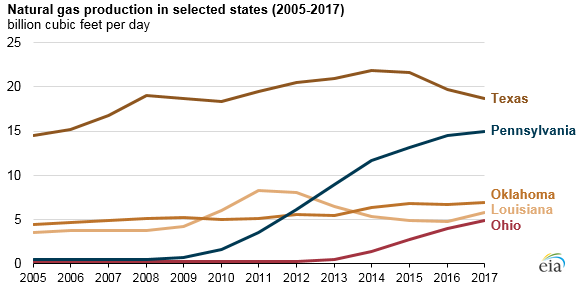

Pennsylvania increased its permits for natural gas drilling by 51 percent in 2017 and its rig count by 65 percent, resulting in annual natural gas production increasing by 3 percent reaching a record 15 billion cubic feet per day, second only to Texas in natural gas production. The state’s permitting and drilling activity increase is a result of expanding regional pipeline capacity, moving natural gas to market centers outside of production areas. These new sources of natural gas are adding greatly to Pennsylvania’s economy and are increasing investment in the state.

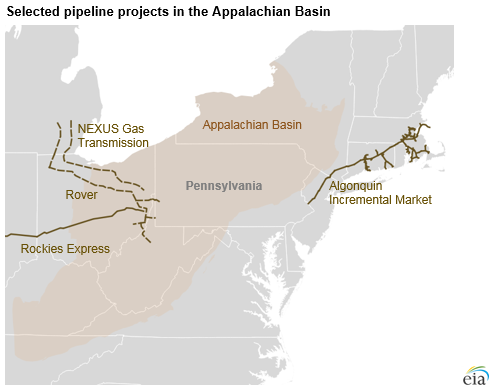

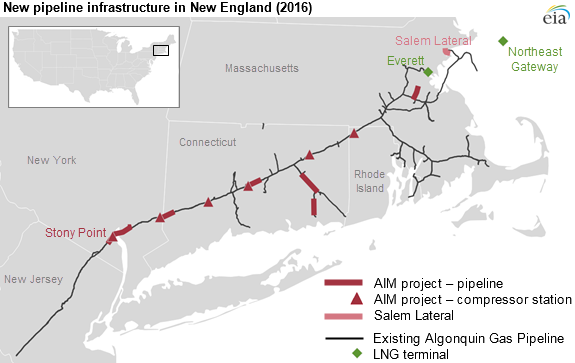

In the past, natural gas production in Pennsylvania was constrained by the lack of regional infrastructure to process and transport it out of the region. But, recently, several pipeline projects entered service including the Rockies Express Zone 3 expansion, moving natural gas westward from southwest Pennsylvania, and the Algonquin Incremental Market pipeline, primarily moving natural gas from northeastern Pennsylvania into New England. Two other projects—the Rover Pipeline Project and the NEXUS Gas Transmission Project, are expected to begin operations during the next few months.

Pipeline Projects

The Rockies Express Pipeline (REX) is one of the nation’s largest pipelines, reaching major supply basins in the Rocky Mountain and Appalachian regions. The Zone 3 Capacity Enhancement project converted the pipeline to bi-directional flow and increased its capacity to 4.4 billion cubic feet per day in Zone 3. (West-to-east long-haul capacity is 1.8 billion cubic feet per day).

The Algonquin Incremental Market Project expands existing pipeline systems in New York, Connecticut, Rhode Island, and Massachusetts, increasing New England’s natural gas pipeline capacity for the first time since 2010. The project includes the construction of 37.4 miles of pipeline beginning in Rockland County New York and traversing in a northeast direction through Westchester and Putnam Counties into Connecticut, Rhode Island, and Massachusetts. About 79 percent of the new pipeline is within or adjacent to existing Algonquin pipeline right-of-ways. The project created an additional 342 million cubic feet per day of natural gas pipeline capacity to the New England market.

An additional project, the Salem Lateral Project, provides natural gas capacity for the Salem Harbor Power Plant, a newly converted coal-to-gas electric power plant. The 674 megawatt power plant will consume up to 115 million cubic feet per day of natural gas to generate electricity for New England consumers.

The Rover Pipeline is a 713-mile pipeline that will transport 3.25 billion cubic feet per day of natural gas from the Marcellus and Utica Shale production areas to markets across the United States and into the Union Gas Dawn Storage Hub in Ontario, Canada. Rover is expected to be in full service in the second quarter of 2018.

The Nexus Gas Transmission (NEXUS) is a 255-mile interstate natural gas pipeline to deliver 1.5 billion cubic feet per day of natural gas from eastern Ohio to existing pipeline system interconnects in southeastern Michigan. The project will transport Appalachian shale gas supplies to consumers in northern Ohio; southeastern Michigan; and the Dawn Hub in Ontario, Canada.

Pennsylvania Natural Gas Production

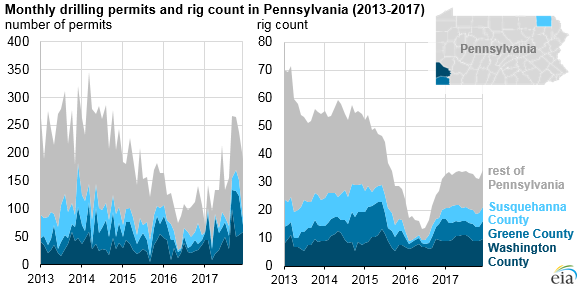

Pennsylvania accounted for 19 percent of total U.S. marketed natural gas production in 2017 and produced more natural gas than any other state except Texas. According to the Pennsylvania Department of Environmental Protection, the state issued over 50 percent more permits in 2017 than in 2016: 2,038 natural gas drilling permits in 2017, compared to 1,352 in 2016. And, according to Baker Hughes, the drilling rig count in the state increased by 65 percent—averaging 33 rigs in 2017, up from 20 in 2016.

Washington and Greene counties in southwestern Pennsylvania and Susquehanna County in northeastern Pennsylvania have the highest number of permits and rigs. In 2016 and 2017, these three counties combined accounted for slightly more than half of the total permits and two-thirds of the active rigs. In Susquehanna County, the estimated ultimate recovery of wells, which is a measure of natural gas productivity, increased over the past five years.

Conclusion

The ability to move natural gas from supply areas like the Marcellus Shale basin in Pennsylvania to demand areas results in more natural gas production, more U.S. energy, and more investment, which helps the economy and reduces the potential for price spikes, particularly in the winter months when cold weather and storms can increase demand above expected levels. Anti-pipeline advocates protest new pipeline development, but those protests only hurt the American public, who need reliable, low-cost energy and the building block chemical feedstocks made possible by natural gas for modern life.