As talks intensify on the once ambitious “Build Back Better” reconciliation measure, the conversation has shifted towards how to pay for a slimmer, but no less disruptive package of subsidies for wind, solar, electric vehicles, and other non-energy related measures. The Democrats would be satisfied to raise corporate taxes. Some in the business community, however, are rumored to be lobbying the Democrats to tax energy instead. Enter S. 2378, a proposal by Senator Chris Coons (D-DE) to levy a carbon tax on certain imports, or more directly to tax our energy.

Styled as the FAIR Transition and Competition Act, the bill promises to jack up gasoline prices as much as a $1.50 per gallon and increase the price of steel, aluminum, cement, other fossil fuels, and the products made from them. The ostensible purpose of the bill is to protect U.S. producers in the steel, iron, aluminum, cement, and fossil fuel industries against competition with producers in other countries. Whatever the real purpose, the upshot is another raid on the pocketbooks of American families who are already being crushed by the weight of the highest inflation in decades.

The Coons bill is small by Washington standards at just 19 pages, but what it lacks in size it more than makes up in potential damage to the economy. In typical D.C. fashion, the measure passes the most important decisions off to bureaucrats even though just last week the Supreme Court cautioned against this sort of power handoff. It also slips in a bypass-SCOTUS-free card to the EPA with respect to the regulation of greenhouse gasses and encourages an interstate competition to exaggerate climate impacts.

The bill would create a set of carbon tariffs for each affected industry. These tariffs would be levied on imports for the affected industries from non-exempt countries. The bill does not stipulate what the tariffs would be nor which countries would be exempt. Instead, it creates multiagency processes to make these critical determinations. This is a recipe for a lobbyist feeding frenzy to influence each stage of every determination.

The stated intent is to have a carbon tariff that matches the costs domestic producers bear in order to meet our climate regulations at all levels of government. Though the bill is vague, we can use projected EPA climate guidelines to estimate possible impacts on the price of gasoline.

Within a month of Inauguration Day, the Biden Administration created the Interagency Working Group on Greenhouses Gases (IWG) and published a technical support document (TSD) to guide the regulatory agencies until the IWG makes a final determination. In theory, the social cost of carbon (SCC) calculates damages done by a metric ton of carbon dioxide between its emission and some arbitrary time in the future (typically centuries or more later).

Federal regulatory agencies are to use the SCC in their cost-benefit analysis for setting policy or judging projects involving carbon-dioxide emissions. In a theoretical optimum, the network of regulations would restrict fuel production and consumption to the levels achieved by a carbon tax equal to the SCC. In practice, the regulations can be clumsier and involve compliance costs beyond those needed to actually reduce the emissions.

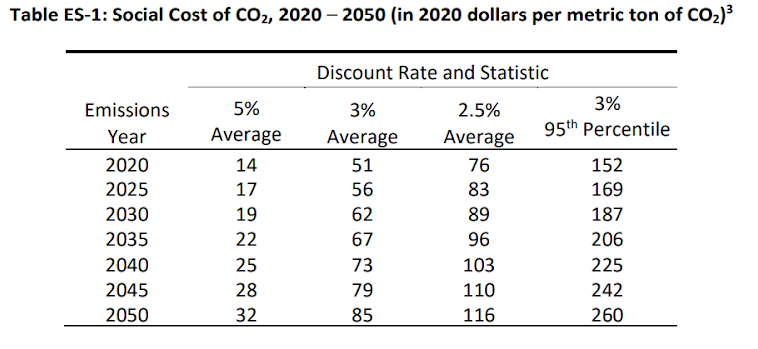

In short, the SCC is a reasonable first cut at projecting how large the carbon tariff might be. The table below, from Page 5 of the TSD, shows that this tariff could be very large.

Using fatally flawed logic, the authors of the TSD omit a column using a 7 percent discount rate, which would reduce the SCC to a trivially low number. That same flawed logic almost guarantees that IAWG’s final report will not choose any number from the 5 percent column as the regulatory guideline. Using the 2025 values of $56/ton, $83/ton, and $169/ton are not implausibly high proxies for the proposed carbon tariff. Indeed, a Brookings study suggests an upper range of SCC values that exceed $1,500/ton.

Though the U.S. is a net exporter of petroleum and petroleum products combined, it is still a net importer of crude petroleum, a significant portion of which comes from countries unlikely to meet the requirements for exemption. Levying a carbon tariff on imported petroleum would not only raise the price of imported oil, but also the price of domestically produced oil since market price is determined by the marginal unit supplied. In this case, the marginal barrel would be the imported barrel. This higher price works its way through the supply chain and increases the price of gasoline by $0.09/gallon for each $10 of the carbon tariff.

Simple multiplication shows that a carbon tariff set equal to the IWG’s 2025 SCCs would add between $0.50 and $1.52 to the per-gallon price of gasoline and slightly more for diesel and jet fuel. This carbon tariff could add hundreds of billions of dollars per year to consumer energy costs. Much of this increased cost would go to petroleum producers, who could be expected to offer little resistance to this carbon tariff, but there would also be tens of billions of dollars of tariff revenue that the bill earmarks for a variety of uses.

The bill allocates the tariff revenue to states, in part, by climate impacts the states suffer. Though the extreme weather that supposedly causes these climate impacts have no upward trends, the allocation formula gives states an incentive to create bureaucracies to find climate costs anyway.

The competition for these climate-damage payouts would help exaggerate climate impacts and would be used to further support the climate agenda. There was a similar incentive with the U.N. Green Climate Fund, and it led to a bizarre claim by a landlocked country that it suffered damages from sea-level rise, which was dutifully reported as fact.

Finally, as alluded to above, the bill includes an innocuous appearing five-word section that could repurpose the Clean Air Act. In a recent ruling (WV vs. EPA), the Supreme Court disallowed the use of minor sections of legislation for major policies, requiring Congress to make such uses explicit in legislation. This ruling has many legal experts predicting the Supreme Court will overturn Mass vs. EPA, which has allowed the EPA to use a section of the Clean Air Act to justify broad and costly CO2 policies. When referring to climate legislation, the Coons bill says, “including the Clean Air Act,” which could easily be viewed as explicit congressional direction. Were the Coons bill to pass, supporters of unchecked regulatory power would have a much stronger case against overturning Mass vs. EPA.

Though the Coons bill is short, the implications and impacts would be large. We could expect the cost of petroleum products alone to rise by hundreds of billions of dollars per year. Transfers of this size invariably lead to additional waste as special interests compete for protection and revenue. None of this is good for American energy consumers who are already burdened with record prices, although it is great for the growth of government power and revenue.