With the twin blows of the Saudi-Russian oil production increases and the worldwide coronavirus pandemic causing a historic drop in oil demand, energy producers are facing the lowest prices on record, and the People’s Republic of China (PRC) is buying as much oil as possible at rock-bottom prices. While China’s numbers are not readily transparent because they consider energy to be critical to their national security, we attempt to give a picture based upon numbers that have appeared in public places. It is clear that China is using the opportunity to purchase low-cost oil stemming from the coronavirus.

In September, prior to when the reports of the coronavirus began in Wuhan, the head of development and planning at China’s National Energy Administration said the country had total oil reserves, including strategic stockpiles, for about 80 days. While the exact amount of stored crude oil was not disclosed, it was expected to be around 788 million barrels, based on China’s average daily imports of 9.85 million barrels per day for the first eight months of 2019.

In September, the head of development and planning at China’s National Energy Administration also said the country will complete building the second phase of its strategic oil storage in 2020. In December, state-owned China National Petroleum Corp. indicated that the government intends to boost the capacity of its strategic petroleum reserves to 503 million barrels by the end of this year, an indicator of the maximum amount the government can store.Lo

China’s filling up of its strategic reserves and stockpiles could help somewhat with the demand destruction from country lockdowns due to the coronavirus pandemic and the price war between Saudi Arabia and Russia.

China’s Oil Imports

China’s crude oil imports have remained robust, increasing by 4.5 percent in March from a year earlier, despite refiners’ output of oil products falling 6.6 percent. Since Chinese refiners were probably producing more petroleum products than the economy needed, they, like refiners in other countries, have plenty of both crude and finished petroleum products such as gasoline. Emerging from the coronavirus lockdown, China’s oil refiners are buying ultra-cheap spot cargoes from Alaska, Canada, and Brazil, taking advantage of the deep discounts at which many crude grades are being offered to China due to non-existent demand elsewhere. The discounts of these spot cargoes vary between $5 and $9 a barrel to Brent, so Chinese buyers are able to stock up on crude oil priced at $15 a barrel or less.

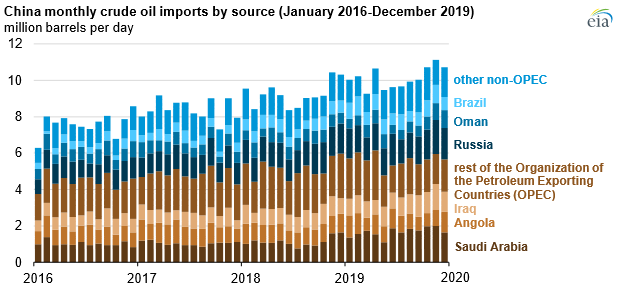

To complicate market matters, this month, Saudi Arabia offered deep discounts to its customers in Asia—its largest market. In 2019, China’s crude oil imports from Saudi Arabia were 1.7 million barrels per day, or 16 percent of total crude oil imports. Russia was the largest non-OPEC source of China’s oil imports in 2019, averaging 1.6 million barrels per day—15 percent of its total imports. Brazil overtook Oman as the second biggest non-OPEC source of China’s oil imports, averaging 0.8 million barrels per day for the year. The United States oil imports to China dropped in 2019 due to trade war tensions that had China imposing tariffs on U.S. goods, including crude oil and liquefied natural gas. In 2019, U.S. oil exports to China averaged 133,000 barrels per day.

Several factors contributed to China’s increase in crude oil imports. China’s petroleum demand outpaced its domestic oil production. China’s domestic crude oil production averaged 4.9 million barrels per day in 2019—essentially flat since 2012, averaging between 4.8 and 5.2 million barrels per day annually. China’s consumption of petroleum products in 2019 increased by 0.5 million barrels per day to 14.5 million barrels per day, resulting in China’s net imports of crude oil increasing to 9.6 million barrels per day.

Also affecting China’s crude oil imports in 2019 was the strategic stockpiling of crude oil and increases in commercial crude oil inventories following refinery expansions, which require increases in storage as refineries begin operations. Last year, China’s refinery capacity increased by 1.0 million barrels per day, with two new refining and petrochemical complexes coming online—each with capacities of 0.4 million barrels per day. As a result, the country’s refinery processing also increased to an all-time high in 2019, averaging 13.0 million barrels per day.

EIA estimates China’s domestic petroleum and other liquids consumption averaged 13.9 million barrels per day in the first quarter of 2020, a decline of 0.6 million barrels per day from the 2019 annual average as a result of the Chinese government’s containment measures related to the outbreak of the 2019 coronavirus outbreak. Despite lower demand, China increased its oil imports from Saud Arabia and Russia. For the first two months of 2020, China’s crude oil imports from Saudi Arabia increased 26 percent, while oil purchases from Russia increased by 11 percent. The United States did not export any crude oil to China in January and February this year. However, U.S. oil exports to China are likely to pick up later this year as China starts to grant tariff waivers on certain U.S. products including crude oil.

Conclusion

China, the world’s largest oil importer, is seizing the opportunity of ultra-low oil prices to fill up its strategic petroleum reserve and commercial stockpiles. Whether it will help the demand destruction from the coronavirus pandemic and the Saudi/Russia price war is unclear. But, buying extra barrels of crude oil is at least some help for producers. The United States is opening its strategic petroleum reserve to companies that would like to lease storage space, which may also help energy producers.

The PRC views energy as vital to its national and economic security and is taking the opportunity provided by the coronavirus pandemic to strengthen its energy position.