The following is testimony prepared by Dr. Mary J. Hutzler, Distinguished Senior Fellow of the Institute for Energy Research, presented to the Republican Congressional Forum On Biden’s Afghanistan Crisis: Forfeiting U.S. Investment in Critical Minerals to the Taliban on October 22, 2021. A full video of the hearing is available, as well as the full testimony in downloadable PDF format.

____

The Institute for Energy Research (IER) is a non-profit organization that conducts research and evaluates public policies in energy markets. IER articulates free market positions that respect private property rights and promote efficient outcomes for energy consumers and producers. IER staff and scholars educate policymakers and the general public on the economic and environmental benefits of free market energy. The organization was founded in 1989 as a public foundation under Section 501(c)(3) of the Internal Revenue Code. Funding for the institute comes from tax-deductible contributions of individuals, foundations, and corporations.

Thank you for giving me this opportunity to testify on Afghanistan’s mineral wealth.

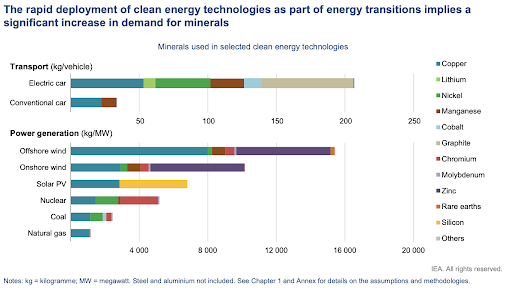

An energy system powered by clean energy technologies differs profoundly from one fueled by traditional hydrocarbon resources. Building solar photovoltaic plants, wind farms and electric vehicles generally requires more minerals than their fossil fuel based counterparts. A typical electric car requires six times the mineral inputs of a conventional car, and an onshore wind plant requires nine times more mineral resources than a gas-fired power plant. Since 2010, the average amount of minerals needed for a new unit of power generation capacity has increased by 50 percent as the share of renewables has risen.

The types of mineral resources used vary by technology. Lithium, nickel, cobalt, manganese and graphite are crucial to battery performance, longevity and energy density. Rare earth elements are essential for permanent magnets that are vital for wind turbines and electric vehicle motors. Electricity networks need a huge amount of copper and aluminum, with copper being a cornerstone for all electricity-related technologies.

The goals of the Biden Administration will put an enormous demand on manufacturing companies for these minerals and/or their resulting products. The United States currently has little extraction and processing capability here or abroad to meet these future demands. And, the United States has lost a major opportunity to invest in Afghanistan’s mineral wealth as that wealth is now under Taliban control. It allows China, which already dominates the global mineral supply chain, to invest in a neighboring country’s mineral resources.

