It’s been nearly a year since the Biden-Harris administration officially paused approvals for new LNG export projects. Analysts at Poten & Partners indicate that this ongoing uncertainty is leading to increased costs and project delays. Lengthened timelines, rising engineering, procurement, and construction expenses, along with methane emissions fees, are impacting projects awaiting approval or final investment decisions. The broader U.S. LNG industry is also feeling the effects, with many projects needing to reapply or seek extensions. LNG facilities are highly labor- and capital-intensive, showcasing some of the most advanced engineering today. For instance, the Golden Pass facilities are expected to generate $34 billion in private sector investments, contribute $5 billion in taxes, and create 5,200 jobs over their operational lifespan. This pause jeopardizes these potential benefits.

Higher Costs: Engineering, procurement, and construction costs have risen, partly due to the bankruptcy of major contractors like Zachry Group, which has reduced the number of available contractors, leading to higher overall project costs.

Project Delays: Regulatory delays have pushed back many projects that were pre-final investment decision, such as Golden Pass LNG, with some now expected to be delayed until 2028 to 2029.

Regulatory and Legal Costs: The need for reapplications and extensions is adding to the overall costs.

Inflation and Gas Prices: Inflation and rising natural gas prices are contributing to higher costs. As domestic U.S. gas demand grows and more coal-fired generation is forced offline by Biden-Harris EPA regulations, the cost of gas production is expected to rise.

These factors collectively impact the competitiveness and timelines of U.S. LNG export projects. The delays and cost increases are making U.S. LNG projects less competitive globally as other countries, such as Qatar, are signing long-term contracts, locking in markets for decades, building infrastructure, and increasing LNG export capacity. U.S. LNG remains attractive, however, due to its flexible cargo destinations and competitive pricing indexed to the Henry Hub gas benchmark.

