In its Annual Energy Outlook 2021, the Energy Information Administration (EIA) assumes that current laws and regulations in effect as of September 2020 will remain through 2050. It expects the U.S. gross domestic product (GDP) to increase annually at a rate of 2.1 percent and that the Brent crude oil price will reach $95 a barrel in 2050 (in constant 2020 dollars). The report’s highlights include:

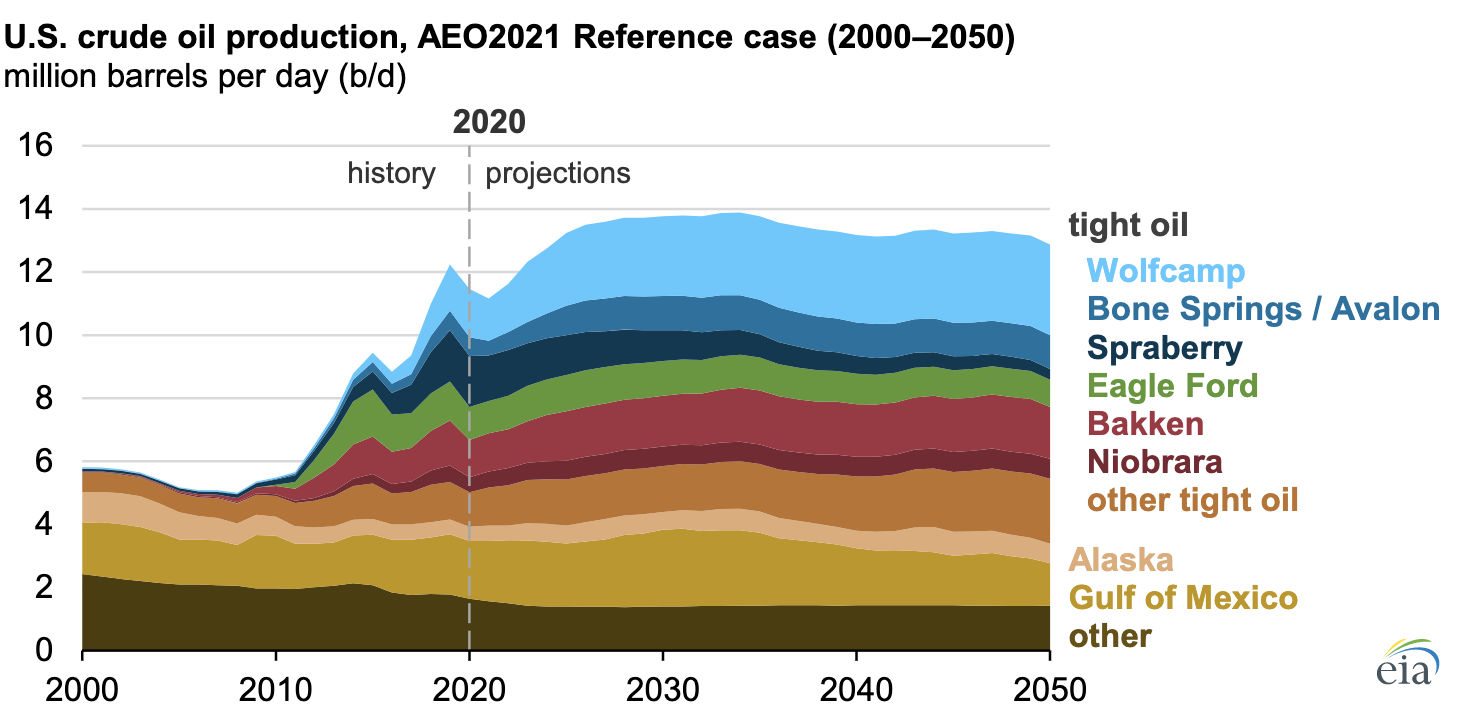

- Domestic crude oil production is expected to return to 2019 levels by 2023 and then remain near 13 million to 14 million barrels per day through 2050. The United States continues to be an integral part of global oil markets and a significant source of supply, despite uncertainty surrounding post-pandemic expectations for oil and natural gas demand.

