The International Energy Agency (IEA) has released its World Energy Outlook (WEO) 2019, providing forecasts of global supply and demand for energy through 2040. The report contains three scenarios:

- The Current Policies Scenario forecasts the global energy future when the world continues along its present path, without any additional policy changes.

- The Stated Policies Scenario that includes each country’s announced policy intentions and targets.

- The Sustainable Development Scenario that forecasts a path that meets sustainable energy goals, aligned with the Paris Climate Agreement, “requiring rapid and widespread changes across all parts of the energy system.”

The agency focuses on the Stated Policies Scenario where energy demand increases by 1 percent per year to 2040. Low-carbon sources supply over half of the new demand, and natural gas supplies a third. Despite these gains towards less carbon-emitting fuels, the expanding global economy and growing population results in slowing increasing carbon dioxide emissions through 2040.

Oil and Natural Gas

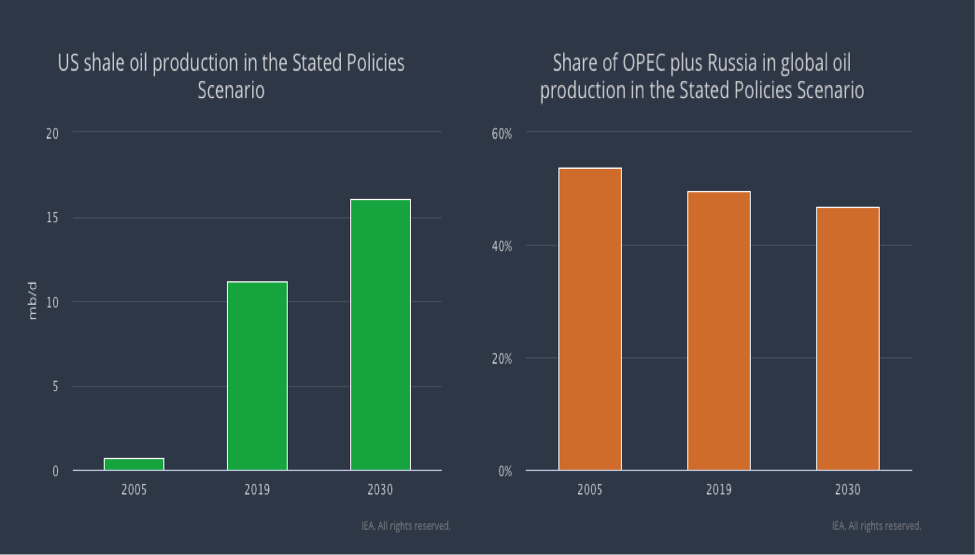

Oil demand growth is expected to slow after 2025 and to flatten out in the 2030s, while natural gas demand continues to grow. In the States Policies Scenario, the United States is expected to account for 85 percent of the increase in global oil production to 2030 and for 30 percent of the increase in natural gas production, despite the rate of U.S. production growth slowing in the forecast from its pace in recent years. By 2025, U.S. shale oil and natural gas production is expected to overtake total oil and natural gas production in Russia.

Oil demand for long-distance freight, shipping and aviation, and petrochemicals is expected to increase. IEA expects oil use in passenger cars to peak in the late 2020s due to fuel efficiency improvements and fuel switching, mainly to electricity. Due mostly to projected lower battery costs, electric cars in some markets become cost-competitive, on a total-cost-of-ownership basis, with conventional cars.

Greater U.S. oil production—increasing to 19 million barrels a day by 2030—is expected to decrease the share of the global oil market held by OPEC members and Russia to 47 percent in 2030 from 55 percent in the mid-2000s. Despite the change in market share, the world will still rely heavily on oil supply from the Middle East. The region is expected to remain the largest net provider of oil to world markets and an exporter of LNG. The Strait of Hormuz remains an important artery for global energy trade, especially for Asian countries that rely heavily on imported fuel—80 percent of international oil trade is expected to flow into Asia in 2040, due largely by a doubling of India’s import needs.

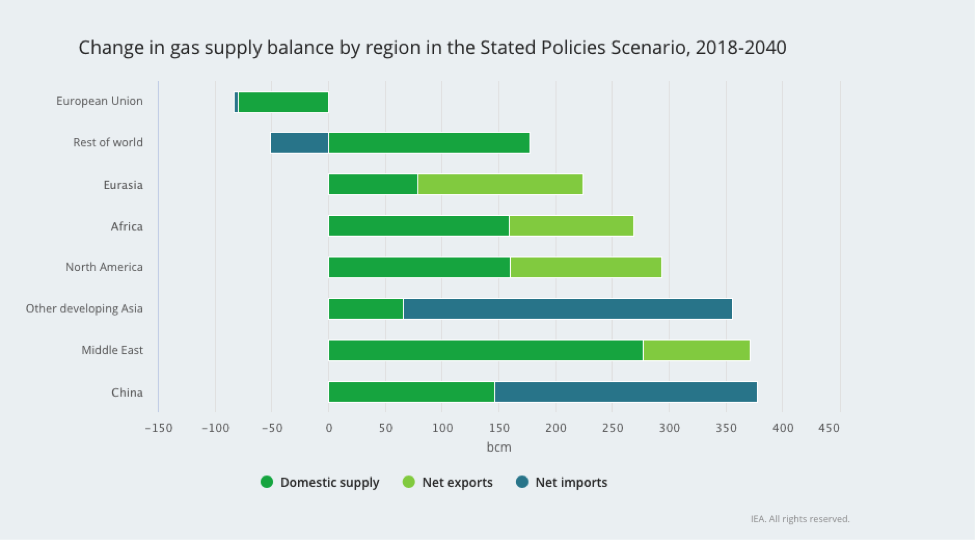

Demand for natural gas has been growing as a fuel for industry and for residential consumers, spurring a worldwide wave of investment in new LNG supply and pipeline connections. IEA expects 70 percent of the increase in Asia’s gas use comes from imports—mostly LNG.

