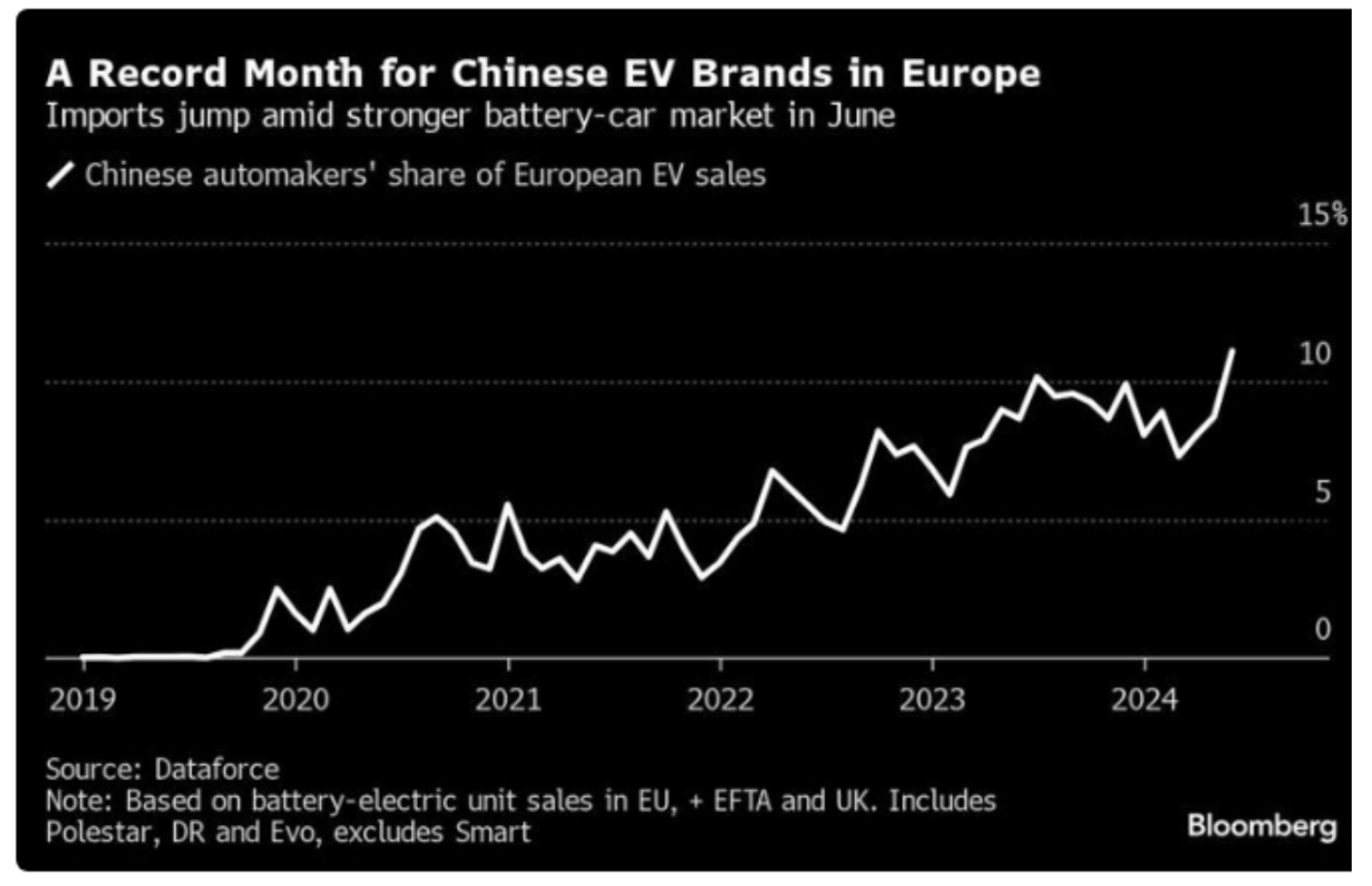

Chinese manufacturers including SAIC Motor, which owns MG, and BYD accounted for 11 percent of all EV sales in Europe in June due to discounts and a marketing push before European tariffs on imported Chinese electric vehicles took effect at the start of July. Europe’s focus on meeting “sustainability goals” may make it difficult to keep blocking inexpensive Chinese electric vehicles. The European Union’s goal is to reach net zero greenhouse gas emissions by 2050—a goal that will prove difficult if it snubs cheap Chinese cars to protect legacy car makers that produce more expensive models. Chinese car companies have also focused on markets in Southeast Asia. In Thailand, the regional manufacturing hub known as the “Detroit of Asia,” Chinese car makers are increasing market share by cutting costs and investing heavily to supplant dominant Japanese brands.

