A rise in European wholesale natural gas prices over the past several months is expected to encourage more utilities to switch to coal for electricity generation this coming winter. While many European countries, such as France, Britain and Italy, have either phased out coal completely or have limited ability for large-scale gas-to-coal switching, coal is a key part of the power mix in Germany, Europe’s number one energy consumer, and much of eastern Europe. In February, European natural gas prices fell to near a three-year low, incentivizing a switch in other direction. Gas prices, however, have risen nearly 40 percent since their February 23 low that arose from a mild winter and an abundant supply.

Both coal and natural gas plants must consider the cost of EU carbon permits to offset their emissions–a cost that is higher for coal plants as they release more carbon dioxide emissions than gas plants. The price of those permits, however, is currently about 32 percent below last year’s record high of more than 100 euros ($108), and are currently at around 68 euros per metric ton, as energy-related deindustrialization has closed industries across Europe. When the carbon price is below 80 euros per metric ton, high efficiency coal plants may replace gas plants with 50 percent efficiency.

Coal and carbon prices have experienced relatively strong losses this year due to weak Asian demand, a cautious market and high stockpiles. In contrast, gas markets experienced an upward trend due to tight LNG supply and maintenance in Norway and the UK. Tight global LNG supply and multiple offline facilities in the United States have contributed to the increase in European gas prices recently, which has been exasperated by Biden’s LNG “pause.” There also could be some volatility caused by the potential for an early Russian pipeline cut and ongoing Norwegian gas maintenance outages during the summer along with a continued tight LNG market.

EU gas storage sites are now about 80 percent full and could be on track to reach full capacity before the end of October. As of July 15, LNG imports into Europe this year totaled 79.66 billion cubic meters, which compares with 99.98 billion cubic meters and 94.13 billion cubic meters in the same periods of 2023 and in 2022, respectively. The lower imports this year have come at a time where pipeline volumes have remained relatively cheap versus their liquefied counterparts.

Germany’s electricity industry is still very dependent on coal imports, with annual imports expected at 33 million metric tons, of which over half (18 million metric tons) are for power generation. Import levels are down about 26 percent from 2022 when gas supplies were cut from Russia following the invasion of Ukraine, while coal for power is down near 40 percent.

