Morgan Stanley is forecasting that legacy American manufacturers will have electric vehicles make up only about 10 percent of their sales by 2030, and that the legacy manufacturers and EV-focused producers like Tesla will bring the share of EV sales up to about 25 percent in the United States by 2030—meeting just half of President Biden’s goal of 50 percent. Biden’s EPA has proposed tailpipe emissions regulations that if finalized would require two-thirds of all light-duty vehicles sold after model year 2032 to be electric, or manufacturers would have to pay fines. The standards act as a mandate to force manufacturers to make and sell electric vehicles. While Morgan Stanley sees Detroit’s auto makers having potential in the global EV adoption, it expects to see changes in the scaling and magnitude of their strategies in the coming quarters. That change is expected as both GM and Ford have lost large sums of money on electric vehicles.

The Biden administration is pursuing other stringent regulations for the auto market to push electric vehicles on American consumers, and federal agencies are also spending billions of taxpayer dollars and offering consumer tax credits to make the vehicles more appealing. Despite these efforts, American manufacturers are starting to back away from lofty near-term production targets as their EV product lines eat into their profits since electric vehicles tend to be considerably more expensive than their gas-powered equivalents. For example, the Ford F-150 pickup truck costs about $38,500, significantly less than the $57,000 price of a Ford F-150 Lightning EV model.

Beyond the higher price tag of electric vehicles compared to gas models, other issues pushing buyers away from electric vehicles include lack of charging facilities, battery range anxiety, poor performance in inclement weather and higher insurance rates. Hertz’s decision to cut its fleet of electric vehicles because of high repair costs has helped educate consumers about some of the shortcomings of electric vehicles.