Afghanistan’s Extensive Mineral Resources

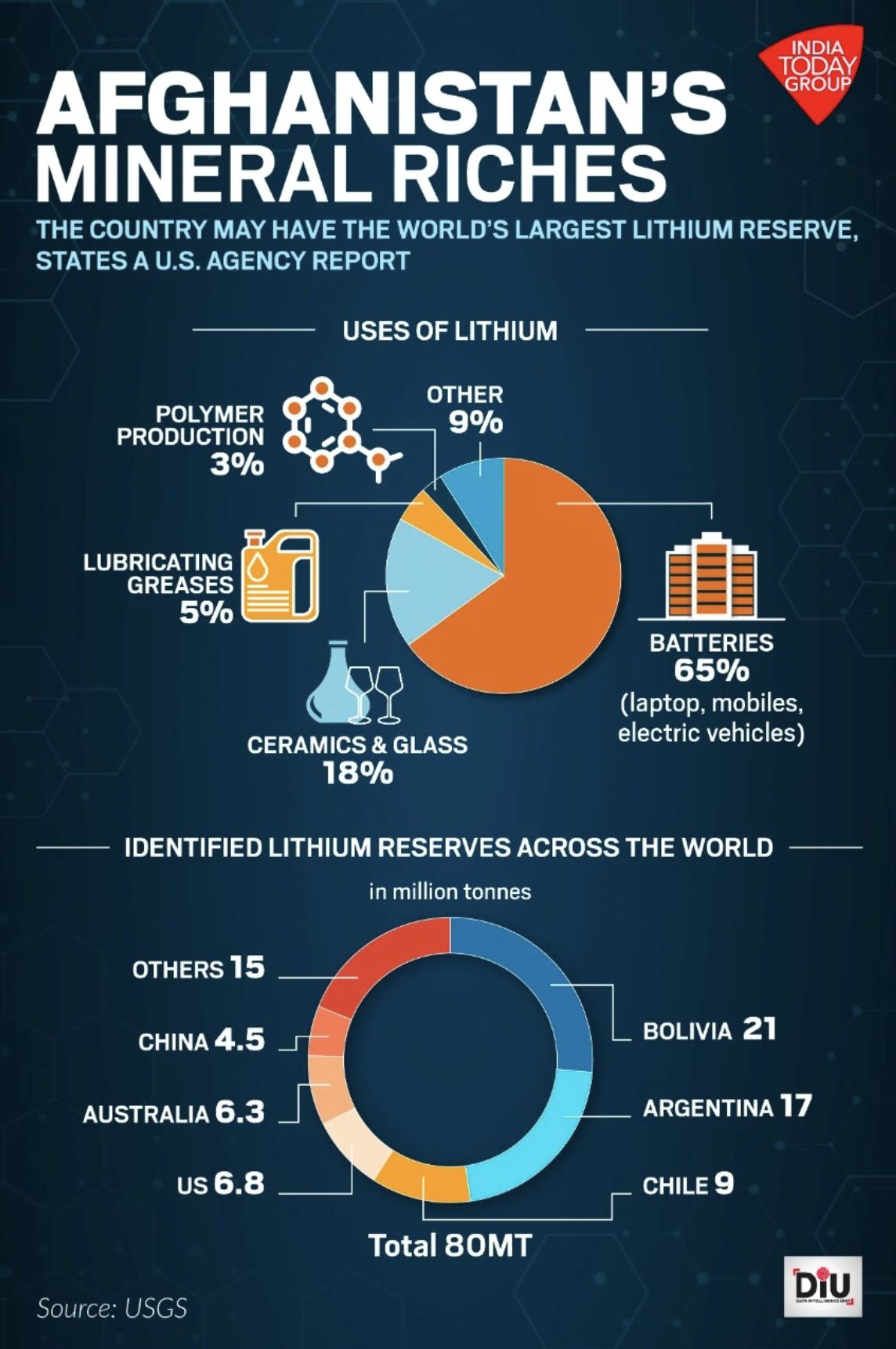

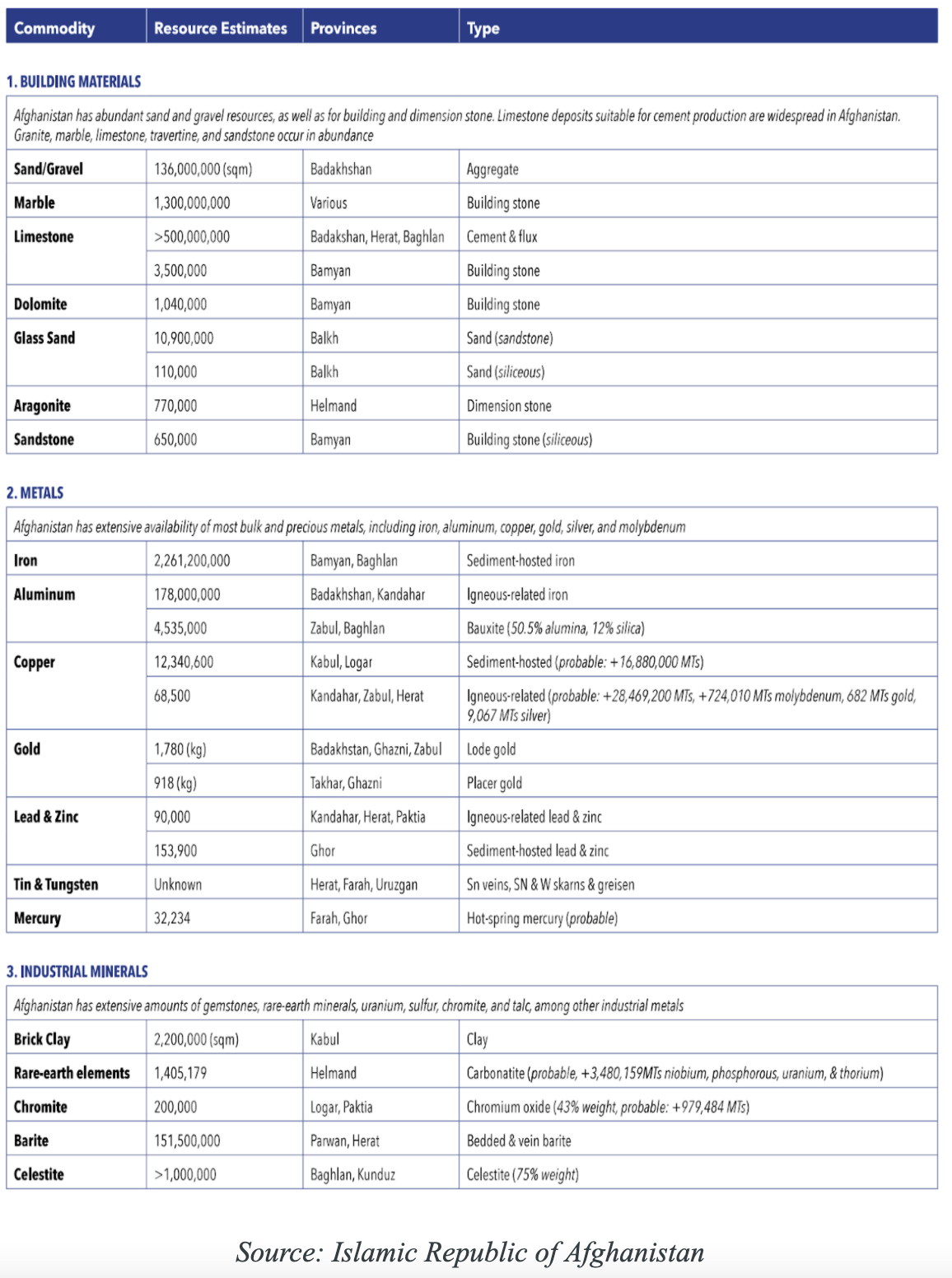

Afghanistan has extensive mineral resources located in every province of the country. The country has world-class deposits of iron ore, copper, gold, rare earth minerals and many other resources. Afghanistan is expected to hold over 2.2 billion metric tons of iron ore, almost 30 million metric tons of copper (about 34 times the known copper reserves in the world), and 1.4 million metric tons of rare earth minerals. Afghanistan’s vast mineral resources also include cobalt, barite, sulfur, lead, silver, zinc, niobium, and lithium. U.S. agencies estimate Afghanistan’s mineral deposits to be worth upwards of $1 trillion and recent estimates suggest the worth of untapped minerals could be as high as $3 trillion. An internal Pentagon memorandum called Afghanistan the “Saudi Arabia of lithium.” A 2010 U.S. study revealed that Afghanistan could have among the world’s largest deposits of lithium, which is key to the new “green” global agenda of switching to electric vehicles that the Biden Administration is pursuing.

The fact that Afghanistan is rich in minerals is not necessarily new information. The Soviets identified mineral deposits in Afghanistan during their decade-long occupation. Since then, the volume and precision of mineral-related information in Afghanistan has been mapped using what is known as broad-scale hyper-spectral data–highly precise technologies deployed by aircraft that provide a three-dimensional profile of mineral deposits below the earth’s surface. That, in effect, allows geological experts to develop a picture of the country’s vast mineral wealth. Afghanistan could become a world leader in the minerals sector, which is in high demand today because of their use in solar panels, wind turbines and electric vehicle batteries as well as in defense applications.

Afghanistan’s Endowment of Primary Metals

Iron is the most abundant mineral resource in Afghanistan. Sedimentary iron ore deposits in central parts of Afghanistan are abundant. The Haji Gak Iron ore deposit contains 2 billion metric tons of ore at 63 to 69 percent iron. Total igneous iron ore reserves are estimated to provide an additional 178 million metric tons of ore at between 47 and 68 percent iron, including the Furmorah deposit, which is estimated to contain 35 million metric tons of ore. Additional discoveries of iron ore are likely. To put that in context, 2.2 billion metric tons of iron ore could be used to construct at least 200,000 replicas of Paris’s Eiffel Tower – the monument which stands at 1,063 feet and was constructed from 7,300 metric tons of iron in 1889.

