The driving season is upon us. With this, motorists of all political persuasions should be aware of proposals small and large to increase the federal gasoline tax. Whether it is several cents per gallon to fund infrastructure, or a nearly $0.50/gallon carbon tax under new legislation, drivers beware!

Background

Motor fuel is one of the most taxed goods in America. In addition to the federal levy of $0.184/gallon for regular gasoline ($0.244/gallon for diesel), the average state tax is approximately $0.23/gallon, for a total of $0.41/gallon.

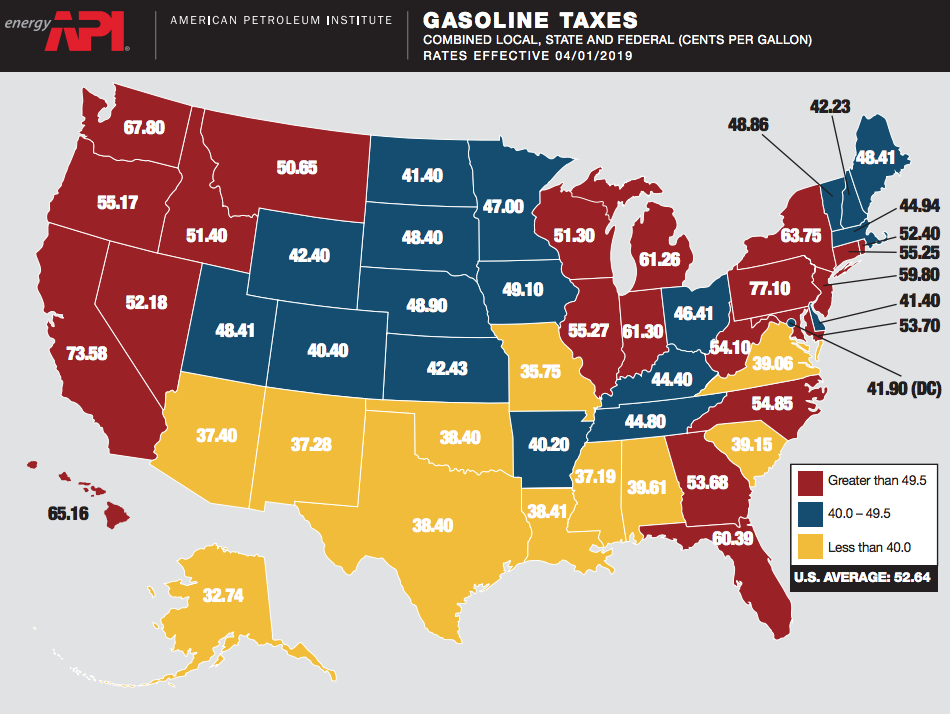

There is more. The American Petroleum Institute (API) computes another $0.11/gallon to account for local/county taxes, sales/gross receipts taxes, oil inspection fees, underground storage tank fees, and other miscellaneous environmental charges.

In all, the average gallon of regular gasoline in the US has approximately $0.52/gallon of tax (diesel: $0.60/gallon), about 18 percent of the current sales price.

Compared to the sales tax applied to general goods and services, motor-fuel levies exceed those states with the highest sales-tax rate (~10 percent).

State-by-State Breakdown

The map below from API shows the state-by-state breakdown for gasoline as of April 2019.

And for diesel as of April 2019:

Beware of California

California is an example of what not to do with motor-fuel policy. Versus the national average of $2.86/gallon, California motorists are currently paying $4.07 for regular gasoline, a 40 percent premium. While Los Angeles is near the state average, motorists in Mono Country (east central California) are paying $4.84 for regular, the highest in the state. Only Hawaii motorists pay more.

Why? It primarily has to do with the motor-fuel levies, amounting to $0.73/gallon for gasoline and $1.10/gallon for diesel in the Golden State. Massachusetts joins California with the highest levies in the nation with $0.77/gallon for gasoline and $0.99/gallon for diesel.

Texas, Oklahoma, and Louisiana, on the other hand, average less than $0.40/gallon and $0.45/gallon for gasoline and diesel, respectively.

Conclusion

“Increasing the [federal] gas tax is so politically fraught that it hasn’t been touched in 26 years,” a recent Bloomberg article reported. Fearing a “political backlash,” increasing the rate “didn’t even come up at a meeting at the White House [earlier this month] between President Donald Trump, House Speaker Nancy Pelosi, and Senate Minority Leader Chuck Schumer to discuss [a $2 trillion] infrastructure plan.”

So it should be. With state motor-fuel taxes higher than federal, usage payments from electronic metering becoming commonplace, and the risk that higher taxes are a de facto carbon tax, the federal levies should not be increased.

And that would be welcome by the 37 million Americans expected to take the road this Memorial Day weekend, a record according to the American Automobile Association.