- Oil prices are rising as the Saudis, Russia and the United States withhold potential supplies from the market.

- Saudi Arabia and Russia announced sustained oil production cuts through the end of the year totaling 1.3 million barrels per day.

- Having already depleted much of the U.S. emergency reserve of oil, Biden is looking to Iran and Venezuela for added supplies despite sanctions.

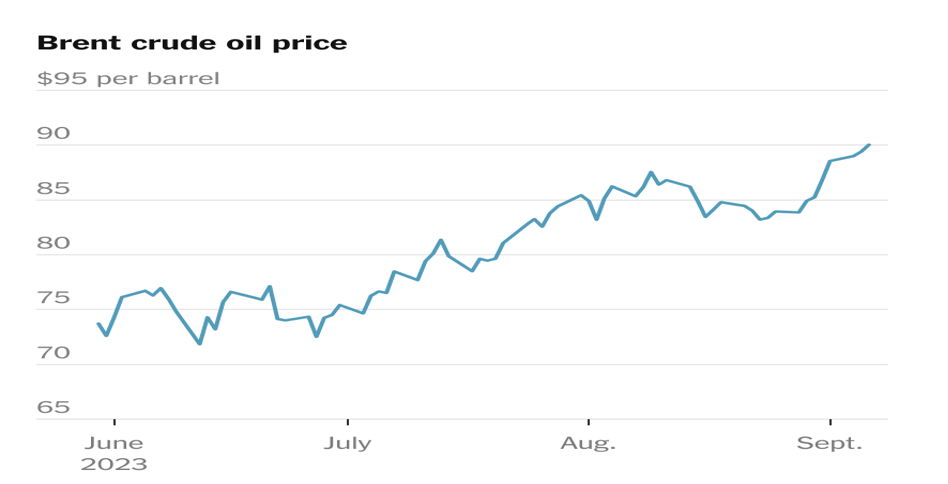

Brent oil traded at around $90 a barrel and is up over 20 percent since June due to Saudi Arabia and Russia recently announcing an extension of their production cuts till the end of the year and President Biden’s continued his anti-oil and gas policies on domestic production. The combined oil production cuts are equal to 1.3 million barrels a day. These cuts are on top of the April cut agreed by several OPEC+ producers running to the end of 2024. Saudi Arabia also hinted that it may make even deeper cuts in the coming months. Some analysts believe that Brent oil could hit $100 a barrel, a level it surpassed in the first months following Russia’s invasion of Ukraine. Higher oil prices will increase the likelihood of more fiscal tightening to curtail inflation. As President Biden has already sold 260 million barrels of oil from the Strategic Petroleum Reserve without replacing it, bringing its level to a 40-year low, the only thing he can do to counteract the production cuts is to bring more oil into the market from other countries. Iran and the Biden administration have held back-channel talks to keep oil flowing to make up for supply reductions. The Biden administration is also in discussions with Venezuela, another exporter under sanctions, who is also in talks with China to help revive its production.

The Saudis intend to hold monthly reviews to consider “deepening the cut or increasing production.” They favor a robust market for their chief source of income, and appear willing to risk alienating customers–those in developing economies and the United States–to achieve their aims. The cuts mean the Saudis are leaving a substantial amount of oil in the ground as their oil fields will be producing around nine million barrels of oil a day for about 6 months–nearly two million barrels a day less than a year ago. Meanwhile, they are investing billions of dollars to increase the amount of oil that they can eventually produce. Currently, the Saudis believe that they are better off with lower production and higher prices than the reverse. The kingdom, however, suffered the sharpest downgrade to economic growth projections by the International Monetary Fund because of the sales volumes it is losing. But, it may need oil at almost $100 a barrel to cover the ambitious spending projects of its Crown Prince Mohammed bin Salman.

Global oil markets are tightening as demand rises toward record levels, and summer’s price rally has resumed despite mounting concern over economic growth in China. The announcement sent Brent oil, the international benchmark, to $90.37 a barrel. The Saudis first introduced their additional supply cut in July, deepening reductions already made with partners in the OPEC+ alliance. With most members of the coalition already suffering output losses due to underinvestment and operational disruptions, Saudi Arabia opted to make a move to support prices, mostly by itself. Major consuming nations have criticized the kingdom and its partners for the intervention, as global fuel demand is rising toward record levels and oil inventories are depleting. A renewed inflationary spike would squeeze consumers and endanger the global recovery.

The direction of the Chinese economy is crucial for global commodity markets. China’s sputtering economy could sap demand for oil, keeping prices down. China’s expected post-pandemic rebound has not occurred, with oil demand growth lower than anticipated. Despite that, China’s oil demand remains high by historical standards. If oil prices continue to increase, however, China could protect its domestic companies by using its oil reserves instead of purchasing oil on the open market. Its strategic reserves have been increasing rapidly over several years and its reserves may now be larger than those in the United States after Biden’s election-year sell-off last year.

Iran’s Oil Exports

The Biden administration has privately acknowledged that it has gradually relaxed some enforcement of sanctions on Iranian oil sales. Iran has restored production to the highest level since sanctions kicked in five years ago and is shipping its most oil to China in a decade. Iranian oil exports to China tripled over the past three years, totaling about one million barrels per day in 2023, up from around 325,000 barrels per day in 2020. In June, Bloomberg confirmed that Iranian oil sales hit a five-year high, “fortifying its re-emergence on the geopolitical stage.” And, Iran is expected to put additional oil on the global market as it produces more.

Venezuela in Talks with China

China became a key lender to Venezuela in 2007, when it first provided funds for infrastructure and oil projects under late president Hugo Chavez. Public data indicate that China lent upwards of $60 billion in oil-backed loans through state-run banks through 2015, reaching a level of diplomatic and financial investment unmatched elsewhere in Latin America. China has lent more money to Venezuela than any other country in the world and is its largest lender.

Venezuela is discussing possible joint ventures between China and state-run Petroleos de Venezuela SA. It is seeking to raise more money from its oil as it has the world’s largest oil reserves, and oil accounts for about 95 percent of the country’s overseas revenue. Venezuelan officials’ recent visit to China comes as the Biden administration is seeking to engage Venezuela in talks to lift sanctions in exchange for allowing fair elections next year. Venezuela’s oil ministry has been working closely with China National Petroleum Corp’s (CNPC) officials on a renewed conduit that would cut out middlemen and allow them to ship oil directly. CNPC is currently producing 80,000 barrels a day, half of what it used to pump in 2015.

Conclusion

Saudi Arabia and Russia have extended their oil production cuts until the end of the year, keeping oil prices high under uncertainties regarding China’s economic recovery from its COVID lockdowns and the likelihood of Iran and Venezuela putting more oil on the market, despite current sanctions. The oil market is vulnerable to price spikes because of these uncertainties and because of the long-term underinvestment in new oilfields and higher interest rates, which make it more expensive to hold oil in storage. Oil prices have increased by more than 20 percent over the past three months, pressuring American consumers through higher prices at the pump, and added costs for groceries and household goods that need to be transported across the country. Among these events, President Biden keeps stopping oil and gas operations in the United States. Most recently, he cancelled legal leases in ANWR, sending a market signal that the president is continuing his assault on U.S. oil and gas.