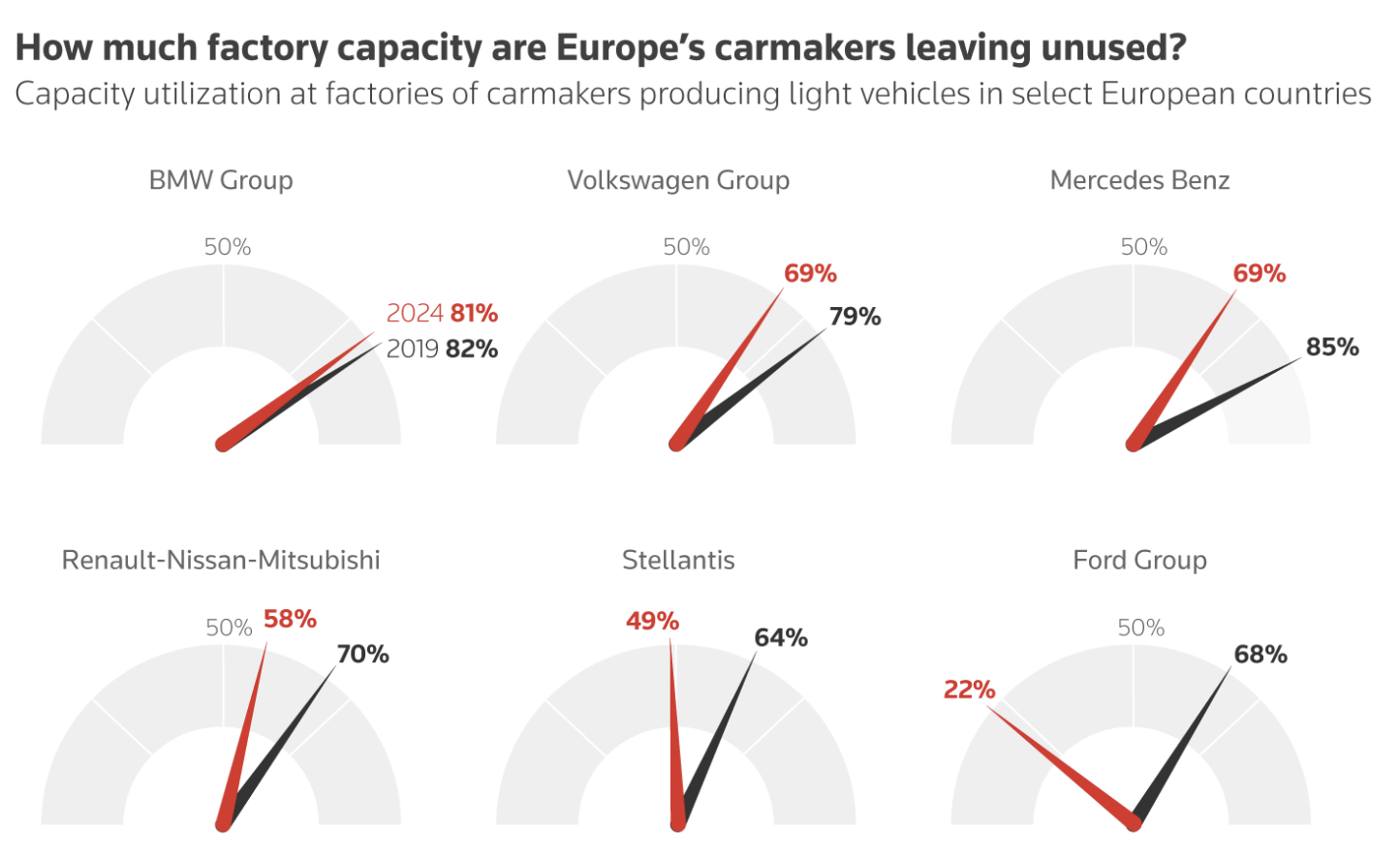

While Volkswagen is in a fight with unions over closing some of its factories, it is not alone among other Western European car dealers with underutilized factory capacity in a time when governments are forcing EV adoption on the public. A review by Reuters of factory capacity utilization for six carmakers in Europe shows that Volkswagen is not an outlier and it may be in a better position than some of its major rivals when it comes to underused plants. Renault and Stellantis, for example, both have lower average capacity utilization rates in Europe than VW, which also included a review of BMW, Ford, and Mercedes-Benz.

The Reuters review also looked at automakers in eight major European car-manufacturing countries: four in higher-cost states – France, Germany, Italy and the UK – and four in lower-cost countries – Czech Republic, Slovakia, Spain and Turkey. There was a clear tendency towards higher factory utilization rates in central and eastern Europe, where costs are lower.

Across Europe, the capacity utilization of factories making light-duty vehicles such as passenger cars was 60 percent in 2023, down from 70 percent in 2019. In the lower-cost countries, the average utilization rate slipped slightly to 79 percent from 83 percent, but in the higher-cost countries, plant use dropped to 54 percent from 65 percent. A utilization rate of about 70 percent is considered the minimum for profitability, depending on the vehicle. Around 80 to 90 percent is cost-effective, providing some flexibility for model changeovers and maintenance.

