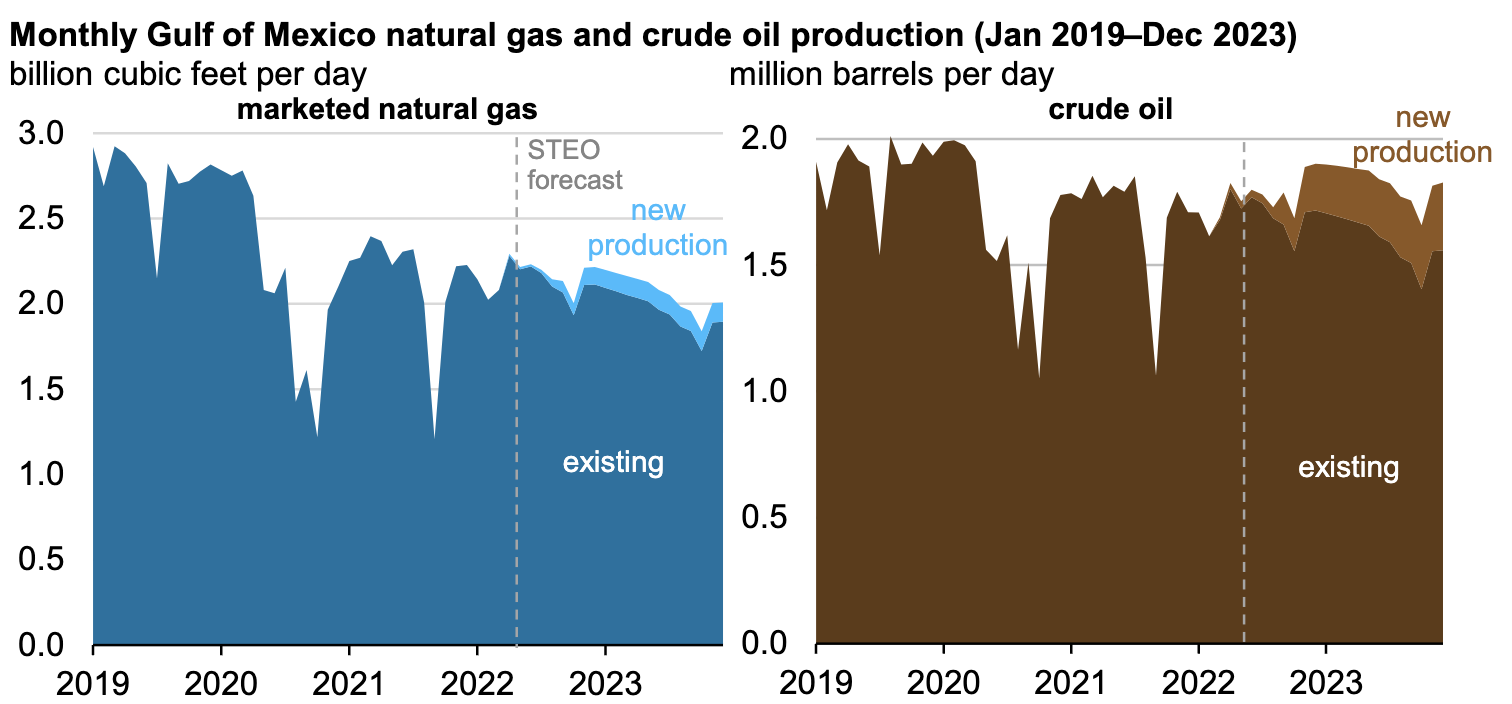

The Energy Information Administration (EIA) forecasts that nine new fields will come online in the deep waters of the Gulf of Mexico this year, which will account for 5 percent of natural gas production and 14 percent of oil production in U.S. federal Gulf of Mexico waters by the end of 2023. However, EIA expects that the additional capacity from these new fields will not sustain oil production at levels similar to the end of 2021 in offshore fields. According to EIA, declining production from existing Gulf of Mexico fields will largely offset the increases in oil production from the new fields, with natural gas production in the Gulf of Mexico continuing its three-year decline. During 2021, 15 percent of U.S. oil production and 2 percent of U.S. natural gas production was produced in the Gulf of Mexico.

The Biden administration has not had a successful offshore lease sale since Biden’s inauguration—lease sales that are required by federal law—because the only offshore lease sale held in November 2021 was invalidated by a federal judge a few months later. The Biden administration has not contested the judge’s decision, which was that climate change was not adequately considered in the sale. In fact, the Biden administration only held the sale after being ordered to do so by another federal judge.

