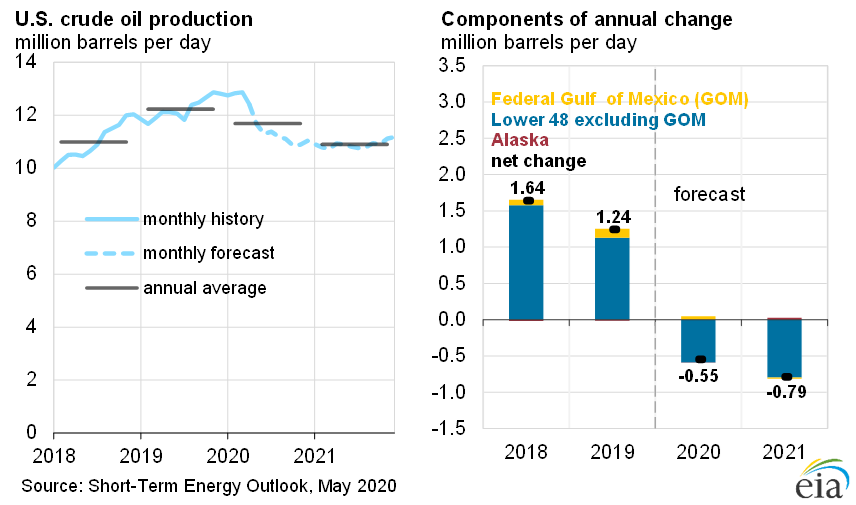

The Energy Information Administration (EIA) released its May Short-Term Energy Outlook, forecasting that oil production in 2020 is expected to be 540,000 barrels per day lower than last year’s record high. The agency expects total oil production in 2020 to be 11.7 million barrels per day. U.S. oil production for 2021 is expected to be lower than 2020 oil production and total 10.9 million barrels per day. U.S. petroleum demand, however, will take a bigger toll, declining by 2.2 million barrels per day in 2020 to 18.3 million barrels per day, as the coronavirus pandemic restricts movement across the world and erodes fuel demand. Petroleum demand is then expected to increase by 1.5 million barrels per day in 2021 to a total of 19.8 million barrels per day. At root is the coronavirus pandemic.

The 2020 projected decline in oil production would be the first annual decline since 2016. Note that EIA is projecting the decline in oil production to last two years. The agency notes that U.S. crude oil production has not declined for two years in a row since the 17-year period of declines beginning in 1992 and running through 2008. Typically, price changes affect production after about a six-month lag; but, current market conditions are expected to reduce this lag as many producers have already announced plans to reduce capital spending and drilling levels.

Motor Gasoline and Jet Fuel Consumption

U.S. motor gasoline consumption is expected to fall to an average of 7 million barrels per day in the second quarter 2020 from 8.6 million barrels per day in the first quarter, and gradually increase to 8.7 million barrels per day in the second half of the year. U.S. jet fuel consumption is expected to drop from 1.6 million barrels per day in the first quarter of 2020 to an average of 0.8 million barrels per day in the second quarter, a 50 percent decline.

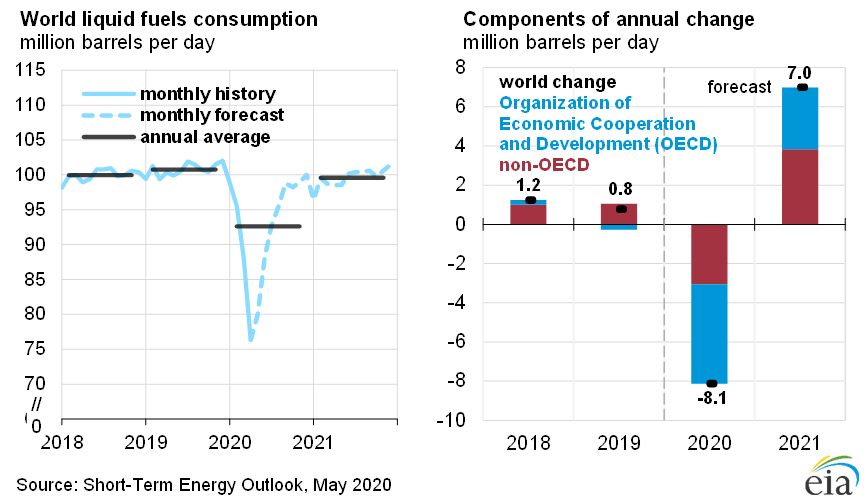

Global Oil Consumption and Production

EIA expects 2020 world oil demand to drop 8.1 million barrels per day to 92.6 million barrels per day and global oil supply to drop by 5.4 million barrels per day to 95.2 million barrels per day this year. Lower global oil demand growth for 2020 reflects growing evidence of disruptions to global economic activity along with reduced expected travel globally as a result of restrictions related to the coronavirus pandemic. Global oil demand for 2021 is expected to increase by nearly 7 million barrels per day.

The agency expects West Texas Intermediate oil prices to average $30.10 per barrel for this year and to increase to an average of $43.31 a barrel in 2021. EIA expects gasoline to average $2.00 a gallon this year and $2.17 per gallon next year.

