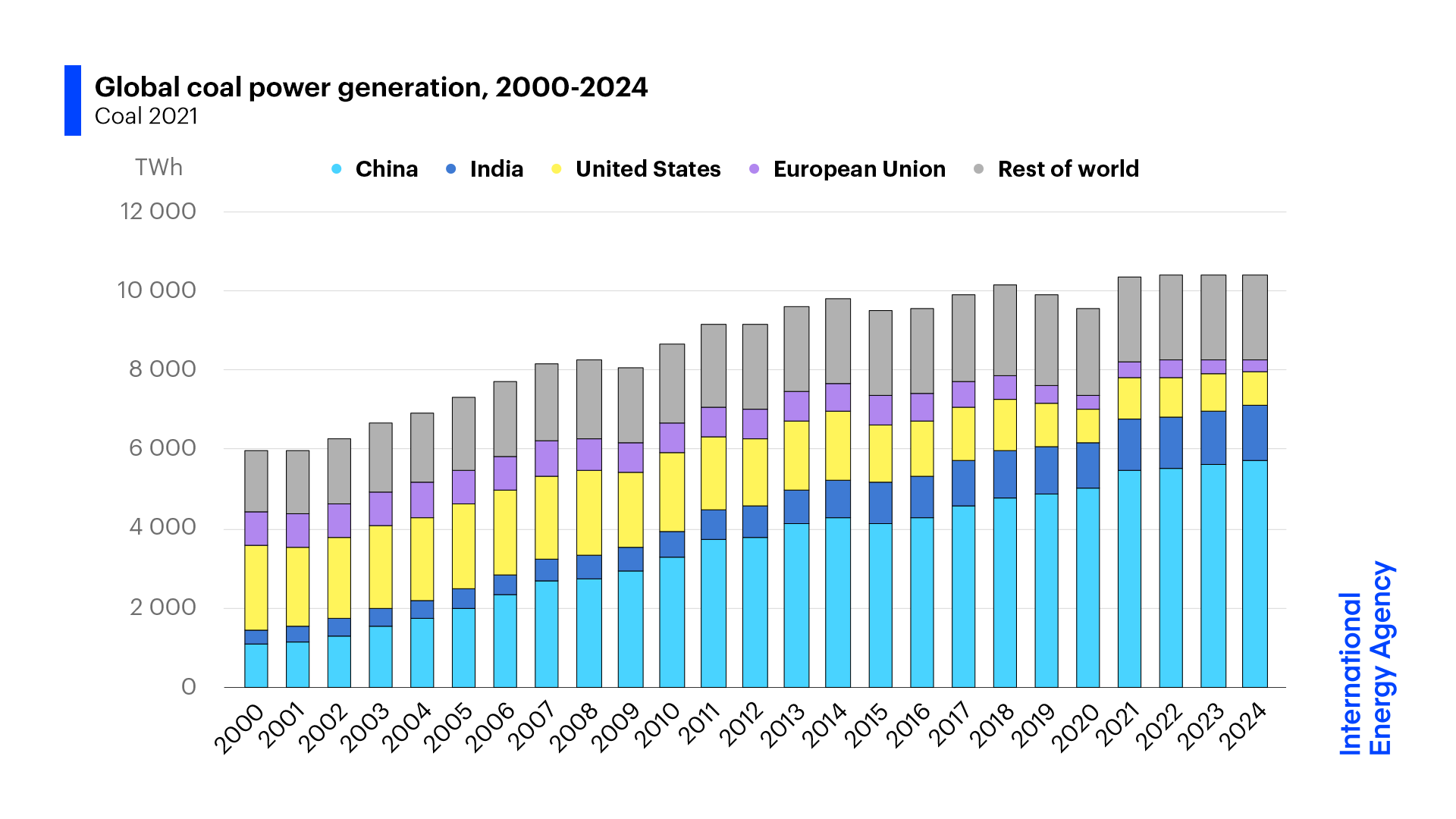

According to the COP26 communications team, the end of coal power is in sight. Yet just months later, the implausibility of that statement can be observed from the latest coal report from the International Energy Agency (IEA). According to the IEA report, global electricity generation from coal is expected to increase 9 percent in 2021 to a historic high driven by the rapid economic rebound from the coronavirus lockdowns and steep increases in natural gas prices. Further, global coal generation is to remain at that level through 2024. In fact, currently, coal is the largest source of global electricity generation and the second-largest source of primary energy. As the chart below shows, China dominates coal markets: it is the largest consumer, producer and importer of coal, having no parallel with any other country or any other fuel. China burns more coal than the rest of the world combined. India is the second-largest coal producer, consumer and importer.

