.

Renewable Capacity Utilization Factors

Note that India expresses its renewable goal in terms of installed capacity. Installed capacity is the maximum output that can be obtained from a plant. Capacity utilization factor measures how well a plant is utilized—i.e., the actual output of the plant compared to the plant’s theoretical maximum output, measured as a percentage of the installed capacity of a plant.

Because wind and solar have low capacity utilization factors, the growth in generation from renewable capacity is much smaller than the growth in that capacity. For example, one of India’s largest solar power producers owns a 40-megawatt solar power plant in Gujarat that generated 63.8 million megawatt hours—just 18.2 percent of its total capacity. While wind’s capacity utilization factor is larger than solar’s capacity utilization factor, it is much smaller than the capacity utilization factors for coal and natural gas that can consistently attain generation levels over 80 percent of their capacity. This is because coal and natural gas are not dependent on the vagaries of weather.

According to data released by the Ministry of New and Renewable Energy in May 2013, India’s capacity utilization factor of solar photovoltaic is anywhere between 11 and 31 percent. In the draft national electricity plan released by India’s central electricity authority in December 2016, the capacity utilization factor of its solar power plants averages around 20 percent. Due to nightfall, monsoons, dust, storms, etc., the total maximum capacity of a solar power plant is never reached.

India intends to increase its ground-mounted, grid-connected solar power, its rooftop grid-connected solar power, and add floating solar power. A major part of the target is to be fulfilled by developing solar parks and ultra-mega solar power projects. While utility-scale solar power capacity has grown over the last few years due to cheaper debt, increased competition, supportive policies, and a fall in module prices, the rooftop solar power sector has significantly lagged behind. Despite government policies providing up to a 30-percent subsidy for rooftop solar (70 percent in case of special category states) and attractive feed-in tariffs offered by state regulators, consumers see the high cost of rooftop solar panels overriding their benefit. The Ministry of New & Renewable Energy recently proposed a new-look rooftop solar power incentive program, the Sustainable Rooftop Implementation for Solar Transfiguration of India, targeting commercial, industrial, residential, and institutional consumers, worth $3.7 billion.

India’s Future Supply Mix

The Energy Information Administration (EIA) expects India’s primary energy consumption to increase at an annual average rate of 3.6 percent between 2015 and 2040 with its gross domestic product increasing at an annual rate of 6 percent (expressed in real purchasing power parity). Its electricity demand is expected to increase at an annual average rate of 2.9 percent between 2015 and 2050 (or by a factor of 2.5), which is much slower than the 5.3 percent it grew in 2017. Coal is still expected to supply the majority of India’s electricity demand in 2050—64 percent, followed by natural gas at 7.5 percent, hydroelectric power at 7.4 percent, nuclear power at 7 percent, solar power at 6.9 percent, and wind power at 4.3 percent.

India has the fifth largest coal reserves in the world at 97.7 billion metric tons, according to the BP Statistical Review of World Energy, and its technically recoverable coal resources are more than triple that number. India produced 716 million metric tons of coal in 2017, making it the second largest producer of coal in the world, behind China. India consumes and produces more coal than the United States, which ranks third.

Conclusion

India has set lofty goals for its renewable capacity builds, especially for solar power. However, because solar power has a low capacity utilization factor, coal will still supply the majority of electricity in India in 2050, according to EIA’s International Energy Outlook.

Further analysis of related issues within the Indian electrical gird by IER can be found here and here.