The Congressional Budget Office (CBO) recently categorized financial support for fossil fuel and renewable energy tax preferences by fuel area for fiscal year 2013. From the CBO analysis, in 2013:

-Renewable energy financial support from tax preferences is expected to be 17 times greater than those for fossil fuels when evaluated on a Btu (British thermal unit) basis of production. In other words, when making a comparison based on the amount of energy produced, financial support based on renewable tax preferences is expected to be 17 times greater than those for fossil fuels.

-On a financial support basis, tax preferences for renewable fuels is expected to receive over twice the tax revenue dollars that fossil fuels are expected to receive for tax preferences.

-Renewable energy is expected to receive a 44 percent share of total federal energy tax preference incentives in 2013, while fossil fuels are expected to receive a 20 percent share but are expected to produce more than 7 times the energy.

This article is an update to one that the Institute for Energy Research posted in 2011 based on Congressional Research Service analyses where financial support for renewable tax preferences for 2009 was found to be 49 times as great on a Btu basis as fossil fuel financial support from tax preferences in that year. Since then tax preferences for certain forms of renewable energy have been curtailed. For example, black liquor, a mixture of conventional fuel and a byproduct of the pulping process used as an energy source for pulp mills, became ineligible for tax credits after 2009, having received $2.5 billion in the first 6 months of 2009 alone. The ethanol tax credit that provided 45 cents per gallon to refiners and blenders of ethanol fuel, the alcohol tax credit of 60 cents per gallon, and the excise tax credit for alcohol fuels expired at the end of 2011.

Beginning in 2010, financial support for tax preferences for renewable energy used in electricity generation increased mainly due to the section 1603 grants that allowed solar plants and wind farms to get an immediate rebate of 30 percent of their investment cost in lieu of taking the 30 percent over time as a tax credit. The 1603 grant program expired at the end of 2011, but some payouts have continued into 2013. While other changes have been made to the tax code between 2009 and 2013, the big ticket items are those discussed above.

The CBO Analysis

The CBO provided testimony to the House Energy Subcommittee of the Committee on Science, Space and Technology regarding federal financial support for fuels and energy technologies.[i] The CBO listed the estimated tax revenue losses as a result of U.S. energy-related financial support for fiscal year 2013. According to the CBO, the federal government provided “various types of financial support for the development and production of fuels and energy technologies in recent decades.” The CBO evaluated two types of financial support: tax preferences, which are special provisions of the tax law that reduce tax liabilities for certain activities, entities, or groups of people) and spending programs administered by the Department of Energy (DOE). For fiscal year 2013, CBO estimated the two types of financial support at $19.8 billion, of which over 80 percent was for tax preferences.

