The International Maritime Organization—the United Nations body that sets standards for the global marine industry—is requiring ships to reduce the sulfur content of their exhaust by over 85 percent by 2020. Ship owners can meet the requirement by switching to a lower-sulfur fuel or by installing scrubbers in their smokestacks. The emission mandate will affect at least 60,000 vessels and cost the industry up to $50 billion. This rule will be the biggest change in ship propulsion since the maritime industry moved from coal to heavy oil early in the 20th century. A significant jump in freight rates is expected with customers bearing, at least partially, the higher costs. Over the past five years, shipping costs have been hovering below break-even levels due to a glut of ships and price wars.

Since the 1970s, the volume of goods traded by sea has increased by 300 percent, according to the United Nations Conference on Trade and Development. Ships now carry more than 80 percent of all goods traded. In 2017, the United Nations Conference on Trade and Development predicted that seaborne trade volumes would increase by around 3.2 percent each year until 2022.

Emission Rule Change

The new formulation of low-sulfur fuel is supposed to replace bunker fuel, which has 3.5 percent sulfur content—above what is allowed for automobile gasoline in the United States. As a result, the shipping industry contributes about 13 percent of global sulfur-dioxide emissions. The new maritime fuel will be limited to a sulfur content of 0.5 percent.

The cost of the low-sulfur fuel is not currently known. Shipping executives expect to pay 25 percent to 40 percent more than they pay for bunker fuel because of the higher cost of producing the low-sulfur fuel and setting up new distribution sites. Prices for the most common bunker fuel are currently around $440 per metric ton.

Compliance Options

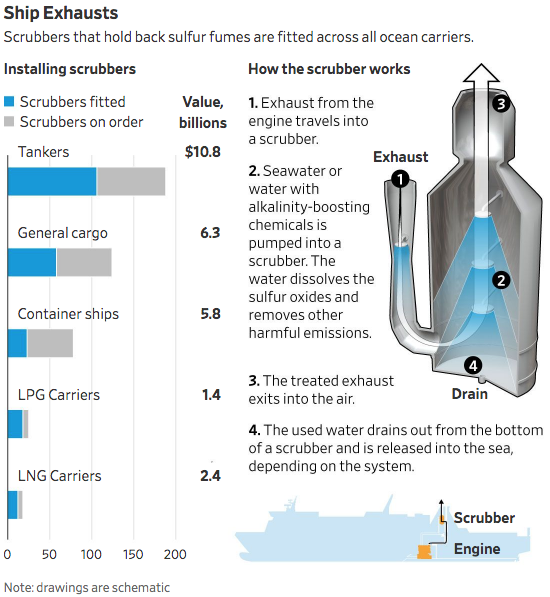

Ship operators can either use low-sulfur fuel or continue using bunker fuel and add scrubbers that trap sulfur in the exhaust system before the sulfur emissions are released in the atmosphere. The scrubbers cost $3 million to $10 million per ship. Carriers installing scrubbers believe they can recover the cost in about two years by continuing to use bunker fuel instead of the more expensive low-sulfur fuel.

Ships with scrubbers are still in the minority with 360 ships having installed scrubbers as of August 2017 and 494 vessels by May 2018 out of a total of around 60,000 commercial vessels on the world’s seas.

There are fears, however, that there will be an insufficient supply of low-sulfur fuel. Despite these fears, about 90 percent of the global fleet is expected to burn the low-sulfur fuel. Some oil companies have indicated that there will be ample supply at major ports.

Differences in refining operations and blend types for the new low-sulfur fuels appear to pose risks for vessels that travel to different regions and mix fuels. Since there are many ways that refineries can formulate low-sulfur blends, vessel owners and operators worry that there may be incompatible fuel blends at the ports, which will cause problems for their engines.

Another longer-term option is to use liquefied natural gas (LNG) as the shipping sector’s fuel. LNG produces almost no sulfur dioxide or particle matter emissions and generates about 90 percent less nitrogen oxides. Burning LNG also produces 20 to 25 percent less carbon dioxide. However, challenging infrastructure issues exist regarding the use of LNG, and its use is limited to specially and newly built vessels.

Further Impacts

As the price of low-sulfur fuels increases to meet the new demand, the prices of diesel and jet fuel will also increase, making the impact of the regulation go beyond the shipping and refining industries. The increase in the price of diesel means the cost of moving goods on trucks within a country will become more expensive. And, because the price of jet fuel is closely linked to the new shipping fuels, airline profits will also be affected. As airlines adjust their fares for higher jet fuel prices, passengers will be impacted by the fare increases. Some of these costs are likely to be reduced over time as fuel producers pay for the new equipment necessary to manufacture the fuels.

One energy economist indicated that the rising price of low-sulfur fuel and the ripple effects that followed could potentially decrease global GDP in 2020 by 1.5 percent, although others disagree that the impacts will be that large.

Conclusion

A new rule affecting the shipping industry will require ships to use fuel with a sulfur content of no more than 0.5 percent beginning in January 2020, which is a significant reduction from the fuels used currently. The change will be costly to the shipping industry, raising freight rates. It will also raise the price of jet fuel because its price is aligned with diesel prices. As a result, airfares will likely increase. There are significant costs associated with changing the fuel regime locally, nationally, or internationally. Policymakers should study those costs very closely to ensure that the goals of affordable fuels and environmental protection can work in conjunction with one another.