Electricity

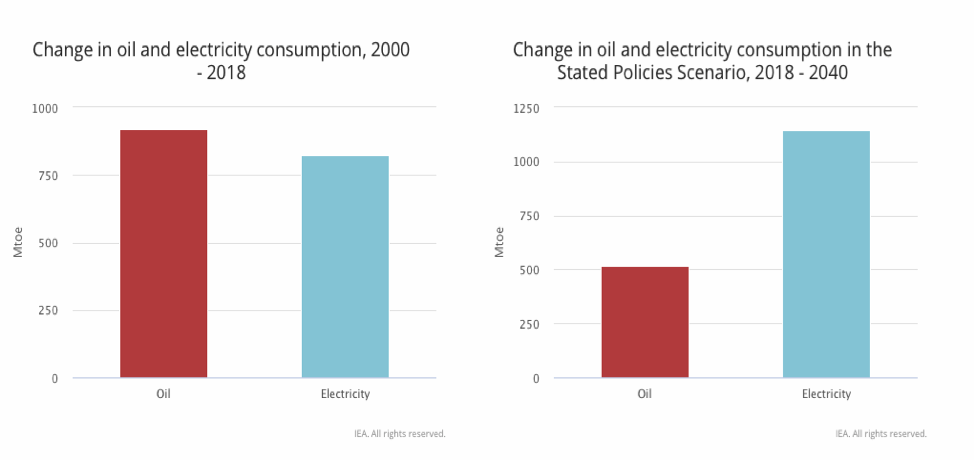

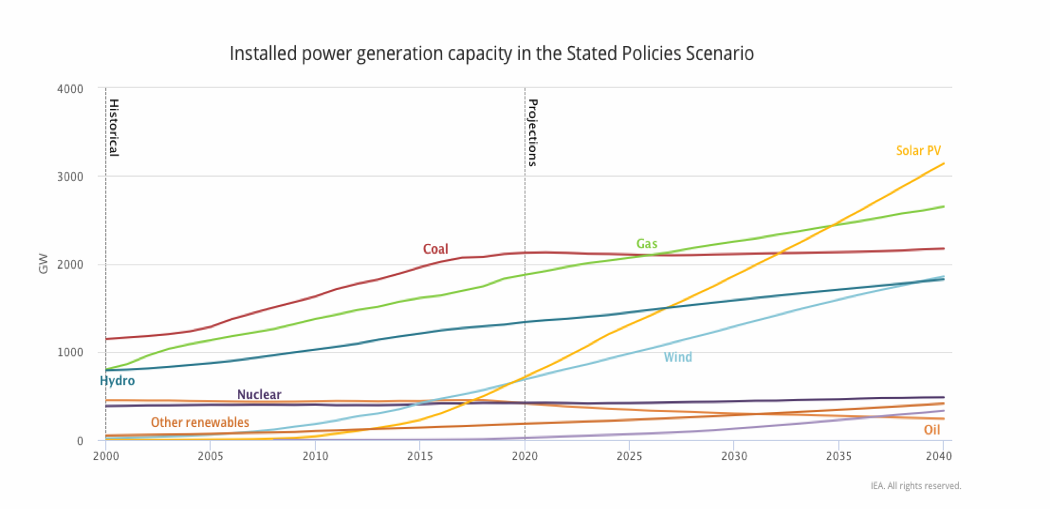

In the Stated Policies Scenario, electricity use grows at over double the pace of overall energy demand. Growth in electricity use is led by industrial motors, mostly in China, followed by household appliances, cooling, and electric vehicles. The share of electricity, less than half that of oil today, is expected to overtake oil by 2040. Wind and solar PV are expected to provide over half of the additional electricity generation to 2040, which enables renewable energy (including hydroelectric) to overtake coal in the global power generation mix in the mid-2020s.

IEA expects solar PV to become the largest component of global installed capacity in the Stated Policies Scenario. By 2040, low-carbon sources provide over half of total electricity generation with hydropower expected to have a 15 percent share of total generation and nuclear providing an 8 percent share.

IEA sees offshore wind expanding due to cost reductions and experience gained in Europe’s North Sea and because it has higher capacity factors than solar PV and onshore wind due to its larger turbine size that reach higher wind speeds offshore. IEA expects offshore wind projects to attract a trillion dollars of global investment to 2040.

Annual electric-vehicle sales are expected to increase to over 30 million in 2040 from 2 million today. The doubling of sales of sport-utility vehicles over the past 10 years is significant to the rate of growth in electric vehicle demand because SUVs are larger, heavier, less fuel-efficient, and harder to electrify. Conventional SUVs consume 25 percent more fuel per kilometer than medium-sized cars. If the popularity of SUVs continues to increase as with recent trends, it could add another 2 million barrels per day to IEA’s projection for 2040 oil demand.

The rate at which battery costs decline is an important variable in forecasting electric car sales. In the Stated Policies Scenario, a major reduction in battery costs is expected to result in about 120 gigawatts of storage installed by 2040.

Conclusion

IEA provides three scenarios to indicate the difference country policy decisions make to the forecasts of the world’s future energy mix and the rate at which a zero-carbon future can be attained. However, neither the Current Policies Scenario nor the Stated Policies Scenario achieve that goal. Besides government policies, other factors that affect the world’s energy future are consumer preferences, technological advancement, and rate of price declines.