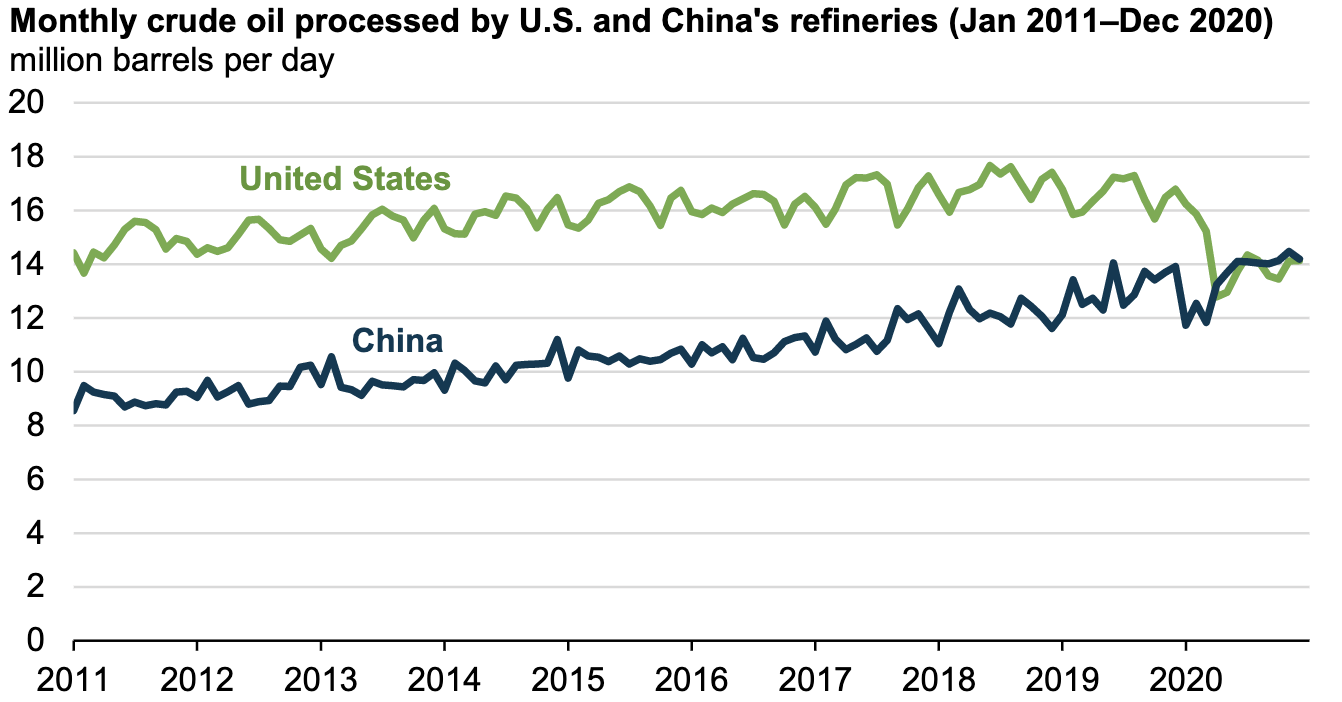

As of April, 2021, the United States had 18.1 million barrels per day of petroleum refining capacity (i.e., operable atmospheric crude oil distillation capacity). U.S. refining capacity had reached a record high of nearly 19.0 million barrels per day as of January 1, 2020, but several refineries have closed since then, resulting in a capacity decline of 4.5 percent. While the United States has been shuttering refineries, China has invested in them. In fact, for most of 2020, China’s refineries processed more crude than U.S. refineries. In April 2020, more crude oil was being refined in China’s refineries than in U.S. refineries for the first time on record, and the trend continued for all remaining months in 2020 except for July and August.

According to the International Energy Agency, China is expected to dethrone the United States as the number one petroleum product producer in 2021, a historical first. About 50 years ago, the United States had 35 times the refining capacity of China. But today, oil exporters are selling more crude to Asia and less to customers in North America and Europe. According to Wood Mackenzie, about 1.4 million barrels per day (about 9 percent) of refining capacity in Europe may shut-down by 2022 to 2023, with plants in the Netherlands, France, and Scotland on a list of potential closures.

