China’s auto sales rose 16.9 percent year-on-year in September, resulting in sales for the first 9 months of 2010 almost totaling sales for the entire 2009 year. This high growth is partly attributed to a government subsidy for fuel efficient cars, but there is also underlying strength in consumer demand.

Fast, steady growth is predicted for future auto sales, according to the State Economic Information Center, a think tank of the Chinese government. To fuel this growth, China needs access to crude oil supplies since it has only 1.5 percent of the world’s reserves.[i] Knowing that crude oil is essential to its economic growth, China is investing in oil reserves throughout the world.

The future of petroleum is now in the world’s most populous country. China ranks second to the United States in petroleum demand.

China’s Vehicle Sales Statistics

According to the China Association of Automobile Manufacturers (CAAM), 1.56 million light duty vehicles were sold in September, 20 percent higher than in August.[ii] Beginning in July, the government issued a new subsidy for small, fuel efficient vehicles with engines no larger than 1.6 liters that meet government emissions standards. The credit of 3,000 yuan, or $440, spurred sales of 18 percent year-on-year in August for the 60 models that qualify.[iii]

Sixty eligible models are manufactured by 22 different auto companies, including Chinese automakers. The auto manufacturers selling in China consist of international companies such as Toyota, General Motors, Ford, and Volkswagen; state-owned companies; and private Chinese automakers. The rise in private auto companies has been phenomenal considering they first appeared in the late 1990’s. In 2003, for instance, BYD Company built its first vehicles, and six years later, it sold more passenger vehicles than any other Chinese automaker. Another example is Great Wall Motor Company, who in 2002 built its first vehicle and seven years later, entered the European market with a fleet inventory of two sedans, an SUV and a pickup.[iv]

The government also provided a subsidy to buyers in rural areas to encourage mobility and promote wealth outside of the large cities[v], and constructed more than 30,000 miles of expressways in the past decade.[vi] Owning a car in China does not only improve mobility, but it also is a status symbol particularly among the younger generation, who cannot afford to buy a house but can afford to buy a car because of the government-sponsored incentive programs.[vii] Passenger vehicle sales rose 19.3 percent year-on-year in September to 1.21 million vehicles.[viii]

In 2009, China’s auto sales totaled 13.6 million[ix], outselling the U.S. market for the first time. China’s auto sales were 3.3 million vehicles or over 30 percent greater than U.S. sales of 10.3 million vehicles.[x] For the first nine months of 2010, China’s auto sales reached 13.1 million vehicles, 36 percent higher than the previous year.[xi] According to CAAM, car sales in China will increase to 25 million by 2015.[xii] That estimate is verified by the State Economic Information Center, who agrees that auto sales will grow by 13 to 15 percent annually between 2010 and 2015.

The Ministry of Information and Technology predicts that there will be more than 200 million vehicles on the road by 2020.[xiii] But CAAM expects even higher growth with annual vehicle sales reaching 46 to 71 million vehicles in 2020, and totaling 300 to 400 million vehicles on the road.[xiv]

By the end of this year, there will be 25 vehicles for every 1,000 inhabitants in China. Generally, the rate of growth in vehicles remains high until 100 vehicles per 1,000 inhabitants is reached, which is predicted to take China 15 years without subsidies; less with subsidies.[xv]

