Global economic expansion is driving oil demand higher and increasing production of U.S. shale oil, particularly from the Permian Basin in Texas, is supplying most of the demand growth and will continue to do so until at least 2020, even with prices at $60 a barrel.

Source: Bloomberg

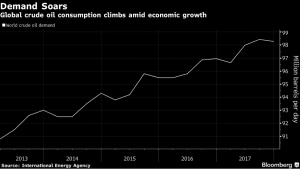

The Energy Information Administration’s (EIA) Short-Term Energy Outlook expects global liquids demand to exceed 100 million barrels per day in 2018 and reach almost 102 million barrels per day by 2019. The International Energy Agency (IEA) believes it will reach 104.7 million barrels per day by 2023. EIA’s Annual Energy Outlook predicts that by 2040 world liquids fuel consumption will be 112.8 million barrels per day despite growing demand for electric vehicles. (See blog entitled, Despite Electric Vehicles, World Petroleum Consumption Will Continue to Climb.) China, India, and other countries in Asian are areas with increasing demand for liquid fuels.

The global manufacturing industry has shown strong growth, much stronger than the last 8 years according to the JPMorgan Global Purchasing Managers Index. Further, freight and passenger travel are also increasing, consuming largely liquid fuels.

In China, industrial production last year grew at the fastest pace since 2014. Industrial production in China averaged 12.28 percent from 1990 until 2018, reaching a high of 29.4 percent in August of 1994. China’s industrial production rose by 7.2 percent year-on-year in January to February of 2018, beating market expectations of 6.1 percent and following a 6.2 percent gain in December. It was the steepest increase in industrial output since June of last year, as production rebounded for mining (1.6 percent from -0.9 percent in December) and increased at a faster pace for manufacturing (7.0 percent from 6.5 percent) and electricity, gas and water production (13.3 percent from 8.2 percent).

Source: Bloomberg

Not only is industrial production picking up in China, but China’s airline passenger traffic increased 15 percent in 2017—the fastest rate of annual growth since 2009. Data from Crucial Perspective shows that passenger load factors are running at record highs in China. (Passenger load factors are a measure of how full planes are). The International Air Transport Association predicts that China will overtake the United States as the world’s largest air travel market by 2022—two years sooner than previously expected.

Source: Bloomberg

India is experiencing rapid air transportation growth, with back-to-back years of 20+ percent growth in passengers, although officials expect that to “moderate” to a rate of 8 to 10 percent for the next two years. All major Indian airports are operating at close to or above design capacity because of the big increase in traffic. The main drivers of growth have been a rising middle class, lower air ticket prices and improving regional connectivity. The two years of growth in domestic air traffic has made India the third largest domestic aviation market after the United States and China.

According to the International Air Transport Association, fuel consumption by commercial airlines worldwide is expected to increase by 5 percent to the highest level on record. The association also estimates air freight in 2017 increased the most in seven years and cargo growth will remain above the trend in 2018.

Freight transportation is also up. The Baltic Dry Index—a measure of freight costs heavily influenced by China’s demand for coal and iron ore—is about 25 percent higher than a year ago. Much of those raw materials are used by Chinese manufacturers to make finished goods for export. Once manufactured, the goods are transported by ship to consumers around the world. Last year, global growth in containerized goods grew at the fastest rate since 2013, mainly due to China.

Source: Bloomberg

In the United States, the Cass Shipments Index, measuring total freight volume, increased 12.5 percent year-on-year in January, which confirms that the U.S. economy—the world’s largest—is strong and getting stronger. In the United States, truck tonnage rates—another indicator of the transport of goods—are at their highest seasonal level in at least 20 years, according to data from the American Trucking Association. Truck tonnage rates increased by almost 8 percent last year and have declined only once annually since 2013, resulting in growth in diesel demand.

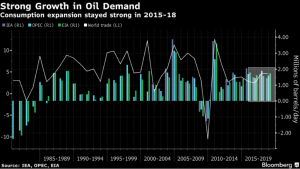

All these indicators indicate that there will be strong growth in liquids demand worldwide. According to the chart below, world liquids consumption grew each year since the global recession, and IEA, EIA, and OPEC expect it to continue to grow.

Source: Bloomberg

Conclusion

Forecasters are expecting liquids demand to be strong in the future. While OECD countries are expected to see relatively flat demand, non-OECD countries are expected to see growth in their liquids demand, particularly China, India, and other Asian countries.