Copper is the most substantial non-ferrous metal resource in Afghanistan. Total reserves of sediment-hosted copper are estimated at almost 30 million metric tons of which 12.3 million metric tons are known deposits and 16.9 million metric tons are probable reserves. These copper deposits are estimated to contain significant amounts of related metals (e.g. 7,670 metric tons of silver and 601,500 metric tons cobalt). In addition, estimates of porphyry-based copper in 12 areas of the country resulted in at least 8 undiscovered deposits containing an additional 28.5 million metric tons of copper, 724,010 metric tons molybdenum, and 682 kilograms of gold. Copper is essential for electrification and electric motors, and any policies to force decarbonization of the world’s economy will require enormous new amounts of copper as well as other materials.

Aluminum deposits are located in Zabul and Baghlan provinces and together contain 4.5 million metric tons of bauxite ore (50.5 percent alumina, 12 percent silica).

Afghanistan has significant amounts of other primary metals including gold, lead, zinc, tin, tungsten, and mercury. The largest lead/zinc deposit is in Kandahar province and contains 90,000 metric tons. Tin and tungsten are abundant but require further study to determine size. Mercury deposits in southwestern Afghanistan are estimated at 32,000 metric tons. Gold deposits are estimated to be close to 2,700 kilograms, with additional discoveries probable, along two main gold belts: Badakhshan southwest to Takhar and Ghazni southwest to Zabul, which can mint at least 300,000 gold pound coins each weighing eight grams.

Afghanistan’s Industrial Metals

Historically, Afghanistan was one of the world’s premier sources of lapis lazuli, emeralds and rubies. Most Afghan gemstones are found in the northeast part of the country.

Afghanistan’s rare earth minerals are estimated at 1.4 million metric tons, which includes a large deposit located at Khanneshin in southern Afghanistan. The country also contains lithium used in batteries and uranium used for nuclear fuel.

Afghanistan’s lithium deposits occur in dry lake beds in the form of lithium chloride; they are located in the western Province of Herat and Nimroz and in the central east Province of Ghazni. The geologic setting is similar to those found in Bolivia and Chile. The deposits are also found in hard rock in the form of spodumene in pegmatites in the north-eastern Provinces of Badakhshan, Nangarhar, Nuristan, and Uruzgan. A pegmatite in the Hindu Kush Mountains in central Afghanistan was reported to contain 20 percent to 30 percent spodumene.