China’s Oil Resources, Production, and Demand

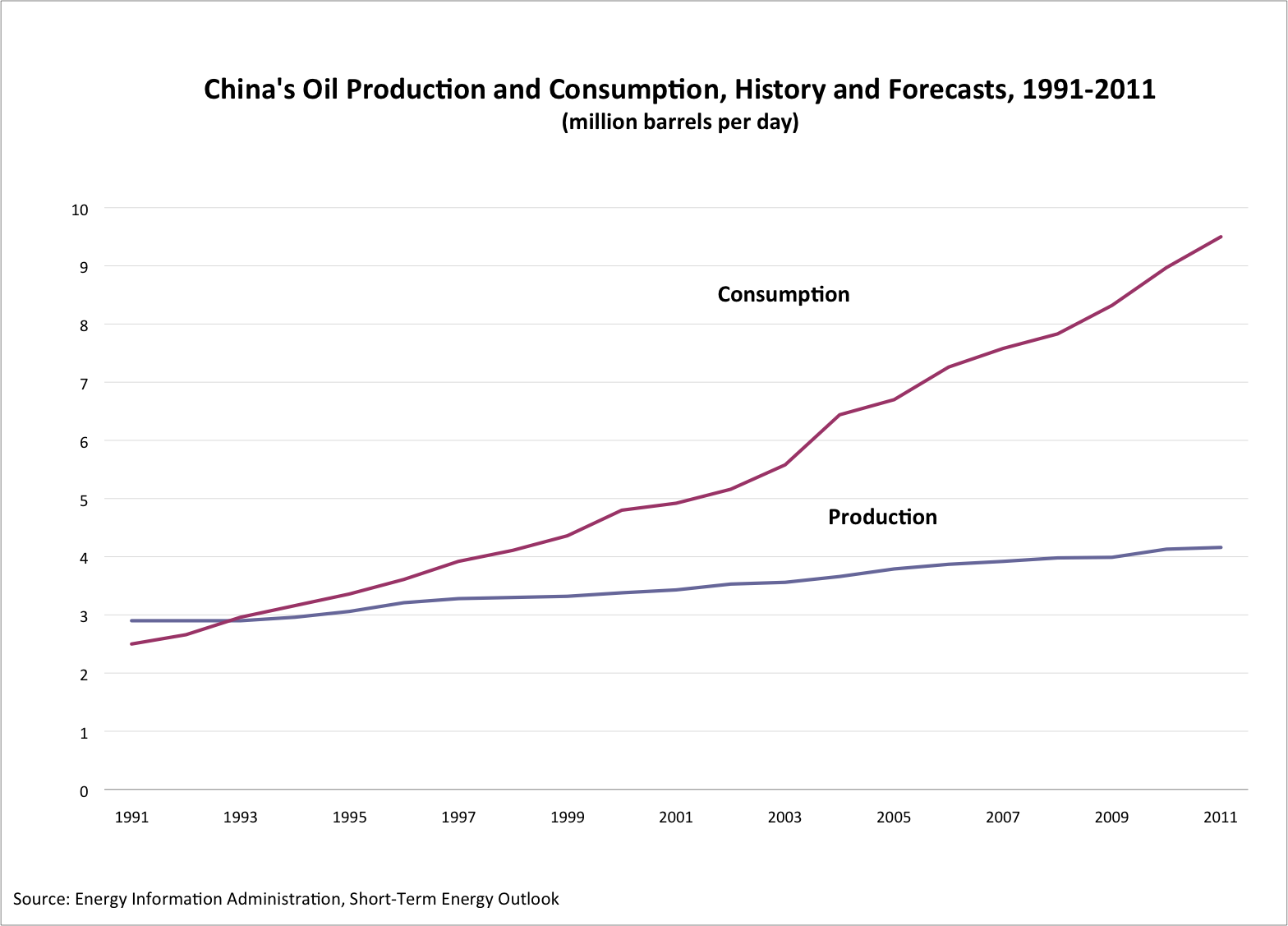

In 2008, China consumed 7.8 million barrels of oil per day, ranking second in the world in oil consumption to the United States. Like the U.S., it must import oil since its production of about 4.0 million barrels per day meets only about half of its needs. In 2008, China imported 3.7 million barrels of oil per day, ranking third to the United States and Japan.[xvi]

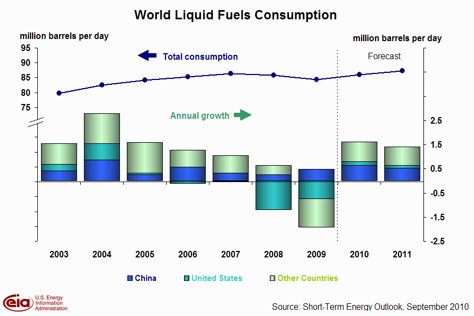

The Energy Information Administration (EIA) forecasts that China’s oil consumption will continue to grow during 2010 and 2011, with oil demand reaching 9.0 million barrels per day in 2010 and 9.5 million barrels per day in 2011.[xvii] Over the two-year period between 2008 and 2010, China is expected to increase its oil consumption by over 1.1 million barrels per day, while the United States is expected to reduce its oil consumption by a net of 0.57 million barrels per day.

In contrast, China’s oil production is forecast to remain relatively flat, increasing by just 0.15 million barrels per day, while the United States is expected to increase its domestic supply by 0.9 million barrels per day. Of course, that latter forecast assumes that the Department of Interior will lift its moratorium on offshore drilling and resume permitting for both onshore and offshore leases at a more normal pace.

