The United States Geological Survey (USGS) expanded the list of critical minerals from 35 to 50 by breaking out rare earth minerals and precious group metals into separate entities and adding nickel and zinc to the list. Begun in 2018, the list of critical minerals is produced to point out the minerals that could impact the U.S. economy as the United States relies on imports for many of them, which are needed for a “green” economy. Four minerals—helium, potash, rhenium, and strontium – were dropped from the list as the United States is the world’s leading producer and net exporter of helium, and the other three are deemed “low disruption potential”. Uranium was also dropped after being reclassified as a “mineral fuel”. Nickel and zinc were added to the list for reasons discussed below.

Nickel and Zinc Added to Critical Mineral List

Nickel was added to the list because the United States relies on refined nickel imports for about half of its annual consumption and because there is only one domestic operating nickel mine in the United States – the Eagle mine in Michigan – which exports concentrates for overseas refining. While there is a single producer of nickel sulphate, it is only as a by-product of precious group metals production. Nickel is an important chemical component of electric vehicle batteries, an area that President Biden wants to promote.

There are two copper and nickel mines in Minnesota trying to open. The PolyMet copper and nickel mine is located within Minnesota’s Mesabi Iron Range and would be the first copper-nickel open pit mine in the state. Besides holding significant deposits, the project has existing rail, roads, utilities and an established supplier network in a traditional mining area but is being held up by court and regulatory action despite having undergone more than a decade of thorough, public environmental reviews.

The Biden administration is also holding up the Twin Metals mine, which is undergoing environmental review with a two-year ban on new prospecting permits and leases in the region near the Boundary Waters wilderness. When Twin Metals, which is owned by the Chilean mining giant Antofagasta, submitted its formal mine plan to federal and state regulators in 2019, the company indicated its design would prevent any acid drainage from the sulfide-bearing ore and protect the wilderness from pollution. The Duluth Complex where these two mines are located holds 95 percent of America’s nickel.

Zinc was added to the list because the refined zinc import dependency of the United States is relatively high at 710,000 metric tons in 2020, representing 83 percent of domestic consumption. The United States has 14 operating mines and three smelter facilities, one primary and two secondaries, one of which resumed operations in 2020 when President Trump was in office after several years of inactivity. Global mine and smelter production concentration has increased significantly over the past, driven mainly by increased production in China. The more supply that is concentrated in one country, the higher the potential risk factor, particularly if that country is a mineral competitor, as is the case with China.

Biden’s Preference to Import Critical Minerals

Despite the list of 50 critical minerals, rather than opening new mines in the United States, President Biden is kowtowing to environmentalists, who do not want new mining in this country. As a result, Biden has indicated that the United States would import its critical minerals from its allies. The only trouble with that logic is that China dominates the supply chain of critical minerals, either by having its own resources, buying into the resources of other countries, and/or having the majority of the processing and refining capability needed to use these minerals after mining the ore. The United States is decades behind, particularly when President Biden wants a “green” economy transformation focused on electric vehicles, wind turbines, and solar panels—all of which need critical minerals that China dominates.

As examples, China owns 50 percent of the cobalt production from mines in the Republic of the Congo and processes 70 percent of the world’s cobalt. It dominates rare earth minerals as it has almost 90 percent of the world’s refining capability. Even in the United States, a Chinese company is part owner of the only rare earth mine at Mountain Pass in California. China also processes 50 percent of the world’s lithium.

For Biden to take such a stance against U.S. mining and a preference for production of the needed minerals elsewhere makes little sense since the United States has the safest and most regulated extraction industries in the world. As a result, less emissions would result here than mining and processing the ores elsewhere.

More on China’s Dominance

Electric vehicle battery metals including lithium, nickel and cobalt, which are overwhelmingly mined and refined outside the United States, face deficits and volatile prices, among other supply chain constraints. S&P Global Market forecasts global primary nickel supply facing a deficit in 2021, coming up short 128,000 metric tons, and cobalt short 1,800 metric tons, with supplies tightening through 2025. And while safe from a deficit in 2021, lithium is expected to hit an estimated 30,000 metric ton shortage in lithium carbonate equivalent by 2025. Lithium is essential for batteries to power electric vehicles and to store energy produced by renewable but intermittent sources like wind and solar.

As a result, China is buying up lithium companies. Zijin Mining Group Co., a major Chinese gold and copper producer, purchased Neo Lithium Corp. for $770 million—the latest in a series of recent acquisitions, mostly involving Chinese bidders for South American assets owned by Canadian firms. In September, two Chinese companies held a bidding war for Canada’s Millennial Lithium Corp., which has lithium assets in Argentina, with Contemporary Amperex Technology Co. eventually outbidding Ganfeng Lithium Co. Ganfeng has been on an acquisition spree, purchasing Mexico’s Bacanora Lithium in August. In total, Bloomberg Intelligence estimates five companies essentially control the $4 billion global lithium market, two of which are Chinese. Contemporary Amperex Technology is the world’s largest battery producer.