Earlier this year, the Biden administration canceled lease sales in federal waters off Alaska’s Cook Inlet, citing a lack of industry interest. On top of those actions, the Biden administration has yet to provide an offshore lease plan for new oil and gas leases in federal waters that is required by law every 5 years. The Department of Interior indicates that a draft of one will be provided by June 30, 2022, but will include an option of no lease sales. The Biden administration continues to withhold oil and gas supplies from the American public.

EIA Gulf of Mexico (GOM) Forecast

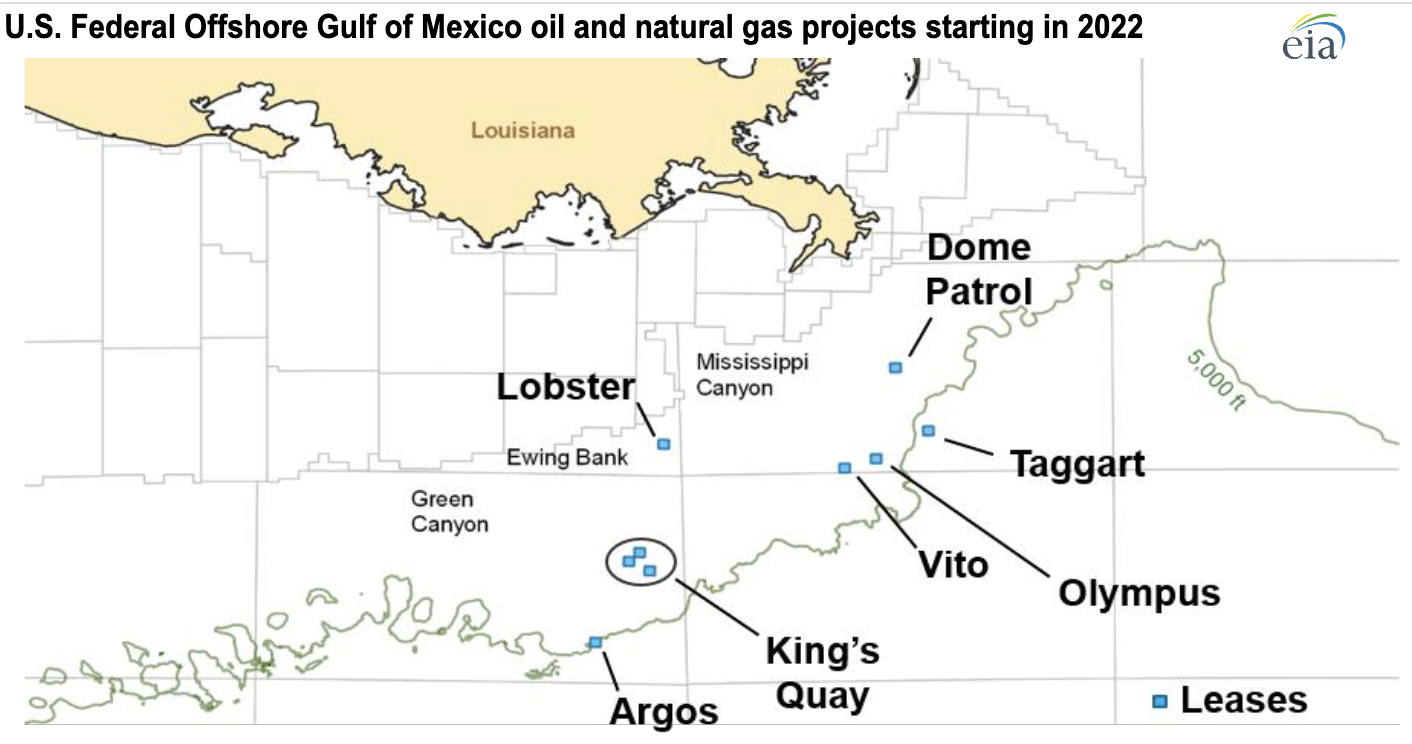

EIA expects that GOM natural gas production will average 2.1 billion cubic feet per day in 2023, down 0.1 billion cubic feet per day from 2022 and that GOM oil production will average 1.8 million barrels per day in 2023, about the same as in 2022. There are no GOM fields scheduled to start production in 2023. The nine fields coming online in 2022 include those at Argos/Mad Dog 2, Vito, Lobster, Dome Patrol, Olympus, Taggart, and the Kings Quay fields. The large development fields at Argos/Mad Dog 2, King’s Quay, and Vito each has a peak production capacity of at least 100,000 barrels of oil equivalent per day. Eight of the nine new fields in the GOM will produce both oil and natural gas by year-end and the ninth field will produce only oil. Offshore producers have made significant progress simplifying and standardizing floating production systems and collaborating with various partners, including overseas construction services companies, to reduce costs and remain competitive with onshore producers.

