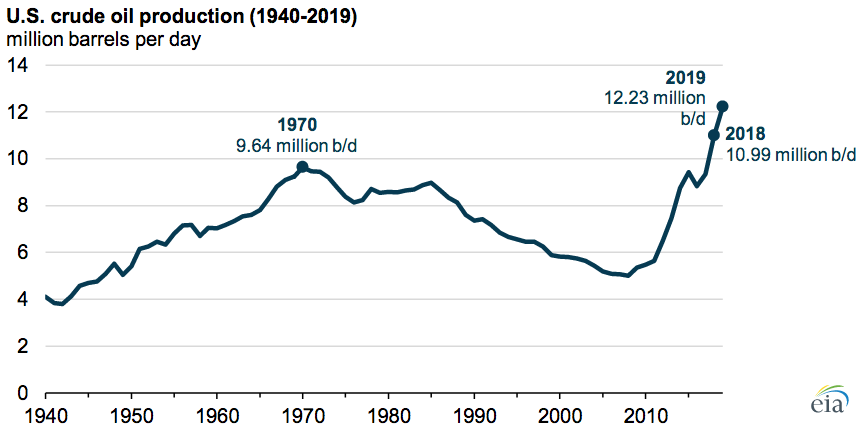

According to the Energy Information Administration (EIA), U.S. oil production broke another record in 2019, surpassing 12 million barrels per day for the first time—an 11 percent (1.24 million barrel per day) increase over 2018 production levels. The 12.23 million barrel-per-day record is due to hydraulic fracturing and horizontal drilling technologies as well as increased productivity. This production record was reached despite less U.S. oil-targeted drilling, which declined 22.6 percent year over year in January.

Regional U.S. Oil Production

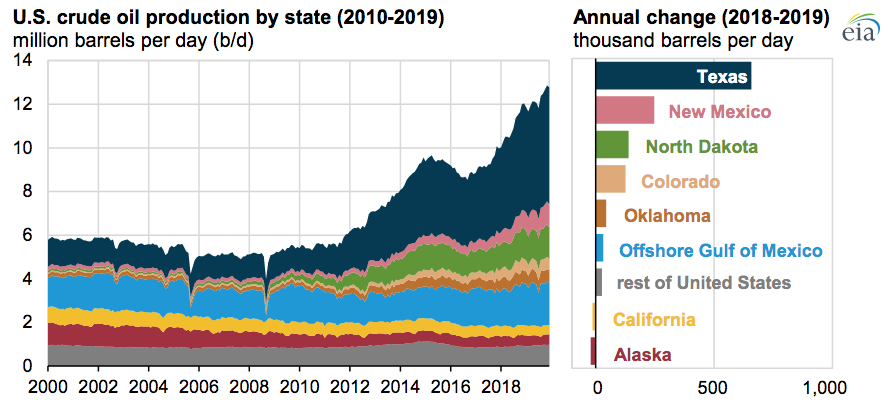

Texas is the number one state producer of crude oil in the nation, accounting for 41 percent of the national total in 2019. Texas crude oil production averaged 5.07 million barrels per day in 2019 and reached a monthly record of 5.35 million barrels per day in December 2019. Texas produces more oil per day than all but three of the world’s countries. Texas’s production increased by almost 660,000 barrels per day in 2019—53 percent of the increase nationally. Since 2010, Texas crude oil production increased by 333 percent (3.9 million barrels per day).

North Dakota ranked second among the states in oil production, and New Mexico ranked third. North Dakota set a record production level in 2019 of 1.4 million barrels per day. New Mexico’s oil production in 2019 was almost 1 million barrels per day, increasing by 36 percent (248,000 barrels per day) over 2018 levels. This increase in New Mexico was the second-largest state-level growth in 2019 and accounted for 20 percent of the total U.S. increase. New Mexico’s oil production increased by 749,000 barrels per day since 2010.

In the Offshore Federal Gulf of Mexico, new projects contributed to the region’s growth in production in 2019. Oil and natural gas producers brought online seven new projects in 2019, and nine more are expected to come online in 2020. The Offshore Federal Gulf of Mexico’s crude oil production grew by 126,000 barrels per day in 2019, resulting in the area’s highest annual average production of 1.88 million barrels per day. The Offshore Federal Gulf of Mexico was the second-largest crude oil-producing region in the United States in 2019.

These increases in oil production more than offset production declines elsewhere. Alaska’s crude oil production decreased for the second year in a row, and California’s production declined for the fifth year in a row.

Petroleum Demand

U.S. petroleum demand decreased slightly in January, continuing a downward trend that began in November, due to a number of factors including the new standard that requires the marine sector to reduce sulfur dioxide emissions and the beginning effects of the coronavirus. According to the EIA, U.S. petroleum demand was 20.22 million barrels per day in January—slightly less than the 20.46 million-barrel-a-day average in 2019. The combination of less demand and more supply resulted in lower oil prices, which many Americans have been experiencing when filling their gasoline tanks. But, further price changes are to be expected as OPEC changes course after its recent meeting with Russia.

OPEC Changes Course

Saudi Arabia recently announced a huge discount in oil prices of $6 to $8 per barrel to its customers in Asia, the United States, and Europe as a result of a recent failed meeting with Russia. OPEC and Russia had been coordinating on production cuts to shore up oil prices, but Russia did not agree on further production cuts to arrest falling oil prices coming from fears that the coronavirus would stop worldwide economic growth. Russia prefers not to cut supply and to allow cheap prices to pick up demand. OPEC and its allies did not announce new reductions and did not commit to extending current cuts. Saudi Arabia then did an about-face and offered to cut the oil price for the U.S. market by $7 per barrel, to Europe by $8. and Asia by $6. Saudi Arabia is able to rapidly increase production and flood the market with cheap crude, driving the price down for everyone.

While U.S. consumers are likely to see lower prices at the gasoline pump, some American oil producers will be hurt by the lower prices since the lower prices are most likely near or below their break-even point. How long Saudi Arabia will continue with this approach is uncertain, but Saudi Arabia is dependent on oil to balance its budget and thus also needs higher oil prices, which might mean that this policy will only last for a short time. At any rate, the U.S. oil industry will bounce back as it did in 2014 when OPEC similarly lowered the price of oil.

Conclusion

U.S. oil production broke a new record in 2019 and was originally expected to continue that trend into 2020 and beyond. However, coronavirus fears, changes in the specifications for bunker fuel, and an OPEC price war could change those expectations for U.S. oil production. As a result of a failed meeting with Russia to cut oil production, Saudi Arabia is increasing its oil production and discounting its oil prices to foreign markets. The low prices will be beneficial for consumers, including travelers at the gas pump and airlines that are suffering from lower demand due to the coronavirus, but some U.S. oil companies will likely be hurt as the low oil prices are at or below their break-even point for production. It is unclear how long Saudi Arabia will continue this approach since its budget is dependent on oil sales. Regardless, the U.S. oil industry will survive and bounce back from Saudi Arabia’s policy.

And contrary to promises by President Obama that “we can’t drill our way out of” (energy shortages and high prices), the United States, through hard work, ingenuity, and investment, has drilled itself into energy abundance that many experts thought could never occur. When the government gets out of the way of energy markets in America, Americans can and will go to work.