Ford’s Future EV Program

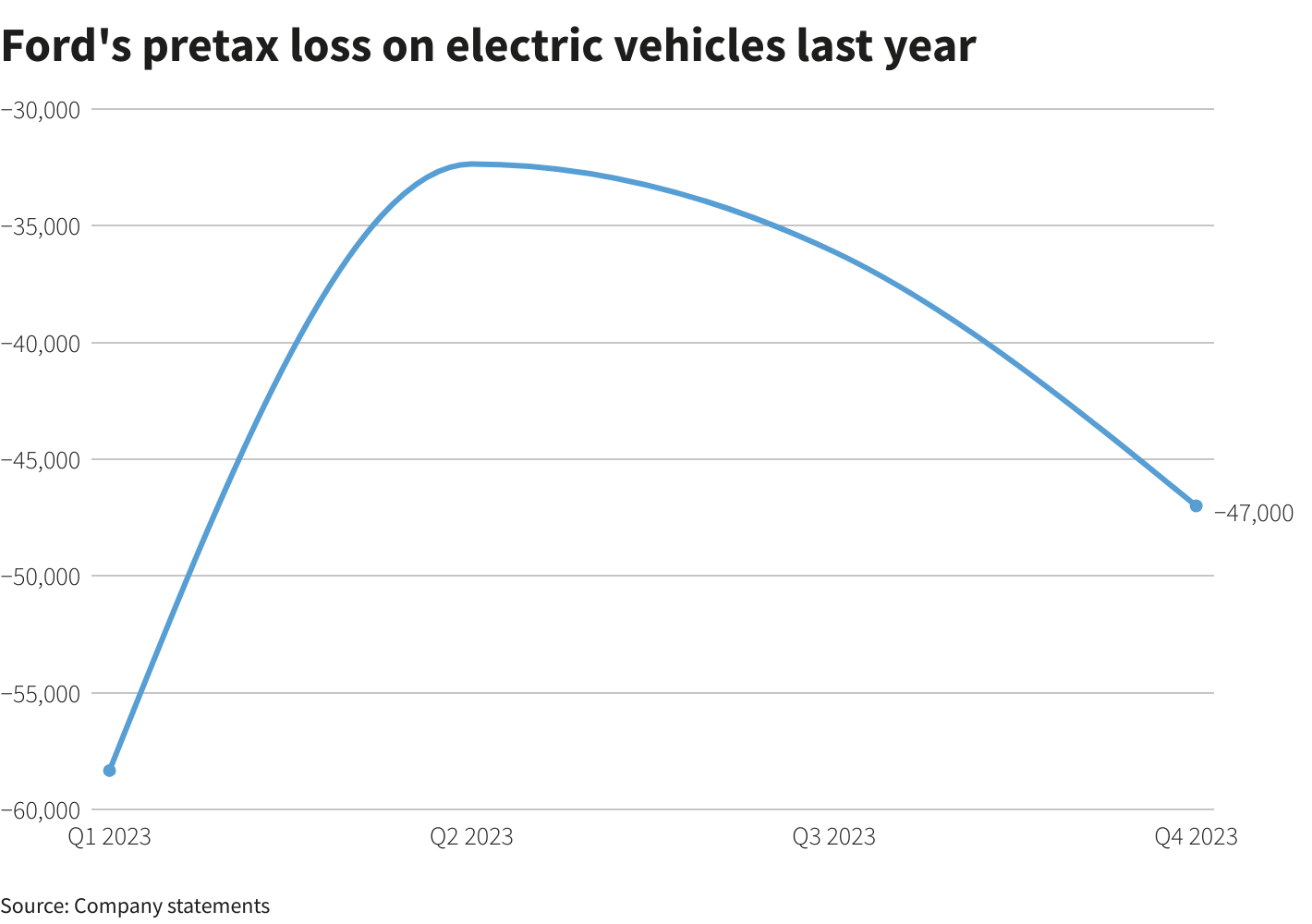

Ford is slowing investment in new EV capacity to match slower demand for electric vehicles as it expects its electric vehicle operations to continue to be a cash drain this year. Its Model E lost an average of more than $47,000 per vehicle in the fourth quarter, 2023. The company projected a wider pretax loss of between $5 billion and $5.5 billion this year. According to Marin Gjaja, head of the Model E EV business, the next generation of Ford EVs will be launched “only when they can be profitable.” But Ford’s electric vehicles will not return 8 percent pretax profit margins by 2026 – a goal set in early 2023. That is in contrast to General Motors, who claims that it expects its North American electric vehicles to cover their production costs and generate a variable profit by the second half of this year.

Ford is overhauling its EV strategy in response to slower adoption by consumers and the price war launched by Tesla. Ford plans to invest in larger electric vehicles such as trucks and vans and have a “skunk works” team develop a low-cost, small EV architecture. The company also intends to invest more in gas-electric hybrids, which command profit margins that are much higher than EV margins. Hybrid sales are expected to grow by 40 percent next year.

For every electric F-150 Lightning Ford sells, it can sell 12 combustion pickup trucks and still stay in compliance with U.S. emissions rules, although the substantial losses from sales of electric vehicles must be made up by buyers of combustion vehicles, making those vehicles more expensive. It expects Ford Pro, the automaker’s commercial business, to be a key driver of profit and potential cash returns to investors this year. Ford Pro is forecast to earn $8 billion to $9 billion this year, up from $7.2 billion in pretax profit last year. Increased sales of redesigned Ford’s Super Duty pickup trucks in North America following a slow launch last year are behind the assumption of higher Ford Pro profits. Ford Pro also expects to gain sales with new electric Transit vans in Europe, where some cities are banning combustion vehicles in central districts.

Conclusion

Ford and GM, which were putting together ambitious EV plans to meet President Biden’s goal of their electric vehicles reaching 50 percent of new cars sales by 2030, have now begun leaning toward manufacturing of their higher-margin hybrid and gas-powered models instead of electric vehicles. Cost cuts and demand for crossover SUVs and pickup trucks helped the automakers offset inflation and EV demand cooling. American consumers opted for hybrid vehicles and family SUVs instead of electric vehicles for many reasons including convenience, relative ease of maintenance, lower cost for the same type of product, lack of EV charging facilities, lower insurance rates and battery range anxiety.

Legacy auto makers have learned that the EV business needs to stand on its own, it needs to be profitable and provide a return above its cost of capital and independent from emissions compliance benefits. For all those reasons, Morgan Stanley is forecasting that Biden’s 2030 target will not be met and U.S. legacy auto makers and Tesla will only reach 25 percent EV sales in 2030. Biden’s EPA and Department of Transportation both have proposed rules that would force automakers to have two-thirds of their sales in 2032 be electric, or pay fines. Biden clearly needs to get more realistic targets or be faced with a number of auto company bankruptcies.