Roughly 85 percent of Chinese oil production capacity is located onshore in eastern China, but most of these oil fields are mature. China’s national oil companies are using natural gas for reinjection purposes to increase the oil recovery rates of its mature fields. The remaining 15 percent of Chinese oil production is offshore, where most of China’s oil production growth is expected. According to the International Energy Agency, current offshore oil production is 680,000 barrels per day, rising to an expected 980,000 barrels per day by 2014, which will offset some of the declines from the more mature onshore fields.

Onshore oil is mostly produced by China’s two major upstream national oil companies, China National Petroleum Corporation and China National Offshore Oil Corporation. Because of the technical expertise of foreign oil companies with offshore drilling, international oil companies have been given access to offshore oil fields through production sharing contracts with the national oil companies of China.[xviii] For instance, without regard to BP’s oil spill in the Gulf of Mexico, the Chinese government is allowing Chevron and BP access to drill in deep waters in the South China Sea, after attempts decades ago to drill in its shallow waters turned up dry wells.[xix]

China’s Foreign Oil Investments

Because of China’s growing future oil demand and its growing reliance on oil imports, its national oil companies are investing in overseas projects. China is taking advantage of the economic downturn and lower asset values overseas to increase its global acquisitions and financing of projects whether for direct investment in energy resources or in loan-for-oil deals where China provides loans for infrastructure development in oil-rich countries in return for future supplies of oil. While several oil-rich countries have been strapped for cash during the credit crunch of 2008 and 2009, China has foreign exchange reserves that it can use to leverage such investments. China has loan-for-oil deals with Russia, Brazil, Venezuela, Kazakhstan, Ecuador and Turkmenistan, among others.[xx]

China agreed to loan companies in Russia and Turkmenistan to construct oil and gas pipelines in exchange for future energy shipments. The loan to Russia is for $25 billion to finance the East Siberia Pacific Ocean oil pipeline in exchange for 300,000 barrels of oil per day. The loan to Turkmenistan is for $3 billion for a natural gas project to feed the Central Asia Gas pipeline. Brazil’s oil company, Petrobas, is receiving $10 billion for oil development in return for 200,000 barrels of oil per day. Venezuela’s loan of $4 billion is to finance infrastructure projects in exchange for its exports to China to increase to one million barrels per day, an almost three-fold increase.[xxi]

More recently, state-owned Sinopec (China Petroleum & Chemical Corporation) invested $7.1 billion in Brazil’s Repsol stock offerings, giving China a 40 percent stake in that business and access to Brazilian offshore sub-salt oil fields.[xxii] China’s national oil companies are also negotiating exploration rights off the coast of Cuba, 40 miles off the coast of Florida, where Cubapetroeo, Cuba’s oil company, estimates that Cuba has up to 20 billion barrels of oil in its offshore areas, although other estimates are less.[xxiii]

When China expands its refinery capacity to include sour and high-sulfur crude types, which it plans on doing, that investment will pave the way for similar deals in other regions of the world with less favorable crude types. This year, China’s Sinopec International Petroleum Exploration and Production Company agreed to buy, for $4.65 billion, the 9 percent interest that ConocoPhillips holds in Syncrude,[xxiv] a Canadian business involved in the production of oil sands (an asphalt-like heavy oil).[xxv]

One of China’s strategic objectives is to offset its growing import dependence with production in oil-rich countries by acquiring access to enough of their oil reserves overseas. According to Michael Wang of IHS Herold, China consumed nearly 9 million barrels of oil per day in 2009[xxvi], with less than 4 million barrels per day of domestic production, creating a gap of nearly 5 million barrels per day. And while China has assets of 1.2 million barrels per day in international oil production, according to Wang, another 3.8 million barrels per day is needed to bridge the gap, without even considering future demand increases. According to Wang, that will require another 12 billion to 20 billion barrels of oil equivalent resources, and at a going rate of $25 per barrel for proved oil reserves, it will cost the Chinese national oil companies an additional $300 to $500 billion.[xxvii]

Most recently, China’s CNOOC is trying to invest in an oil field in southern Texas, paying up to $2.2 billion for a one-third stake in Chesapeake’s Energy’s assets that could result in up to half a million barrels a day of oil equivalent. This is China’s second try at investing in a U.S. oil field, having failed 5 years ago to buy California-based Unocal Corporation. In this current deal, if it proves successful, China will also be gaining technical expertise in drilling in hard-to-get deposits in shale rock.[xxviii]

Conclusion

China’s oil consumption will grow to keep its escalating auto market in fuel and to construct the highways to carry the vehicles. If EIA’s forecast for China’s oil growth of more than one million barrels per day every two years continues, China’s need for oil imports will accelerate due to its low level of oil reserves and fairly constant domestic production of around 4 million barrels per day. Recognizing this, China’s national oil companies and government banks are making deals in oil-rich countries providing infrastructure loans or purchasing shares in those countries’ resources in exchange for future oil supplies.