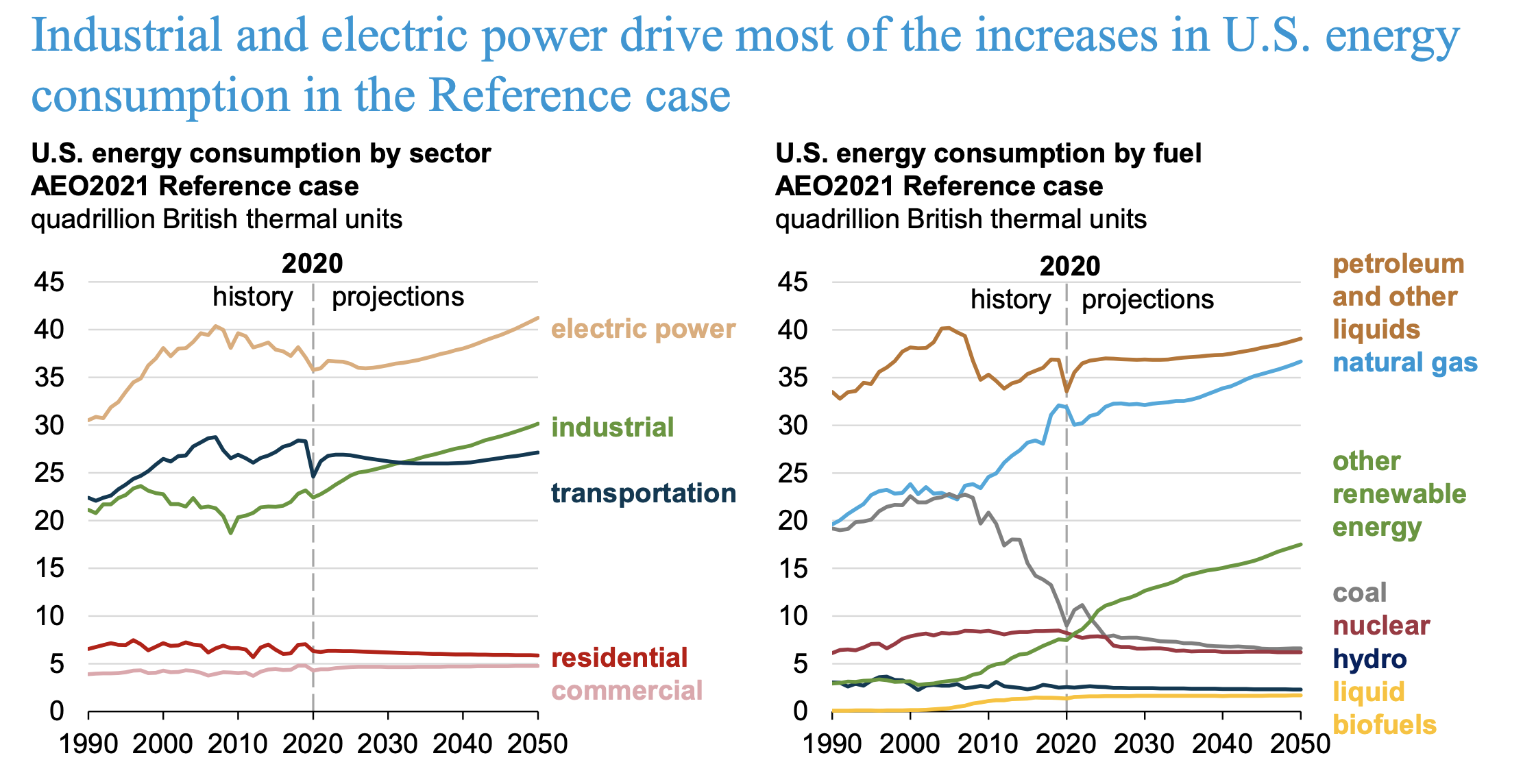

- The United States is not expected to return to 2019 levels of U.S. energy consumption until 2029 but this is highly dependent on the pace of U.S. economic recovery.

