The International Maritime Organization—the United Nations body that sets standards for the global marine industry—is requiring ships to reduce the sulfur content of their exhaust by over 85 percent by 2020. Ship owners can meet the requirement by switching to a lower sulfur fuel or by installing scrubbers in their smoke stacks without using a lower sulfur fuel. Either way, it will cost more to ship products. The refining industry is expecting a surge in diesel demand as ship owners switch from heavier bunker fuels to diesel. If diesel prices increase, it is likely that jet fuel prices will also increase since jet fuel prices are linked to diesel prices. Because about a quarter of an airline’s operating expenses is fuel, air fares are likely to increase as well.

Refineries produce three main categories of fuel: gasoline for cars; distillates, including both diesel and jet fuel; and heavier fuels for industrial purposes and to power ships. By a marketing convention, jet-fuel prices are usually aligned to diesel prices, typically selling for a few cents more a gallon. Because the majority of refineries are running at their maximum, they cannot easily produce more to keep prices from increasing. U.S. refineries typically operate at 95 percent of their capacity.

The Trump administration wants a more gradual introduction of the standard, giving fleet operators and refiners more time to adapt and easing anticipated increases in diesel and jet-fuel prices. The White House believes the shipping and energy markets would face less disruption if the rules were phased in as experience is gained in the process.

Impact of the Rule on Ships

Beginning in January 2020, the sulfur content in fuel used by ships will be limited to 0.5 percent, far below the 3.5 percent existing standard and the current 2.2 percent average. The rule will significantly raise fuel costs that could drive businesses into bankruptcy or financially weaken operators. It is estimated that the rule will cost the industry about $40 billion. Retrofitting a vessel with a “scrubber” costs $5 million to $10 million a ship. Lower-sulfur fuels are about 55-percent more expensive than those used today.

Ships contribute about 13 percent of total sulfur-dioxide emissions by burning heavy fuel with a sulfur content as high as 3.5 percent, which is more than 2,000 times the level allowed for cars on U.S. highways.

A study estimated that about 6.7 percent of the global commercial fleet—about 4,000 ships—will be using scrubbers after 2020. Of the new vessels being built or retrofitted to comply with the new rule in China and Korea—a total of about 1,500 vessels—one-quarter will have scrubbers installed. Another 65 percent is being built to use lower sulfur fuel blends and the remainder are built for other fuel options, such as liquefied natural gas.

Carnival Corporation—the world’s biggest cruise-ship operator—invested $400 million to install scrubbers in 82 of its 102 ships. Sweden’s Stena Line—one of Europe’s largest ferry operators—lost about 30 percent of its workforce to pay for scrubbers.

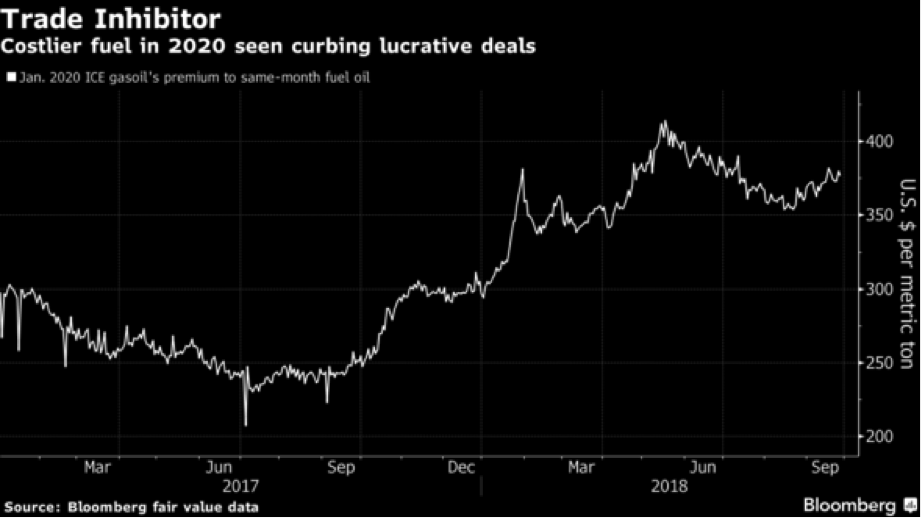

Compliant fuels for purchase in 2020 are already trading at large premiums. (See chart below.) In 2020, the two main clean marine fuels for purchase will be an existing 0.1 percent sulfur product and a new “bunker fuel” with a maximum 0.5 percent sulfur content. If shippers install scrubbers, they have the option of continuing to burn today’s bunker fuel.

Shipping Markets

Ships can switch destinations to profit from higher cargo prices but that option will become more challenging because of the changes to the fuel vessels must burn. While the fuel will cost more than what ship owners pay today, the fuels may be incompatible from one supplier to the next, making topping off more complicated. The lack of a uniform product could even cause carriers to break down. Using mismatched fuels could result in blocked filters, potentially leading to engine blackout.

Detour trades happen intermittently, at times helping to avoid localized shortages of a commodity when there is an unexpected disruption. For example, some gasoline tankers heading toward New York recently detoured because of market conditions and the effects of Hurricane Florence. Gas carriers, crop carriers, and crude tankers deviated over the past year for various reasons.

Conclusion

A new rule effective beginning January 2020 will require ships to use fuel with a sulfur content of no more than 0.5 percent, which is a significant reduction from the fuels used today. The change will be costly to the shipping industry raising freight rates. It will likely raise the price of jet fuel as well because its price is aligned with diesel prices. As a result, air fares will likely increase. The Trump administration is requesting that the rule be phased in to allow ease of implementation and more gradual increases in prices for shipping and air travel.