There is an estimated 980,000 metric tons of chromium oxide, including 200,000 metric tons in the Logar Valley. Two known sulfur deposits in Bakhud and Badakhsan contain about 250,000 metric tons. Sulfur deposits in the Afghan-Tajik basin have a mean of 6 million metric tons of undiscovered sulfur. The largest deposit of metamorphic talc is found at the Achin deposit south of Jalalabad, measured at 1.25 million metric tons of talc and 31,200 metric tons of magnesite. The country also has an estimated 152 million metric tons of barite, a colorless mineral commonly used by the oil and gas industry in drilling. Other deposits contain asbestos, celestite, clay, and potash.

Building Materials

Afghanistan is rich in building materials. It is the eighth most mountainous country in the world. The Hindu Kush Himalayas span the northeast and contain various minerals and stones including marble, limestone and sandstone which are used widely in construction. Marble is versatile and commonly used in architecture and sculpture. Afghanistan has 1.3 billion metric tons of marble, which is enough to build 13,000 Washington Monuments – standing at 555 feet and 55 feet wide. Nangarhar province which borders Pakistan is known for its pink onyx marble which is among the most sought-after in the region. Limestone, an essential component of cement, and sandstone are common types of sedimentary rock used widely in construction. Afghanistan is estimated to have at least 500 million metric tons of limestone found mainly in the provinces of Badakhshan, Herat and Baghlan.

Hydrocarbon Resources

Afghanistan has extensive hydrocarbon resources. The two largest hydrocarbon basins are the Amu Darya and Afghan-Tajik basins, which encompass approximately 515,000 square kilometers within Afghanistan. Since the first oil field was discovered in 1959, over 150 million barrels of oil reserves and over 4,500 billion cubic feet of natural gas reserves have been identified in 29 fields in the Afghan portion of these basins. Only a small portion of these reserves have been developed. A 2011 study estimated undiscovered, but technically recoverable conventional resources of these two basins to be about 1.6 billion barrels of oil (220 million metric tons) and close to 440 billion cubic meters of natural gas.

In addition to these two large known hydrocarbon basins, there are smaller undiscovered hydrocarbon assets in three main basins located in western and southern Afghanistan: (1) the Tirpul Basin located in Western Afghanistan, extending from near Herat in the east to the Iranian border in the west, (2) the Helmand Basin, which is located in southwestern Afghanistan, southwest of Kandahar, and (3) the Katawaz Basin in northern Afghanistan. An initial assessment of the Tirpul basin estimates undiscovered conventional technically recoverable petroleum resources of 22 million barrels of oil and 1.3 billion cubic meters of natural gas. No initial assessments of the other two basins have been made.

Afghanistan has rich reserves of coal, which is primarily located from the northern provinces of Takhar and Badakhshan through the center of the country and towards the west in Hera. Afghanistan’s coal production increased by 63 percent between 2008 and 2018. Afghanistan’s coal mines, however, are known to be dangerous with outdated infrastructure leading to regular mine collapses and poisonous gas leaks, suffocating miners. China is by far the world’s largest producer of coal, producing half of the world’s output and 8 times as much as coal the United States. China also has significant coal mining expertise which Afghanistan might be able to seek to improve their mining operations.