China’s June EV Sales In the EU

Chinese brands registered more than 23,000 battery-electric vehicles across EU during June–the most ever. Their 72 percent jump from May was twice the gain in overall European EV registrations for June. Chinese-made imports from Western manufacturers who have off-shored manufacturing to China including Volvo Car AB, BMW AG and Tesla Inc. are also subject to the new EU levies that took effect on July 1. The EU’s provisional charges subject SAIC to an additional 38 percent fee, while BYD will pay an extra 17 percent on the existing 10 percent customs duty. Chinese carmakers are hurrying to add European EV manufacturing so they can avoid the duties. They are also looking at ways to avoid U.S. tariffs. A month before the European Union imposed tariffs on electric vehicles imported from China, the United States quadrupled tariffs on electric vehicles built in China.

Another driver of the European EV market in June was the introduction of incentives in Italy, which helped to spur a doubling of battery-electric sales in the country from a year ago. About €200 million in new-EV subsidies ran out in less than nine hours, according to the government. About 60 percent was obtained by families and the rest by companies. That increase hurdled Italy, which has been lagging in EV sales, into the top six of a regional market that includes EU states, countries like Norway and Switzerland that participate in its single market, and the UK.

European carmakers seeing the advantage of Chinese automakers have joined forces with Chinese counterparts. For example, Stellantis began shipping electric vehicles from China under a joint venture with Zhejiang Leapmotor Technology Co. and has already started assembling pre-production electric vehicles at a Stellantis plant in Poland.

Overall, June was the third-highest month ever for EV volumes with 208,872 registrations across the EU, behind December 2022 and March 2023, and just ahead of June 2023.

China Automakers Move into the Thai EV Market

Thailand is one of the first countries to experience the sudden influx of China’s automobile brands and it is reshaping its car industry. China’s EV auto market is evident everywhere in Thailand. Billboards contain advertisements for Chinese cars and land prices are soaring because so many Chinese firms are building car factories.

Chinese companies are moving ahead of their global rivals in Japan, who have pushed hybrids over electric vehicles, and the United States, where Tesla dominates the sector. Last year, sales of popular Japanese brands such as Nissan, Mazda and Mitsubishi dropped as consumers bought new electric cars from Chinese manufacturers instead. Japanese automobile brands accounted for 86 percent of new car sales in Thailand in 2022. It dropped to 75 percent last year, with China’s BYD, Great Wall Motor and SAIC Motor gaining market share. Japan’s dominance over Thailand’s automotive industry dates to the 1960s when Nissan Motor and its local partner, Siam Motors, opened the country’s first car factory. Now, however, dealers that had worked with Japanese and American automakers for decades are turning over showrooms to make way for Chinese vehicles. Amid an increasingly crowded field, Chinese automakers are slashing prices on electric vehicles and gaining market share.

Thailand is small compared the U.S. and EU auto markets, but it is the biggest auto market in Southeast Asia. It serves as a regional manufacturing hub. Its proximity and strong trade ties to China allow Chinese cars to be imported quickly and inexpensively.

In 2021, Thailand said it wanted electric vehicles to account for 30 percent of its automobile production by the end of the decade-an ambitious goal that is likely unattainable without Chinese electric vehicles. Its government also put in place subsidies and tax breaks to increase EV demand. However, a weak Thai economy has resulted in a significant decline in overall car sales this year. While, electric vehicle sales have slowed, they are still up 50 percent over last year. Chinese automakers have also cut prices. Six Chinese EV companies are currently selling cars in Thailand, and three more are expected this year. BYD, Aion, Great Wall, Hozon Auto’s Neta and Chery are among those that have opened or are building factories in Thailand.

Conclusion

The overseas push in Europe and Thailand is part of China’s strategy to focus on new energy vehicles and upend the current balance of power in the automobile industry. After years of government support for the sector, Chinese manufacturers are mass-producing electric vehicles. They have established dependable supply chains and have worked out ways to reduce prices. While China’s international push has been met with tariffs in two major auto markets to prevent a glut of Chinese vehicles from upending local competitors, cheap Chinese electric vehicles may be the only way to meet their emission reduction goals. European policymakers are trying to strike a balance between easing access to less-expensive Chinese-made electric vehicles that would aid progress toward sustainability goals and protecting the legacy automaking industry in a tough economy. Those are conflicting objectives. The question for U.S. policymakers remains whether forcing Americans into electric vehicles is a good position for the United States, where oil resources are bountiful, unlike in China—a country that is controlling the world’s EV manufacturing supply chain.