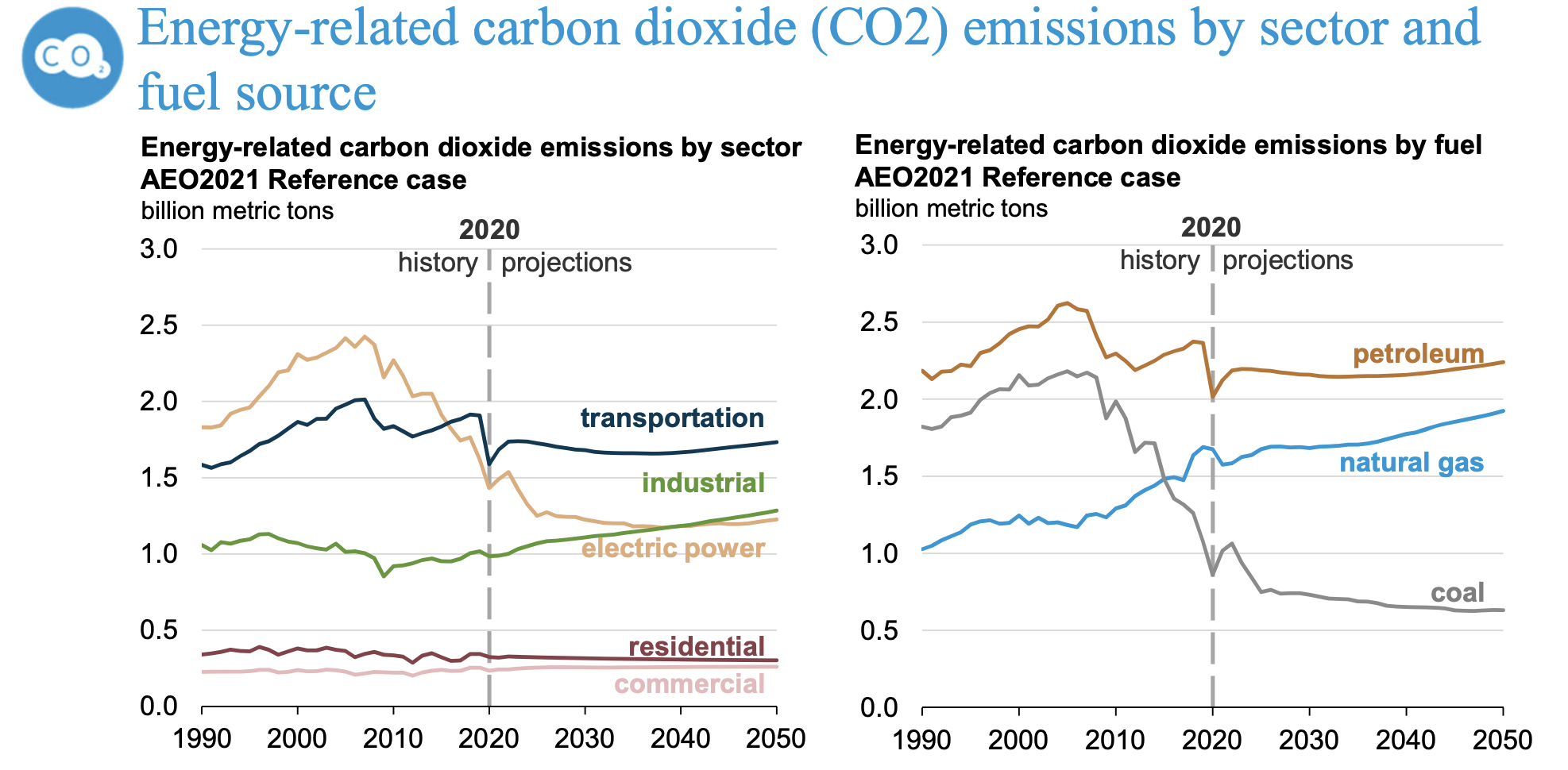

- Energy-related carbon dioxide emissions, which have been declining, are expected to fall further in 2035, before increasing to 2050. They remain substantially below the 2005 level through the forecast.