The U.S. Mineral Situation

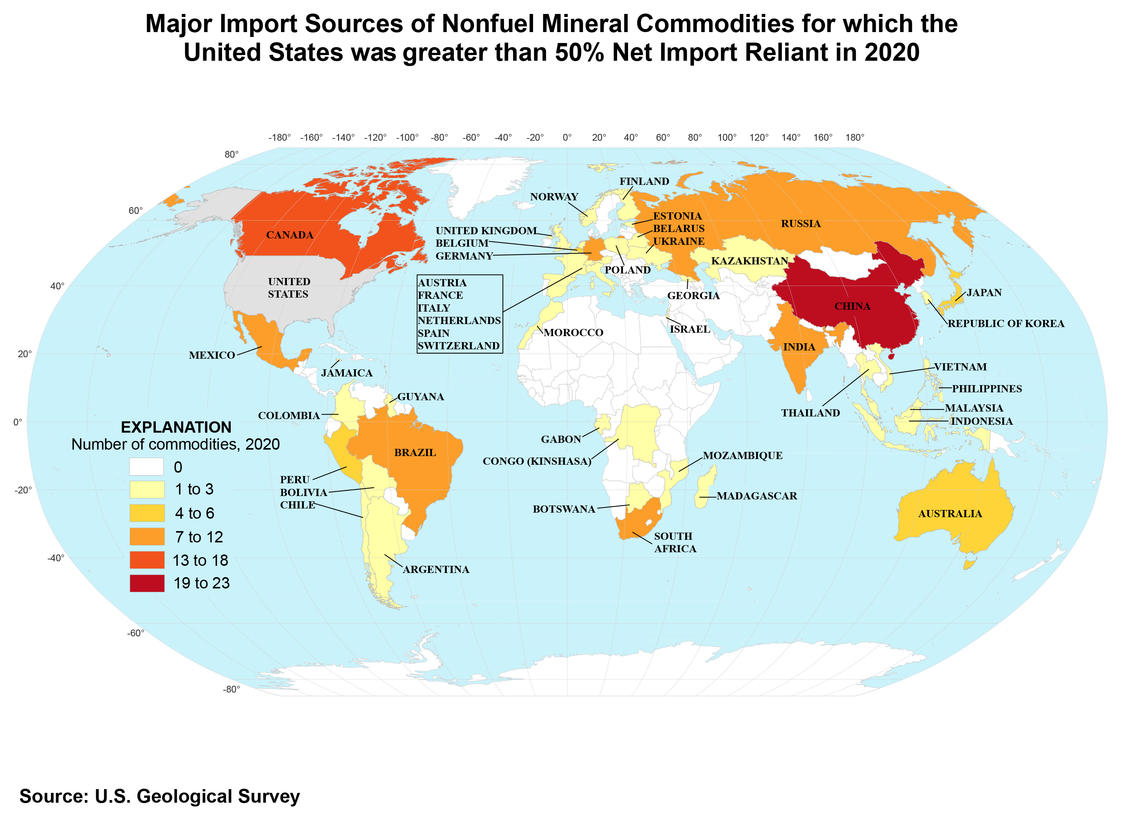

The Department of Interior published a list of 35 mineral commodities considered critical to the economic and national security of the United States. Of the 35 mineral commodities identified as critical, the United States lacks any domestic production of 14 and is more than 50 percent import-reliant for 31. This import dependence is a problem because it can put supply chains and U.S. companies and mineral users at risk, particularly when China dominates the mineral supply chains.

Examples of U.S. Critical Mineral Production, Mining, Processing, and Imports

Copper: The United States currently produces about as much copper as it uses. But, massive amounts of copper will be needed if the United States wants to increase its electric vehicle population and its electrification. Electric vehicles, for instance, use twice as much copper as vehicles with internal combustion engines.

In 2020, U.S. mine production of recoverable copper was estimated at 1.2 million tons, 5 percent less than in 2019. Arizona is the leading copper-producing State, accounting for an estimated 74 percent of domestic output. However, two new copper mines in Arizona are having trouble getting approvals. The Resolution copper mine in Oak Flat, Arizona, which can meet about 25 percent of U.S. copper demand, is currently under federal environmental review. But, last month, the House Natural Resources committee voted to include language in the reconciliation package to block the building of the Resolution copper mine.

The Rosemont copper mine in the northern Santa Rita Mountains in Arizona recently received a setback when Federal regulators rejected its mining company’s request to reduce critical habitat for jaguars deemed endangered on land that overlaps the footprint of the proposed mine. Hudbay Minerals Inc. has been working for more than a decade to get permission to open the mine that could create thousands of jobs and bring billions in economic development to the region. The mine only needed about 6 percent of the land that had been excluded for the jaguars.

The Pebble copper and gold mine, 100 miles from Bristol Bay, Alaska had its permit application rejected in November 2020 by the U.S. Army Corps of Engineers. In January, the Pebble Partnership requested the Army Corps of Engineers to reverse its denial of the proposed mine’s Clean Water Act dredge and fill permit. According to Northern Dynasty Minerals, the decision is receiving new oversight and is likely to take a year or longer. More recently, however, the Environmental Protection Agency indicated that, depending on the outcome in the courts, it would reopen a proposed veto of the Pebble mine, which, if finalized, would effectively block its development on state lands. That process, started under the Obama administration, culminated in a proposed veto of the mine in 2015, before Pebble had filed a permit application with the Army Corps of Engineers.

The PolyMet copper and nickel mine is located within Minnesota’s Mesabi Iron Range and would be the first copper-nickel open-pit mine in Minnesota. Besides holding significant deposits, the project has existing rail, roads, utilities and an established supplier network in a traditional mining area but is being held up by court and regulatory action despite having undergone more than a decade of thorough, public environmental reviews.

Nickel: The United States produces less than one percent of the world’s nickel and has 0.1 percent of its reserves. According to Rystad Energy, nickel could be one of the first battery minerals to experience shortages. By 2024, global demand for nickel is expected to increase from 2.5 million metric tons to 3.4 million metric tons, surpassing supplies. Tesla’s Elon Musk is also worried about nickel, indicating at the company’s Battery Day event in September, “Well, I’d just like to re-emphasize, any mining companies out there, please mine more nickel….Tesla will give you a giant contract for a long period of time, if you mine nickel efficiently and in an environmentally sensitive way.”

Lithium: The only lithium production in the United States is from a brine operation in Nevada. Lithium resources in the United States—from continental brines, geothermal brines, hectorite, oilfield brines, and pegmatites—are 7.9 million tons—about one-tenth of the rest of the world. Lithium consumption for batteries has increased significantly in recent years because rechargeable lithium batteries are used extensively in the growing market for portable electronic devices and increasingly are used in electric tools, electric vehicles, and grid storage applications. Today, most commercial lithium comes from deposits in Australia, Chile, Argentina, and China.