Lithium-Ion Battery Cell Capacity and Component Prices

Battery producers have begun to increase lithium-ion cell prices as anode, cathode and other raw material input prices continue to rise. Nickel sulphate prices are up 34 percent and cobalt hydroxide are up almost 82 percent over the past year. But the largest increase is lithium with the price of Benchmark’s lithium carbonate for use in batteries skyrocketing by 313 percent, reaching RMB185,000 per metric ton ($28,675 a metric ton) in mid-October.

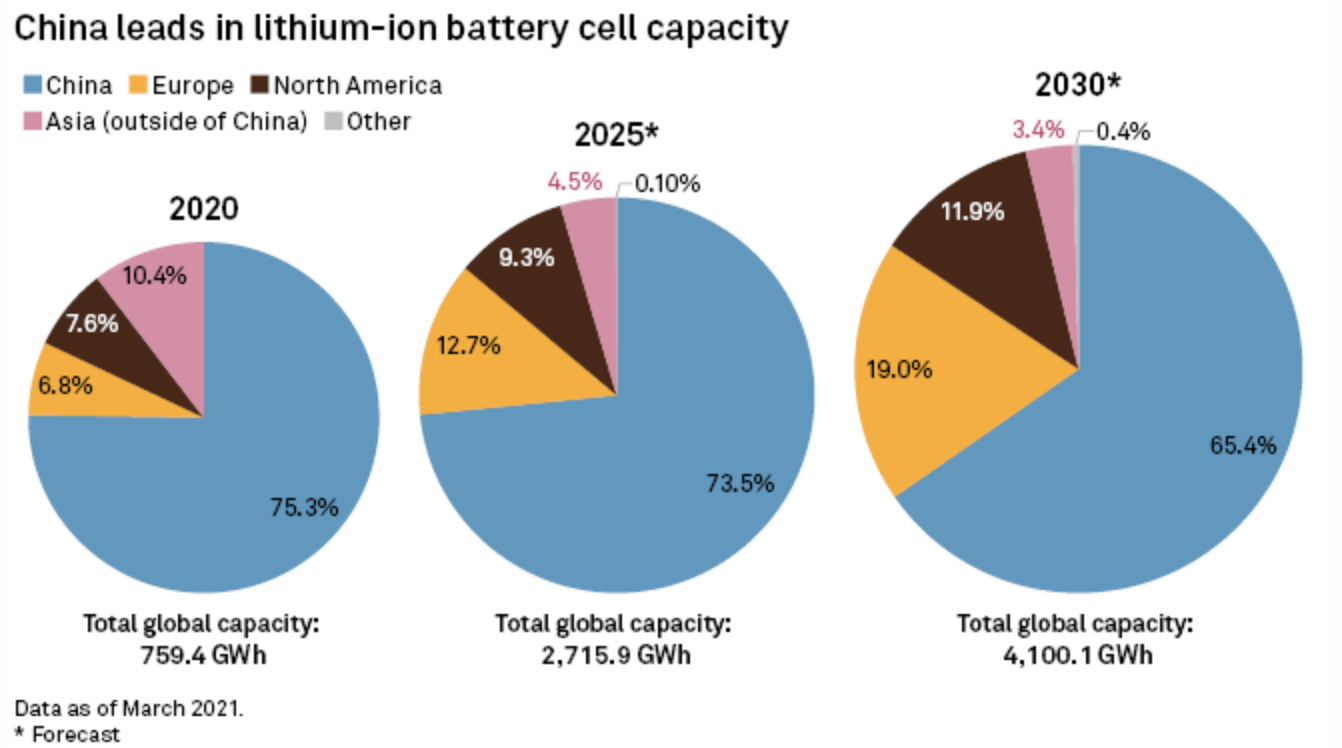

In 2020, North American lithium-ion battery cell capacity represented just 7.6 percent of global capacity, while 75.3 percent of global battery cell capacity was located in China.