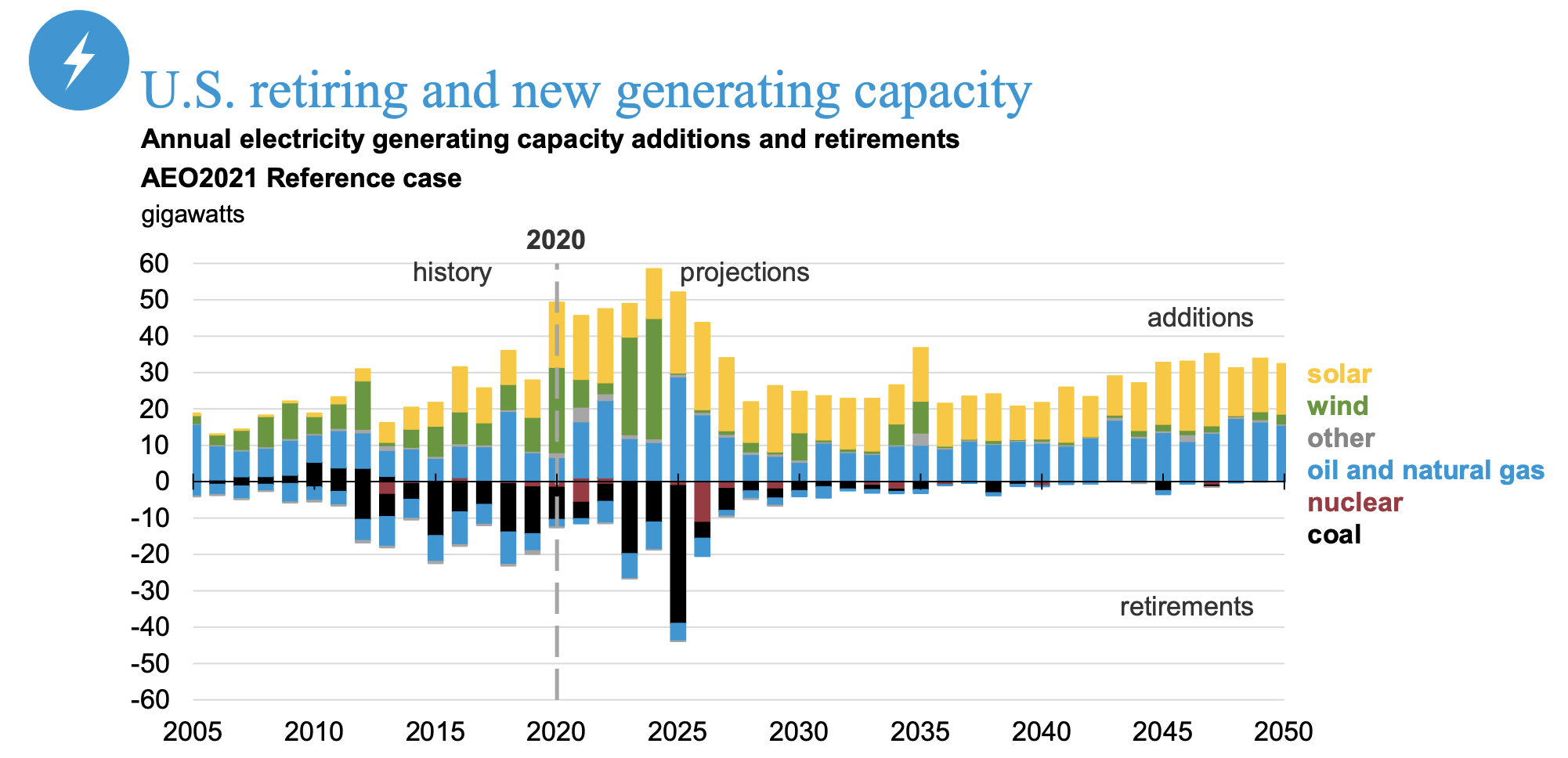

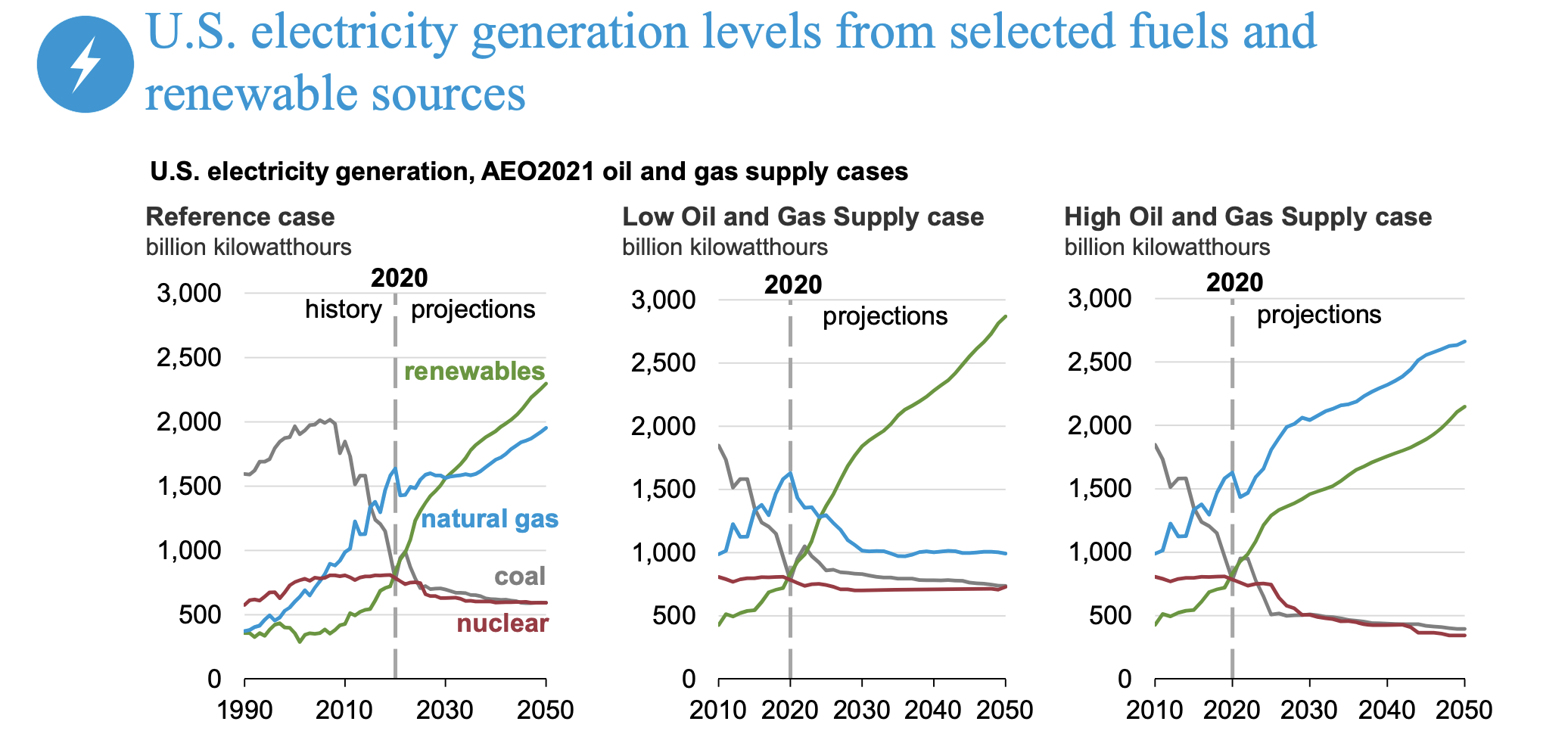

- Renewable energy incentives and falling technology costs support robust competition with natural gas, as coal and nuclear power generation decrease in the electricity mix with further capacity retirements.

Oil Production

EIA projects U.S. crude output to top the 2019 record of 12.25 million barrels per day in 2023, after oil production in 2020 fell 6.4 percent to 11.47 million barrels per day. Oil production is forecast to peak at 13.88 million barrels per day in 2034 before it starts to decline, but remain above 13 million barrels per day through 2050. EIA projects that the United States will continue to export more petroleum and other liquids than it imports, but the balance of imports to exports will be highly sensitive to supply, demand, and price factors. The impact of President Biden’s announcement to suspend leasing on federal lands and waters is not included in these projections.

Oil production from tight oil formations is primarily driving EIA’s projection for growth in U.S. crude oil production. Most of this tight oil production comes from the Wolfcamp play in the Permian Basin, which spans parts of western Texas and eastern New Mexico, along with the Bakken play in the Williston Basin in Montana, North Dakota, and South Dakota. President Biden’s ban on new drilling leases on federal lands could hurt EIA’s oil supply projection if his executive order results in a permanent ban or if it is in effect for a long time as his Interior Department studies the issue.

Further, the Biden administration is revoking dozens of drilling permits issued by agency professionals without the approval of political appointees—another Biden Executive order. About 70 permits governing onshore wells were supposedly improperly issued without political appointee approval, meaning the companies will have to seek new approvals. While the companies are told that they do not face penalties for any drilling or other activities they started under the invalidated permits, they are being ordered to cease those operations while seeking new approvals.