Pressure by German unions and politicians to force Volkswagen to make its electric vehicles at home is hurting the company because the decision means the automaker is using its most expensive locations to make high-cost electric vehicles, which are not selling in the numbers expected. Germany had the highest wages for factory workers in the automotive industry by international comparison at 59 euros ($66) per hour in 2022, in contrast to 21 euros ($23) in the Czech Republic and 16 euros ($18) in Hungary. In China, wages hover around $3 an hour, according to a Reuters analysis. While wages are high, new car sales in Europe are down, falling 18 percent in August to their lowest in three years, dragged down by a 44 percent drop in overall EV sales, including a 69 percent slump for German EV sales. Negative results in new car registrations were found across the region’s four major markets: double-digit losses were in Germany (-27.8 percent), France (-24.3 percent), and Italy (-13.4 percent), with the Spanish market declining by 6.5 percent.

Volkswagen vs. German Unions

German unions assert that Volkswagen’s troubles are of its own making. They criticize management for failing to develop affordable and attractive electric vehicle models, which they believe would drive consumer demand. Currently, the lowest-priced electric vehicle from the German automaker is the ID.3, priced at over 36,000 euros ($40,000). The unions are urging Volkswagen to create more budget-friendly models, either an inexpensive electric car or a sustainable low-cost combustion engine. In Osnabrück, Germany, where one of VW’s least utilized plants operates at just 30% capacity, production includes the Porsche Boxster, Porsche Cayman, and the VW T-Roc Cabriolet, all set to cease by 2026. The unions are still waiting to learn about future production plans for these factories. Under existing labor agreements, VW workers who are temporarily idled continue to receive their salaries, a significant financial burden if electric vehicle sales continue to lag.

Volkswagen believes it has one to two years to improve its position against increasing competition from China. In December, the company initiated a €10 billion cost-cutting plan, which now seems insufficient to ensure its survival. VW has also ended a long-standing job security pact at six German plants, allowing for potential layoffs starting mid-2025 unless a new agreement is reached. With labor representatives holding half the votes on the company’s supervisory board, it will be challenging for VW to close any plants. While the unions seek a negotiated settlement, management indicates that the scale of the difficulties means compromises will have to be made.

Managing Overcapacity

Managing excess capacity has long been a challenge for European automakers, constrained by labor agreements and the potential political backlash from closing unprofitable plants. High interest rates and a slowing economy have dampened demand, coinciding with a surge in Chinese electric vehicle exports to Europe. Volkswagen estimates that annual car demand in Europe should be around 14 million vehicles, a decline from 16 million prior to the pandemic.

Other automakers facing similar overcapacity issues in Europe have also taken measures to cut costs. French manufacturer Renault has eliminated thousands of jobs in the region as part of a €3 billion cost-reduction initiative launched in 2021. Stellantis is projected to have reduced nearly 20,000 jobs in Europe by the end of 2024. Both companies have scaled back production lines and reduced capacity, shifting towards a reliance on temporary workers rather than maintaining large permanent workforces. Ford plans to cut 5,400 jobs in Europe as part of a regional restructuring strategy, which includes ceasing production at its Saarlouis plant in Germany while increasing output in Spain, where costs are lower. By the end of 2024, all three companies are expected to experience worse average capacity utilization rates than VW.

Auto industry experts suggest that the divide between Eastern and Western Europe is likely to widen as Chinese manufacturers, including major players like BYD and Chery, establish operations in countries such as Hungary, Turkey, and Poland. They believe that car markets, especially in Germany, may increasingly focus on producing premium or luxury vehicles that can justify higher operating costs, resulting in significantly fewer cars being manufactured overall.

Stellantis has shifted some EV production to lower-cost markets. It will make electric vehicles in Poland via a joint venture with China’s Leapmotor. Its Citroen e-C3, which should sell for about 23,000 euros ($25,600), will be made in Slovakia. Stellantis has severe excess capacity issues at home. Production slumped 63 percent in the first half of 2024 at its Mirafiori plant in Turin, the historic home of Fiat. Production of its main model, the electric Fiat 500, has been on and off for months due to sluggish EV demand, while its Maserati luxury brand is limited to two low-volume cars. Workers at Mirafiori have been put on furlough, partially funded by the Italian government.

Conclusion

European automakers have factories that are underutilized and they are worried as Chinese EV exports are arriving while Chinese EV companies are building plants in Eastern Europe, where labor costs are lower. Some experts say it may force Western European auto companies to build mostly premium or luxury vehicles. European automakers, such as Volkswagen, are having a hard time cutting costs and closing underutilized factories as auto unions want them to develop low-cost models and keep all factories open. The reality, however, is that politicians forcing the energy transition from fossil fuels to renewable energy is causing chaos in many markets, including the auto industry and they are feeding into China’s hands, as the Chinese have been preparing for the transition for decades and are far ahead of western countries.