The Thacker Pass Lithium Mine is located in Humboldt County, Nevada, about 25 miles from the Nevada-Oregon border. The proposed mine could produce a quarter of today’s global lithium demand. The Bureau of Land Management (BLM) granted the project its final permit in January 2021. The mine’s development, however, is still on hold, as several permits are in legal challenges. The need for more lithium production can be recognized by the following: For Tesla to make 20 million electric vehicles in a year, it would need 165 percent of the total lithium produced worldwide in 2019.

Cobalt: Most Cobalt used in the United States is imported or produced from secondary tailings. In 2020, the nickel-copper Eagle Mine in Michigan produced cobalt-bearing nickel concentrate and in Missouri, a company produced nickel-copper-cobalt concentrate from historic mine tailings, i.e. secondary tailings.

Cobalt plays an important role in lithium-ion batteries — conducting heat to prevent them from catching fire in smart phones and electric vehicles. Cobalt is also used in other commercial, industrial and military applications, from jet engines to magnets. Today’s global cobalt supply chains are dominated by China. Most of the world’s cobalt is currently produced in the Democratic Republic of the Congo, where somewhere between 40 percent and 50 percent of its cobalt production is owned by Chinese companies. The cobalt is shipped to China for further processing where about two-thirds of the entire world’s cobalt refining takes place. Refining is an essential aspect of making cobalt usable.

The only mine in the United States set up to primarily produce cobalt is located in Idaho’s Lemhi County. The mine is permitted, under construction, and projected to open in mid-2022.

Rare Earth Elements: There are 17 rare earth elements that are used in the production of high-tech devices such as smartphones and computers, defense equipment such as radar systems and guided missiles, and energy technologies such as electric cars and wind turbines. While these elements are common in the earth’s crust, they are found in tiny concentrations and are mixed together, making them difficult to isolate. Often they are produced in conjunction with other ongoing mining projects as a byproduct of the mineralization, so the more mining that occurs generally, the more likely there are to be discovered elements like rare earths. Rare earth metals are often broken up into two categories according to their atomic weight: light and heavy. Heavy rare earth metals are less common, and some elements within the group are facing shortages as demand outpaces supply, which typically makes them more valuable than light rare earths, though they also have smaller markets.

From 1940 to 1990, the United States produced and mined its own rare earth minerals at the Mountain Pass mine in California. Until the 1980s the United States was one of the world’s largest producers, but was usurped by China, whose production increased by more than 500 percent since 1990 due to its substantial deposits and cheap labor. The cost of developing a rare earth mine can cost up to a half-billion dollars.

Rare earths supply in the United States currently comes from the Mountain Pass mine in California, which went back into production in the first quarter of 2018 after closing in the fourth quarter of 2015 due to China’s competitive prices, opposition from environmentalists, and U.S. environmental regulations escalating the cost of production. It was run by Molycorp before it went bankrupt and then was bought by MP Materials in 2017, which is partially owned by a Chinese company.

In 2020, the United States produced 38,000 metric tons of rare earths, up from 28,000 metric tons the previous year—a 36 percent increase, accounting for 16 percent of global production. The rare earth ore that the United States mines at Mountain Pass gets shipped to China to be upgraded into compounds and products which are then shipped back to the United States. The United States is a major importer of rare earth materials. According to the United States Geological Survey, the United States gets around 80 percent of its rare earth imports from China.

MP Materials, who mines Mountain Pass, is one of the three companies chosen by the Trump Administration’s Department of Defense to receive direct government funding for one of two separation plants to be built in the United States. The Pentagon awarded a Defense Production Act Title III grant worth $9.6 million to MP Materials so it can begin to refine the strategic minerals at its Mountain Pass, California, mine. The other separation plant is being developed by Australia’s Lynas teamed with Texas-based Blue Line. The Department’s $30 million investment will help fund construction of a light rare earth element (LREE) processing plant in Hondo, Texas. The United States will receive LREEs (and potentially heavy REEs in the future) from the company’s mine at Mount Weld in Western Australia. The materials will be shipped to America in an unprocessed state until Lynas’ REE processing facility in Kalgoorlie, Western Australia is operational. The Hondo plant should produce about 5,000 tons a year of rare earth products.

The United States currently has virtually no capacity to produce neodymium-iron-boron magnets—the most common end-use application for rare earths and one that is set for major growth as electric vehicles increase their market share. Rare earth magnets are also key inputs to many other applications from wind turbines to the F-35 fighter jets. General Motors had one of the two original patents for the magnets but sold the rights to China. Japan’s Sumitomo sold the other patent to Hitachi, which is now the primary supplier outside of China.