Transportation

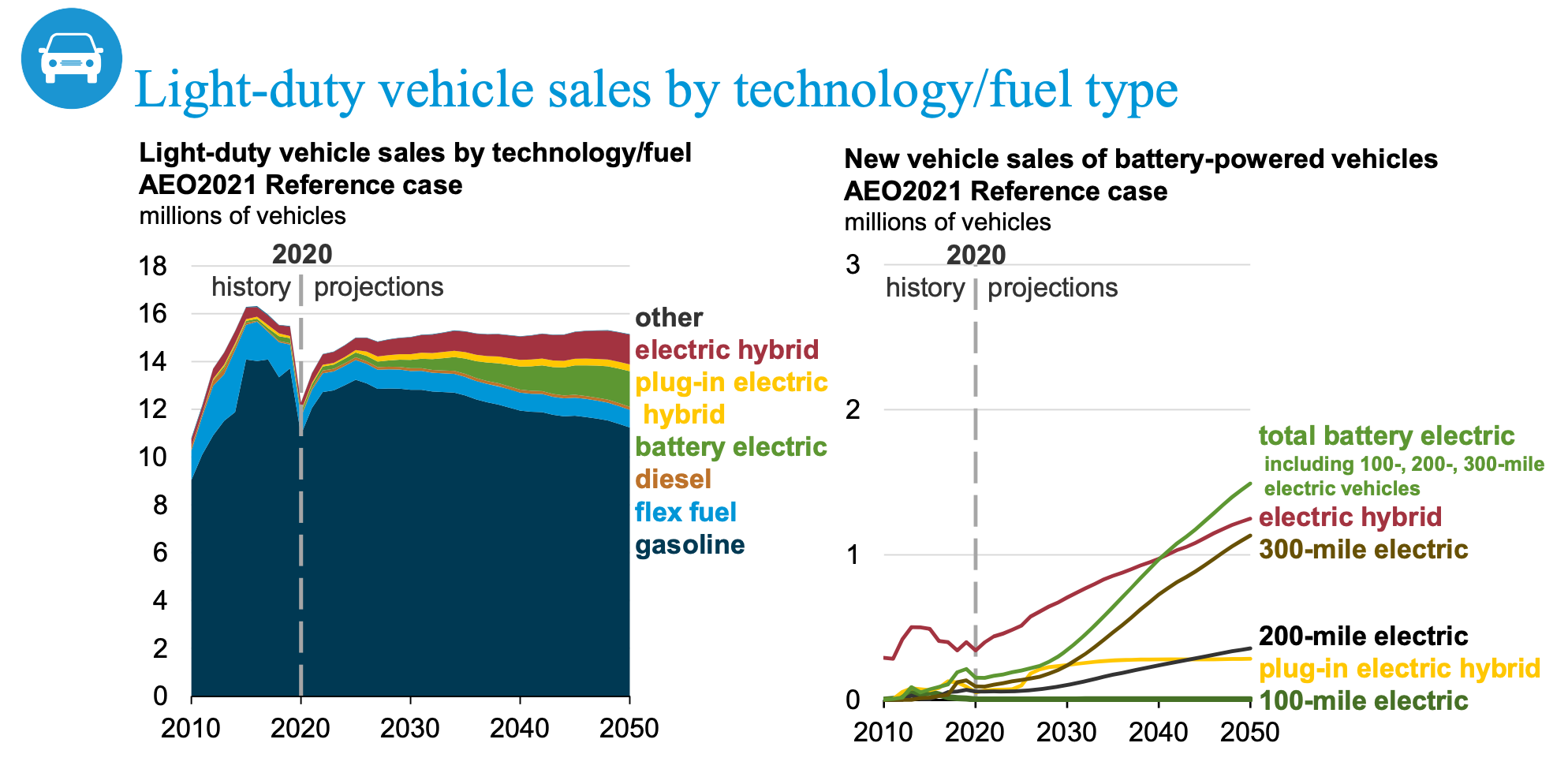

Energy consumption in the transportation sector remains lower than its 2019 level for the entire projection period because travel greatly decreased in 2020 as a result of lockdowns caused by the coronavirus pandemic, and assumed improvements in fuel economy offset projected resumed travel growth. U.S. passenger air travel demand decreased by nearly two-thirds in 2020 and is expected to return to 2019 levels in 2025; bus passenger travel demand decreased by nearly half in 2020 and is expected to return to 2019 levels in 2031; and light-duty vehicle (LDV) travel is expected to return to 2019 levels by 2024. Americans are projected to be travelling much less.

