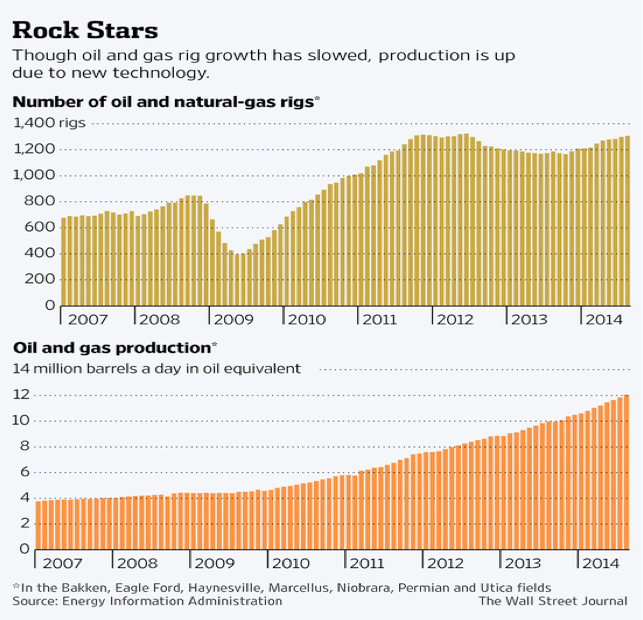

A decade ago, it was believed that wells that had been hydraulically fractured would have a short life span, that the oil and gas industry would need to keep drilling to keep output up, and that the oil and gas boom would dissipate fairly quickly. But, recent data show that not to be the case. Production is still increasing despite a slowing in oil and gas rig growth, which indicates that the early skeptics who thought this was a temporary production boom requiring numerous new wells to keep output up were wrong. Rather than drilling in new shale formations, oil and gas producers are finding ways to get more out of the formations they have already found.[i]

Through the use of hydraulic fracturing, the United States has become the world’s largest oil and gas producer, keeping natural-gas prices low for U.S. consumers, and keeping crude oil prices in check around the world. Without the U.S. oil production boom, it is predicted that oil prices would be around $150 a barrel, rather than $100 per barrel. If this estimate is correct, the United States is saving the global economy about $4.9 billion a day in oil spending.[ii]

Source: Wall Street Journal, http://online.wsj.com/articles/fracking-gives-u-s-energy-boom-plenty-of-room-to-run-1410728682

North American Oil Production Makes Up for World Market Disruptions

It is estimated that without the additional supply from the United States, the world oil market would be about 3 million barrels short of the over 90 million barrels of oil it currently demands. That shortage would drive up the price of oil to well over $100 per barrel.

Since 2011, U.S. oil production has increased by almost 3 million barrels a day, with total production at 8.5 million barrels in July 2014, due to hydraulic fracturing and directional drilling in shale oil fields. That is less than the volume of oil production that has been disrupted in world markets from the Arab Spring and follow-on uprisings, the chaos in Nigeria, Iran sanctions, Russia’s invasion of Ukraine, and unrest in Iraq. About 3.5 million barrels of oil a day have been off the market since last fall. The increase in U.S. oil production coupled with the increase in Canadian oil production of around 1 million barrels per day has made up for these oil disruptions.[iii]