Biden’s LNG Pause Will Hurt U.S. Allies

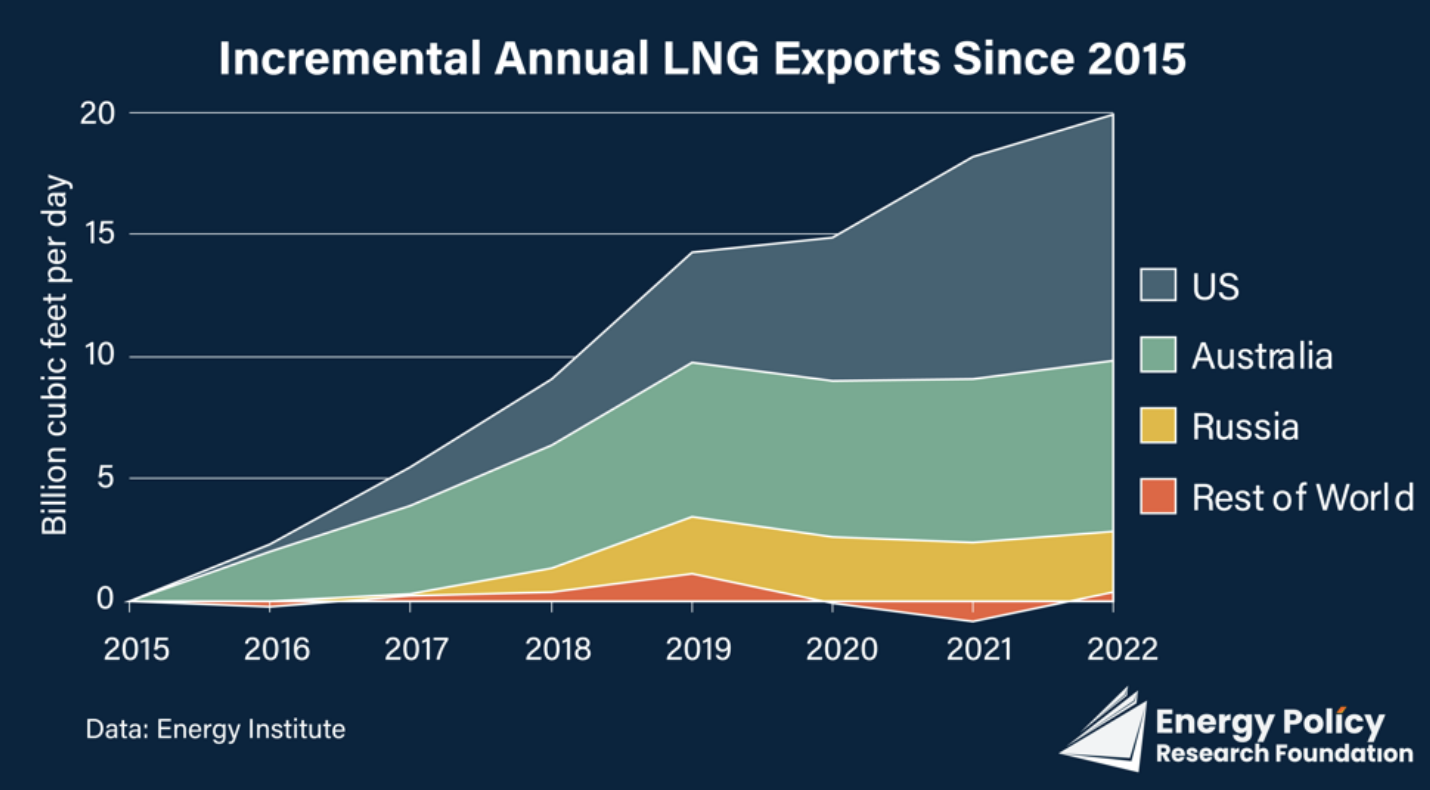

Biden’s LNG pause will hurt long-term US national and economic interests and hinder US allies’ ability to access energy affordably and reliably. Despite Secretary Granholm’s assertion that the pause would not impact any relationship that the United States has with allies or their ability to access energy, the pause may damage the foundations of the energy security cooperation the United States has built with allies over the past decade. Since 2015, the United States, along with Australia, has been a key contributor of incremental LNG exports to global markets, ensuring a more stable natural gas price environment, which has supported a transition from coal to lower-carbon fuels. After the Russian invasion of Ukraine, the United States offered a way out of Russian pipeline gas by offering greater volumes of LNG, using flexible, destination-free contracts. In such markets, a nation’s reliability as a supplier is critical, and that has been undermined by Biden’s pause.

But without more project approvals, there will be a shortage of LNG in the future that U.S. allies are depending on. The Energy Policy Research Foundation projects that the world LNG supply capacity will be around 61 billion cubic feet per day in 2040 considering both existing and proposed projects, which will fall short of the demand scenarios in the Institute for Energy Economics, Japan’s latest Energy Outlook. In the reference case, global LNG demand could reach 79 billion cubic feet per day in 2040. With massive deployment of non-carbon technologies, the demand estimate is around 66 billion cubic feet per day. In other words, making the annual supply shortage between 5 and 18 billion cubic feet per day by 2040. This shortage is certain to drive prices higher, as energy-hungry nations bid for supply.

Biden’s pause creates uncertainties that affect both the daily operations of U.S. companies as well as the image of the United States as a reliable supplier as there is a real risk of proposed projects never getting approved or reaching a final investment decision (FID), which pressures companies to consider relocating to other regions as part of their contingency plans. This can be very costly. The uncertainty erodes the trust the market players have placed in the United States as a reliable source of LNG supply and a stable destination for investment. Qatar, for example, has taken this opportunity created by the Biden administration’s LNG pause to ramp up its LNG exporting infrastructure, hoping to attract more buyers and investors. Qatar has decided to “make hay while the sun shines,” as competitors in the United States are frozen during the Biden pause.

Conclusion

Some European countries that are able to generate electricity from coal may be turning to their coal-fired units for power this winter, in lieu of natural gas, whose prices have increased since the low reached in February. European gas prices have increased due to a tight LNG supply market, and maintenance activities in Norway and the UK. Exasperating the problem is Biden’s LNG pause in permit approvals for new U.S. facilities that is creating an image of the United States as an unreliable supplier. The pause could result in proposed new facilities losing their investors, moving offshore and/or creating a shortage in future LNG supplies to U.S. allies.