Projected energy consumption in the transportation sector is expected to decrease because of the market-based adoption of energy efficiency technologies in new vehicles and the increasingly stringent federal fuel economy standards for new light-duty vehicles (through 2026) and heavy-duty vehicles (through 2027). Efficiency improvements fully offset the consumption growth from light duty vehicle travel growth through 2043 and partially offset the consumption growth from heavy-duty vehicle travel growth through 2036.

Motor gasoline remains the predominant transportation fuel despite a growing mix of technologies in passenger vehicles. Gasoline demand is expected to increase 9.1 percent to 8.97 million barrels per day in 2021 before it declines through 2050. According to EIA, it reached a peak of 9.33 million barrels per day in 2018. The amount of crude oil processed at U.S. refineries decreased in 2020 because of lower demand for transportation fuels, but it returns to 2019 levels by 2025.

Although the greatest potential for increased electricity demand is within the transportation sector, electricity demand from this sector remains less than 3 percent of economy-wide electricity demand throughout the projection period. Current laws and regulations are not projected to induce much market growth, despite continuing improvements in electric vehicles through evolutionary market developments. Both vehicle sales and utilization (miles driven) would need to increase substantially for electric vehicles to raise electric power demand growth rates by more than a fraction of a percentage point per year. EIA’s reference case forecast does not include regulations or laws being proposed by President Biden to incentivize and mandate electric vehicles.

Natural Gas

Natural gas production is expected to outpace demand of 35.4 trillion cubic feet in 2050, reaching a record 43.0 trillion cubic feet. The remainder of the natural gas produced will be exported or stored. EIA projects that U.S. liquefied natural gas (LNG) exports will increase by an average of 2.6 percent per year to a record 5.0 trillion cubic feet in 2032 and hold near that level through 2050.

Electricity

EIA projects that electricity demand will largely return to 2019 levels by 2025. The agency expects natural gas to account for about 36 percent of U.S. electric generation by 2050, while the shares of coal and nuclear, both currently around 20 percent, are each expected to decline by about half. As coal and nuclear generating capacity retires, new capacity additions come largely from natural gas and renewable technologies. Renewable electric generating technologies are projected to account for almost 60 percent of the capacity additions from 2020 to 2050, more than doubling the renewables’ (including hydroelectric) share of the electricity generation mix by 2050 from its current 20 percent share.

Renewable electricity generation increases more rapidly than overall electricity demand through 2050 due to the assumed cost-competitiveness of solar photovoltaic and natural gas combined-cycle units that leads to their capacity additions. EIA includes two sensitivities on the cost of renewable technologies in the Annual Energy Outlook 2021, which are depicted below. The graph shows the sensitivity of the projections to the assumed cost.

By 2035, non-carbon generating technologies supply 51 percent of the electricity mix—about half of President Biden’s campaign promise of 100 percent. By 2050, the non-carbon supply mix increases to 53 percent.

Carbon Dioxide Emissions

The transportation sector is expected to produce the most carbon dioxide emissions of the U.S. sectors throughout the forecast period and petroleum is expected to produce the most carbon dioxide emissions of the fossil fuels. Carbon dioxide emissions from coal are expected to decline and carbon dioxide emissions from natural gas are expected to increase as it becomes the fossil fuel of choice due to its lower carbon intensity. Carbon dioxide emissions in 2035 are expected to be 24 percent lower than in 2005 and in 2050, they are expected to be 20 percent lower.

Conclusion

EIA continues its journey of lowering the cost of renewable technologies, particularly wind and solar PV, resulting in an electricity sector dominated by renewable energy. Coal and nuclear generation continue to decline in the forecasts, about halving their current market shares. Electric vehicles do not take over the transportation market, which remains petroleum-based. Oil and natural production continue to prosper, but President Biden may cause that forecast to change depending on the results of the review by his Department of Interior regarding leasing and other activities on federal lands and waters. Carbon dioxide emissions remain 20 percent or more below 2005 levels throughout the forecast, with its lowest point in 2035.