Drilling Productivity Continues to Increase

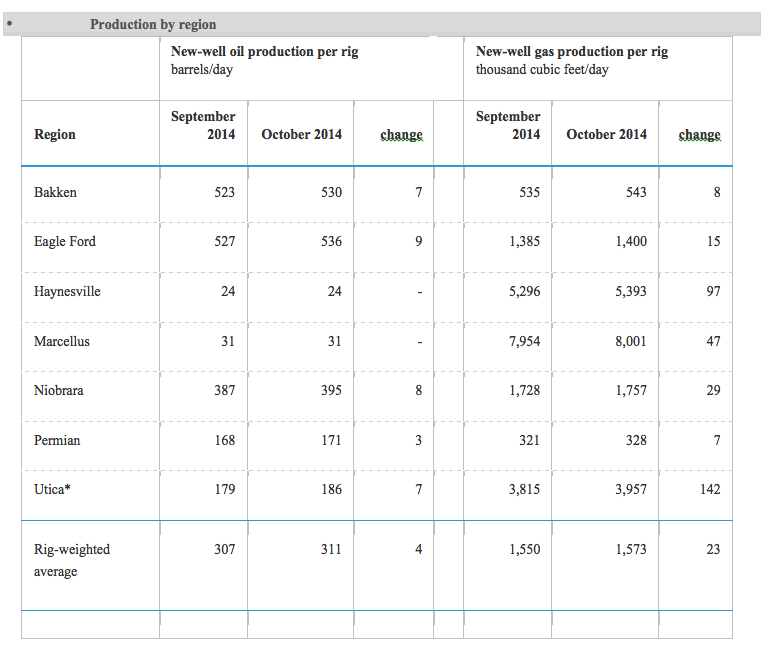

According to the Energy Information Administration (EIA), the number of rigs drilling in the United States is basically flat, but production continues to increase, and this drilling productivity shows no sign of slowing. U.S. production of tight oil, of which shale oil is a component, increased from less than 1 million barrels per day in 2010 to more than 3 million barrels per day in the second half of 2013.

[iv]Source: Energy Information Administration, http://www.eia.gov/petroleum/drilling/

[iv]Source: Energy Information Administration, http://www.eia.gov/petroleum/drilling/

EIA’s Annual Energy Outlook 2014 expects growth in tight oil production, which includes oil from shale formations, to continue. EIA projects that the production of crude oil and lease condensate will increase from 6.5 million barrels per day in 2012 to 9.6 million barrels per day in 2019, 22 percent higher than in the agency’s previous year’s forecast, as producers locate and target the sweet spots of plays currently under development and find additional tight formations that can be developed with the latest technologies. After 2019, EIA projects that domestic crude oil production will decline, but remain at or above 7.5 million barrels per day through 2040. Tight oil production increases from 2.3 million barrels per day in 2012 (35 percent of total crude oil production) to 4.8 million barrels per day in 2021 (51 percent of the total). Tight oil production declines after 2021 in EIA’s reference case, as the agency assumes in that case that development moves into less-productive areas.

With more optimistic assumptions in resource development that EIA assumes in its High Oil and Gas Resource case, tight oil production growth continues through 2035. In this case, domestic crude oil production increases to nearly 13 million barrels per day and net U.S. oil imports decline through 2036 and remain at or near zero from 2037 through 2040, the end of EIA’s projection period. In the High Oil and Gas Resource case, higher well productivity reduces development and production costs per unit, which results in more and earlier development of tight oil resources than in the reference case. The greater abundance of tight oil resources in the High Oil and Gas Resource case causes tight oil production to peak later in the projection, at 8.5 million barrels per day in 2035. From 2012 through 2040, cumulative tight oil production in the High Oil and Gas Resource case amounts to 75 billion barrels, compared with 44 billion barrels in the reference case.

Likewise, shale gas production drives EIA’s natural gas forecast. Dry gas production increases from 24 trillion cubic feet in 2012 to 37.5 trillion cubic feet in 2040 due to continued growth in shale gas production resulting from horizontal drilling and hydraulic fracturing. Shale gas production increases from 9.7 trillion cubic feet in 2012 to 19.8 trillion cubic feet in 2040 in EIA’s reference case. In the High Oil and Gas Resource case, total natural gas production reaches 45.5 trillion cubic feet in 2040, and shale gas production is 59 percent of that total, 26.95 trillion cubic feet.

Conclusion

Drilling productivity is driving record production for both oil and natural gas in shale formations. Producers are able to get more production from existing wells than many thought. This increased drilling productivity is the reason for more optimistic forecasts of domestic oil and gas production. This production renaissance is taking place on private and state lands, despite President Obama trying to take credit for it. While federal lands have enormous resource potential, this Administration policies have decreased rather than increased oil and natural gas production on federal lands and waters.

[i] Wall Street Journal, Fracking Gives U.S. Energy Boom Plenty of Room to Run, September 14, 2014, http://online.wsj.com/articles/fracking-gives-u-s-energy-boom-plenty-of-room-to-run-1410728682

[ii] Quartz, The US shale oil boom is saving the world almost $5 billion a day, September 15, 2014, http://qz.com/265580/the-us-shale-oil-boom-is-saving-the-world-almost-5-billion-a-day/

[iii] Quartz, Oil prices aren’t coming down any time soon, and Iraq is just the latest reason, June 12, 2014, http://qz.com/220082/oil-prices-arent-coming-down-any-time-soon-and-iraq-is-just-the-latest-reason/

[iv] Energy Information Administration, Annual Energy Outlook 2014, May 7, 2014, http://www.eia.gov/forecasts/aeo/