Rare Element Resources Ltd. was recently awarded $21.9 million for the engineering, construction and operation of a rare earth separation and processing demonstration plant to be located in Upton, Wyoming—an award begun under the Trump Administration. The company anticipates that the demonstration plant design, permitting and licensing, and construction will be finalized within a period of 18 to 26 months. Operations to process and separate rare earth elements from the previously stockpiled Bear Lodge Project ore are expected to follow for an additional 12 to 14-month period. The total timeline for the demonstration project is 40 months. The award represents approximately one-half of the total estimated costs for the project, with the remainder of the funding to be secured by the company. The planned demonstration plant will produce commercial-grade neodymium/praseodymium rare earth high-purity oxide used in producing high-strength permanent magnets utilizing proprietary processing and separation technology.

China’s Dominance in Critical Minerals Supply Chain

China dominates the global supply chain for critical minerals. Due to its cheap coal generation, China processes and refines most of the world’s critical minerals. Where it does not have domestic raw materials, China invests in them around the world—most notably in Africa, South America and Asia. As mentioned, they are even invested in the Mountain Pass mine in the United States.

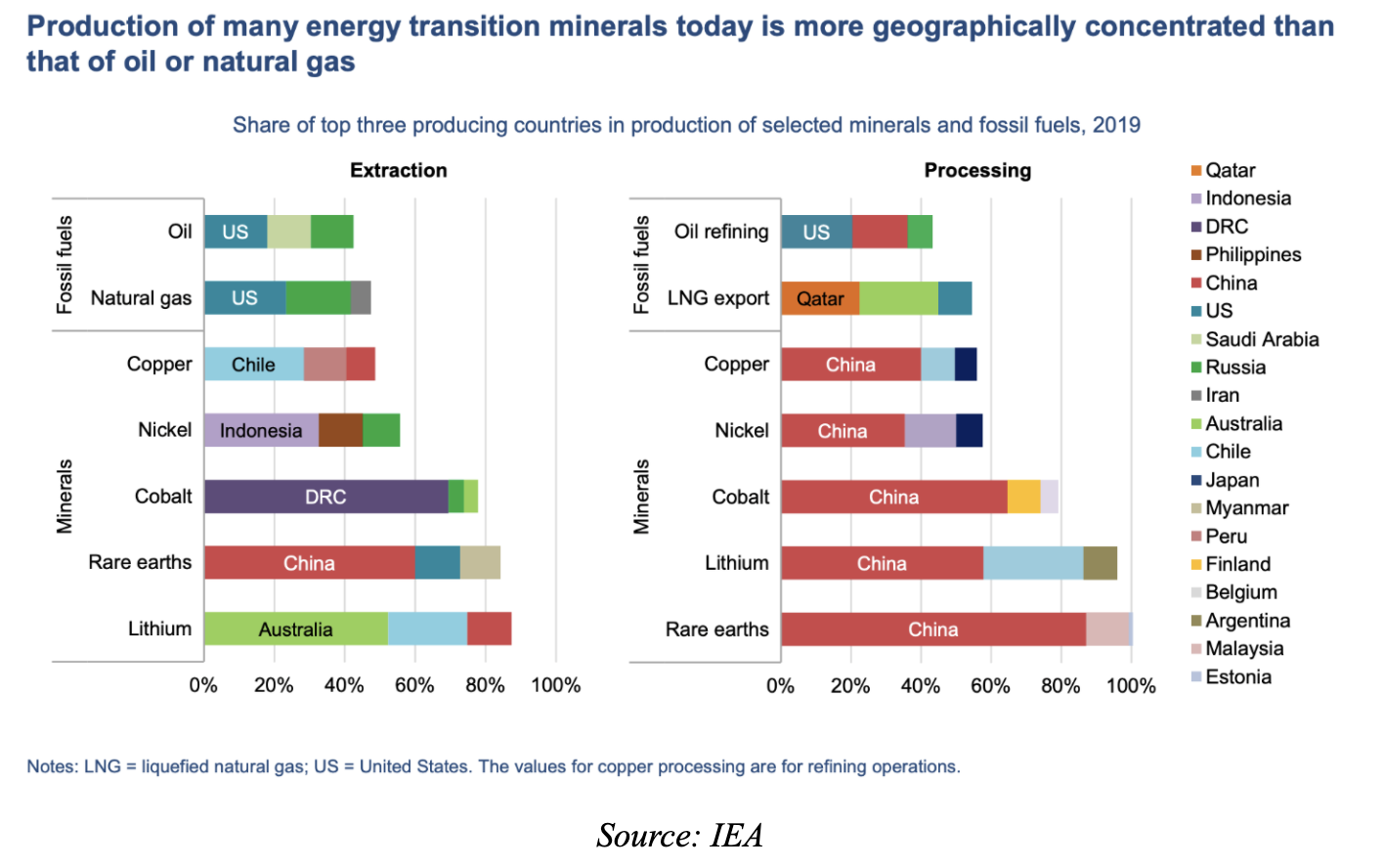

The world’s top three producing nations control well over three-quarters of the global output of lithium, cobalt and rare earth elements. In 2019, the Democratic Republic of the Congo and People’s Republic of China were responsible for 70 percent and 60 percent of global production of cobalt and rare earth elements, respectively. However, for processing operations, China’s involvement is even higher. China’s share of refining is around 35 percent for nickel, 50 to 70 percent for lithium and cobalt, and almost 90 percent for rare earth elements. Chinese companies have made substantial investment in overseas assets in Australia, Chile, the Congo and Indonesia. China’s investments and huge role in processing and refining critical minerals increase the risks that could arise from physical disruption, trade restrictions or other global developments. For example, in 2010, China cut its rare earth exports by 40 percent and cut off supplies to Japan over a territorial dispute, causing prices to soar.

