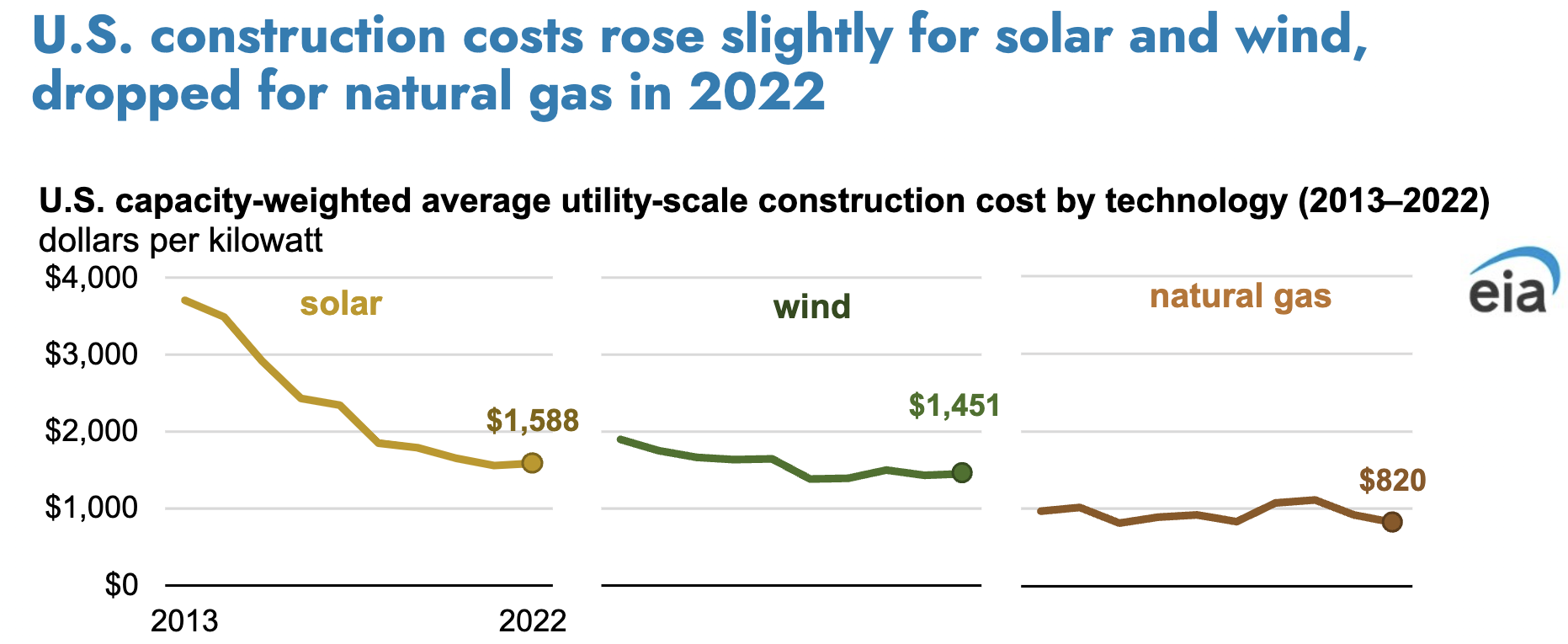

The Energy Information Administration (EIA) recently released power plant cost data and found a decrease in the cost of gas-fired electricity, while the price of wind and solar power rose after a long-term decline. The agency found that natural gas-fired utility construction costs were $820 per kilowatt in 2022, while solar power construction costs were $1,588 per kilowatt and wind power construction costs were $1,451 per kilowatt. As seen below, wind and solar construction costs have been much higher than gas-fired construction costs for the entire timeline shown: 2013 through 2022. The gas-fired power costs are a combination of combined cycle, internal combustion engine, and turbine technology. Breaking out those figures, combined cycle gas-fired construction costs at $722 per kilowatt in 2022 were less than half that of wind and solar construction costs. Gas combined cycle construction costs had declined by 42% from 2021 cost data. Electric utility companies would be building combined cycle gas-fired generators if it were not for massive wind and solar subsidies that the federal government provides, EPA’s pending power plant rule, and state mandates for wind and solar power—policies that distort the generating market and are driving electricity prices for consumers higher.