China’s refiners are becoming a growing force in international markets for gasoline, diesel, and other fuels, putting other refiners out of business. Chinese refining capacity has nearly tripled since 2000 as it worked to keep pace with the rapid growth of diesel and gasoline consumption. The country’s crude processing capacity is expected to climb to 20 million barrels per day by 2025 from 17.5 million barrels per day at the end of 2020.

China vs. U.S. Refinery Output 2020/2021

April 2020 was the first full month for the United States in which responses to the COVID-19 pandemic reduced demand for petroleum products. While U.S. refiners had seen record declines in April, China’s refinery oil processing began increasing their levels due to a demand increase following a decline in China’s COVID-19 cases. China’s refinery runs also started to increase in April 2020 because China implemented a policy in 2016 that encourages refiners to refine more petroleum products by fixing product prices at $40 when the Brent crude oil price falls to less than $40 per barrel. The Brent crude oil price fell and remained less than $40 per barrel between March and May 2020. U.S. oil was even negatively priced at one point in April, 2020, meaning companies were paying for others to take their oil.

While China processed a record 14.1 million barrels per day of oil in June 2020, which increased further in November to 14.5 million barrels per day, U.S. refinery runs did not return to their March 2020 levels in 2020 because of a combination of demand reductions and hurricanes that disrupted refinery processes. Hurricanes Laura and Sally in late August and September and Hurricanes Delta and Zeta in October resulted in refinery shut-ins on the Gulf Coast, where more than half of U.S. refining capacity is located. Although some refineries came back online in late 2020, U.S. refinery runs remained lower than historical averages in 2020. In April 2021, U.S. refinery runs had increased to 15,160 barrels per day—close to the March 2020 figure of 15,266 barrels per day.

Also affecting the weak refinery margins in the United States is the price of renewable credits (RINs) that refiners need to buy to meet their renewable volume obligation for blending ethanol and biodiesel into their gasoline and diesel under the Environmental Protection Agency’s refinery fuel standard. In May and June, 2021, the price of RINs was a record high of just under $2. EPA is supposed to reevaluate factors that raised the price of RINs, which should lower them and help refinery margins.

U.S. Refinery Closures

Operable refinery capacity is the amount of capacity that is in operation or could be brought into production within 90 days. Operable refinery capacity declined by 335,000 barrels per day after the Philadelphia Energy Solutions refinery in Pennsylvania closed in May. Operable capacity fell another 19,000 barrels per day in June when Marathon’s refinery in Dickinson, North Dakota, closed to be converted to a renewable diesel plant. Other closures:

- HollyFrontier shut all units as of the end of August 2020 at its 48,000 barrels per day refinery in Cheyenne, Wyoming. It stopped petroleum refining operations but plans to resume operations in 2022 as a renewable diesel processing plant, which receives subsidies from the U.S. government.

- Marathon announced plans in August to indefinitely shutter two facilities: the 161,000 barrel per day refinery in Martinez, California, and the 27,000 barrel per day refinery in Gallup, New Mexico. Marathon attributed the closures to reduced petroleum demand in 2020. In October, the company announced that it is evaluating plans to convert the Martinez refinery to a renewable diesel facility.

- Shell Oil Products US in Covent, Louisiana closed at the end of 2020, reducing operable capacity by 211,146 barrels per day. Shell wants its refineries to be more integrated with the chemical complexes to produce more biofuels, hydrogen and synthetic fuels. Other refineries under review for potential sale or closure include Puget Sound, Washington, and Mobile, Alabama.

Conclusion

U.S. refineries are shuttering or being converted to biofuels facilities, while China is building more refineries and is expected to overtake the United States in refinery runs this year. Soon China will have more operable refining capacity than the United States. The closure of U.S. refineries is along the path that President Biden wants as he seeks a zero carbon future by 2050 while China will continue to produce petroleum products, build coal mines and plants, and further fuel its growing economy.