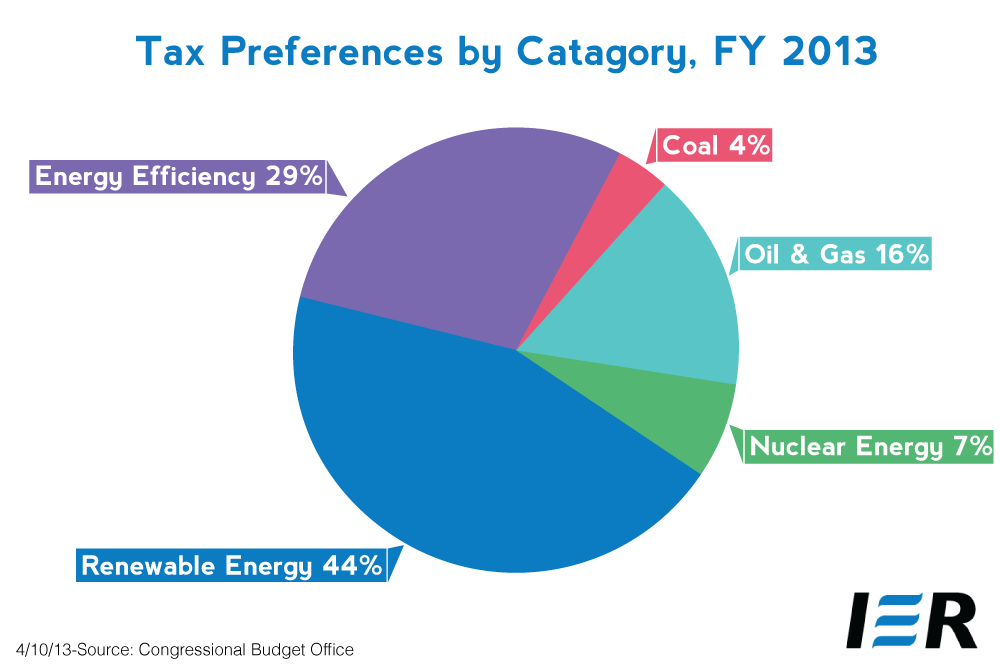

The total tax revenue lost due to energy-related federal support for tax preferences in fiscal year 2013 is estimated at $16.4 billion with renewable energy getting the lion’s share of $7.3 billion or 44 percent and energy efficiency receiving $4.8 billion or 29 percent. Fossil fuels received 20 percent and nuclear energy received 7 percent. See table and graph below.

[table id=60 /]

Source: Congressional Budget Office, http://science.house.gov/sites/republicans.science.house.gov/files/documents/HHRG-113-SY20-WState-TDinan-20130313.pdf

Source: Congressional Budget Office, http://science.house.gov/sites/republicans.science.house.gov/files/documents/HHRG-113-SY20-WState-TDinan-20130313.pdf

The $7.3 billion in renewable energy tax preferences in 2013 include section 1603 grants totaling $2.6 billion that are provided for qualifying renewable investments in lieu of tax credits. Those grants allow solar plants and wind farms to get an immediate rebate of 30 percent of their investment cost instead of taking the 30 percent over time as a tax credit. The section 1603 grant program expired at the end of 2011, but developers are still receiving support due to scheduled payouts after the program expired.

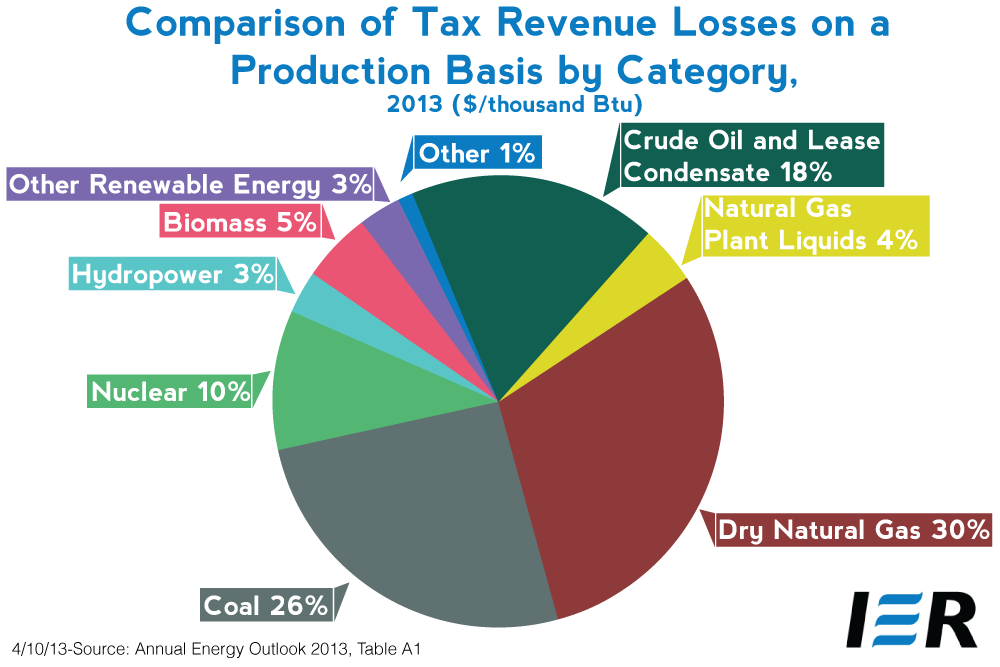

Using estimated primary energy production data from the Energy Information Administration (EIA) in its Annual Energy Outlook 2013[ii], the Institute for Energy Research (IER) compared the amount of production expected to come from each source. The following figure provides the distribution of primary energy production expected in 2013 by fuel type using EIA information. Fossil fuels are expected to represent 78 percent of total energy production in the United States in 2013, while nuclear fuel is expected to represent 10 percent, and all renewable fuels combined are expected to represent 11 percent. Of the renewable share, biomass represented the largest portion at 5 percent, with hydroelectric power second with a 3 percent share. Wind, solar and geothermal energy combined is expected to represent less than 3 percent of the 11 percent renewable production share.

