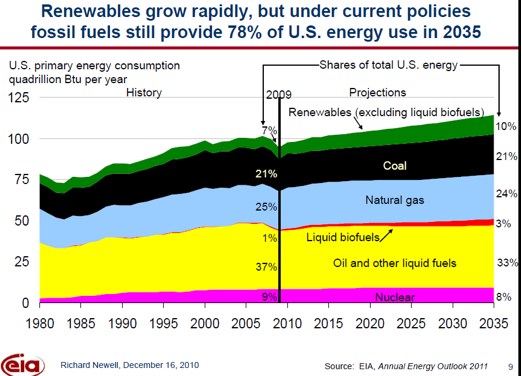

The Energy Information Administration (EIA), the independent statistical agency in the U.S. Department of Energy, released their reference case forecasts from the Annual Energy Outlook (AEO) 2011 last week. The AEO contains projections of U.S. energy supply, demand, and prices through 2035 and serves as a base line for government and industry projections of future energy policies. While some forecasters are turning toward more carbon-free fuels in the future, the EIA still expects fossil fuels to supply over three quarters of the energy consumption in the United States in 2035.[i] The share of fossil fuels is expected to decline only 5 percentage points from 83 percent in 2009 to 78 percent in 2035. Even with this large share of fossil fuels, energy-related carbon dioxide emissions are still below 2005 levels in 2020, by 3.4 percent, and they are not expected to exceed 2005 levels until 2027.

Major Forecast Findings

- U.S. Consumption of all fossil fuels increases: Consumption of coal, the most carbon intensive fossil fuel, increases by 3 percent between 2009 and 2035, consumption of petroleum products, including biofuels, increases by 14 percent, and natural gas consumption increases by 16 percent.

- Oil production increases in the near term and then declines: U.S. crude oil production increases from 5.4 million barrels per day in 2009 to 6.1 million barrels per day in 2019 and then declines slightly through 2035. Production increases onshore from enhanced oil recovery projects and shale oil plays.

- Shale gas more than triples its natural gas production share between 2009 and 2035: Technically recoverable shale gas resources are estimated to be 2.3 times the level assumed in last year’s AEO, resulting in double the production level in 2035 compared to AEO 2010 and increasing total natural gas production by 20 percent in 2035 from AEO 2010 levels. Total U.S. natural gas production increases by 25 percent between 2009 and 2035, largely as a result of the huge increase in shale gas production. Shale gas represents 45 percent of total natural gas production in 2035, compared to 14 percent in 2009.

- Imports meet a declining share of total U.S. energy demand: The net import share of energy consumption declines from 24 percent in 2009 to 18 percent in 2035 because of increased use of domestically produced biofuels, demand reductions resulting from efficiency standards, rising energy prices, and increased natural gas shale production. Net petroleum imports decline from 52 percent in 2009 to 42 percent in 2035 and net natural gas imports decline from 11 percent in 2009 to 1 percent in 2035.

- Natural gas and renewables continue to be the major sources of new generating technology, but coal still dominates total generation: Capacity of natural gas-fired generation, the least cost new plant generating technology, increases by 135 gigawatts over the 2009 to 2035 forecast period and renewable generating technologies, including hydroelectric, increase their capacity by less, 57 gigawatts. The renewable generation share, including hydropower, increases from 11 percent in 2009 to 14 percent in 2035 due to federal tax credits and state renewable electricity mandates. Even with these increases, coal remains the dominant source of electricity generation in 2035, producing 43 percent of total generation, 2 percentage points less than in 2009.

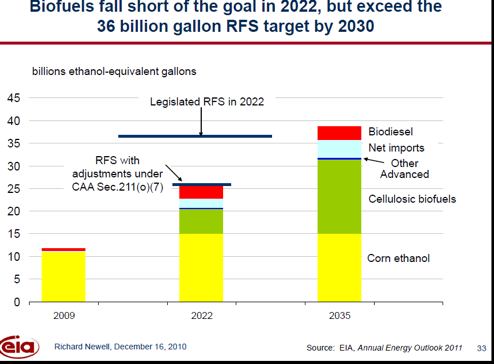

- Biofuels do not meet legislated targets. The Energy Independence and Security Act of 2007 mandates 36 billion gallons of biofuels production (e.g. corn-based ethanol, cellulosic ethanol, biodiesel) by 2022. But by EIA’s forecast, this renewable fuel standard (RFS) cannot be met until 2030. (See graph below.)

Conclusion

Under the assumption of current laws and regulation, the EIA expects fossil fuels to dominant the energy market in 2035, providing 78 percent of our energy consumption. This means that despite large subsidies and set-asides, the EIA projects that renewables will only increase their share of our energy consumption by 5 percentage points over the next 25 years. The forecast also indicates that the United States can produce 82 percent of its energy requirements in 2035 domestically. But to do that, we need all sources of energy and will need to continue to drill for and produce oil, onshore and offshore, and use hydraulic fracturing to produce natural gas from shale deposits. To support this forecast, the Obama Administration needs to reverse its current slow pace of awarding drilling permits and moderate new requirements on offshore drilling. Without these changes, we will be subject to having to import more energy and be at the mercy of foreign governments. And, increasing federal and state regulation regarding hydraulic fracturing of natural gas production will result in less gas produced domestically and increased dependence on liquefied natural gas imports. As this forecast shows, we clearly have sufficient domestic energy to reduce imports to 18 percent in 2035. We just need to be able to produce it.

[i] Energy Information Administration, Annual Energy Outlook 2011, Reference Case, December 16, 2011, http://www.eia.gov/neic/speeches/newell_12162010.pdf, http://www.eia.gov/forecasts/aeo/pdf/0383er(2011).pdf, and http://www.eia.gov/neic/press/press352.html