Besides the turmoil in China, the hot financial news this month was that oil hit a six-year low. Indeed, adjusting for price inflation, oil went as low as it had plummeted in the immediate aftermath of the financial crisis, meaning you would have to go all the way back to 2004 to reach a similar low.

Whenever prices drop this far, it’s useful to point out the lack of consistency in the critics of the market economy. If oil prices had risen 50 percent over the last year, you can be assured that various “experts” would be testifying before Congress on manipulation in the futures markets, while common folk would be demanding federal penalties on such “price gouging.” Yet because prices have fallen more than half in the last year, most people are content to view it as decentralized forces.

There are many reasons that oil has fallen. Some obvious ones include the surge in U.S. production and the trouble with the Chinese economy (which consumes a lot of natural resources).

But I want to draw attention (as I have been doing here at IER) to the connection to U.S. monetary policy:

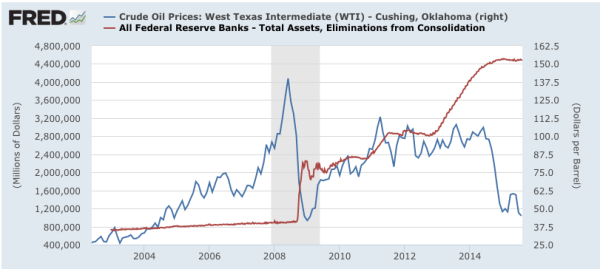

In the chart above, the blue line shows oil prices, while the red line shows total assets held by the Federal Reserve. Note that from 2009 – 2012, the blue line (oil prices) seemed to rise with the QE1 and QE2 bursts of asset purchases.

Now it’s true, oil prices traded within a $25 band during the huge increase in Fed assets known as QE3 starting in late 2012, but it’s clear that the crash in oil happened just as the Fed completed its so-called “taper” and stopped injecting new money into the financial system.

The Fed can affect oil prices through three primary mechanisms. First, by influencing the value of the dollar against other currencies, the Fed influences the dollar-price of crude oil (which is a fungible commodity traded on global markets of course). Indeed, a chart of the US dollar index shows the mirror movements of oil prices, vis-à-vis the Fed’s assets.

Another mechanism is that fears of monetary inflation can push investors into “real” assets such as commodities, including oil and gold.

Finally, the Fed can fuel oil prices by stimulating economic growth, whether that growth is sustainable or not. Many economists are blaming China’s slow-down on U.S. monetary policy, for example.

In sum, the boom and now crash in oil prices can at least partly be attributed to the Fed’s policy shifts from 2009 – 2014. This is similar to the general boom and then bust in asset prices during the housing bubble years, which many analysts have also attributed to initially loose monetary policy that was eventually tightened. Time will tell whether the fall in oil this time around goes hand in hand with crashes in other assets, as it did in 2008.