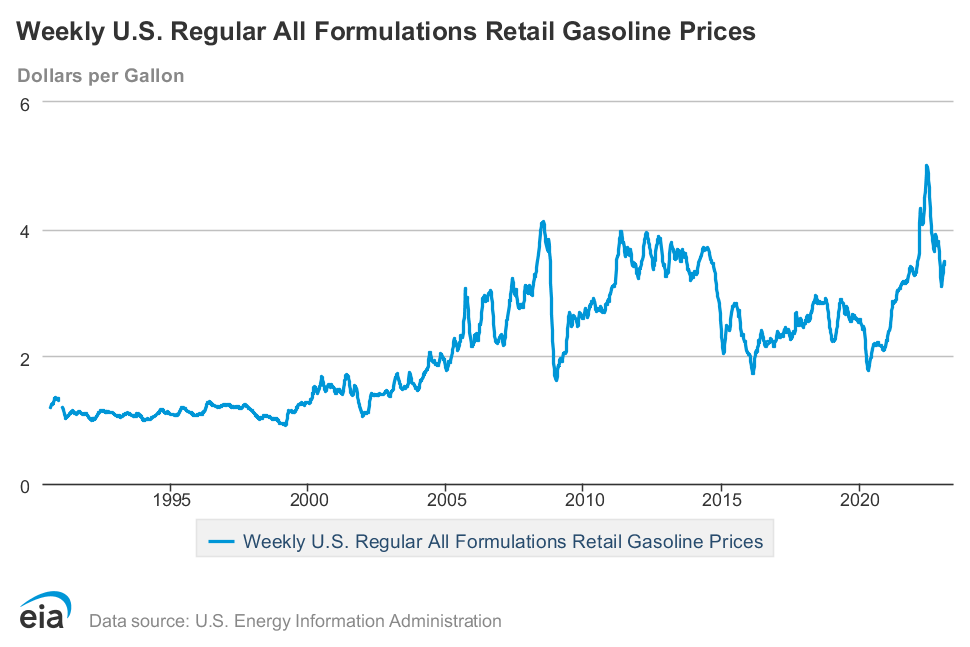

On February 7, 2023, in his state of the union address, President Joe Biden stated, “Here at home, gas prices are down $1.50 a gallon since their peak.” While the statement is true, he fails to indicate that they are still almost a dollar higher than when he took office on January 20, 2021. And according to Gas Buddy, which provides real-time prices and projections, gas at the pump is expected to rise back to $4 a gallon this year. Gasoline prices peaked in June of 2022 at over $5 a gallon due mainly to Biden’s anti-oil and gas policies and Russia’s invasion of Ukraine. Gas prices fell since then due mainly to Biden’s use of the Strategic Petroleum Reserve—our national emergency oil reserve–to lower gas prices before the mid-term election on November 8. He depleted the reserve by 260 million barrels, reducing it to a 40 year low, and promised to refill it this year. But, when the first bids came in, his administration rejected them supposedly because of price and quality concerns. Biden’s depletion of the reserve is putting U.S. energy security at risk.

Biden’s extreme anti-fossil fuel policy of blocking permits, canceling the Keystone XL pipeline, suspending leases in ANWR, restricting oil and gas leasing to the lowest level since WWII and generally waging war on our traditional energy resources is why America has gone from being energy independent to facing an energy crisis in just two short years.

However, in recognition of the true situation, President Biden went off-script during his state of the union address stating, “We’re still going to need oil and gas for a while.” This assessment from the president, not included in his prepared remarks, points out the conflict between his administration’s climate and economic goals. Biden has repeatedly pushed oil companies to invest in pumping more oil even as he and his administration openly advocate to end its use. Biden continues to blast oil companies for using record profits to buy back stock and reward their shareholders, instead of putting that money into more drilling to increase production and “keep gas prices down.” But, as oil executives told him: “We’re afraid you’re going to shut down all of the oil wells and all the oil refineries anyway so why should we invest in them?”

So, Tuesday night, Biden told them, “We’re going to need oil for at least another decade,” quickly adding, “and beyond that.” Biden, however, will need to walk the talk if he expects oil companies to spend more capital on investments that take decades to pay off. The oil industry needs more encouraging signals from Washington that they are not getting. Instead, Biden called on Congress to quadruple a new tax on corporate stock buybacks, saying that would encourage more long-term investments. The push dovetails with California Governor Gavin Newsom’s proposal to add a windfall-profits tax on refineries. By continuing to politicize market fundamentals and single out stock buyback programs, the president is ignoring how his own policies discourage the reinvestment of earnings back into the U.S. liquid fuel supply chain. It is counterproductive to explore new taxes at a time when more supply is needed.

Recently, Biden raged against U.S. oil company profits, even though it is Biden’s own policies that have helped cause oil prices to rise, creating large profits for oil companies. Major oil companies released their 2022 earnings, with Exxon and Chevron making $55.7 and $35.5 billion, respectively. Biden’s efforts to curb the use of fossil fuels and reduce emissions in pursuit of his climate pledges to the U.N. have led to higher fuel prices that have led to large oil company profits. But, Biden’s SPR policy distorted those markets in order to lower oil and gasoline prices for short term political gain. Biden apparently does not want to accept that lowering emissions requires higher prices and the political and economic consequences that result from them.

Oil and gasoline prices are expected to rise this year as Gas Buddy indicates. The Biden administration’s Inflation Reduction Act raises royalty rates and imposes more regulations and various fees on fossil fuels that will continue to raise prices. And, it is likely that his administration will continue with onerous regulation on the industry. Further, Biden’s regulation-heavy policies discouraged investors from supporting U.S. oil companies. With no reversals of his anti-oil and gas policies to match his rhetoric that he would like prices to go down for consumers, energy prices are likely to remain high and continue to rise.

Conclusion

President Biden wants his cake and wants to it eat too. He campaigned on killing the oil and gas industry and is instituting onerous policies to do so, which raises prices for American consumers and increases inflation. But, he does not want to accept the political fallout from those policies. Americans have indicated that they do not want to pay much to reduce greenhouse gas emissions and that they see that goal as a low priority, while Biden continues with policies that make it his highest priority, hoping that Americans do not recognize that his policies are causing higher prices and inflation by hiding behind the Ukraine war and profits for oil companies, among other things. Hopefully, sometime soon, the American public will be able to see through his shenanigans and lies to protect themselves.