Background

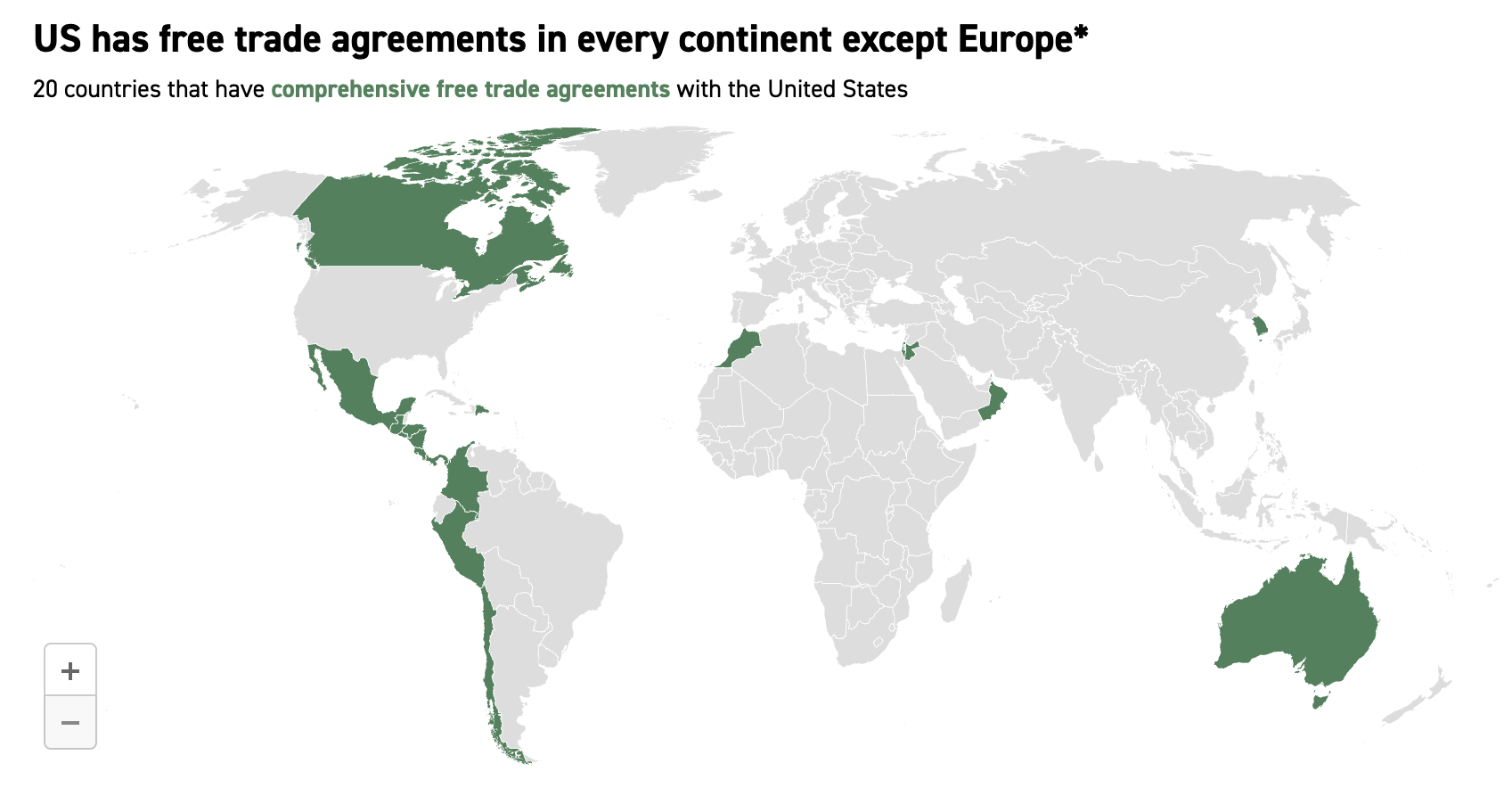

The Biden-Harris administration’s freeze specifically targeted pending applications for exporting LNG to countries without a free trade agreement (FTA) with the U.S., which includes all of Europe. The U.S. has FTAs with 20 countries across all continents except Europe. According to the Department of Energy (DOE), this pause was implemented to allow for updates to the climate and economic assessments used to determine if such authorizations serve the public interest. It’s important to note that this halt does not impact the Federal Energy Regulatory Commission, which independently authorizes the siting and construction of LNG import and export facilities. Instead, the DOE is responsible for permitting companies to export the supercooled gas. Analysts following the situation believe it is unlikely the DOE will approve any additional non-FTA export authorizations before Biden’s term ends in January. In late August, the DOE did grant a non-FTA authorization to New Fortress Energy for its LNG export project off the eastern coast of Mexico, but only for five years, significantly shorter than the requested term through 2050. Most companies are likely to avoid investing billions in construction costs when facing a freeze on export permits from those facilities.

Following the Biden administration’s announcement of the pause, the Center for LNG compiled a list of a dozen pending non-FTA export authorizations at the DOE. Large projects still awaiting approval include the Calcasieu Pass 2 and Commonwealth LNG projects in Louisiana, as well as an expansion of the Corpus Christi LNG project in Texas.

Companies looking to import or export natural gas in the U.S. must obtain authorization from the DOE. Under the Natural Gas Act (NGA), the DOE is required to assess the public interest for applications to export LNG to non-FTA countries. The NGA outlines two standards for reviewing LNG export applications based on the destination countries. Applications for exporting LNG to countries with existing FTAs or for importing LNG from any source are automatically considered in the public interest. However, the DOE must evaluate applications for non-FTA countries and grant export authority unless it determines that the proposed exports are not aligned with the public interest or are explicitly prohibited by law or policy.

In late March, sixteen Republican attorneys general filed a lawsuit against the DOE over the pause. In a 62-page ruling on July 1, Judge James Cain of the U.S. District Court for the Western District of Louisiana noted that the NGA instructs the DOE to ensure an “expeditious completion” of its review of export applications. However, the DOE has significant discretion regarding the speed of its reviews, and there is no legal definition of what “expeditious” entails, leaving it to the DOE and the administration to determine their pace for approvals.

DOE is planning a 60-day public comment period on the economic and environmental analyses it is preparing and expects it “will complete the process by the end of the first quarter of 2025.” DOE will “review and take into consideration” public comments, the department said. “Once ready, an announcement of the updated analyses will be made available in the Federal Register and include instructions on how to submit comments,” DOE said. DOE has a department fact sheet that provides more details about the analyses.

According to the Energy Information Administration’s Short-Term Energy Outlook, U.S. LNG exports are projected to rise 17 percent from 2024 to 2025. The International Energy Agency’s latest gas market report also indicates that global gas demand is expected to increase by 2.3 percent this year.

Conclusion

The Biden-Harris administration in its LNG pause has created a situation where LNG project developers do not have a clear view of what the future looks like, which is essential for developing multibillion-dollar infrastructure projects. The pause is unlikely to be resolved before the next administration takes office as DOE is to complete the analyses at the end of the first quarter of 2025. The delay is causing costs to increase and timelines to be forfeited because of government fiat. It is also causing other countries to capture long-term contracts, covering decades, and to expand their LNG infrastructure. U.S. LNG is a net benefit to America and to U.S. allies, particularly Europe, which has used U.S. LNG to replace Russian natural gas after it invaded Ukraine.