In 2022, solar, wind, and natural gas technologies accounted for 86% of the new capacity added to the electric grid. The EIA’s Short-term Energy Outlook (STEO) indicates that approximately 10 gigawatts of natural gas capacity were added that year, alongside nearly 9 gigawatts from wind and around 11 gigawatts from solar. Moving into 2023, solar installations surged to 19 gigawatts, while natural gas and wind contributed only 5 and 6 gigawatts, respectively. Looking ahead, EIA’s STEO forecasts minimal growth in natural gas capacity for 2024 and 2025, but anticipates solar will increase by 63 gigawatts and wind by 14 gigawatts over the same period. This boost in solar capacity will bring it within 10 gigawatts of the total coal-generating capacity in the U.S. by the end of 2025, especially as stringent Biden-Harris regulations lead to the early retirement of coal plants. However, it’s important to note that solar facilities typically generate less power and their intermittent nature means they provide only about half, or even less, of the output compared to equivalent coal plants with the same capacity.

Despite this, the EIA expects solar’s share of total U.S. electricity generation to rise from 4% in 2023 to 5% in 2024, reaching 7% by 2025. Increased solar generation is predicted to impact natural gas generation the most, which is expected to drop from 42% of U.S. electricity generation in 2024 to 39% in 2025. This decline in natural gas’s share is also attributed to rising prices and limited new gas capacity being introduced, as noted earlier. It’s worth mentioning that once solar and wind facilities are established, they are prioritized for dispatch over fossil fuel generators since they incur no resource costs.

Biden-Harris Onerous Rules for Fossil Fuel Power Plants

In April, the Biden-Harris Environmental Protection Agency (EPA) introduced a new power plant regulation aimed at closing coal-fired plants and restricting the development of new natural gas facilities unless they utilize costly and untested carbon capture and sequestration technology. Over two dozen states, including Indiana, Alabama, Alaska, and West Virginia, have contested this regulation, claiming that the federal government has not adequately demonstrated that the proposed emission control methods can achieve the targeted reduction of carbon dioxide emissions by 90%. Additionally, four Regional Transmission Organizations have submitted an amicus brief in support of the states’ lawsuit against the EPA, arguing that the enforcement of these rules could threaten the reliability of power supply, contradicting the administration’s assertions that these regulations would not compromise long-term energy stability. They have called on the Court to send the regulations back to the EPA for further consideration. Meanwhile, the Supreme Court has declined to block the rule pending decisions from lower courts. The Biden-Harris EPA is also expected to propose a rule by the end of the year aimed at reducing carbon dioxide emissions from existing natural gas plants, which account for 42% of the country’s electricity generation.

Other Biden-Harris Rules affecting fossil fuel power plants include:

- A rule strengthening and updating the Mercury and Air Toxics Standards (MATS) for coal-fired power plants, tightening the emissions standard for toxic metals by 67 percent, and finalizing a 70 percent reduction in the emissions standard for mercury from existing lignite-fired sources.

- A rule to reduce pollutants discharged through wastewater from coal-fired power plants by more than 660 million pounds per year.

- A rule requiring management of coal ash that is placed in areas that had been regulated at the state but not the federal level, including at previously used disposal areas that may leak and contaminate groundwater.

- The “good neighbor” provision of the Clean Air Act requires “upwind” states to reduce ozone emissions that affect the air quality in “downwind” states. The rule is currently with the courts.

Massive Tax Subsidies Promote Wind and Solar Power Deployment

The Democrat-passed Inflation Reduction Act (IRA), in which VP Kamala Harris played a key role in its passage by breaking a Senate tie, provides massive subsidies for “green technologies,” with effectively no cap on them. Despite more than four decades of subsidies for wind and solar technologies, the IRA continues to subsidize them as if they are still emerging. The Biden-Harris Administration promised that the tax provisions in the bill would cost $369 billion, but by expanding the law’s application, they are now estimated to exceed $1 trillion.

As the Biden administration continues to allocate taxpayer funds to support these technologies, their intermittent nature is contributing to instability in the electric grid, leading to the retirement of dependable coal, natural gas, and nuclear power plants, which can no longer cover their costs due to decreased generation time. Furthermore, the aggressive promotion of wind and solar energy is resulting in significant financial outflows to China, which controls the global market for solar panel exports and the essential minerals required for the production of wind and solar technologies, as well as the batteries needed for backup power.

Conclusion

According to the Energy Information Administration, construction costs for natural gas generators remain much lower than those for wind and solar technologies. Despite the lower costs for gas technologies, massive federal subsidies for wind and solar power and state mandates for their deployment result in large increases in wind and solar capacity additions. Further, Biden-Harris regulations are forcing the closure of coal plants prematurely and holding back future construction of natural gas plants. Despite challenges from states and transmission organizations tasked with supplying reliable power, the Biden-Harris EPA plans to issue a rule by the end of the year for reducing carbon dioxide emissions from existing gas plants. Due to the intermittency of wind and solar plants, much more capacity is required to supply the same generation levels as fossil fuel and nuclear plants.