In 2019, Chinese chemical companies accounted for 80 percent of the world’s total output of raw materials for advanced batteries. China controls the processing of almost all of the critical minerals–rare earth, lithium, cobalt, and graphite. Of the 136 lithium-ion battery plants in the pipeline to 2029, 101 are based in China. The largest manufacturer of electric vehicle batteries with a 27.9 percent market share is China’s Contemporary Amperex Technology Co. Ltd. founded in 2011.

In addition to rare earths, the manufacturing of lithium-ion batteries depends on key materials like graphite, cobalt, manganese and nickel. In 2020, China produced 59 percent of the world’s graphite, slightly less than the 64 percent produced in 2019, and has 24 percent of the world’s reserves.

China has only 1 percent of the world’s cobalt reserves, but China owns eight of the 14 largest cobalt mines in the Democratic Republic of Congo and they account for about half of the country’s output. China dominates in the processing of raw cobalt, where raw material is turned into commercial-grade cobalt metal. An American company once owned the largest mine in the Congo, but sold it in 2016 to China Molybdenum.

China is among the top five countries with the most lithium resources and it has been buying stakes in mining operations in Australia and South America where lithium reserves are located. China’s Tianqi Lithium owns 51 percent of the world’s largest lithium reserve in Australia. In 2018, the company became the second-largest shareholder in Sociedad Quimica y Minera—the largest lithium producer in Chile. Another Chinese company, Ganfeng Lithium, has a long-term agreement to underwrite all lithium raw materials produced by Australia’s Mount Marion mine—the world’s second-biggest, high-grade lithium reserve.

China mines only 6 percent of the world’s manganese, but refined 93 percent of it in 2019. Most manganese supply is concentrated in South Africa, followed by Australia and Gabon. North America produced zero manganese.

Unlike the other minerals, the nickel mining industry is fairly evenly spread around the world, but China controls most of the chemical processing. Electric vehicles account for about 7 percent of overall nickel consumption today, but that would skyrocket under plans to electrify vehicles as proposed by President Biden.

Conclusion

Afghanistan’s mineral wealth is enormous and ripe for investment. The opportunity is there for China or Russia to capture some of the country’s mineral wealth as they are befriending the Taliban, who is now in control of the country’s resources. Of the 35 critical minerals identified by the Department of Interior, the United States lacks any domestic production of 14 and is more than 50 percent import-reliant for 31 of them, placing the United States at risk for trade disruptions and other national security risks.

China has the willingness and capability to pursue development of the necessary energy and minerals to retain global dominance. China’s “Silk Belt and Road” initiative links and further strengthens trade relations with other nations, most notably for their natural resource wealth. Linking to developing countries by both surface roads and maritime infrastructure, China’s initiative extends credit to nations with little economic base who are rich in natural resources that China wishes to develop for future manufacturing, economic and national security interests. China offers infrastructure investments these nations require, in return for commitments of natural resources in payment. The “silk belt,” however, may prove more like silk handcuffs for those nations accepting of China’s overtures.

China’s commitment and capabilities to develop the massive infrastructure necessary for economic growth is clear. For example, during just 3 years of the Obama/Biden Administration, China used 140 percent of the cement used by the United States during the entire 20th Century. China makes over half the world’s steel and uses over half the world’s coal, almost nine times that of the United States. Clearly, China has the means and more importantly, the will, to develop these resources and spread influence throughout the globe.

Afghanistan’s massive natural resources, need for revenue and its close proximity to China make it an obvious area of interest for China. Afghanistan enjoys the potential for 23 gigawatts of hydroelectric generation, the construction of which China dominates in the world. China currently has 370 gigawatts of hydroelectric capacity, compared to 102 gigawatts in the United States. The combination of enormous mineral wealth and cheap potential hydroelectric power necessary for development makes the prospect of long term mineral supplies from Afghanistan an obvious attraction to the People’s Republic of China, which dominates the market for minerals necessary for the world’s transition into “green energy.”

Further, to meet the Biden Administration goals, substantially more critical minerals will be needed. While the United States is largely dependent on imports currently, it could secure these resources by opening mines in the West that are currently having trouble receiving final approvals. Without increasing the U.S. extraction and processing of these critical minerals, the United States will become more dependent on China for them, as China dominates their supply chains. This makes the United States much more dependent on China than it ever was on the Middle East for oil. The United States imports about 80 percent of its rare earth requirements from China, compared to a high of 23 percent of imported oil from the Middle East in 2001.

_____

Download a full PDF of the testimony here.

_____