Estimated Primary Energy Production by Source, 2013

Source: Annual Energy Outlook 2013, Table A1, http://www.eia.gov/forecasts/aeo/er/

One way to compare financial support is based on the amount of energy produced. When evaluated on a unit of production basis, financial support for fossil fuel tax preferences is estimated to be $0.05 per thousand Btu (British thermal unit) in 2013 and fuel financial support for renewable energy tax preferences is estimated to be $0.83 per thousand Btu. In other words, financial support for renewable energy tax preferences is expected to be 17 times greater than those for fossil fuels on a per Btu basis in 2013.

IER also compared the 2013 estimated tax revenue losses by tax category to the estimated tax revenue losses for 2012. Tax revenue losses from tax preferences for renewables in FY 2012 totaled $8.4 billion, of which $5.4 billion was from section 1603 grants mentioned above. Tax revenue losses from tax preferences for fossil fuels in 2012 totaled $3 billion dollars, of which $0.6 billion was for coal and $2.4 billion was for oil and gas. Tax revenue losses for tax preferences for nuclear energy totaled $1 billion in 2012. When evaluated on a unit of production basis, fossil fuel tax preferences were $0.05 per thousand Btu in 2012 and renewable fuel tax preferences were $0.94 per thousand Btu. In other words, financial support for renewable energy tax preferences were 19 times greater than that for fossil fuels on a per Btu basis in 2012.

[table id=62 /]

Sources: 2012: Calculated from http://www.whitehouse.gov/sites/default/files/omb/budget/fy2013/assets/spec.pdf , http://www.treasury.gov/initiatives/recovery/Documents/Section%201603%20Awards.xls , and, Energy Information Administration, Monthly Energy Review, Table 1.2, http://www.eia.gov/totalenergy/data/monthly/pdf/sec1_5.pdf 2013: Calculated from Congressional Budget Office, Table 1, http://science.house.gov/sites/republicans.science.house.gov/files/documents/HHRG-113-SY20-WState-TDinan-20130313.pdf and Annual Energy Outlook 2013, Table A1, http://www.eia.gov/forecasts/aeo/er/

Conclusion

While renewable energy advocates do not want to admit it, renewables get the lion’s share of financial support from energy tax preferences both on a total dollar basis and also when compared to the amount of energy produced. Fossil fuels are expected to garner 20 percent of 2013 energy tax preference incentives, while renewable energy is expected to receive 44 percent. And, on a unit of production basis, financial support for renewable tax preferences in 2013 is expected to be 17 times as great as those for fossil fuels. In 2012, renewable energy received an even greater share of energy tax preference incentives–54 percent, while fossil fuels received 19 percent. On a per unit of production basis, financial support for renewable energy tax preferences in 2012 were 19 times as great as financial support for fossil fuel tax preferences.

Supposedly, governments provide financial support to fix market failures, i.e. to correct distortions in energy markets, or to achieve an economic objective. However, these financial support initiatives can distort markets by changing price signals to consumers. Further, tax policy is determined within a political system with compromises, which complicates the process and can compound the distortions. Current and past tax policies have been used in an attempt to reduce imported oil through greater use of domestic resources and to decrease environmental emissions by promoting renewable energy and conservation.

Before undertaking such financial support, policy makers need to ask themselves: “What market distortions is the financial support trying to fix? Are the distortions compounded by the financial support? Are benefits to taxpayers being reaped?”

[i] Congressional Budget Office, Federal Financial Support for Fuels and Energy Technologies, Testimony for Energy Subcommittee, Committee on Science, Space, and Technology, March 13, 2013, http://science.house.gov/sites/republicans.science.house.gov/files/documents/HHRG-113-SY20-WState-TDinan-20130313.pdf

[ii] Energy Information Administration, Annual Energy Outlook 2013 Early Release, December 5, 2012, Table A1, http://www.eia.gov/forecasts/aeo/er/