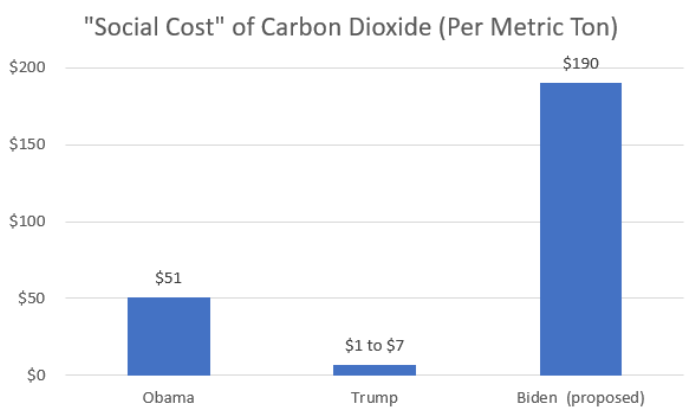

President Biden’s Environmental Protection Agency (EPA) has proposed a new estimate for the social cost of carbon emissions that nearly quadruples the interim figure from the Obama Administration. The Biden administration has been using the Interagency Working Group’s interim value of $51 per metric ton of carbon dioxide, but EPA has proposed increasing it to $190. Agencies use the number in their analyses of the costs and benefits of climate regulation on sources ranging from power plants and automobiles to the oil and gas sector. The higher the social cost of carbon, the easier it is to reject projects involving natural gas, coal and oil. The Trump Administration used a value between $1 and $7 a metric ton. The interim value of $51 per metric ton has raised legal challenges from several states, including Louisiana and Missouri.

EPA is requesting public comment on the estimate, which it made public when it released its proposed methane standards for the oil and gas sector. The new social cost estimates were not used as part of that analysis, but they were included in a separate 137-page supplemental document dated September 2022. The document estimates the social cost of carbon as $120, $190 or $340 per metric ton of carbon dioxide, using discount rates of 2.5 percent, 2.0 percent and 1.5 percent, respectively. The discount rates reflect the weight given to emissions of carbon dioxide. A higher rate means a lower dollar value is assigned to those emissions; a lower rate assigns more dollar value to them. In addition to carbon, EPA also calculates social cost values for methane and nitrous oxide.

Federal agencies are responsible for incorporating the social cost of carbon in their analysis and evaluating how they would be applied in rulemaking. The Interagency Working Group’s role is to have agencies share resources and streamline the process so that each agency does not recreate the process from scratch. It is unclear whether the figures released by EPA reflect changes the working group is also considering. In the supplemental document, EPA noted that it was participating in the working group’s work and that the process is ongoing. The Interagency Working Group originally planned to release its proposal in April. EPA’s draft technical report is available to the working group as it continues its work. EPA began working on the social cost of methane and integrated it into some rulemaking before the Interagency Working Group undertook the work.

EPA has a new “modular” approach recommended by the National Academy of Sciences to producing the estimates that includes four steps, or modules, of the estimation process: socioeconomics and emissions, climate damages and discounting. The resulting values supposedly represent a range of climate outcomes. EPA had previously used preexisting models for the current interim values. The interim analysis gauged costs at $14, $51 and $76 per metric ton of carbon dioxide, using discount rates of 5 percent, 3 percent and 2.5 percent, respectively. The new EPA figures are $120, $190 and $340 using discount rates of 2.5 percent, 2.0 percent and 1.5 percent, respectively.

The difference between the current interim figures and EPA’s proposal is due mainly to the change in the discount rates used; EPA used a 2 percent discount rate, rather than the 3 percent rate used in calculating the interim value. The updates to the functions, model, socioeconomics, and pricing of risk also increased the value of the social cost of carbon by about one-third.

The firm, Resources for the Future, provides a calculator for obtaining the carbon tax for various types of fossil fuels using different assumed social costs of carbon (SCC). While the SCC is not a direct carbon tax, it acts like one when analyzing fossil fuel projects, elevating their costs against their benefits. The Biden administration will use it to increase the costs of fossil fuel projects in its regulatory analyses and other analyses across the federal government. At $190 per metric ton for the social cost of carbon, the carbon tax for gasoline, which would be added to the cost of gasoline in any federal analysis, would be $1.71 per gallon, making electric vehicles more economic against internal combustion vehicles. In the case of a new 1,000-cubic-foot natural gas project, the carbon tax would be $10.09. For sub-bituminous coal, used in the generation of electricity, the carbon tax would be $320 per ton, most likely making coal plants uneconomic. This gives the government a strong argument to reject fossil fuel projects or to add enormous regulatory costs to them.

Status of Litigation

Federal agencies are currently using a social cost of carbon value first developed by the Obama administration, adjusted for inflation. The federal government has already faced strong opposition from several states on its adoption of the interim value of $51 per metric ton, which is far more than the value that the Trump administration used of $1 per metric ton. The states argue that the Biden administration lacks the authority to raise the metric under the Constitution.

In February, Judge James Cain Jr. of the U.S. District Court for the Western District of Louisiana blocked the use of the metric by issuing an injunction, saying it imposed regulatory costs on the states. A federal appeals court rejected that decision, and the Biden administration has received other positive outcomes in court defending the current interim metric of $51 per metric ton.

In March, the 5th U.S. Circuit Court of Appeals overturned the ban, ruling that the states had raised “merely hypothetical” arguments to show that they face immediate harm from the Biden administration’s use of the climate metric. Attempts to reverse the ruling at the Supreme Court did not gain traction later in the spring. The case, however, is not yet fully resolved. The appeals court will hear oral arguments on the challenge on December 7. Last month, the 8th U.S. Circuit Court of Appeals found that another lawsuit failed to show “actual injury” from the administration’s use of the social cost of carbon.

The new EPA figure should not immediately affect regulations or any of the litigation since it has not yet been finalized. The new figure, however, could be indirectly used in litigation because it contains a more detailed analysis of the reasons for looking at carbon emissions, which was the biggest difference between the Obama estimates and those of the Trump Administration, which only included direct impacts in U.S. territory. The Obama and Biden Administrations both used assumptions about international impacts to increase costs of American projects.

Conclusion

The Biden Administration has raised the mythical social cost of carbon estimate from the already high level of $51 per metric ton to $190 per metric ton by decreasing the discount rate and changing the methodology and parameters in its climate model. Because the social cost of carbon is essentially a direct tax leveled on energy usage, almost quadrupling the value will raise energy prices in the federal government’s analyses—prices, which are already 50 to 100 percent higher since President Biden took office in January 2021. The energy crisis will get even more severe if this proposal is finalized, as it will unleash a vast amount of new expensive environmental regulations, the costs of which will be added to consumer prices. Already, blackouts and brownouts are expected in the Northeast if a cold winter occurs and diesel stockpiles there are at very low levels, causing rationing to take place in several areas.

EPA’s proposal will next undergo a peer-review process that should solicit comments that show how dangerous this proposal is to the U.S. energy system and American well-being. The social cost of carbon is simply another front in the war on domestic oil, coal, and natural gas.