Other Fuels

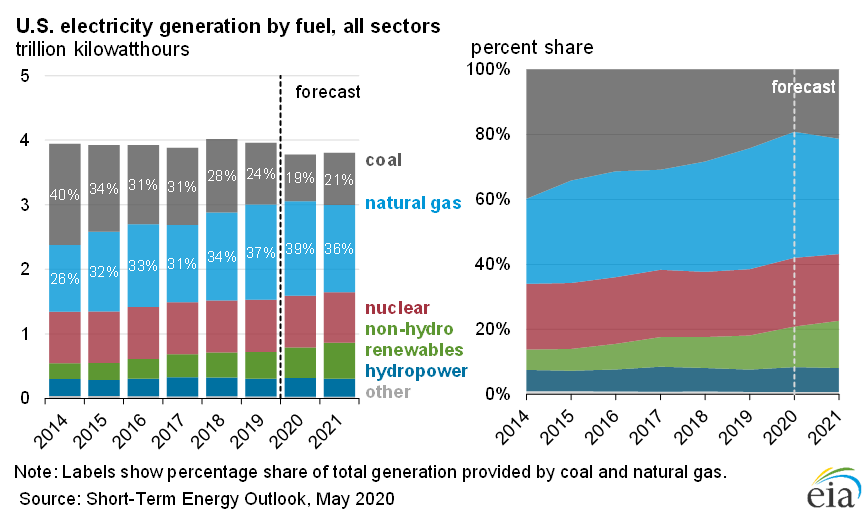

The coronavirus pandemic is also affecting other fuels, particularly electricity and coal. EIA expects that total U.S. electric power generation will decline by 5 percent in 2020 due to declines in retail sales in the commercial and industrial sectors of 6.5 percent each and a decline in residential sector sales of 1.3 percent. Most of the expected decline in electricity generation is reflected in lower fossil fuel generation, especially at coal-fired power plants. EIA forecasts that coal generation will fall by 25 percent in 2020 and that natural gas generation will be relatively flat this year due to favorable fuel costs and the addition of new natural gas-fired generating capacity.

Non-hydroelectric renewable energy sources account for the largest portion of new generating capacity additions in 2020 and results in an 11 percent growth in renewable generation in the electric power sector. Renewable generation increases because renewables are dispatched whenever they are available due to their low operating costs and the production tax credit for wind. EIA expects the electric power sector will add 20.4 gigawatts of new wind capacity and 12.7 gigawatts of utility-scale solar capacity in 2020 that are a result of tax-payer-funded subsidies and state mandates.

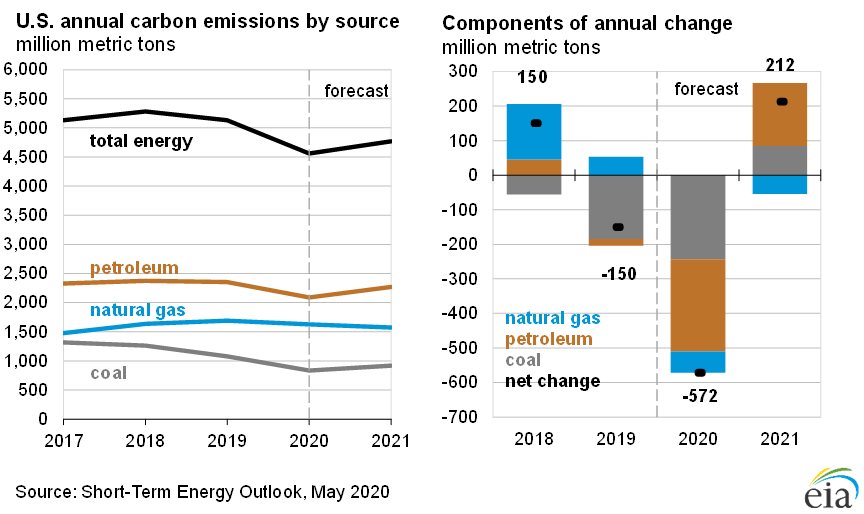

Carbon Dioxide Emissions

After decreasing by 2.8 percent in 2019, EIA expects that U.S. energy-related carbon dioxide emissions will decrease by 11 percent (572 million metric tons) in 2020. This record decline is the result of restrictions on business and travel activity and slowing economic growth related to the coronavirus. Carbon dioxide emissions decline in 2020 primarily due to less coal and petroleum consumption. In 2021, EIA expects that energy-related carbon dioxide emissions will increase by 5 percent as the economy recovers and stay-at-home orders are lifted.

Conclusion

Global and U.S. petroleum demand is expected to decline in 2020, lowering prices, and reducing oil production around the world. Along with petroleum, U.S. electricity demand is expected to decline mainly due to closed factories and commercial establishments resulting from the coronavirus state lockdowns. Because renewable energy has very low operating costs, it is dispatched before other types of generation, resulting in increased renewable generation in EIA’s generation forecast. Coal-fired generation is affected the most, losing generation share mainly to low-cost natural gas.