U.S. Thacker Pass Lithium Mine

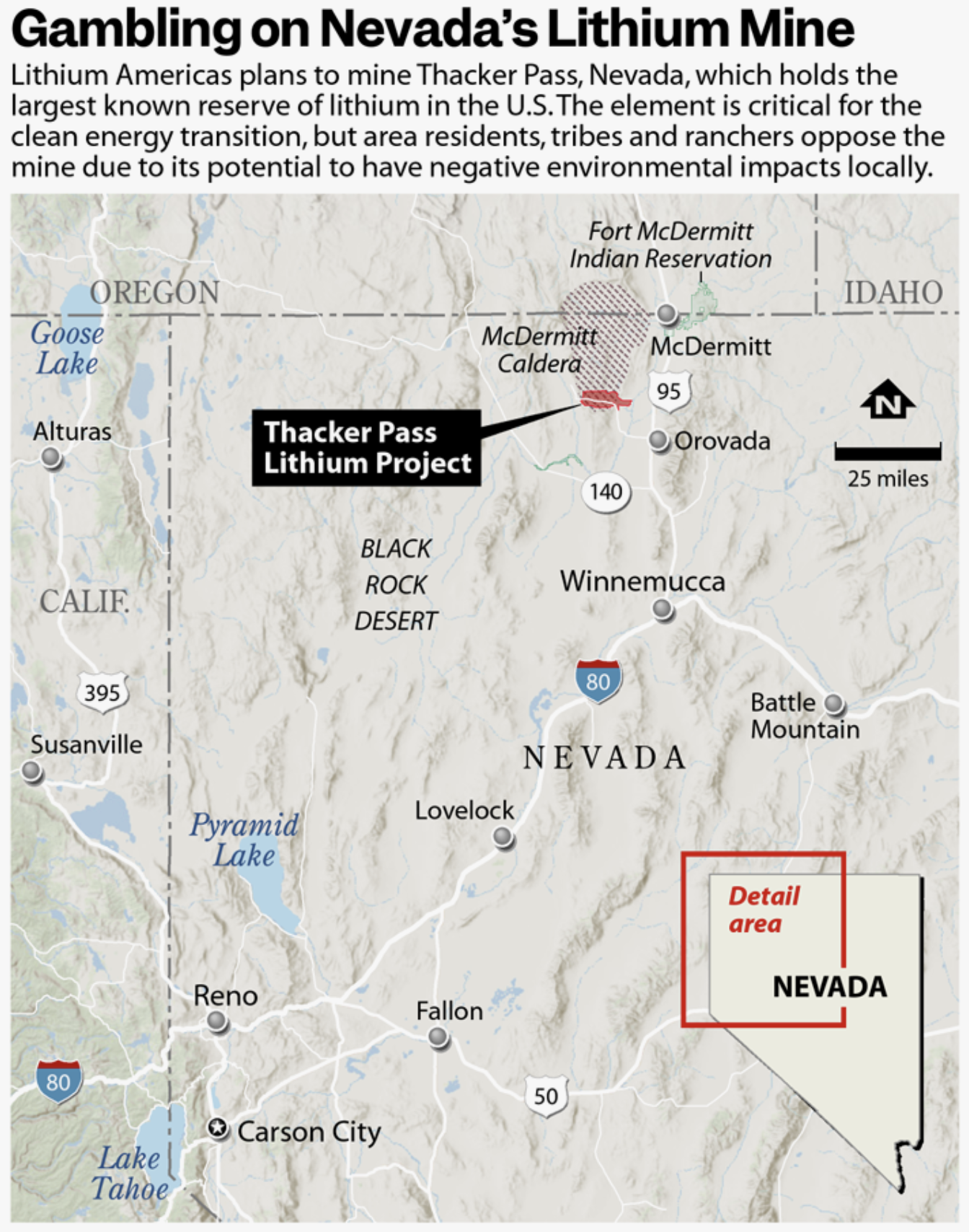

In January 2021, the U.S. Bureau of Land Management approved the Thacker Pass Lithium Project, granting Lithium Americas, a multinational company headquartered in Vancouver, British Columbia, and its subsidiary, Lithium Nevada, the exclusive rights to mine there. Despite its name, and the fact that it is also developing a lithium mine in Argentina, Lithium Americas’ majority stakeholder is China’s Ganfeng Lithium, the world’s largest producer of lithium.

The proposed lithium project in the United States would span 17,933 acres that would hold an open-pit mine and a sulfuric acid plant to process lithium from the raw ore. The mine is expected to have a lifespan of at least 46 years and produce 60,000 tons a year. It is expected to consume 1.7 billion gallons of water each year—500,000 gallons of water for each ton of lithium. According to

BloombergNEF, global demand for lithium chemicals is expected to reach almost 700,000 tons a year by 2025.

Lithium Americas claims it has established Environmental, Social and Governance (ESG) standards to meet the world’s increasing demand for sustainability in business. “Thacker Pass is designed to meet or exceed all state and federal requirements during construction, operation, and reclamation,” and will meet limitations on air and water pollution, which were assessed in the FEIS required under the National Environmental Policy Act (NEPA). But, opponents engaged in ongoing litigation against the project claim the FEIS was rushed and failed to meet obligations specified under NEPA.

Conclusion

Critical minerals are essential to a supposedly green economy—electric vehicles, batteries, wind turbines and solar panels—that President Biden is pushing. The USGS has just upped the number of critical minerals that the United States needs by 15—from 35 to 50—and included nickel and zinc on its list. While the United States has nickel resources, the Biden administration is holding up mine projects in Minnesota and is supporting the import of these minerals instead. The major problem with that logic is that China is firmly in control of the critical mineral markets, particularly with ore processing, placing the United States in the hands of a government that it sees as a major competitor. The United States will be much more reliant on China for critical minerals than it ever was on the Middle East for oil. Given the decades of concerns about the transfer of wealth abroad and the serious national security implications of dependency on others for our oil supplies prior to becoming energy independent in 2019, Americans may be rightly concerned about this currently planned dependency in pursuit of President Biden’s green vision.