Global coal power generation is expected to increase to 10,350 terawatt-hours in 2021 – a new all-time high—despite its share of the global power mix declining. In 2021, coal’s share is expected to be 36 percent of the global mix – 5 percentage points below its 2007 peak.

In China, where over half of global coal-fired electricity generation occurs, coal power is expected to grow by 9 percent in 2021, and, in India, it is expected to grow by 12 percent. Those increases would set new records in both countries, even as they plan on large amounts of solar and wind capacity. IEA expects coal generation to increase by almost 20 percent this year in the United States and the European Union, but to go back into decline next year amid slow electricity demand growth and increasing renewable power generation.

Global Coal Demand

Global coal demand, including other uses beside power generation, such as cement and steel production, is forecast to grow by 6 percent in 2021. And, depending on weather patterns and economic growth, IEA projects that global coal demand could reach a new record in 2022 and remain at that level for the following two years.

In 2020, global coal demand fell by 4.4 percent, the largest decline in decades, dropping by almost 20 percent in the United States and the European Union, and by 8 percent in India and South Africa. But, those drops were partially offset as coal demand in China grew by 1 percent. China’s economy began recovering from Covid-19 much earlier than elsewhere. China’s overall coal use is more than half of the global total. China’s power generation, including district heating, accounts for one-third of global coal consumption. Coal demand in China is due to fast growing electricity demand and the resilience of its heavy industry. For example, China uses coal-fired electricity to produce solar panels and it supplied 80 percent of the world’s solar panels in 2019.

However, in China, IEA expects coal demand growth to average less than 1 percent per year between 2022 and 2024. In India, stronger economic growth and increasing electrification are forecast to drive coal demand growth of 4 percent per year. India is expected to add 130 million metric tons to coal demand between 2021 and 2024. For most industrial purposes where coal is used, such as iron and steel production, there are few technologies that can replace it in the near term. Based on current trends, global coal demand is set to increase to 8,025 million metric tons in 2022–the highest level ever seen–and to remain there through 2024.

Coal Production

Coal production failed to keep pace with coal demand in 2021, particularly during the first half of the year, cutting into stock levels and pushing prices up. In China and India, where coal shortages led to power outages and idled factories, policies to ramp up production and reduce coal shortages were quickly implemented, due to mostly state-owned production companies. The main coal exporting countries, in many cases, were prevented from fully taking advantage of high coal prices by supply chain disruptions, such as flooding in Indonesian mines, and due to lower investment from financing and government restrictions. Other than China, most of the additional production in 2021 came from existing mines or reopened mines that had been idled during periods of low prices. Futures contracts for coal are trading below spot prices, which is not conducive to investment. IEA expects coal production to reach an all-time high in 2022 and then plateau as demand flattens.

Coal Prices

Coal prices fell to $50 per metric ton in the second quarter of 2020 and then started to climb towards the end of the year, with supply cutbacks balancing the market before rebounds in economic activity and coal demand in China started pushing prices up. In 2021, coal prices increased further because coal demand outstripped supply in China and due to supply disruptions and higher natural gas prices globally. Coal prices reached all-time highs in early October 2021, with imported thermal coal in Europe hitting $298 per metric ton. Because of quick policy changes by the Chinese government to balance the market, however, coal prices declined. As of mid-December, European prices were below $150 per metric ton.

Conclusion

Global coal trends will be shaped largely by China and India, which account for two-thirds of global coal consumption. Both countries expect to continue to use coal to fuel their economies and bring electrification to their populations, despite continuing to add renewable energy to their portfolios. While COP 26 proselytizers expect coal to be transitioned out, the opposite is likely for these two countries and many developing nations believe that they need coal to prosper as the developed world has prospered from its use since the industrial revolution. For John Kerry, President Biden’s climate envoy, to tell developed countries anything differently is to blow smoke into their eyes, making them believe that they should suffer from high energy prices and to sacrifice reliable and affordable energy in order to reduce carbon dioxide emissions that the developed world will continue to emit.