Since the late 1990s, new development in the GOM has been targeting oil-bearing reservoirs. Most of the natural gas produced in the GOM comes from associated-dissolved natural gas production in oil fields instead of natural gas fields. In 2020, gross withdrawals of natural gas in the GOM that came from natural gas wells accounted for less than 30 percent of total GOM natural gas production, compared with 76 percent in 1999.

Required Offshore Lease Plan

Shortly after taking office, President Biden signed an executive order to pause the issuing of new leases, but a successful legal challenge from western states forced the administration to hold new lease sales. The new offshore lease plan, however, is likely to block new drilling in the Atlantic and Pacific oceans; the eastern Gulf of Mexico has been closed to drilling since 1995. At issue is whether to allow lease sales in parts of the Arctic Ocean as well as the western and central Gulf of Mexico. During his campaign, Biden pledged to end new drilling on public lands and in federal waters. The draft five-year plan for the National Outer Continental Shelf Oil and Gas Leasing Program is expected to include several options, including a “no action alternative” — that would not offer any new lease sales.

Areas made available for leasing under the new plan would be auctioned through 2027. Once the Interior Department’s Bureau of Ocean Management releases the draft five year plan, it will be subject to a period of public comment before it is finalized.

According to Erik Milito, president of the National Ocean Industries Association, new leases in the Gulf of Mexico could mean an additional 2.4 million barrels of oil a day, which can impact the global marketplace. For example, oil prices dropped by over $9 a barrel in 2008 when President George W. Bush opened the Outer Continental Shelf to oil drilling, signaling he wanted more supply to be produced. Biden could get similar results if he truly wanted more investment in oil production and made a proposal that clearly showed it. Instead, Biden has offered a temporarily pause on the federal gas tax that needs to be approved by Congress, released oil from the strategic petroleum reserve, and suspended a ban on summertime sales of ethanol-gasoline blends. None of these actions encourages new oil development or produced a single barrel of new oil production.

Recent History of Offshore Leases

Both the Obama/Biden and the Biden/Harris administrations have tried to block new offshore production. President Obama banned drilling in portions of the Arctic Ocean’s Beaufort and Chukchi Seas, and later invoked an obscure provision of a 1953 law, the Outer Continental Shelf Lands Act, to also ban drilling in areas along the Atlantic coastline. President Trump tried to open all coastal waters of the United States to oil and gas drilling, including the areas kept off limits by the Obama administration, but was unable to make that happen. Due to pressure from coastal states, President Trump signed an executive order that prohibits drilling for 10 years off the coasts of Florida, Georgia, South Carolina and North Carolina. This, unlike Biden’s actions, happened at a time of low oil prices because of the huge increases in production the United States enjoyed on its way to energy independence reached in 2019.

President Biden signed a pause on drilling on federal lands and waters during his first weeks in office, calling for a review of the program that ended up increasing royalties for onshore production by 50 percent and also increasing rents. New onshore royalties will be 18.75 percent, matching those for offshore which were hiked by the Obama/Biden administration. President Biden in his 17 months in office has not had a successful offshore lease sale and all indications is that he would like to continue in that direction.

Conclusion

According to EIA, declining production from existing GOM fields is expected to be greater than the increase in production from new fields for natural gas and to be equal for oil. With no new fields coming on line in 2023, offshore oil production may decline as natural gas production is doing in the GOM. And with a hold on leasing federal lands and waters the share of energy produced from those areas will continue to lag the production from state and private lands.

Biden’s Interior Department is supposed to release a 5-year lease plan by the end of this month that will include a no lease sale option despite the plan and lease sales being required by law. Biden and his administration clearly do not want to encourage investment in new offshore oil fields and are doing everything possible to decrease production, contrary to what they state. Cutting off domestic energy supplies and begging foreign nations to produce more oil seems to be the Biden administration’s policy.