The Chinese have learned that affordable, accessible energy is needed to keep its economy booming and are planning accordingly. Not unlike elsewhere in the world, oil remains king of the transportation market.

[i] Energy Information Administration, International Energy Outlook 2010, http://www.eia.doe.gov/oiaf/ieo/index.html

[ii] China Daily, September vehicle sales jump, October 13, 2010, http://www.chinadaily.com.cn/business/2010-10/13/content_11403898.htm

[iii] China Automotive News, China sales rise 16% in August, aided by subsidy, September 14, 2010, http://www.autonewschina.com/en/article.asp?id=5808

[iv] China Automotive News, Private automakers are rising fast in China, September 17, 2010, http://www.autonewschina.com/en/article.asp?id=5824

[v]Energy Information Administration, International Energy Outlook 2010, http://www.eia.doe.gov/oiaf/ieo/index.html

[vi] The Wall Street journal, China’s Car Economy Revs Up, October 6, 2010, http://online.wsj.com/article/SB10001424052748703399404575505851977324226.html?KEYWORDS=Mcdonalds

[vii] Energy Information Administration, International Energy Outlook 2010, http://www.eia.doe.gov/oiaf/ieo/index.html

[viii] China Daily, September vehicle sales jump, October 13, 2010, http://www.chinadaily.com.cn/business/2010-10/13/content_11403898.htm

[ix] China Daily, CAAM says auto sales up to 25m by 2015, September 8, 2010, http://www.chinadaily.com.cn/business/2010-09/08/content_11275762.htm

[x] Energy Information Administration, International Energy Outlook 2010, http://www.eia.doe.gov/oiaf/ieo/index.html

[xi] China Daily, September vehicle sales jump, October 13, 2010, http://www.chinadaily.com.cn/business/2010-10/13/content_11403898.htm

[xii] China Daily, CAAM says auto sales up to 25m by 2015, September 8, 2010, http://www.chinadaily.com.cn/business/2010-09/08/content_11275762.htm

[xiii] The Wall Street journal, China’s Car Economy Revs Up, October 6, 2010, http://online.wsj.com/article/SB10001424052748703399404575505851977324226.html?KEYWORDS=Mcdonalds

[xiv] China Daily, September vehicle sales jump, October 13, 2010, http://www.chinadaily.com.cn/business/2010-10/13/content_11403898.htm

[xv] Automotive News China, Forecast: Chinese auto sales to grow 13 percent annually for 15 years, September 5, 2010, http://www.autonewschina.com/en/article.asp?id=5750

[xvi] Energy Information Administration, http://tonto.eia.doe.gov/country/index.cfm

[xvii] Energy Information Administration, Short-Term Energy Outlook, September 2010, http://www.eia.doe.gov/emeu/steo/pub/contents.html

[xviii] Energy Information Administration, Country Analysis Briefs, http://www.eia.doe.gov/emeu/cabs/China/Oil.html

[xix] The Wall Street Journal, Chevron, Devon in Deal, September 8, 2010, http://online.wsj.com/article/SB10001424052748704358904575477250932405706.html?mod=googlenews_wsj

[xx] Energy Information Administration, Country Analysis Briefs, http://www.eia.doe.gov/emeu/cabs/China/Oil.html

[xxi] Ibid.

[xxii] Money Morning, China Continues Game-Changing Energy Moves with Sinopec’s $7 Billion Brazil Buy, October 4, 2010, http://moneymorning.com/2010/10/04/sinopec/

[xxiii] Upstreamonline.com, Cuba looks to cooperate on offshore safety, August 25, 2010, http://www.upstreamonline.com/live/article227380.ece

[xxiv] Reuters, China bags oil sands stake, not finished yet, April 13, 2010, http://www.reuters.com/article/idUSTRE63C17X20100413 and www.conocophillips.com

[xxv] Syncrude, http://www.syncrude.ca/users/folder.asp?FolderID=5753

[xxvi] This level of oil consumption for China in 2009 is higher than the EIA estimates graphed earlier in this article.

[xxvii] The Oil Daily, China’s NOCs (National Oil Companies) Seen Maintaining Rapid Pace of Asset Purchases, September 24, 2010.

[xxviii] Houston Chronicle, Chinese oil giant takes big step into Texas shale, October 12, 2010, http://www.chron.com/disp/story.mpl/business/energy/7242533.html