As someone who teaches the history of economic thought, I am happy whenever the hot news involves the ideas of 19th century French economists. However, I was dismayed that the reaction to Rick Perry’s remarks about supply and demand included the casual dismissal of the legacy of J.B. Say. As I’ll argue in the present post, I think the elite commentary was unfair to both Say and Perry.

Perry’s Statement

The controversy started when Secretary of Energy Rick Perry reportedly said at a coal-fired power plant in West Virginia, “Here’s a little economics lesson: supply and demand. You put the supply out there and the demand will follow.”

The smug guffaws from social media and news outlets soon followed. For example, Eugene Scott at CNN wrote an article titled, “Touting coal, Perry confuses supply and demand.” The article continued:

“It’s an old assertion named Say’s Law and it’s wrong. It’s that simple,” said Doug Holtz-Eakin, president of the American Action Forum, a center-right think tank. “Supply does not automatically create its own demand.”

“There are two separate entities that have their own determinants and then they interact to deliver prices,” he added.

The late French economist Jean-Baptiste Say argued that supplying beyond demand never occurred because demand would always match the supply. But Holtz-Eakin, a former Congressional Budget Office director, said that is a misunderstanding of basic economics.

It’s precisely because of this glib dismissal of the work of J.B. Say that I feel compelled to write. Correctly construed, “Say’s Law” is correct and sheds much light on how economies operate. Furthermore, I think the critics are (intentionally?) misunderstanding Perry’s straightforward point.

Say’s Law

Others have written more elaborate defenses of Say in the wake of the controversy, but here’s the argument in a nutshell: Say was arguing against the common belief that a recession was caused by a “scarcity of money” or a “glut of goods.” It’s understandable that a merchant would think a general downturn in the economy was due to consumers not spending enough money, but Say showed that this view was untenable.

It doesn’t make sense, Say argued, to worry about a general “overproduction” leading to a depression, because that’s the mark of prosperity. For example, Americans currently enjoy a much higher standard of living than Americans in the year 1817. Why is that? Well, it’s because we produce so much more: of food, clothing, housing, entertainment, etc. It would be nonsense to argue, “We are in awful shape in 2017—businesses can’t sell their products—because we’re just producing too much stuff, in every sector.”

Say’s insight was to abstract away from money as a medium of exchange, and to look at the more fundamental transactions. When a farmer buys bread from the baker, yes, in the real world he spends money to do so. But where does the farmer get the money in the first place? Why, by selling his farm products (perhaps eggs). From this perspective, the farmer ultimately is able to “demand bread” only because he previously “supplied eggs.” This is the sense in which Say argued that our demand for products is ultimately constituted by our supply of products.

“Supply Creates Its Own Demand”

It was rhetorically necessary for John Maynard Keynes, in his famous 1936 work, to dismiss the laissez-faire approach as obsolete in favor of his more “general theory” of employment. So Keynes put the phrase “supply creates its own demand” into the mouth of Say and his disciples, and then proceeded to knock down the caricature.

Interpreted literally, the phrase is obviously incorrect. As Rep. Ted Lieu argued to the delight of tens of thousands of Twitter followers:

Source: https://twitter.com/tedlieu/status/883047148698296320

But that’s not (of course) what J.B. Say was claiming. Look, if we are going to be uncharitable, I can do the opposite trick and mock all the people who said Perry had confused supply and demand. All the people who argued, “No Perry, the real rule is that consumers have to demand a product and then business will supply it,” are equally ignorant. After all, I hereby announce my willingness to spend up to $10,000 on a vacation to Mars. There’s my demand, entrepreneurs. Now where’s the supply of that service? Hmm, so much for Keynesian demand-side explanations…

Of course, I’m being tongue-in-cheek. There is truth to the proposition that “demand creates supply” if we interpret it charitably. But on the other hand, there is truth to the proposition that “supply creates demand” if we interpret it charitably. And a more sophisticated explanation would say that supply and demand interact.

To sum up, what J.B. Say actually wrote about the “law of markets” was quite sophisticated, and it would be very refreshing if today’s pundits and policymakers took 20 minutes to review his arguments. Say never wrote “supply creates its own demand,” and he never endorsed the obviously false proposition that a business putting out any product whatsoever will automatically find buyers.

What Did Perry Mean?

Now if J.B. Say didn’t deserve the recent ridicule of the pundits, what about Rick Perry?

Contrary to most commentators, I don’t think Perry was actually invoking Say’s Law. (Disclaimer: I have no special inside information here, I am reacting to the official news accounts.) My guess is that Perry was simply pointing out that if the federal government would get out of the way of coal operations, then the fuel would be used more.

This is yet another example where the climate interventionists are trying to have it both ways. On the one hand, they want not just a carbon tax but also specific mandates against coal-fired power plants. On the other hand, when critics complain about the loss of coal jobs, the interventionists say that the government has nothing to do with it: it’s all about productivity and competing fuel types.

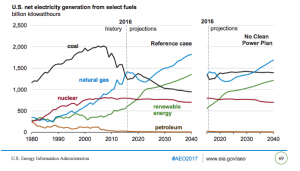

Well, the EIA itself agrees that the EPA’s so-called “Clean Power Plan” is reducing the output from coal-fired power plants. (After all, that’s what its purpose is.) Here’s a chart from a recent EIA long-term outlook:

As the chart indicates, EIA forecasts that electricity generation from coal will plummet under the “Clean Power Plan,” but will remain stable if the CPP is repealed. Yes, the “fracking” boom in natural gas certainly plays a role in the fortunes of coal, but it would be ridiculous to assume that an EPA program specifically designed to penalize coal isn’t affecting the business prospects of coal producers.

Conclusion

J.B. Say was an important economist who taught us an important lesson about the operation of markets. Subsequent economists, eager to justify interventions in the name of fighting depression, have caricatured “Say’s Law” into something that Say never wrote. More recently, Rick Perry seemed to be making the obvious point that government impediments to coal production were restricting coal production, but the critics instead chose to mock him (and Say) for a doctrine he obviously wasn’t pushing.