China’s energy demand is slumping due to the outbreak of the coronavirus (COVID-19) and it is affecting energy markets worldwide. Since energy consumption tends to track with economic performance, the Chinese economy is suffering as well. The Chinese are importing and consuming less oil and natural gas, flying fewer planes, and running fewer factories. China’s oil demand is estimated to have fallen by about a third. It is expected that global oil demand will drop by 4 percent this month. According to the International Energy Agency, year over year demand is expected to fall by 435,000 barrels per day during the first quarter of 2020—the first quarterly contraction in over 10 years. The agency cut its 2020 oil growth forecast by 365,000 barrels per day down to an increase of 825,000 barrel per day. The Energy Information Administration expects global liquid fuels demand will average 101.7 million barrels per day in 2020—1 million barrels per day more than in 2019, but 378,000 barrels per day less than its previous forecast.

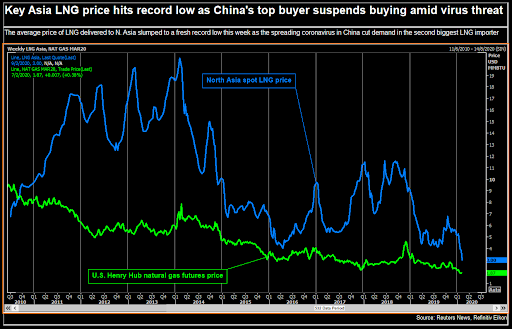

China’s demand for liquefied natural gas is also down. China’s largest importer of liquefied natural gas, China National Offshore Oil Corp., which operates nearly half of the country’s terminals, suspended contracts with at least three suppliers because of the coronavirus. The company is declaring “force majeure”—a legal move to suspend contractual obligations in the event of unexpected natural disasters, terrorist attacks, or other “acts of God.”

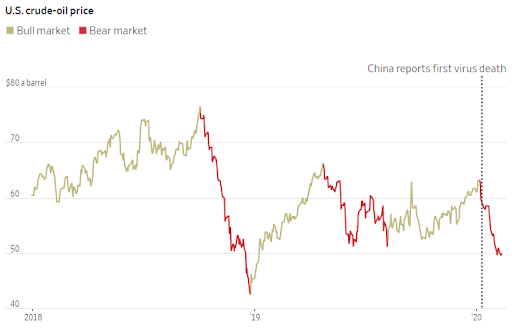

As the world’s second-largest economy, Chinese demand helps determine international oil and natural gas prices. The price of West Texas intermediate crude oil is around $50 a barrel—a decline of about 20 percent over the last month. The average price of a regular gallon of gasoline recently dropped below $2.40—its lowest level in a year. With the average U.S. household consuming 100 gallons of gasoline a month, a 45-cent decline over the past nine months results in annual savings of $540, or $45 per month back in families’ pockets.

Analysts are projecting plentiful supplies of both oil and natural gas. Futures prices for natural gas are down about 30 percent in the past year, which benefits the U.S. households—about half of the total U.S. households that use natural gas as a primary heating source—as well as businesses which rely upon natural gas for heating and processing. Asian spot prices for liquefied natural gas have already dropped to $3 per million British thermal units—less than half of what they were at the same time last year. At least one cargo bound for India has traded below the $3 mark—down 30 cents within a week.

Electricity

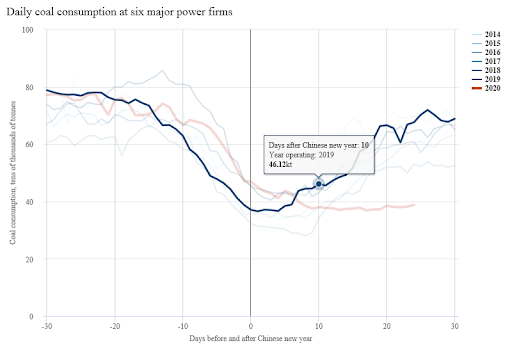

One forecaster expects China’s industrial electricity demand to decline this year by as much as 73 billion kilowatt hours due to the lull in factory output that has occurred because of the virus. While that decline may seem small, representing about 1.5 percent of industrial power consumption in China, the loss is equal to the power used in the country of Chile and it illustrates the scope of the disruption caused by the outbreak. Last year, China’s industrial consumers used 4.85 trillion kilowatt hours of electricity, accounting for 67 percent of the country’s total electricity consumption. If the epidemic goes on past March, China’s power consumption this year is expected to increase by only 3.1 percent—lower than the 4.1 percent initially expected.

The expected reduction in China’s power demand is the energy equivalent of about 30 million metric tons of thermal coal or about 9 million metric tons of liquefied natural gas. The coal figure is more than China’s average monthly imports last year while the LNG figure is a little more than one month of imports, based on customs data.

Electricity demand and industrial output in China remain far below their usual levels, as indicated by:

- Coal-fired power stations report daily data usage at a four-year low.

- Oil refinery operating rates in Shandong province are at the lowest level since 2015.

- Output of key steel product lines are at the lowest level for five years.

- Domestic flights are down up to 70 percent compared to last month.

- China car sales dropped 92 percent during the first two weeks of February.

The measures to contain the coronavirus have resulted in reductions of 15 percent to 40 percent in output across key industrial sectors, which may have cut a quarter or more of the country’s carbon dioxide emissions over the two-week period when activity would normally have resumed after the Chinese new-year holiday. Over the same period in 2019, China released around 400 million metric tons of carbon dioxide, so the downturn in industrial output could have cut carbon dioxide emissions by 100 million metric tons.

Conclusion

The coronavirus has resulted in the loss of industrial output in China. As economies have become more linked in the recent past, some supply chains have also included partial processing of goods and their transport to other parts of the world, so a reduction in transport or manufacturing affects not just the Chinese, but the rest of the world as well. The loss of industrial output has also resulted in lowered energy demand. The lower demand for oil and natural gas has brought international prices for the fuels down, aiding consumers in the short term but hurting producers and projections for the year. Electricity demand in China has also been reduced due to lower industrial output. The lower demand and lower prices are not expected to continue once the virus is totally contained. But, the date when that will occur is unclear, particularly since other countries (South Korea, Iran, and Italy) have now seen large increases in the number of affected cases.

There is no doubt that we are seeing significant impacts upon the energy economy throughout the world as a result of the coronavirus. Energy use is typically one of the fastest indicators of economic performance owing to its vast importance in every aspect of economic growth. The coronavirus is simply a reminder of just how intertwined energy and economic progress have become.